Should You Buy Apple Stock? Wedbush's Take After Price Target Revision

Table of Contents

Wedbush's Price Target Revision: The Details

Wedbush Securities recently revised its price target for Apple stock, sending ripples through the investment community. Understanding the specifics of this revision is crucial for anyone considering an investment in Apple. Let's break down the key details:

- Previous Price Target: [Insert Previous Price Target from Wedbush].

- Revised Price Target: [Insert Revised Price Target from Wedbush].

- Percentage Change: [Calculate and insert the percentage change between the old and new price targets].

The rationale behind this significant upward (or downward, depending on the actual revision) revision, according to Wedbush analyst [Insert Analyst's Name and Credentials], centers around [Insert Key Reasons from Wedbush's report – e.g., robust iPhone 15 sales exceeding expectations, continued growth in the services sector, positive indications in the wearables market, etc.]. These factors, combined with [mention any other contributing factors mentioned by Wedbush], paint a picture of [Bullish/Bearish – choose the appropriate term] sentiment towards Apple's future prospects.

- Key Reasons for Revision:

- Strong iPhone sales.

- Growth in Apple's Services revenue.

- Positive outlook for wearables and other product segments.

- [Add other reasons as applicable from Wedbush's report]

Analyzing the Implications of Wedbush's Prediction

Wedbush's revised price target for Apple stock doesn't exist in a vacuum; it influences the overall market sentiment and, subsequently, the stock's price. The announcement is likely to:

-

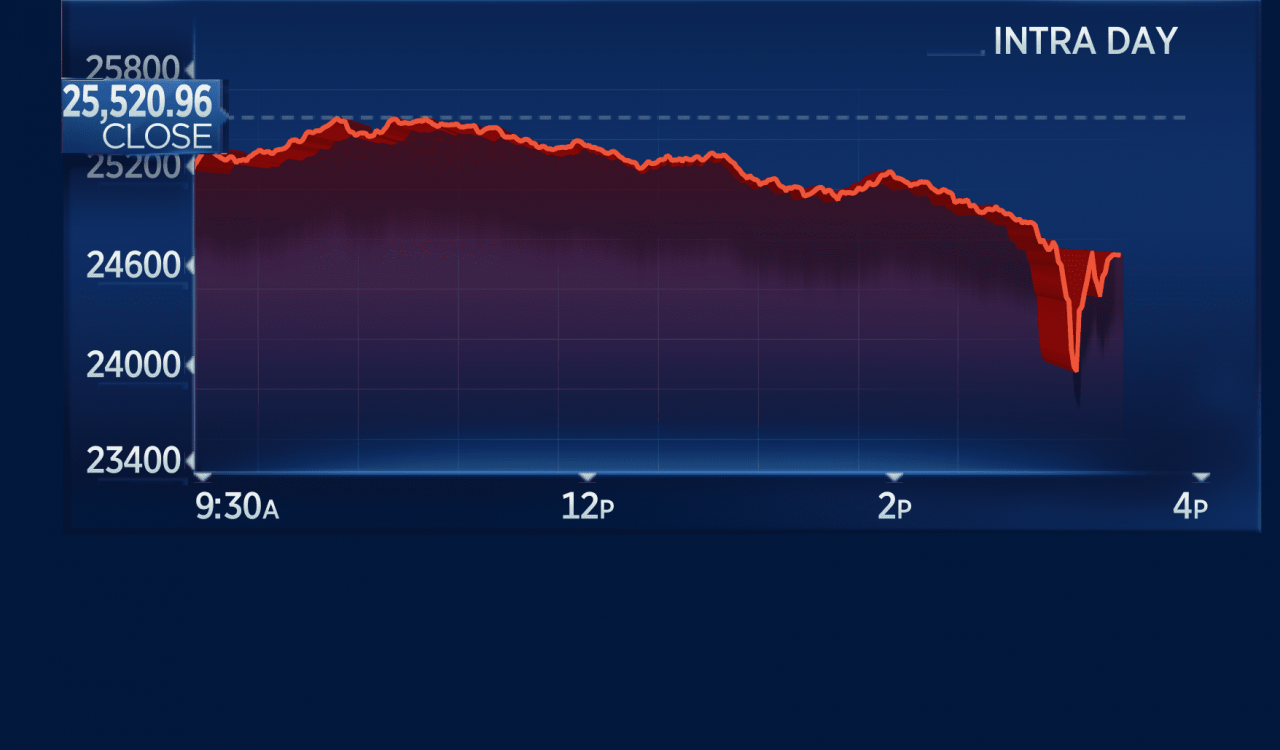

Impact on Stock Price: The revised price target could lead to a short-term increase (or decrease) in Apple's stock price, as investors react to the news. Long-term effects, however, depend on whether Apple meets or surpasses the expectations driving Wedbush's prediction.

