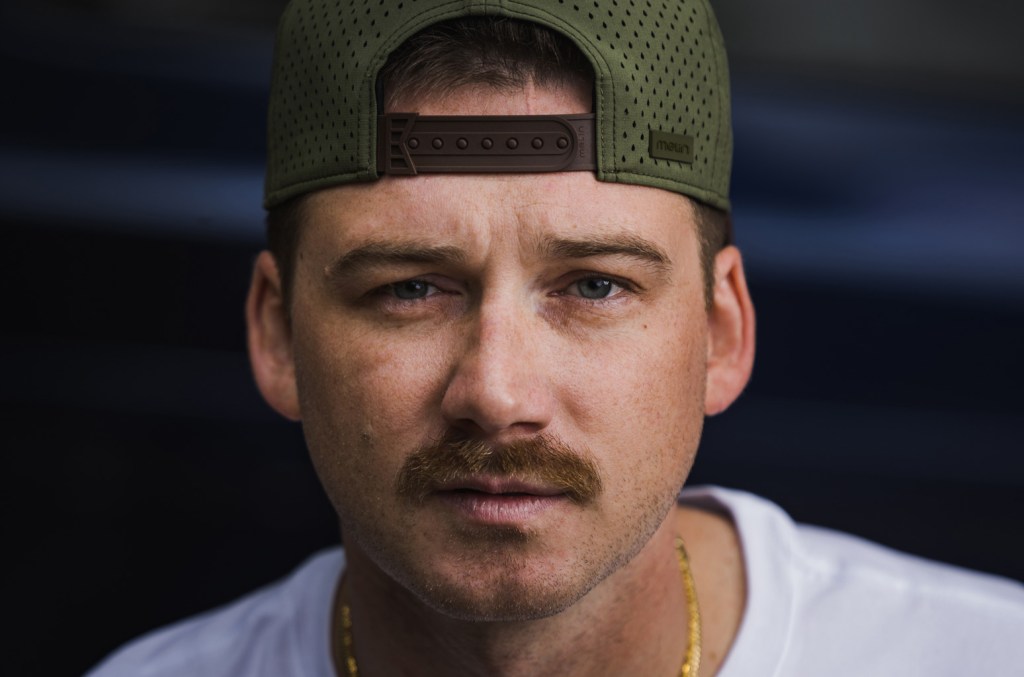

Record Deal: Morgan Wallen's Label Sells $200 Million Catalog Stake

Table of Contents

The $200 Million Deal: A Deep Dive into the Numbers

This groundbreaking $200 million record deal represents a significant portion of Morgan Wallen's music catalog. While the exact percentage sold hasn't been publicly disclosed, the sheer magnitude of the figure speaks volumes about Wallen's immense success and the growing market for established music catalogs.

- The Players: The buyer and seller involved in this transaction remain undisclosed, adding an element of intrigue to the situation. Speculation within the industry points to a major investment firm specializing in music intellectual property.

- Future Earnings: This sale significantly boosts Wallen's net worth, providing him with a substantial financial windfall. While he will still earn royalties from future streams and sales, the upfront payment from this $200 million record deal offers immediate financial security and removes the uncertainty surrounding future catalog value.

- Historical Context: This $200 million record deal easily ranks among the largest music catalog acquisitions in history. Comparing it to other significant sales, such as Bob Dylan's $300 million deal and Stevie Nicks' reported $100 million sale, highlights the rapidly increasing value placed on established artist catalogs. These high-value transactions demonstrate the appeal of these assets for investors, who see them as a stable and lucrative investment.

Impact on the Music Industry: Setting New Precedents

The $200 million sale of a portion of Morgan Wallen’s music catalog reflects several significant industry trends. The transaction sets a new benchmark for music catalog valuations, signaling a continued upward trajectory in pricing.

- Market Trends: This deal reinforces the growing trend of music catalogs becoming highly sought-after assets. The predictability of income streams generated by established catalogs, particularly in the streaming era, makes them incredibly attractive investments.

- Negotiating Power: For artists, this deal raises questions about fair compensation and negotiating power. As catalog values soar, it compels artists to carefully consider the implications of long-term deals and the potential value of their intellectual property.

- Artist Ownership: The sale raises concerns regarding artist control over their music. While this deal likely provides Wallen with significant financial benefits, it also cedes a portion of ownership and future income streams from his catalog. This dynamic underscores the ongoing debate about artist rights and the balance of power between artists and labels in the music industry.

- Smaller Artists: For smaller artists, this deal underscores the challenges of navigating the increasingly complex music industry. It highlights the potential value of carefully cultivating a strong catalog and fanbase to maximize their earning potential in the long term.

Morgan Wallen's Career Trajectory and the Value of His Catalog

Morgan Wallen's phenomenal career trajectory directly correlates with the substantial value of his music catalog. His consistently high streaming numbers, strong album sales, and dedicated fanbase all contribute to the catalog's attractiveness.

- Streaming Revenue: In today's digital music landscape, streaming revenue plays a crucial role in determining catalog value. Wallen's impressive streaming numbers significantly enhance the perceived value of his music catalog, making it an extremely desirable asset for investors.

- Album Sales: While streaming dominates the market, strong album sales still contribute to the overall value of a music catalog. Wallen's successful album releases have solidified his position as a top-tier artist, further increasing the worth of his catalog.

