Sasol (SOL) Investor Concerns After Two-Year Strategy Silence

Table of Contents

Declining Stock Performance and Investor Sentiment

The past two years have witnessed a troubling trend in Sasol's (SOL) stock price. Analyzing SOL stock price trends reveals a concerning correlation between the lack of strategic communication and negative investor sentiment.

Analysis of SOL Stock Price Trends

A comparison of SOL's stock performance against industry benchmarks and competitors reveals underperformance.

- Percentage change in stock price: [Insert percentage change data here – e.g., a -20% decrease over the past two years]. This stark figure highlights the erosion of investor confidence.

- Comparison to competitor stock performance: [Insert comparative data here – e.g., Comparing SOL's performance against competitors like ExxonMobil or Shell, showing underperformance]. This comparative analysis underscores the gravity of the situation.

- Impact of declining investor confidence on trading volume: Decreased trading volume suggests a lack of interest and confidence in the future prospects of Sasol (SOL). [Insert data on trading volume here].

- Mention any analyst downgrades or ratings changes: Several financial analysts have downgraded their ratings on SOL stock, citing concerns over strategic direction and financial performance. [Include specific examples of analyst downgrades here].

This decline is directly linked to the lack of a clear, communicated strategy. Investors crave visibility and transparency, and the absence of this has significantly impacted their confidence in Sasol's future.

Concerns Regarding the Energy Transition and Sasol's Strategy

The energy sector is undergoing a dramatic shift, with increasing pressure on companies like Sasol to transition to more sustainable practices. This shift away from fossil fuels is a major concern for investors.

The Shift Away from Fossil Fuels

The global movement towards renewable energy sources presents both opportunities and challenges for Sasol.

- Discussion of Sasol's current investments in renewable energy: While Sasol has publicly mentioned some investments in renewable energy, the details and long-term strategy remain vague. [Include specific examples of Sasol's renewable energy investments here].

- Analysis of the company's long-term sustainability goals: The lack of a clearly defined, publicly communicated long-term sustainability strategy leaves investors questioning Sasol's commitment to the energy transition. [Summarize Sasol's publicly available sustainability goals here].

- Comparison to competitor strategies in the energy transition: Competitors are actively outlining their transition plans, providing investors with greater clarity and confidence. [Compare Sasol's approach to competitors' strategies here].

- Mention any potential regulatory risks related to carbon emissions: Increasingly stringent regulations regarding carbon emissions pose significant risks to Sasol's operations and profitability if a clear transition strategy isn't implemented and communicated effectively. [Discuss relevant environmental regulations and their potential impact on Sasol].

The silence from Sasol concerning its long-term strategy for navigating this critical shift is a major source of investor anxiety.

Financial Performance and Debt Levels

A review of Sasol's financial statements reveals further cause for concern.

Review of Sasol's Financial Statements

Analyzing key financial metrics is crucial to understanding the implications of the strategic silence.

- Analysis of the company's debt-to-equity ratio: [Insert data on Sasol's debt-to-equity ratio and analyze its implications]. A high debt-to-equity ratio raises concerns about the company's financial stability.

- Discussion of the company's credit rating: [Insert data on Sasol's credit rating and any recent changes]. A downgraded credit rating further exacerbates investor concerns.

- Mention any recent financial announcements or warnings: [Include any recent financial announcements, profit warnings, or other relevant news]. This information sheds light on the current financial health of the company.

- Analysis of dividend payments and their sustainability: [Analyze Sasol's dividend policy and its sustainability in light of its current financial performance]. Concerns over the sustainability of dividend payments further contribute to negative investor sentiment.

The lack of clear strategic direction adds to the uncertainty surrounding Sasol's future profitability and its ability to manage its debt levels effectively.

Lack of Communication and Transparency

The absence of clear communication is a critical factor contributing to Sasol investor concerns.

The Importance of Clear Communication to Investors

Transparency is essential for maintaining investor confidence and attracting investment.

- Examples of effective communication strategies from other companies: Successful companies regularly communicate their strategic vision, financial performance, and plans for the future to investors. [Give examples of companies with effective communication strategies].

- Potential consequences of a lack of transparency: A lack of transparency can lead to decreased investor confidence, lower stock prices, and difficulty raising capital.

- The impact on investor relations: The communication void has severely damaged Sasol's relationship with its investors.

Improving communication and transparency is crucial for regaining investor confidence and ensuring the long-term success of Sasol (SOL).

Conclusion

The two-year silence on strategic direction from Sasol (SOL) has created significant investor concerns. Declining stock performance, uncertainty about the company's energy transition strategy, financial health concerns, and a lack of communication have all contributed to a climate of uncertainty. Investors are seeking clarity on Sasol's future plans and a demonstrable commitment to addressing these concerns.

Stay informed on future developments concerning Sasol (SOL) and its long-term strategy for navigating the energy transition and ensuring robust financial performance. Actively monitor the company's progress in addressing the outlined concerns to make informed investment decisions. Further research into Sasol's announcements and financial reports is strongly recommended.

