Steepening Japanese Government Bond Yield Curve: Investor Divisions And Economic Implications

Table of Contents

Factors Contributing to the Steepening Japanese Government Bond Yield Curve

Several interconnected factors are contributing to the observed steepening of the Japanese Government Bond yield curve.

The Bank of Japan's (BOJ) Policy Shift

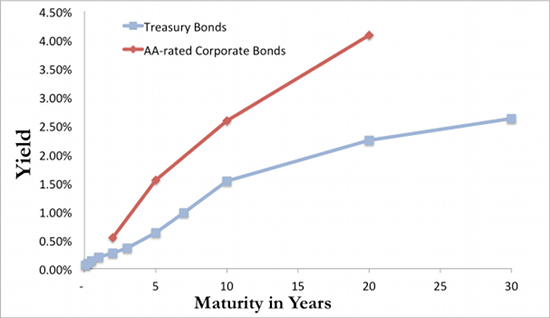

The Bank of Japan's recent policy adjustments have been a pivotal driver of the steepening JGB yield curve. The BOJ's long-standing yield curve control (YCC) policy, designed to maintain ultra-low interest rates, underwent significant modifications in late 2022 and early 2023.

- Timeline of Changes: The BOJ initially allowed for greater flexibility in the 10-year JGB yield, effectively widening the acceptable band around its target. This was followed by further adjustments, culminating in a complete overhaul of the YCC policy in December 2022.

- Impact on JGB Yields: These policy changes led to a significant rise in longer-term JGB yields, while short-term yields remained relatively low, resulting in a steeper yield curve. This reflects a shift away from the BOJ's previous policy of quantitative easing (QE) and a move towards normalization of monetary policy. The 10-year JGB yield, previously tightly controlled near zero, has seen a substantial increase, widening the spread between short and long-term yields.

- BOJ Monetary Policy Implications: The shift signifies a departure from the ultra-loose monetary policy that had characterized Japan's economic strategy for years. The rationale behind this shift includes the need to address persistent inflationary pressures while navigating the complex dynamics of a post-pandemic global economy.

Inflationary Pressures and Rising Interest Rates Globally

Global inflationary pressures and the subsequent rise in interest rates in major economies, particularly the US, have significantly influenced investor expectations for JGB yields.

- Influence of US Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes to combat inflation have strengthened the US dollar and attracted capital away from Japanese assets, contributing to increased JGB yields. This is because higher US yields make dollar-denominated assets more attractive to global investors.

- Global Inflationary Pressures: Rising global inflation erodes the purchasing power of JGB returns, leading investors to demand higher yields as compensation for this risk. This inflationary environment has prompted many central banks globally to raise interest rates, affecting the comparative attractiveness of JGBs.

- Impact on Inflation Expectations: Market participants are factoring in expectations of sustained or even rising inflation in their pricing of JGBs, pushing yields higher to reflect this increased risk. The impact of global inflation on Japan's own inflation rate further contributes to the upward pressure on JGB yields.

Increased Demand for Longer-Term JGBs

Despite the steepening curve, there has been some evidence of increased demand for longer-term JGBs, partially offsetting the upward pressure on yields.

- Long-Term Investment Strategies: Some investors see longer-term JGBs as attractive long-term investments, particularly given the relative stability of the Japanese economy.

- Inflation Hedging: While inflation erodes the real return, some investors view longer-dated JGBs as a partial hedge against inflation compared to shorter-term bonds.

- Shift in Risk Appetite: The demand for longer-term JGBs could also reflect a change in investor risk appetite, with a preference for longer-duration assets offering higher potential returns, despite increased interest rate risk.

Diverging Investor Opinions on the Future of the Japanese Government Bond Yield Curve

The steepening JGB yield curve has created a divergence of opinion among investors regarding its future trajectory.

Bullish vs. Bearish Sentiments

The market sentiment is split regarding the continuation of the steepening trend.

- Bullish Sentiment: Some investors believe the steepening trend will persist, citing ongoing global inflationary pressures, further BOJ policy adjustments, and potentially increased government borrowing needs.

- Bearish Sentiment: Others argue the steepening will reverse or plateau, pointing to potential economic slowdowns, a weakening of the US dollar, and the BOJ's potential intervention to prevent excessive yield increases. This perspective often emphasizes the limitations of the BOJ's control over the yield curve and the potential for a market correction.

