Ryanair Cites Tariff War As Top Growth Risk, Initiates Share Buyback

Table of Contents

Ryanair's Concerns Regarding Tariff Wars

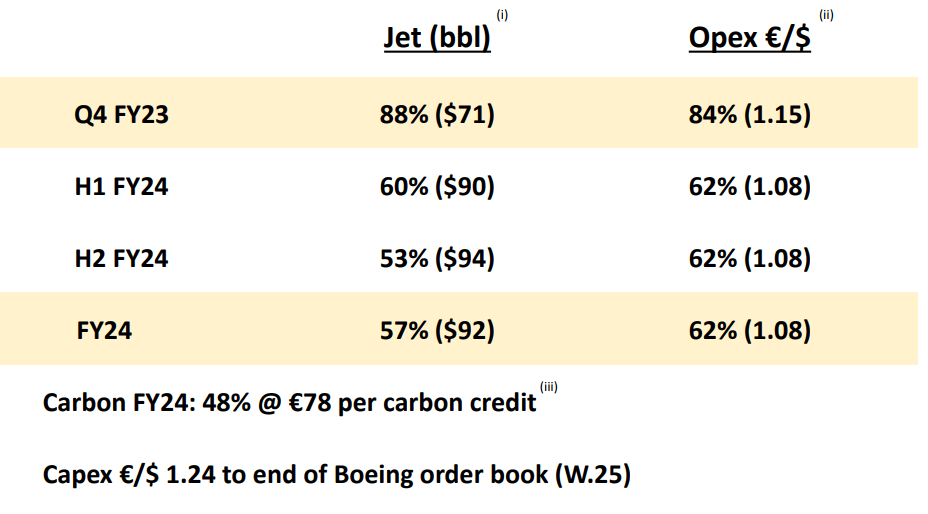

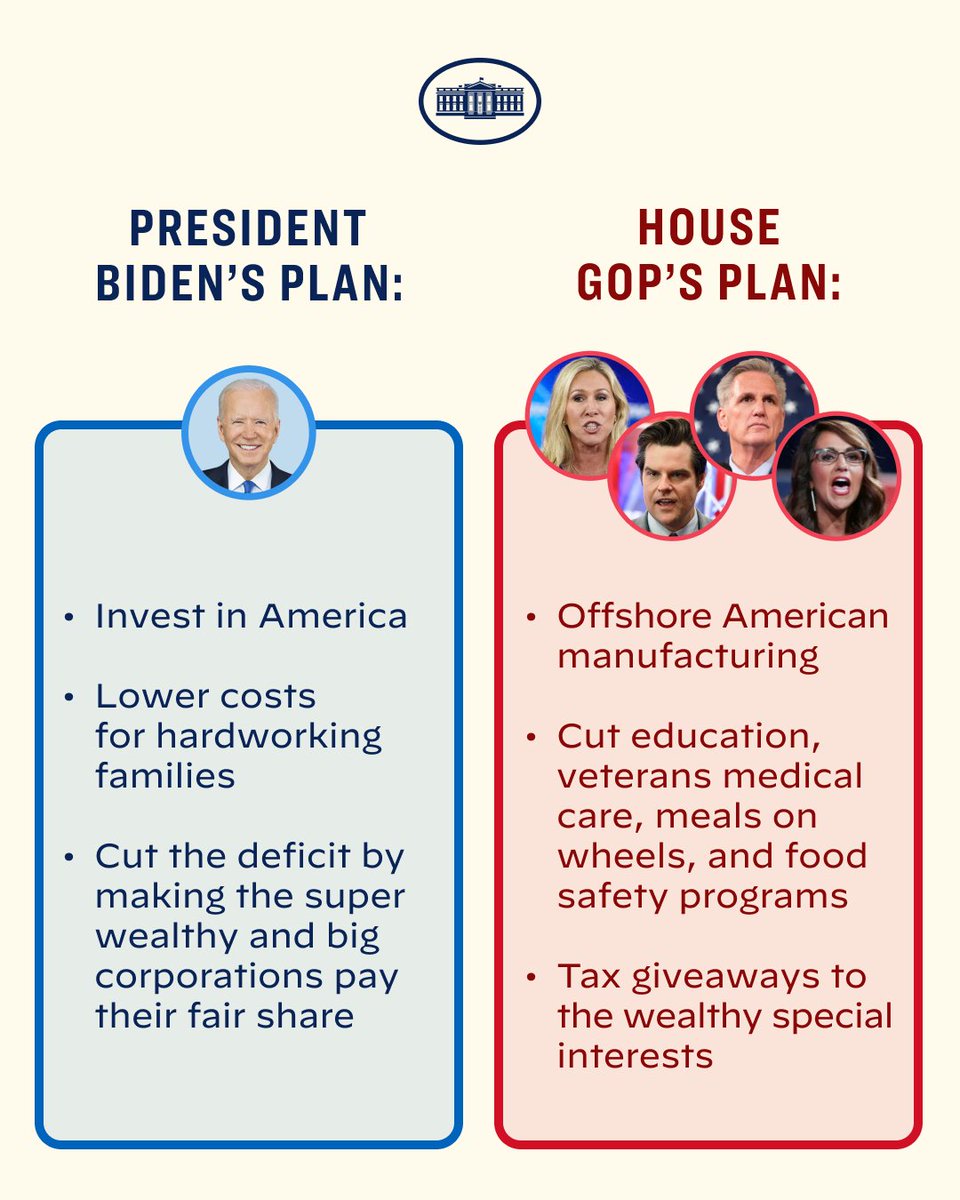

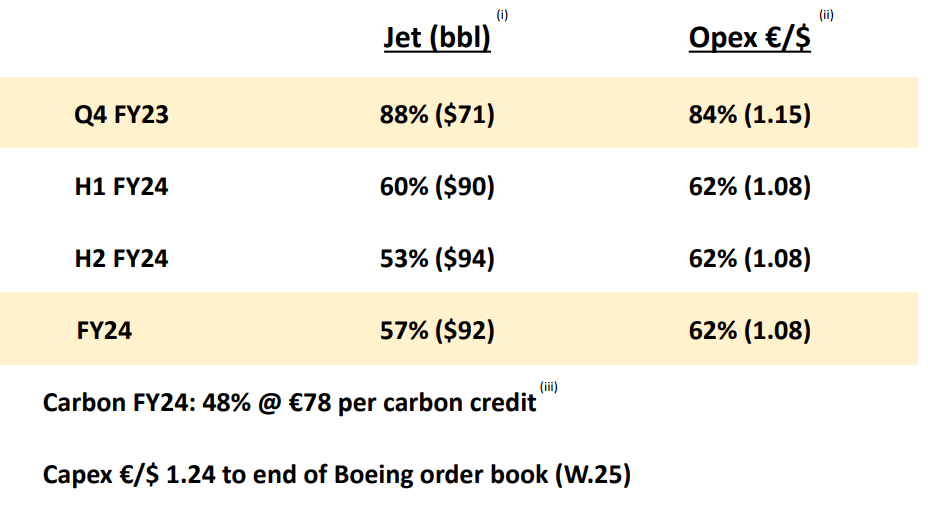

The ongoing threat of tariff wars presents a significant risk to Ryanair's operational efficiency and profitability. These trade disputes, characterized by import and export tariffs, directly impact the airline's operational costs in several key areas. The airline industry is particularly vulnerable to fluctuating fuel prices, and increased tariffs on aviation fuel represent a substantial blow to the bottom line. Furthermore, many aircraft parts are imported, making Ryanair susceptible to increased maintenance expenses as a result of trade protectionism.

The impact of these escalating costs isn't easily absorbed. Ryanair faces a difficult choice: absorb the increased costs, potentially impacting profit margins, or pass them on to consumers through higher ticket prices. Increased ticket prices, however, risk reducing consumer demand, particularly in a price-sensitive market like the budget airline sector. This delicate balance is further complicated by the geopolitical uncertainty surrounding trade disputes. The unpredictability of these conflicts makes it challenging for Ryanair to accurately forecast costs and plan for future growth.

- Increased fuel costs: Higher tariffs on aviation fuel significantly increase operational expenditures.

- Higher maintenance expenses: Tariffs on imported aircraft parts add to the overall cost of aircraft maintenance.

- Potential impact on passenger numbers: Increased ticket prices to offset rising costs could deter price-sensitive passengers.

- Uncertainty in global trade: The unpredictable nature of trade disputes makes long-term planning difficult and risky.

Details of the Share Buyback Program

In a move that reflects confidence in its long-term prospects, Ryanair has announced a substantial share buyback program. While the exact number of shares to be repurchased hasn't been publicly disclosed yet (details are expected soon), the initiative underscores the company's belief in its undervalued stock and its strong financial position. The share buyback program is viewed as a strategic capital allocation decision, designed to return value to shareholders and potentially boost the share price.

