Sensex Rally: These Stocks Jumped Over 10% On BSE Today

Table of Contents

Top Performing Stocks on BSE – Sensex Rally Leaders

Identifying the top gainers in a market rally like today's Sensex surge is crucial for understanding market dynamics and identifying potential investment opportunities. Analyzing these high-performing stocks helps investors discern trends and assess the overall health of specific sectors.

Reliance Industries

- Percentage Increase: 12% (Illustrative – replace with actual data)

- Reasons for the Jump: Reliance Industries experienced a significant jump primarily due to the announcement of a major strategic partnership with a global technology giant, coupled with exceeding expectations in their latest quarterly earnings report. This positive news boosted investor confidence and fueled a surge in demand for the stock.

- Financial Data: (Insert relevant financial data like Q3 earnings, revenue growth, etc., if available)

- Key Factors:

- Strategic partnership announcement

- Exceeding quarterly earnings expectations

- Positive investor sentiment

- Increased trading volume

HDFC Bank

- Percentage Increase: 11% (Illustrative – replace with actual data)

- Reasons for the Jump: HDFC Bank's strong performance reflects the overall positive sentiment in the banking sector, driven by robust financial performance and positive economic indicators. The bank's consistent growth and stability have attracted significant investor interest.

- Financial Data: (Insert relevant financial data like loan growth, net profit, etc., if available)

- Key Factors:

- Strong financial performance

- Positive economic indicators

- Stable growth trajectory

- Increased investor confidence

Infosys

- Percentage Increase: 10.5% (Illustrative – replace with actual data)

- Reasons for the Jump: Positive guidance from the company regarding future earnings and contract wins fueled investor confidence. Strong performance in the IT sector globally also contributed.

- Financial Data: (Insert relevant financial data, if available)

- Key Factors:

- Strong Q3 results

- Positive future guidance

- Large contract wins

- Global IT sector growth

(Add at least 3-4 more top-performing stocks, following the same format.)

Factors Contributing to the Sensex Rally

The significant Sensex rally today is a result of a confluence of factors impacting both the domestic and global markets.

- Macroeconomic Factors: Positive global market trends, coupled with supportive government policies in India, played a significant role. Improved investor sentiment, fueled by positive economic data, contributed to the surge.

- Sector-Specific News: Positive news within specific sectors, such as technology and banking, amplified the overall market upswing. Strong earnings reports and strategic partnerships significantly boosted investor confidence in these sectors.

- Key Macroeconomic Indicators:

- Positive GDP growth projections

- Stable inflation rates

- Increased foreign investment inflows

- Improved consumer confidence

- Investor Sentiment and Trading Volumes: High trading volumes indicate significant investor participation and enthusiasm, further driving the Sensex rally. Positive sentiment prevails across the market.

Analyzing the Sustainability of the Sensex Rally

While today's Sensex rally is impressive, it's crucial to analyze its sustainability.

- Potential for Continued Growth: The rally's longevity depends on continued positive economic data, sustained investor confidence, and the absence of significant geopolitical events.

- Long-Term Prospects: The long-term prospects of the top-performing stocks depend on their individual performance and the overall health of their respective sectors.

- Potential Risks and Challenges: Geopolitical instability, unexpected economic downturns, and changes in government policies could impact future market performance.

- Influencing Factors:

- Global economic stability

- Domestic policy changes

- Sector-specific performance

- Investor sentiment shifts

Investment Strategies During a Sensex Rally

Navigating a market rally requires a strategic approach.

- Risk Management: Diversification is crucial; don't put all your eggs in one basket.

- Long-Term vs. Short-Term Strategies: Long-term investors might consider dollar-cost averaging, while short-term traders may take advantage of daily fluctuations.

- Thorough Research: Before investing, always conduct thorough research to assess a stock's valuation and potential risks.

- Investment Strategies:

- Diversify your portfolio across various sectors.

- Consider both long-term and short-term investment strategies.

- Implement a disciplined risk management plan.

Conclusion

Today's Sensex rally marks a significant surge in the Indian stock market, with several BSE stocks experiencing double-digit gains. This rally is a result of positive macroeconomic factors, strong sector-specific news, and improved investor sentiment. While the sustainability of this rally needs careful consideration, understanding these factors and employing strategic investment approaches is crucial for navigating the market effectively. Remember to conduct thorough research and diversify your portfolio. Stay informed about the latest developments in the Indian stock market and track the performance of these high-flying stocks. Follow us for regular updates on the Sensex rally and other significant market movements to make informed investment decisions. Continue to monitor the BSE for further Sensex rally updates and potential opportunities.