- Fanbase Loyalty: Wallen commands a remarkably loyal and engaged fanbase, translating into consistent streams, album sales, and merchandise revenue. This loyal following makes his catalog a safe and predictable investment.

- Future Potential: Given Wallen’s continued success and the ever-increasing value of music catalogs, his catalog's future potential is substantial. His ability to continue generating significant revenue from his existing music guarantees the long-term value of the investment.

The Future of Music Catalog Ownership

The sale of a portion of Morgan Wallen’s music catalog is part of a larger trend of artists and labels increasingly monetizing their music rights.

- Financial Security: Artists and labels often sell their catalogs for immediate financial gains, providing a form of financial security and diversification.

- Long-Term Value: Investors see the inherent long-term value of a successful music catalog, as they provide a reliable stream of income from royalties and other revenue streams.

- Future Trends: The future of music ownership remains in flux. This ongoing trend raises profound questions about the future of creative control, artist rights, and the evolving relationship between artists and their intellectual property. Will we see more young artists prioritizing building and retaining ownership of their catalogs?

Conclusion: Understanding the Significance of Morgan Wallen's Record Deal

The $200 million record deal surrounding Morgan Wallen's music catalog is a landmark event, highlighting the significant financial value of established music catalogs and underscoring the changing dynamics of the music industry. The deal’s impact extends beyond Wallen’s personal finances, setting new precedents for future artist negotiations, catalog valuations, and the ongoing discussion about artist ownership in the digital age. This $200 million record deal is a compelling case study that will shape the music industry for years to come. What are your thoughts on this momentous transaction and its implications? Share your opinions using #MorganWallen #RecordDeal #MusicCatalog #MusicIndustry. Stay tuned for more updates on the evolving music industry landscape by subscribing to our newsletter!

Featured Posts

-

Confrontation In Paris Le Pens Witch Hunt Claim And The Opposing Demonstrations

May 29, 2025

Confrontation In Paris Le Pens Witch Hunt Claim And The Opposing Demonstrations

May 29, 2025 -

Serious Suzuka Crash For Hondas Luca Marini Moto Gp Season Implications

May 29, 2025

Serious Suzuka Crash For Hondas Luca Marini Moto Gp Season Implications

May 29, 2025 -

Venlo Man Slachtoffer Dodelijk Schietincident

May 29, 2025

Venlo Man Slachtoffer Dodelijk Schietincident

May 29, 2025 -

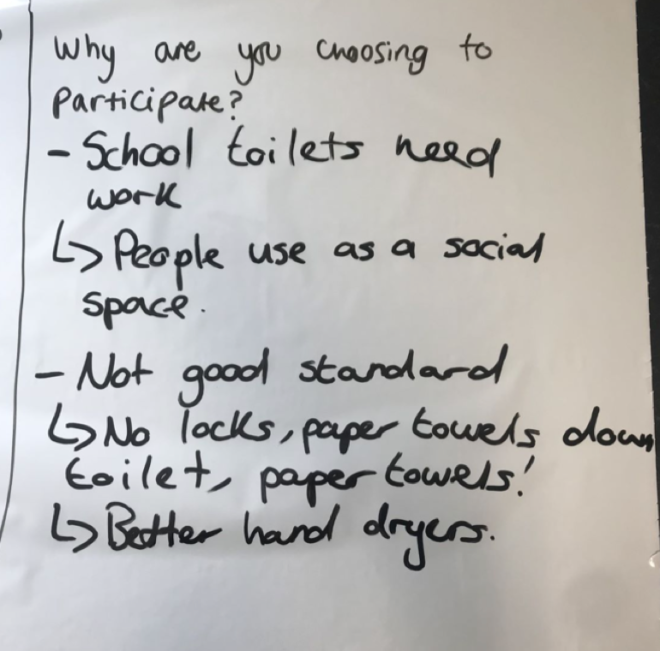

Turning Toilet Talk Into Talk Radio An Ai Powered Podcast Revolution

May 29, 2025

Turning Toilet Talk Into Talk Radio An Ai Powered Podcast Revolution

May 29, 2025 -

Akutt Nyhetsvarsel Brann Rammer Fire Bater I Oslo

May 29, 2025

Akutt Nyhetsvarsel Brann Rammer Fire Bater I Oslo

May 29, 2025

Latest Posts

-

Are Strong Corporate Earnings Sustainable An Analysts Perspective

May 30, 2025

Are Strong Corporate Earnings Sustainable An Analysts Perspective

May 30, 2025 -

L Histoire Mouvementee De La Deutsche Bank Un Siecle De Defis Et De Reussites

May 30, 2025

L Histoire Mouvementee De La Deutsche Bank Un Siecle De Defis Et De Reussites

May 30, 2025 -

Finance Minister And Deutsche Bank A Strategic Dialogue

May 30, 2025

Finance Minister And Deutsche Bank A Strategic Dialogue

May 30, 2025 -

Why Analysts Are Worried About Future Corporate Earnings

May 30, 2025

Why Analysts Are Worried About Future Corporate Earnings

May 30, 2025 -

Corporate Earnings Solid Now Uncertain Future

May 30, 2025

Corporate Earnings Solid Now Uncertain Future

May 30, 2025