ROCK Stock Earnings Preview: Key Metrics And Financial Outlook

Table of Contents

Revenue Growth and Analysis

Year-over-Year Revenue Comparison

Analyzing ROCK's year-over-year revenue growth is critical for understanding its trajectory. A comparison to the previous year reveals significant trends. A chart illustrating this growth would provide a visual representation of ROCK's performance.

- Factors Contributing to Revenue Growth: New product launches, successful marketing campaigns, expansion into new markets, and increased customer acquisition could all positively impact revenue. Strong sales figures often indicate a healthy business environment and consumer demand.

- Potential Headwinds Impacting Revenue: Increased competition, economic downturns, supply chain disruptions, and changes in consumer spending habits could negatively affect revenue. These factors require careful consideration when assessing the financial outlook of ROCK stock.

Segment Performance Breakdown

ROCK's business likely consists of various segments. Examining each segment's performance helps identify areas of strength and weakness. A detailed breakdown reveals the drivers of overall revenue growth.

- Segment-Specific Performance: Each segment should be analyzed individually, highlighting growth or decline and explaining contributing factors. This granular analysis provides a more comprehensive picture than overall revenue figures alone.

- Factors Driving Segment Performance: Identifying the specific factors driving performance in each segment is crucial. This could include market trends, competitive dynamics, and internal operational efficiency.

Profitability and Margins

Gross Profit Margin Analysis

Analyzing ROCK's gross profit margin provides insight into its pricing strategy, production efficiency, and cost management. Understanding this margin is fundamental for assessing profitability.

- Impact of Raw Material Costs: Fluctuations in raw material prices directly affect gross profit margins. Increased costs can squeeze margins, while decreases can boost profitability.

- Production Efficiency and Pricing Strategies: Efficient production processes and effective pricing strategies are crucial for maintaining healthy gross profit margins. Comparing ROCK's gross profit margin to industry competitors provides valuable context.

Net Income and Earnings Per Share (EPS)

Net income and earnings per share (EPS) are key indicators of a company's overall profitability. Forecasting potential outcomes requires analyzing past performance and current market trends.

- Impact of Operating Expenses, Interest Expenses, and Taxes: These factors significantly influence net income. High operating expenses can reduce profitability, while lower interest expenses and taxes can improve it.

- EPS Compared to Analyst Expectations and Previous Quarters: Comparing ROCK’s EPS to analyst expectations and previous quarters helps determine if the company is meeting or exceeding expectations. This comparison is a crucial element of any ROCK stock earnings preview.

Key Financial Ratios

Liquidity and Solvency

Assessing ROCK's liquidity and solvency provides insight into its financial health and ability to meet its short-term and long-term obligations. Key ratios include the current ratio, quick ratio, and debt-to-equity ratio.

- Implications for Financial Stability and Future Prospects: Strong liquidity and solvency ratios indicate a healthy financial position, suggesting a greater capacity for future growth and stability. Conversely, weak ratios suggest potential financial risk.

- Comparison to Industry Benchmarks: Comparing ROCK's ratios to industry benchmarks allows for a comparative analysis and helps determine its relative financial strength.

Efficiency Ratios

Efficiency ratios like inventory turnover, asset turnover, and return on assets (ROA) provide insight into how effectively ROCK utilizes its assets and resources.

- Implications for Operational Efficiency and Profitability: High efficiency ratios indicate effective resource management and strong profitability. Conversely, low ratios might suggest areas for operational improvement.

- Comparison to Industry Benchmarks: Benchmarking against industry averages helps assess ROCK's relative efficiency and identify areas for potential improvement.

Future Outlook and Guidance

Management's Expectations

Management's commentary on future prospects offers invaluable insights into the company's strategic direction and expectations. Their guidance for upcoming quarters is crucial for investors.

- Key Growth Opportunities and Potential Challenges: Understanding management’s outlook on both growth opportunities and potential challenges allows for a more nuanced assessment of the future outlook.

- Significant Strategic Initiatives or Changes: Any significant strategic initiatives or changes impacting future performance should be carefully considered. This information can be a major factor influencing investment decisions.

Analyst Consensus Estimates

Analyst consensus estimates provide an independent perspective on ROCK's future performance. Comparing these estimates to management's guidance helps gauge the overall market sentiment.

- Comparison and Contrast: A comparison between management's guidance and analyst estimates helps identify areas of agreement and disagreement, providing a more balanced view.

- Potential Discrepancies and Implications: Significant discrepancies between management's outlook and analyst estimates warrant careful consideration and further investigation.

Conclusion

This ROCK stock earnings preview has analyzed key metrics, including revenue growth, profitability, key financial ratios, and the future outlook. Understanding these aspects is critical for investors seeking to make informed decisions. The analysis of ROCK stock shows the importance of considering various factors, from year-over-year revenue comparisons to management’s expectations and analyst consensus estimates. A comprehensive understanding of these factors is essential for assessing the overall financial health and future prospects of ROCK.

Stay informed about ROCK's performance by regularly checking for updates and conducting your own thorough research. Understanding ROCK stock earnings is vital for making sound investment decisions. Continue your due diligence and develop a comprehensive investment strategy centered around analyzing key metrics and the financial outlook of ROCK stock.

