Revised Growth Forecast From Bank Of Japan: Trade Disputes Cause Concern

Table of Contents

The Bank of Japan's Downgraded Growth Projections

The BOJ has lowered its growth forecast for the fiscal year 2023 (April 2023 to March 2024) by a significant margin. While the previous forecast projected a robust growth rate of X%, the revised forecast stands at a considerably lower Y%. This represents a Z percentage point decrease, reflecting a more pessimistic outlook for the Japanese economy. This substantial revision marks a significant departure from previous predictions and underscores the growing uncertainty surrounding global trade.

- Specific numbers regarding GDP growth: The BOJ's initial forecast predicted a GDP growth of X%, but this has been revised downward to Y%, representing a Z% decrease.

- Comparison to previous forecasts and analyst predictions: This revision falls below most analyst predictions, indicating a more severe impact from global trade tensions than initially anticipated. Many experts had projected growth closer to W%, showcasing the extent of the BOJ's pessimism.

- Mention any revisions to inflation projections: Alongside the downward revision of GDP growth, the BOJ may have also adjusted its inflation projections, reflecting the dampening effect of reduced economic activity on price increases. These revised inflation expectations could influence future monetary policy decisions.

The Impact of Trade Disputes on the Japanese Economy

The escalating trade disputes, particularly the ongoing US-China trade war, have significantly impacted the Japanese economy. Japan, deeply integrated into global supply chains, is highly vulnerable to disruptions caused by protectionist measures. The imposition of tariffs and trade restrictions has led to a decline in Japanese exports, affecting various key industries.

- Explain how trade wars, particularly the US-China trade war, negatively affect Japanese exports: The US-China trade war has created uncertainty and disruption in global supply chains, directly impacting Japanese businesses reliant on exports to these major markets. Tariffs imposed by both countries increase the cost of Japanese goods, reducing their competitiveness.

- Discuss the vulnerability of specific Japanese industries (e.g., automotive, electronics): Industries like automotive and electronics, heavily reliant on exports, are particularly vulnerable. The imposition of tariffs on Japanese automobiles in certain markets has reduced demand and profitability. Similarly, the electronics industry faces challenges due to disruptions in supply chains and reduced consumer demand.

- Analyze the impact on supply chains and investment decisions: Trade disputes create uncertainty, prompting businesses to delay investment decisions and potentially relocate production facilities to mitigate risks. This uncertainty also disrupts established supply chains, leading to increased costs and production delays.

- Bullet points:

- Examples of specific trade barriers impacting Japan: Tariffs on Japanese automobiles in the US and EU, restrictions on Japanese electronics imports in certain markets.

- Statistics illustrating the decline in exports or investment: Data showing a percentage decline in exports to major markets since the escalation of trade disputes. Statistics showing a reduction in foreign direct investment in Japan.

- Analysis of the ripple effect on related industries: The decline in exports in one sector can have a cascading effect on related industries, such as parts suppliers and logistics companies.

Uncertainty and Investor Sentiment

The ongoing trade tensions have significantly impacted investor confidence, leading to increased market volatility. The uncertainty surrounding future trade policies makes it difficult for investors to make informed decisions.

- Explain how the trade tensions are impacting investor confidence and market volatility: The uncertainty surrounding future trade policies creates a climate of fear and uncertainty, leading to reduced investment and increased volatility in the Japanese stock market.

- Discuss potential capital flight or reduced foreign investment: Concerns about the long-term stability of the Japanese economy can lead to capital flight as investors seek safer investment opportunities elsewhere. Foreign direct investment may also decline as businesses hesitate to commit capital in an uncertain environment.

- Analyze the effects on the Yen and its exchange rate: The Yen's exchange rate can fluctuate significantly based on investor sentiment and economic expectations. Increased uncertainty and concerns about the Japanese economy can lead to fluctuations in the Yen's value.

- Bullet points:

- Market data showing volatility in the Japanese stock market: Data demonstrating increased volatility in the Nikkei 225 index during periods of heightened trade tensions.

- Analysis of changes in foreign direct investment: Data illustrating changes in foreign direct investment flows into Japan since the escalation of trade disputes.

- Information about the Yen's performance against other currencies: Analysis of the Yen's exchange rate against major currencies, showing fluctuations resulting from trade-related uncertainties.

The BOJ's Response and Potential Monetary Policy Adjustments

In response to the downgraded growth forecast, the BOJ is likely to consider further monetary easing measures. However, the effectiveness of monetary policy in addressing trade-related issues is limited.

- Discuss whether the BOJ is considering further monetary easing measures: The BOJ might consider further quantitative easing or adjustments to interest rates to stimulate economic activity and counteract the negative impact of trade disputes.

