Stock Market Valuation Concerns: BofA's Perspective And Analysis

Table of Contents

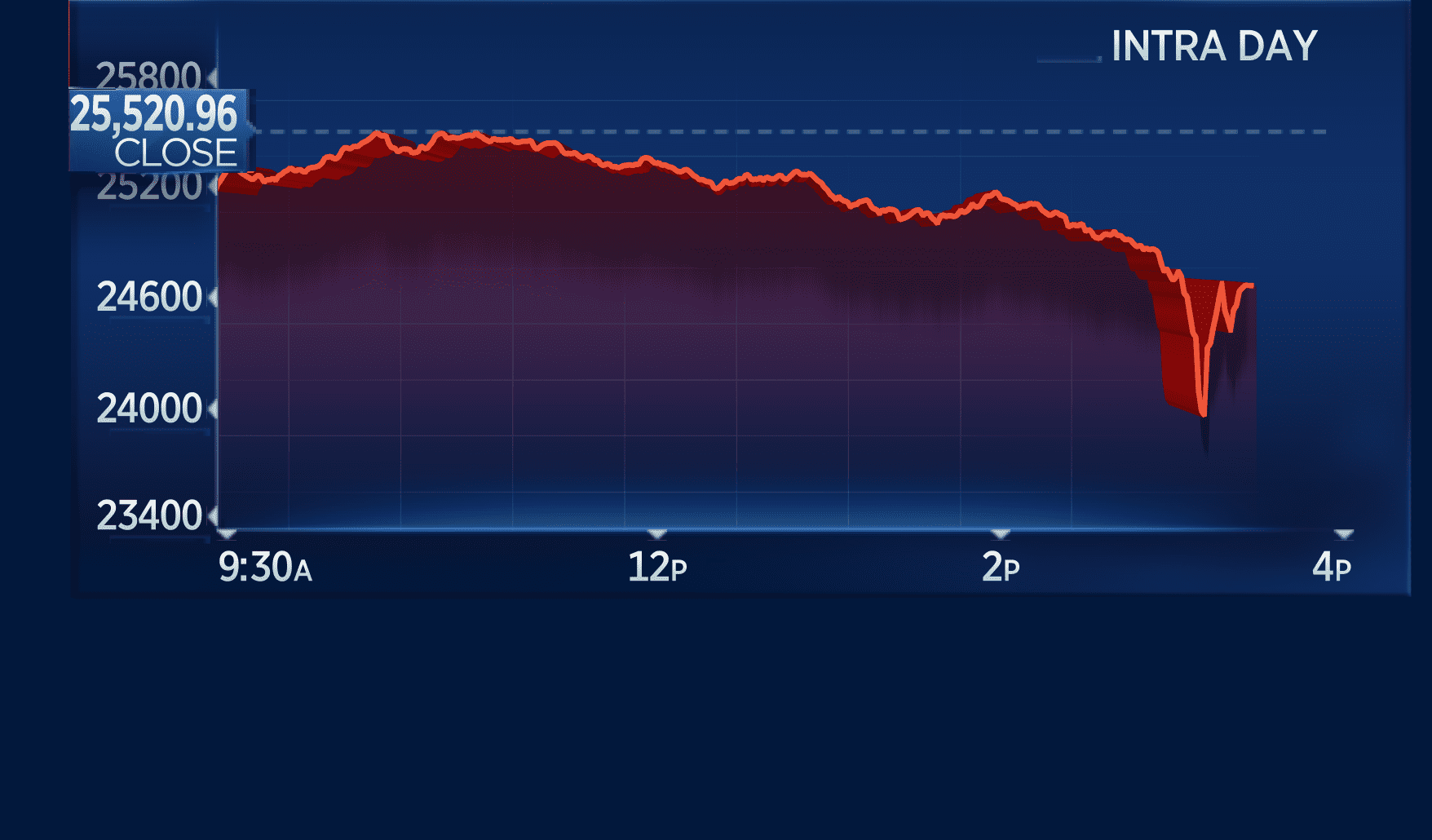

The stock market's recent performance has sparked significant debate regarding its valuation. Bank of America (BofA), a leading financial institution, has voiced considerable concerns about current market levels. This article delves into BofA's perspective on stock market valuation, examining their analysis and outlining the implications for investors. We will explore the key factors driving BofA's concerns and offer insights into navigating this potentially volatile market environment.

BofA's Key Valuation Concerns

Elevated Price-to-Earnings Ratios (P/E):

Price-to-earnings ratios (P/E ratios) are a fundamental metric in stock market valuation, representing the price an investor pays for each dollar of a company's earnings. A high P/E ratio generally suggests that the market is anticipating strong future earnings growth. However, excessively high P/E ratios can indicate overvaluation, potentially leading to a market correction. BofA's analysis suggests that current P/E ratios across many sectors are significantly above historical averages, raising concerns about potential overvaluation.

- High P/E ratios suggest overvaluation, potentially leading to market corrections. This means investors might be paying more for a company's stock than its current earnings justify, increasing the risk of a price drop.

- Comparison of current P/E ratios across different sectors reveals significant variations. Some sectors appear more overvalued than others, requiring a nuanced approach to investment.

- Historical data illustrates periods of high P/E ratios followed by market downturns. Studying past market cycles helps understand the potential consequences of elevated valuations. Analyzing periods like the dot-com bubble provides valuable insights into similar scenarios.

Impact of Interest Rate Hikes:

The Federal Reserve's (and other central banks') strategy of raising interest rates to combat inflation has significant implications for stock valuations. Higher interest rates increase the cost of borrowing for companies, impacting their profitability and potentially reducing future earnings. This, in turn, can affect investor sentiment, leading to lower demand for equities.

