The Unseen Costs: Second-Order Effects Of Reciprocal Tariffs In India

Table of Contents

Increased Prices for Consumers

Reciprocal tariffs directly increase the cost of imported goods, leading to higher prices for consumers. This is a significant concern, particularly affecting essential goods and disproportionately impacting lower-income households. Understanding these second-order effects is crucial for policymakers.

Inflationary Pressures

The immediate consequence of reciprocal tariffs is inflationary pressure. Increased import costs translate directly into higher prices at the retail level. This impact is amplified by:

- Increased cost of raw materials for manufacturing: Many Indian industries rely on imported raw materials. Tariffs on these inputs increase production costs, leading to higher prices for finished goods.

- Reduced purchasing power for consumers: Higher prices erode consumer purchasing power, limiting their ability to buy other goods and services. This reduced spending power further impacts economic growth.

- Potential for social unrest due to rising living costs: Significant price increases, especially in essential commodities, can lead to social unrest and instability.

Reduced Consumer Spending

Higher prices inevitably lead to reduced consumer spending. This dampening effect on demand has a cascading impact across various sectors:

- Impact on discretionary spending: Consumers are likely to cut back on non-essential purchases first, impacting industries like entertainment, tourism, and luxury goods.

- Reduced demand across various industries: Decreased consumer spending translates into reduced demand across the board, impacting businesses of all sizes.

- Potential for job losses in consumer-facing sectors: Reduced demand can lead to layoffs and business closures in industries heavily reliant on consumer spending.

Impact on Domestic Industries

While reciprocal tariffs are often implemented to protect domestic industries, the reality is more nuanced. The second-order effects can significantly reduce their competitiveness and create further economic challenges.

Reduced Competitiveness

Higher input costs, resulting from tariffs on imported raw materials and intermediate goods, limit the ability of Indian industries to compete globally. This is particularly true for export-oriented industries.

- Difficulty accessing cheaper raw materials: Tariffs increase the cost of essential inputs, making Indian products less price-competitive in international markets.

- Loss of export markets due to higher prices: Higher production costs due to tariffs make Indian exports less attractive, potentially leading to a loss of market share and revenue.

- Potential for decreased innovation due to reduced global competition: Sheltering domestic industries from global competition can stifle innovation and efficiency improvements.

Supply Chain Disruptions

Reciprocal tariffs disrupt established supply chains, leading to delays, increased costs, and uncertainty for businesses. The ripple effect can be substantial:

- Increased logistics costs: Finding alternative suppliers and navigating new trade routes can significantly increase logistics costs.

- Delays in production and delivery: Supply chain disruptions lead to production delays and affect timely delivery of goods, harming business operations.

- Uncertainty impacting investment decisions: The instability created by reciprocal tariffs makes businesses hesitant to invest in expansion or new projects.

Retaliatory Measures and Geopolitical Implications

The imposition of reciprocal tariffs can easily escalate into trade wars, damaging international relations and further harming the Indian economy.