- Analyze the limitations of monetary policy in addressing trade-related issues: Monetary policy primarily addresses domestic economic factors. While it can stimulate demand, it cannot directly resolve the structural issues caused by international trade disputes.

- Examine potential alternative government policies to mitigate the negative impacts: Government policies targeting specific industries, support for export diversification, and investment in domestic infrastructure could play a crucial role in mitigating the negative impacts of trade disputes.

- Bullet points:

- Discussion of potential interest rate changes: Analysis of the possibility of further interest rate cuts by the BOJ.

- Analysis of quantitative easing measures: Discussion of potential expansion of the BOJ's quantitative easing program.

- Mention any government stimulus packages or support programs: Discussion of any government initiatives aimed at supporting affected industries or stimulating economic growth.

Conclusion

The Bank of Japan's downward revision of its growth forecast underscores the significant impact of escalating global trade disputes on the Japanese economy. The uncertainty surrounding the global trade environment creates considerable challenges, affecting investor confidence, export performance, and overall economic growth. The limited effectiveness of monetary policy in addressing these structural issues necessitates a multi-pronged approach, potentially involving government interventions to support affected industries and stimulate economic activity. The BOJ's response, along with potential government policies, will be crucial in navigating these challenges and mitigating the negative impacts on the Japanese economy.

Call to Action: Stay informed about the evolving situation by regularly checking for updates on the Bank of Japan's economic forecasts and analysis of global trade developments. Understanding the Bank of Japan's revised growth forecast and its implications for the Japanese economy is crucial for investors and businesses alike. Continue to monitor the Bank of Japan's pronouncements on its growth forecast and trade dispute impacts.