-

Market Sentiment: A positive revision generally boosts investor confidence, potentially attracting more buyers. Conversely, a negative revision might lead to selling pressure. It's essential to monitor overall market trends and other analyst opinions to get a complete picture.

-

Bullish or Bearish Outlook: Wedbush's revision signals a [Bullish/Bearish - Choose the appropriate term] outlook on Apple's stock. This should be considered alongside other market analyses and your own investment risk tolerance.

-

Comparison to Other Analyst Predictions: It's crucial to compare Wedbush's prediction to those of other reputable analysts covering Apple stock. This helps gauge the consensus view and identify potential outliers.

Factors to Consider Before Investing in Apple Stock

While Wedbush's price target revision provides valuable insight, it's just one piece of the puzzle. Before investing in Apple stock, you must consider several other critical factors:

-

Market Conditions: The overall state of the stock market significantly influences individual stock performance. A bearish market can negatively impact even the strongest companies.

-

Apple's Competitive Landscape: Apple faces competition from other tech giants in various markets. Its ability to maintain its market share and innovate will directly affect its future success.

-

Apple's Financial Health and Future Prospects: Analyze Apple's financial statements, including revenue, profits, and debt levels. Look at the company's growth trajectory and potential expansion plans.

-

Current Economic Climate: Macroeconomic factors such as inflation, interest rates, and geopolitical events can greatly affect stock performance.

-

Strengths of Apple:

- Strong brand recognition and loyalty.

- Diversified product portfolio.

- Significant cash reserves.

- Robust ecosystem.

-

Weaknesses of Apple:

- High dependence on iPhone sales.

- Intense competition in various markets.

- Pricing concerns for some products.

- Supply chain vulnerabilities.

Alternative Investment Strategies: Diversification and Risk Management

Investing solely in one company, even a seemingly stable one like Apple, carries significant risk. Diversification is key to mitigating potential losses. Consider these strategies:

-

Diversified Portfolio: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce risk.

-

Index Funds or ETFs: These offer broad market exposure, diversifying your investment automatically.

-

Thorough Research: Always conduct comprehensive research before making any investment decision. Consult with a qualified financial advisor if needed.

-

Examples of Diversification:

- Investing in a mix of tech stocks, healthcare stocks, and consumer goods stocks.

- Allocating a portion of your portfolio to bonds for stability.

- Considering real estate investments to diversify beyond stocks.

Conclusion: Should You Buy Apple Stock? Weighing the Evidence After Wedbush's Update

Wedbush's revised price target for Apple stock offers valuable information, but it shouldn't be the sole factor determining your investment decision. Consider the broader market conditions, Apple's competitive landscape, its financial health, and your own risk tolerance. Remember, the potential for high returns often comes with higher risk.

Ultimately, the decision of whether to buy Apple stock rests on your individual assessment. Do your research, understand the risks involved, and make an informed decision about whether Apple stock aligns with your investment strategy and risk tolerance. Don't hesitate to consult a financial professional for personalized guidance.

Featured Posts

-

Indonesia Classic Art Week 2025 Perpaduan Seni Dan Keanggunan Porsche

May 24, 2025

Indonesia Classic Art Week 2025 Perpaduan Seni Dan Keanggunan Porsche

May 24, 2025 -

Trade War Fallout Another Day Of Losses For Dutch Stocks

May 24, 2025

Trade War Fallout Another Day Of Losses For Dutch Stocks

May 24, 2025 -

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 24, 2025

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 24, 2025 -

Economische Recessie Geen Probleem Voor Relx Ai Zorgt Voor Groei

May 24, 2025

Economische Recessie Geen Probleem Voor Relx Ai Zorgt Voor Groei

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 How To Buy Tickets Now The Lineup Is Confirmed

May 24, 2025

Bbc Radio 1 Big Weekend 2025 How To Buy Tickets Now The Lineup Is Confirmed

May 24, 2025

Latest Posts

-

Live Stock Market Updates Bond Sell Off Dow Futures Bitcoin Rally

May 24, 2025

Live Stock Market Updates Bond Sell Off Dow Futures Bitcoin Rally

May 24, 2025 -

Gen Zs Marketing Queen Alix Earles Dwts Success Story

May 24, 2025

Gen Zs Marketing Queen Alix Earles Dwts Success Story

May 24, 2025 -

Universals 7 Billion Theme Park Will It Topple Disneys Reign

May 24, 2025

Universals 7 Billion Theme Park Will It Topple Disneys Reign

May 24, 2025 -

The Tush Push Endures A Look At Nfls Evolving Celebration Policies

May 24, 2025

The Tush Push Endures A Look At Nfls Evolving Celebration Policies

May 24, 2025 -

Stock Market Today Bonds Fall Dow Futures Uncertain Bitcoin Rises

May 24, 2025

Stock Market Today Bonds Fall Dow Futures Uncertain Bitcoin Rises

May 24, 2025