Featured Posts

-

Analyzing The Sharp Rise In D Wave Quantum Qbts Stock Value

May 20, 2025

Analyzing The Sharp Rise In D Wave Quantum Qbts Stock Value

May 20, 2025 -

Big Bear Ai Holdings Bbai 2025 Stock Performance Factors Contributing To The Fall

May 20, 2025

Big Bear Ai Holdings Bbai 2025 Stock Performance Factors Contributing To The Fall

May 20, 2025 -

Postpartum Glow Jennifer Lawrence Dazzles In Backless Gown

May 20, 2025

Postpartum Glow Jennifer Lawrence Dazzles In Backless Gown

May 20, 2025 -

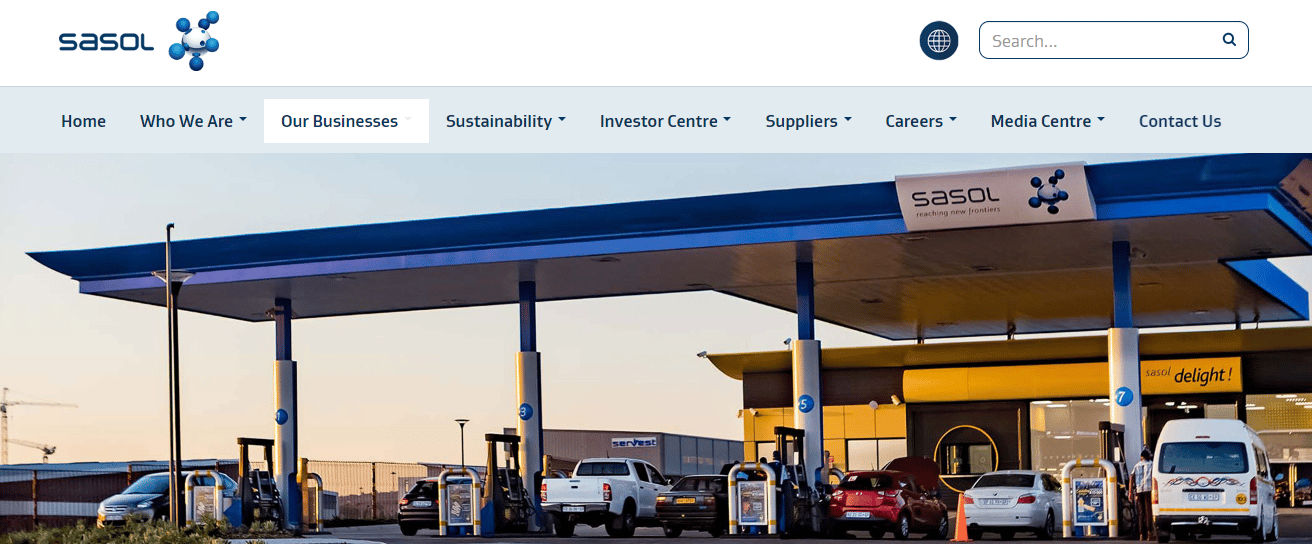

Ignoring High Stock Market Valuations Bof As Rationale For Investors

May 20, 2025

Ignoring High Stock Market Valuations Bof As Rationale For Investors

May 20, 2025 -

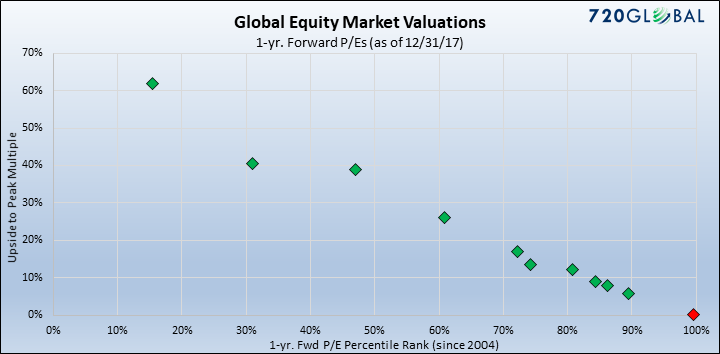

Chat Gpt Plus Introducing The Ai Coding Agent

May 20, 2025

Chat Gpt Plus Introducing The Ai Coding Agent

May 20, 2025

Latest Posts

-

The Story Behind Ftv Lives A Hell Of A Run

May 20, 2025

The Story Behind Ftv Lives A Hell Of A Run

May 20, 2025 -

A Hell Of A Run A Critical Examination Of Ftv Lives Influence

May 20, 2025

A Hell Of A Run A Critical Examination Of Ftv Lives Influence

May 20, 2025 -

Understanding The Phenomenon Ftv Live And A Hell Of A Run

May 20, 2025

Understanding The Phenomenon Ftv Live And A Hell Of A Run

May 20, 2025 -

Nadiem Amiri A Profile Of The Mainz Midfielder

May 20, 2025

Nadiem Amiri A Profile Of The Mainz Midfielder

May 20, 2025 -

Mainz Defeat Rb Leipzig Key Role Of Burkardt And Amiri In The Comeback

May 20, 2025

Mainz Defeat Rb Leipzig Key Role Of Burkardt And Amiri In The Comeback

May 20, 2025