- Impact of Investment Strategies: These differing perspectives significantly influence investment strategies, with bullish investors favoring strategies that benefit from rising yields and bearish investors seeking protection from further yield increases.

Impact of Geopolitical Factors

Geopolitical uncertainty also plays a role in shaping investor sentiment towards JGBs.

- Geopolitical Risk and Safe-Haven Asset Status: The ongoing war in Ukraine and heightened US-China tensions introduce elements of geopolitical risk, potentially impacting investor confidence. While JGBs are considered a safe-haven asset, heightened global uncertainty can lead to increased demand for these bonds, at least temporarily, leading to lower yields. However, such increased demand might only be temporary.

- Global Uncertainty and Market Volatility: Periods of heightened global uncertainty often lead to increased market volatility, impacting the attractiveness of JGBs relative to other assets. Such volatility can influence the overall steepness of the yield curve.

Economic Implications of a Steepening Japanese Government Bond Yield Curve

The steepening JGB yield curve carries significant economic implications for Japan.

Impact on Government Borrowing Costs

A steeper yield curve directly affects the Japanese government's cost of borrowing.

- Government Debt and Fiscal Sustainability: Rising long-term yields increase the cost of refinancing existing government debt and issuing new bonds, potentially straining fiscal sustainability. This is particularly concerning given Japan's already high level of public debt.

- Implications for Fiscal Policy: Higher borrowing costs may necessitate adjustments in fiscal policy, potentially limiting the government's ability to fund public services and infrastructure projects. The government may need to prioritize debt reduction strategies and consider policy changes to mitigate this impact.

Effects on the Japanese Economy

The changing JGB yield curve has broader effects on the Japanese economy.

- Impact on Investment Climate: Higher interest rates can dampen investment by increasing borrowing costs for businesses. This can reduce the overall pace of economic growth.

- Consumer Confidence and Spending: Higher interest rates can also affect consumer confidence and spending as borrowing becomes more expensive, leading to reduced consumer demand. However, higher yields might also incentivize some savings.

- Economic Growth Potential: The overall impact on economic growth is complex and depends on various factors, including the magnitude and duration of the yield curve steepening, the responsiveness of businesses and consumers to higher interest rates, and the effectiveness of government policies.

Conclusion

The steepening Japanese Government Bond yield curve presents a multifaceted challenge, with several factors influencing its trajectory and leading to divergent investor opinions. Understanding the interplay between BOJ policy, global economic conditions, and investor sentiment is crucial for navigating this dynamic environment. The economic implications are significant, directly impacting government borrowing costs and potentially affecting the broader economic growth trajectory. Staying informed about the Japanese Government Bond yield curve is vital for both investors and policymakers. Continuous monitoring of developments and engagement with expert analysis are key to comprehending the future direction of this pivotal market indicator. Actively following updates on the Japanese Government Bond yield curve is essential for making informed decisions.

Featured Posts

-

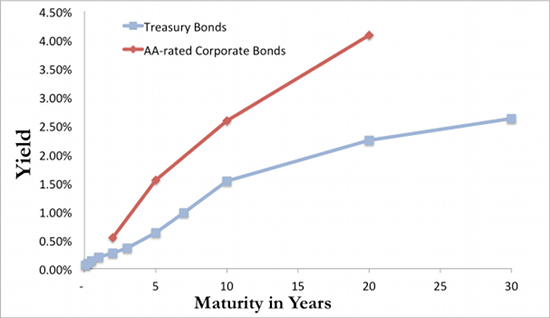

Analyzing Uber Technologies Uber As An Investment

May 17, 2025

Analyzing Uber Technologies Uber As An Investment

May 17, 2025 -

Covid 19 Vaccine Policy Change Proposed Rfk Jr S Hhs To Reconsider Routine Vaccinations

May 17, 2025

Covid 19 Vaccine Policy Change Proposed Rfk Jr S Hhs To Reconsider Routine Vaccinations