Featured Posts

-

Texas Rangers 2024 A Closer Look At Andrew Chafins Season

May 13, 2025

Texas Rangers 2024 A Closer Look At Andrew Chafins Season

May 13, 2025 -

Swiatek Falls To Ostapenko Again In Stuttgart Semifinal Clash

May 13, 2025

Swiatek Falls To Ostapenko Again In Stuttgart Semifinal Clash

May 13, 2025 -

The Nightmare Of The Gaza Hostage Crisis Families Ongoing Struggle

May 13, 2025

The Nightmare Of The Gaza Hostage Crisis Families Ongoing Struggle

May 13, 2025 -

Updated Elsbeth Season 2 Previews Episodes 16 17 And The Finale

May 13, 2025

Updated Elsbeth Season 2 Previews Episodes 16 17 And The Finale

May 13, 2025 -

Sicherheitsalarm An Braunschweiger Schule Gebaeude Geraeumt Keine Kinder Gefaehrdet

May 13, 2025

Sicherheitsalarm An Braunschweiger Schule Gebaeude Geraeumt Keine Kinder Gefaehrdet

May 13, 2025

Latest Posts

-

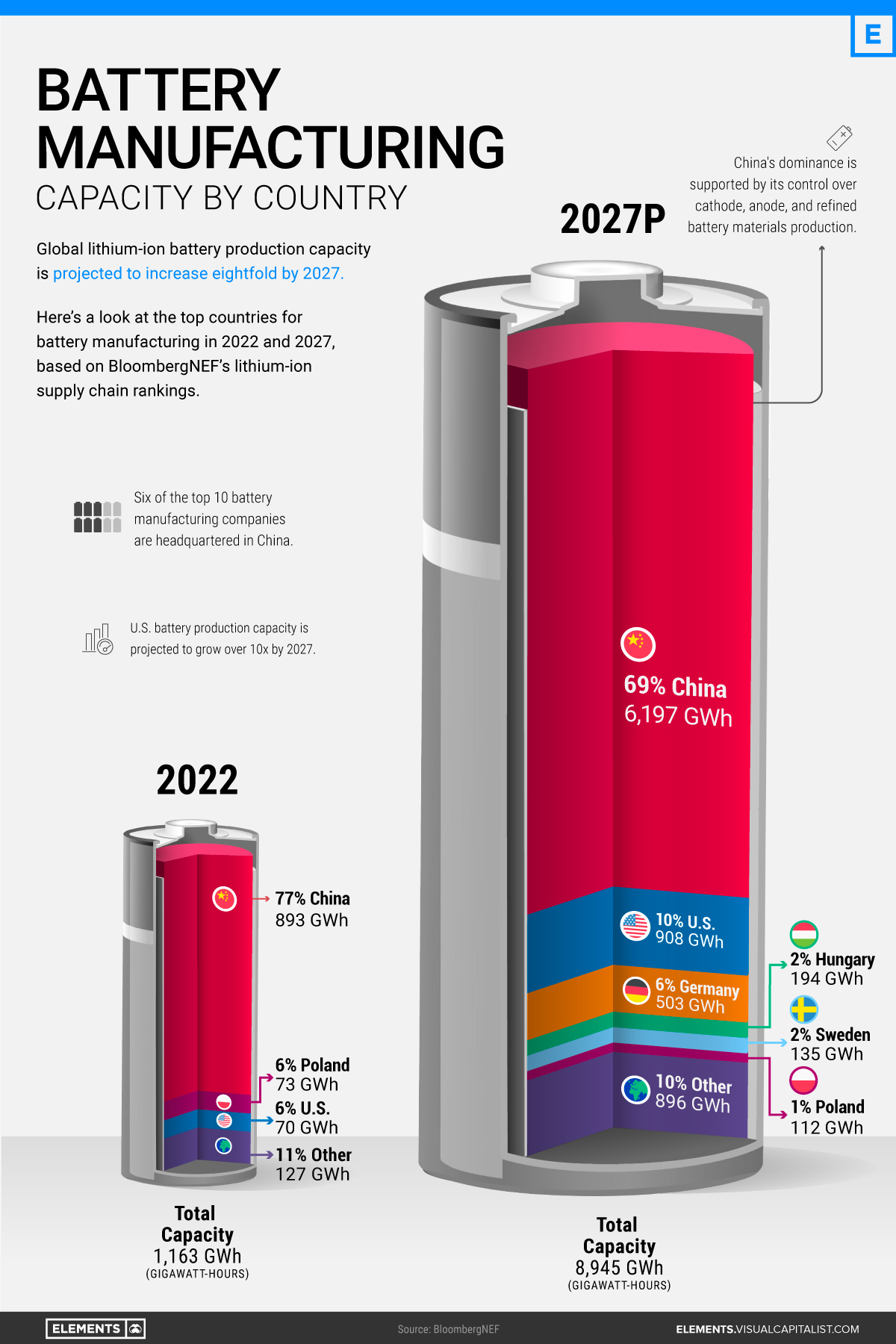

Byd Seal Buyers Guide Everything You Need To Know

May 13, 2025

Byd Seal Buyers Guide Everything You Need To Know

May 13, 2025 -

A Case Study Addendum How Byd Became A Leader In Ev Battery Manufacturing

May 13, 2025

A Case Study Addendum How Byd Became A Leader In Ev Battery Manufacturing

May 13, 2025 -

Addendum Analyzing Byds Success In The Ev Battery Market A Case Study

May 13, 2025

Addendum Analyzing Byds Success In The Ev Battery Market A Case Study

May 13, 2025 -

Byd Case Study Examining Their Leading Position In Ev Battery Manufacturing

May 13, 2025

Byd Case Study Examining Their Leading Position In Ev Battery Manufacturing

May 13, 2025 -

Case Study Addendum Byds Leadership In Electric Vehicle Battery Production

May 13, 2025

Case Study Addendum Byds Leadership In Electric Vehicle Battery Production

May 13, 2025