- Increased borrowing costs for companies impact profitability. Higher interest rates make it more expensive for businesses to expand, invest, and manage their debt.

- Reduced investor appetite for riskier assets occurs as safer alternatives like bonds become more attractive. Investors may shift their portfolios towards less volatile, higher-yielding bonds.

- The potential for higher discount rates used in valuation models significantly impacts future earnings estimations. Higher discount rates reduce the present value of future earnings, leading to lower stock valuations.

Geopolitical and Macroeconomic Uncertainty:

Global events, including geopolitical instability (e.g., the war in Ukraine), persistent inflation, and supply chain disruptions, contribute to significant uncertainty in the market. This uncertainty makes it difficult to accurately predict future earnings and increases market volatility. BofA's analysis highlights these risks as major factors contributing to their valuation concerns.

- Uncertainties lead to increased market volatility, making it challenging for investors to make informed decisions. Rapid price swings can lead to substantial losses.

- Potential for downward revisions in earnings forecasts as companies struggle with rising costs and reduced demand. This can further impact stock valuations.

- The impact of inflation on consumer spending and corporate profits is a critical concern. High inflation erodes purchasing power, potentially leading to decreased consumer demand and reduced corporate profitability.

BofA's Recommended Investment Strategies

Defensive Positioning:

BofA recommends a more defensive approach to portfolio construction, suggesting investors prioritize capital preservation over aggressive growth. This might involve reducing exposure to riskier assets and increasing allocations to more stable investments.

Sector-Specific Analysis:

BofA advises investors to conduct thorough sector-specific analysis, identifying potentially undervalued or less volatile sectors. This involves a detailed examination of individual companies within different industries to find opportunities that better align with a defensive investment strategy. Certain defensive sectors might offer better risk-adjusted returns.

Diversification Strategies:

Diversification remains a crucial aspect of mitigating risk in any market environment. BofA emphasizes spreading investments across various asset classes and sectors to reduce the impact of losses in any single area. This helps to cushion the portfolio against market volatility.

- Specific examples of BofA's recommendations include increasing allocations to high-quality bonds, dividend-paying stocks, and potentially some defensive sectors like consumer staples.

- Risk assessment is paramount, requiring investors to carefully evaluate the potential risks and rewards associated with each investment.

Alternative Perspectives and Counterarguments:

While BofA's concerns are significant, alternative perspectives exist. Some analysts argue that current valuations are justified by factors such as technological innovation, disruptive business models, and long-term growth potential in specific sectors.

- Arguments suggesting that current valuations are justified by factors such as innovation and growth potential highlight the ongoing technological revolution and the emergence of new growth industries.

- Perspectives emphasizing the long-term growth prospects of the market point towards the resilience of the economy and the potential for sustained expansion over the long run.

- Analysis of differing methodologies used in stock valuation reveals that various approaches can lead to different conclusions about market valuations. Different models and assumptions can produce contrasting results.

Conclusion:

BofA's analysis highlights significant concerns regarding current stock market valuations, emphasizing elevated P/E ratios, the impact of rising interest rates, and persistent macroeconomic uncertainties. While alternative perspectives exist, understanding BofA's concerns is crucial for informed investment decision-making. Investors should consider diversifying their portfolios, adopting a more defensive strategy, and carefully analyzing sector-specific valuations. Staying informed about stock market valuation concerns and adapting your investment strategy accordingly is essential for navigating this complex market environment. Continue to monitor BofA's insights and other expert opinions to make well-informed decisions about your stock market investments.

Featured Posts

-

1 050 Price Hike At And T Details The Impact Of Broadcoms V Mware Deal

Apr 24, 2025

1 050 Price Hike At And T Details The Impact Of Broadcoms V Mware Deal

Apr 24, 2025 -

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 24, 2025

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 24, 2025 -

The Impact Of Trumps Budget Cuts On Tornado Preparedness And Response

Apr 24, 2025

The Impact Of Trumps Budget Cuts On Tornado Preparedness And Response

Apr 24, 2025 -

The Canadian Dollars Performance A Detailed Analysis

Apr 24, 2025

The Canadian Dollars Performance A Detailed Analysis

Apr 24, 2025 -

Stock Market Today Dow S And P 500 Live Updates April 23rd

Apr 24, 2025

Stock Market Today Dow S And P 500 Live Updates April 23rd

Apr 24, 2025

Latest Posts

-

Thomas Mueller Till Mls Senaste Nytt Och Rykten

May 12, 2025

Thomas Mueller Till Mls Senaste Nytt Och Rykten

May 12, 2025 -

Apres Le Divorce Eric Antoine Et La Naissance De Son Enfant Avec Sa Nouvelle Compagne

May 12, 2025

Apres Le Divorce Eric Antoine Et La Naissance De Son Enfant Avec Sa Nouvelle Compagne

May 12, 2025 -

Eric Antoine Un Nouveau Depart Un Nouvel Amour Un Nouveau Bebe

May 12, 2025

Eric Antoine Un Nouveau Depart Un Nouvel Amour Un Nouveau Bebe

May 12, 2025 -

Le Divorce D Eric Antoine Et L Arrivee De Son Bebe

May 12, 2025

Le Divorce D Eric Antoine Et L Arrivee De Son Bebe

May 12, 2025 -

Eric Antoine Nouveau Chapitre Apres La Separation Un Bebe Avec Sa Nouvelle Compagne

May 12, 2025

Eric Antoine Nouveau Chapitre Apres La Separation Un Bebe Avec Sa Nouvelle Compagne

May 12, 2025