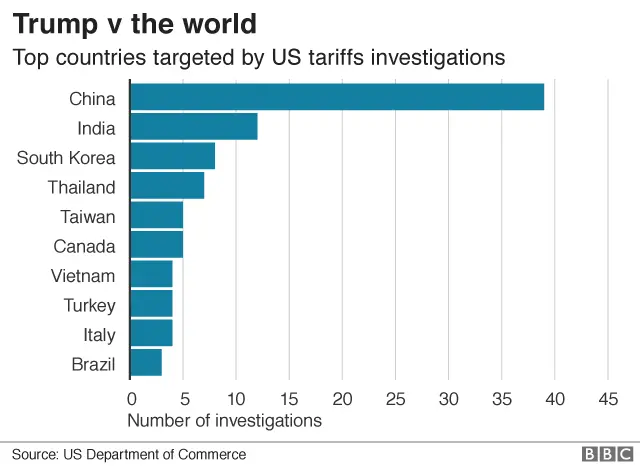

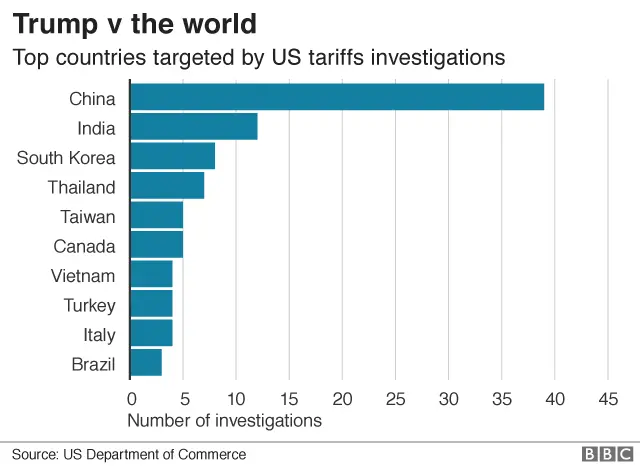

Trade Wars and Escalation

Reciprocal tariffs are rarely unilateral. Trading partners often retaliate with their own tariffs, triggering a cycle of escalating trade restrictions.

- Potential for retaliatory tariffs from trading partners: Other countries might impose their own tariffs on Indian exports, further damaging the country's trade balance.

- Damage to India's international reputation: Engaging in trade wars can damage India's reputation as a reliable and predictable trading partner.

- Negative impact on foreign investment: Trade uncertainty can deter foreign investors, reducing capital inflows and hindering economic growth.

Weakened International Alliances

Reciprocal tariffs can strain diplomatic ties, making it harder for India to collaborate with other countries on crucial issues.

- Reduced trust and cooperation with trading partners: Trade disputes can erode trust and make it more difficult to negotiate future trade agreements.

- Difficulty in securing favorable trade agreements: A reputation for using protectionist measures can make it harder to negotiate favorable trade agreements with other countries.

- Impact on broader geopolitical stability: Escalating trade disputes can create broader geopolitical instability, affecting India's relationships with key partners.

Conclusion

The second-order effects of reciprocal tariffs in India extend far beyond simple import and export figures. The increased prices, reduced consumer spending, hampered domestic industries, and potential for escalated trade conflicts highlight the complexity and potentially severe consequences of such policies. A careful evaluation of the long-term costs, considering these unseen consequences, is crucial before implementing reciprocal tariffs. A thorough cost-benefit analysis, accounting for all the second-order effects of reciprocal tariffs in India, is essential for informed policy-making. Understanding the full impact of these policies is vital for the sustainable and inclusive growth of the Indian economy. Ignoring the unseen costs of reciprocal tariffs can have far-reaching and detrimental consequences for India's economic future.

Featured Posts

-

Fentanyl Crisis Holding China Accountable According To A Former Us Envoy

May 15, 2025

Fentanyl Crisis Holding China Accountable According To A Former Us Envoy

May 15, 2025 -

Bmw And Porsches China Challenges A Growing Industry Trend

May 15, 2025

Bmw And Porsches China Challenges A Growing Industry Trend

May 15, 2025 -

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Pal Carsamba Guenue

May 15, 2025

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Pal Carsamba Guenue

May 15, 2025 -

Dreigende Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Dreigende Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025 -

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025

Latest Posts

-

Examining Trumps Stated Oil Price Preference Goldman Sachs Report

May 15, 2025

Examining Trumps Stated Oil Price Preference Goldman Sachs Report

May 15, 2025 -

Dismissing Stock Market Valuation Concerns Bof As Argument

May 15, 2025

Dismissing Stock Market Valuation Concerns Bof As Argument

May 15, 2025 -

Estimating The Impact Of Trumps Tariffs On Californias Revenue

May 15, 2025

Estimating The Impact Of Trumps Tariffs On Californias Revenue

May 15, 2025 -

Trumps Oil Price Outlook A Goldman Sachs Social Media Analysis

May 15, 2025

Trumps Oil Price Outlook A Goldman Sachs Social Media Analysis

May 15, 2025 -

Should Investors Worry About High Stock Market Valuations Bof A Weighs In

May 15, 2025

Should Investors Worry About High Stock Market Valuations Bof A Weighs In

May 15, 2025