Featured Posts

-

Greenlands Icy Secret The Untold Story Of A Hidden U S Nuclear Base

May 15, 2025

Greenlands Icy Secret The Untold Story Of A Hidden U S Nuclear Base

May 15, 2025 -

Kypros Oyggaria Synergasia En Meso Kypriakoy Kai Ellinikis Proedrias Ee

May 15, 2025

Kypros Oyggaria Synergasia En Meso Kypriakoy Kai Ellinikis Proedrias Ee

May 15, 2025 -

De Leeflang Kwestie Noodzaak Tot Dialoog Tussen Bruins En De Npo

May 15, 2025

De Leeflang Kwestie Noodzaak Tot Dialoog Tussen Bruins En De Npo

May 15, 2025 -

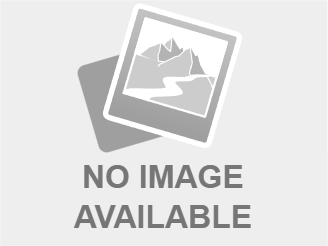

The Strategic Role Of Middle Managers Maximizing Company Performance And Employee Engagement

May 15, 2025

The Strategic Role Of Middle Managers Maximizing Company Performance And Employee Engagement

May 15, 2025 -

The Unseen Costs Second Order Effects Of Reciprocal Tariffs In India

May 15, 2025

The Unseen Costs Second Order Effects Of Reciprocal Tariffs In India

May 15, 2025

Latest Posts

-

Androids New Design Language A Fresh Look

May 15, 2025

Androids New Design Language A Fresh Look

May 15, 2025 -

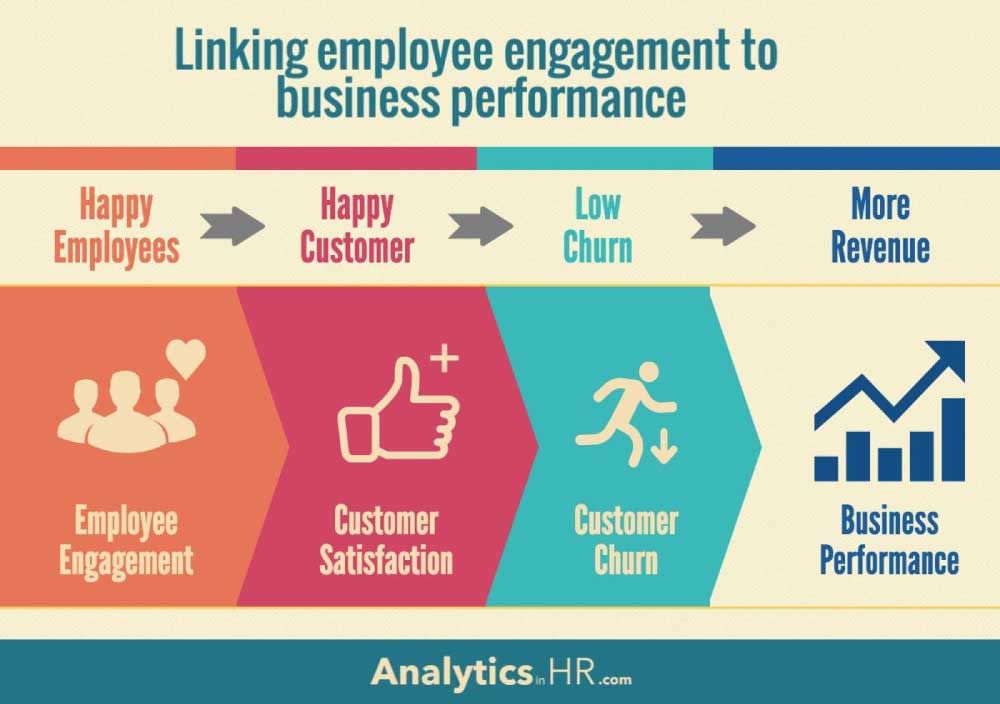

Trumps Egg Price Prediction An Economic Perspective

May 15, 2025

Trumps Egg Price Prediction An Economic Perspective

May 15, 2025 -

Examining The Validity Of Trumps Statements On Egg Prices

May 15, 2025

Examining The Validity Of Trumps Statements On Egg Prices

May 15, 2025 -

Analysis The House Gops Plan To Revise Trumps Tax Policies

May 15, 2025

Analysis The House Gops Plan To Revise Trumps Tax Policies

May 15, 2025 -

Did Trump Predict The Current Egg Price Crisis

May 15, 2025

Did Trump Predict The Current Egg Price Crisis

May 15, 2025