May 17, 2025 -

Week In Review Analyzing Past Mistakes For Future Success

May 17, 2025

Week In Review Analyzing Past Mistakes For Future Success

May 17, 2025 -

Trade Wars And Automotive Production A Case Study Of Honda And Canada

May 17, 2025

Trade Wars And Automotive Production A Case Study Of Honda And Canada

May 17, 2025 -

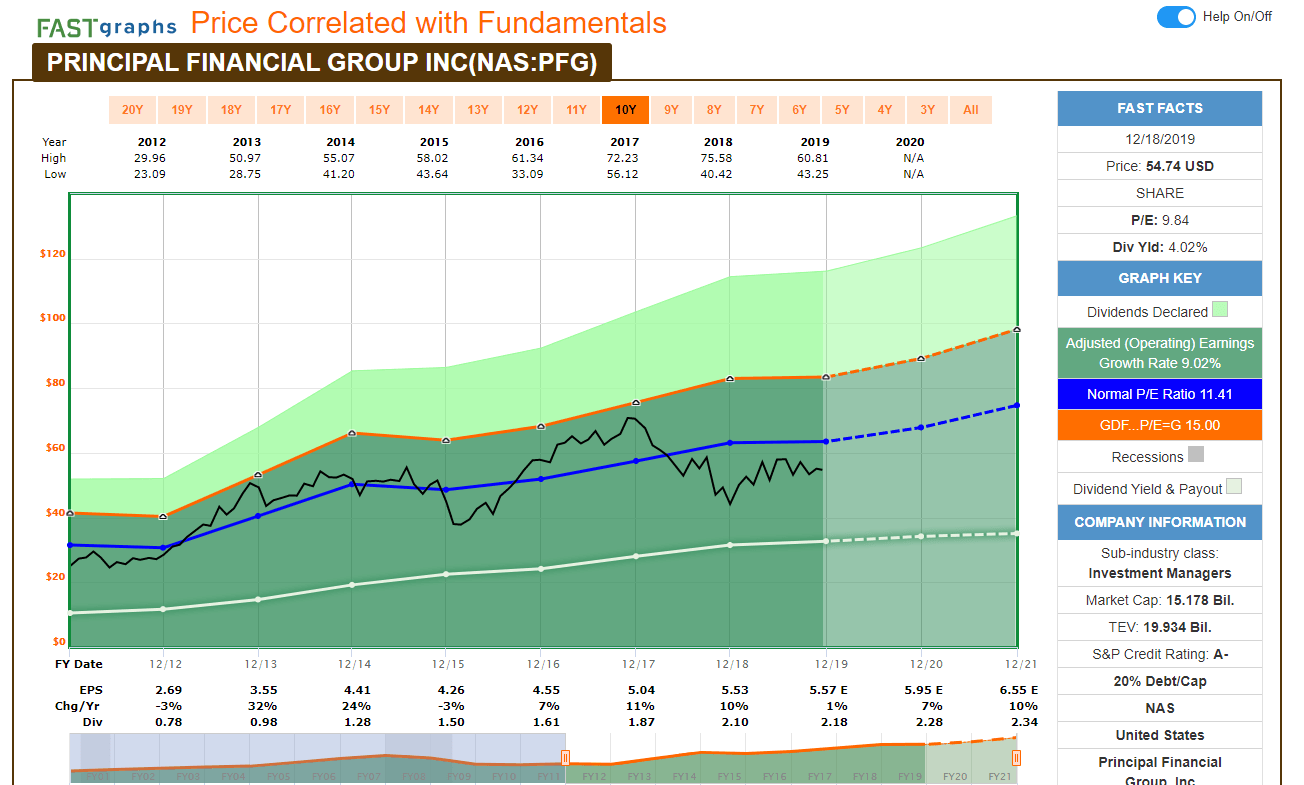

Principal Financial Group Nasdaq Pfg 13 Analyst Ratings And Outlook

May 17, 2025

Principal Financial Group Nasdaq Pfg 13 Analyst Ratings And Outlook

May 17, 2025

Latest Posts

-

Finale Barcelone Rune Pobeduje Povredenog Alcarasa

May 17, 2025

Finale Barcelone Rune Pobeduje Povredenog Alcarasa

May 17, 2025 -

The Trump Marriage Fact And Fiction Regarding A Potential Split

May 17, 2025

The Trump Marriage Fact And Fiction Regarding A Potential Split

May 17, 2025 -

Lawrence O Donnell Exposes Trumps Humiliation On Live Television

May 17, 2025

Lawrence O Donnell Exposes Trumps Humiliation On Live Television

May 17, 2025 -

Alcaraz Povreden Rune Slavi U Finalu Barcelone

May 17, 2025

Alcaraz Povreden Rune Slavi U Finalu Barcelone

May 17, 2025 -

Iga Svjontek Ukrajinka Rezultati Statistika I Vesti

May 17, 2025

Iga Svjontek Ukrajinka Rezultati Statistika I Vesti

May 17, 2025