Featured Posts

-

The Perilous State Of Reform Uk Five Reasons For Worry

May 03, 2025

The Perilous State Of Reform Uk Five Reasons For Worry

May 03, 2025 -

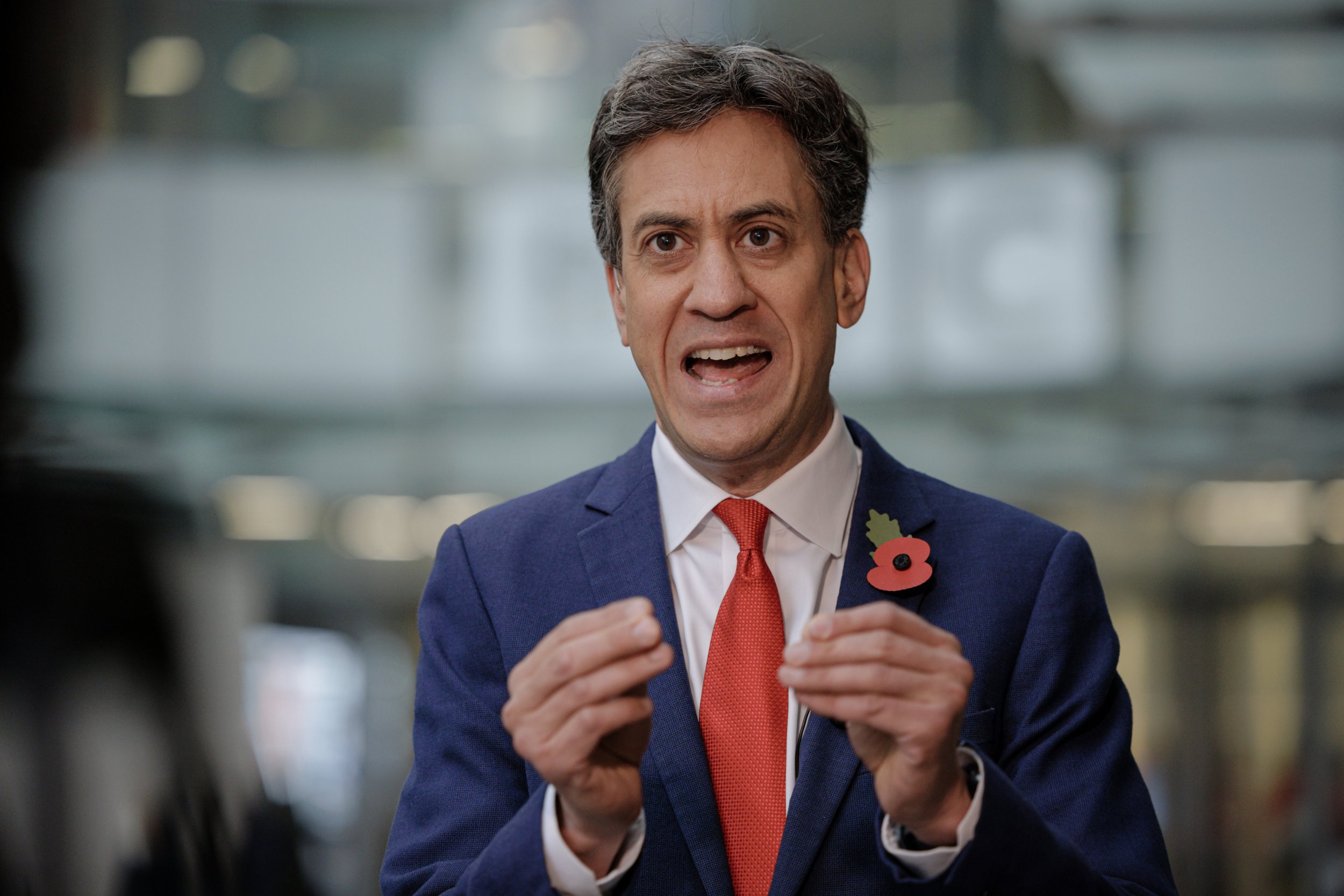

Energy Policy Overhaul Guido Fawkes On The New Course

May 03, 2025

Energy Policy Overhaul Guido Fawkes On The New Course

May 03, 2025 -

Daisy May Cooper On Body Image Weight Loss Lip Fillers And Honesty

May 03, 2025

Daisy May Cooper On Body Image Weight Loss Lip Fillers And Honesty

May 03, 2025 -

Government Funded Mental Health Courses A Comprehensive Guide

May 03, 2025

Government Funded Mental Health Courses A Comprehensive Guide

May 03, 2025 -

Tory Chairman And Reform Uk A Growing Rift Despite Anti Populism Stance

May 03, 2025

Tory Chairman And Reform Uk A Growing Rift Despite Anti Populism Stance

May 03, 2025

Latest Posts

-

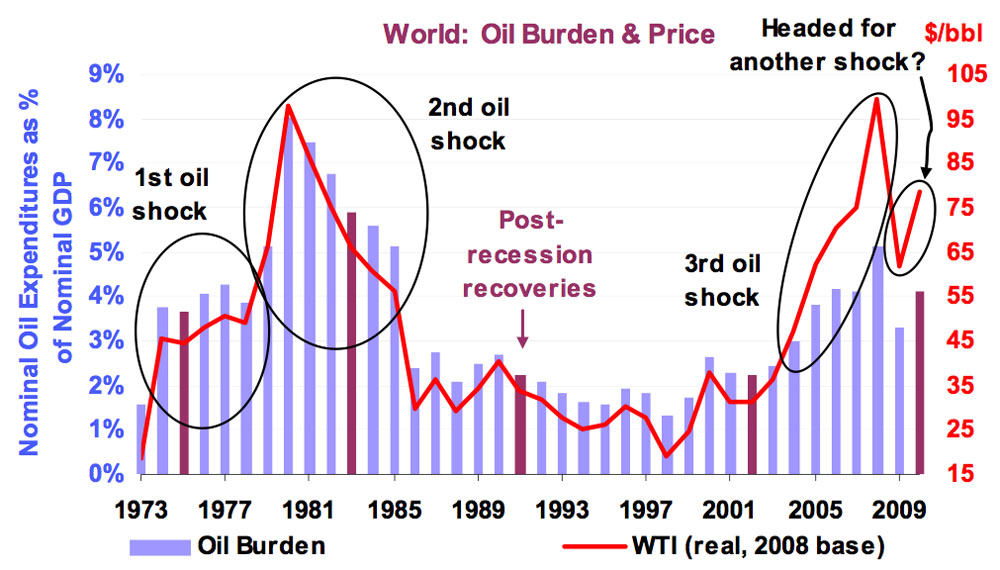

The Airline Industrys Vulnerability To Oil Supply Chain Instability

May 04, 2025

The Airline Industrys Vulnerability To Oil Supply Chain Instability

May 04, 2025 -

Oil Price Volatility And Its Effect On Airline Profitability

May 04, 2025

Oil Price Volatility And Its Effect On Airline Profitability

May 04, 2025 -

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025 -

Tomatin Affordable Housing Strathdearn Community Project Marks Significant Progress

May 04, 2025

Tomatin Affordable Housing Strathdearn Community Project Marks Significant Progress

May 04, 2025 -

Pupils Celebrate Groundbreaking Of New Tomatin Affordable Housing In Strathdearn

May 04, 2025

Pupils Celebrate Groundbreaking Of New Tomatin Affordable Housing In Strathdearn

May 04, 2025