This move signifies that Ryanair believes its current stock price does not accurately reflect the company's intrinsic value and future earnings potential. By repurchasing its own shares, Ryanair reduces the number of outstanding shares, potentially increasing earnings per share and making the remaining shares more valuable. This, in turn, is expected to positively impact investor sentiment and enhance the company’s market capitalization.

- Amount of shares to be repurchased: To be announced publicly.

- Timeline for the buyback: To be announced publicly.

- Reasons for the share buyback: Undervaluation of the stock, strong financial position, returning value to shareholders.

- Expected impact on share price: Analysts predict a positive impact on the share price.

Analyst Reaction and Market Impact

The announcement of both the tariff war concerns and the share buyback program has elicited a mixed reaction from financial analysts. While some analysts express concerns about the potential impact of tariff wars on Ryanair’s profitability, others see the share buyback as a positive sign of the company's financial health and its long-term strategic vision. The immediate market reaction has been largely positive, with Ryanair’s stock price experiencing a modest increase following the news.

The broader implications for the airline industry are significant. Other low-cost carriers are likely to face similar challenges from tariff wars, and the overall market will be affected by fluctuating fuel prices and increased operational costs. The competitive landscape might shift as airlines adapt to these new economic realities. The success of Ryanair’s share buyback program will be closely watched by investors as a potential benchmark for other companies in the sector considering similar strategies.

- Analyst ratings and price targets: A mix of positive and neutral ratings, with varying price targets.

- Stock price movement after the announcement: A modest increase in the share price.

- Competitor responses: Other low-cost carriers are expected to face similar challenges and may adopt similar strategies.

- Overall market impact: The impact on the airline industry is expected to be significant, with increased uncertainty and potential for consolidation.

Conclusion

Ryanair's recent announcements highlight the significant threat posed by tariff wars to the airline industry and its own growth. The company's substantial share buyback program, however, signals its belief in its long-term financial strength and resilience in the face of external challenges. This strategic move demonstrates a proactive approach to navigating the complexities of the current global economic climate.

Call to Action: Stay informed about the evolving impact of tariff wars and Ryanair's strategic responses. Follow our updates for further analysis on Ryanair's performance and the wider implications of this significant development in the aviation sector and the effect on Ryanair’s share buyback program. Learn more about the intricacies of Ryanair’s strategic responses to global economic challenges.

Featured Posts

-

The Gop Tax Plan And The National Deficit A Numbers Based Assessment

May 20, 2025

The Gop Tax Plan And The National Deficit A Numbers Based Assessment

May 20, 2025 -

Ryanair Cites Tariff War As Top Growth Risk Initiates Share Buyback

May 20, 2025

Ryanair Cites Tariff War As Top Growth Risk Initiates Share Buyback

May 20, 2025 -

Jennifer Lawrence Moeder Voor De Tweede Keer

May 20, 2025

Jennifer Lawrence Moeder Voor De Tweede Keer

May 20, 2025 -

Suki Waterhouses Tik Tok The Twink Comment That Went Viral 97 1k Views

May 20, 2025

Suki Waterhouses Tik Tok The Twink Comment That Went Viral 97 1k Views

May 20, 2025 -

Ieadt Ihyae Aghatha Krysty Jraym Jdydt Btqnyt Aldhkae Alastnaey

May 20, 2025

Ieadt Ihyae Aghatha Krysty Jraym Jdydt Btqnyt Aldhkae Alastnaey

May 20, 2025

Latest Posts

-

Are Quantum Stocks Like Rigetti Rgti And Ion Q A Smart Investment In 2025

May 20, 2025

Are Quantum Stocks Like Rigetti Rgti And Ion Q A Smart Investment In 2025

May 20, 2025 -

Analyzing The D Wave Quantum Qbts Stock Market Rally

May 20, 2025

Analyzing The D Wave Quantum Qbts Stock Market Rally

May 20, 2025 -

D Wave Quantum Qbts Stock Jump Analyzing Fridays Price Increase

May 20, 2025

D Wave Quantum Qbts Stock Jump Analyzing Fridays Price Increase

May 20, 2025 -

Investing In Quantum Computing Stocks In 2025 A Guide To Rigetti Rgti And Ion Q

May 20, 2025

Investing In Quantum Computing Stocks In 2025 A Guide To Rigetti Rgti And Ion Q

May 20, 2025 -

Why Did D Wave Quantum Qbts Stock Soar This Week An In Depth Analysis

May 20, 2025

Why Did D Wave Quantum Qbts Stock Soar This Week An In Depth Analysis

May 20, 2025