The Impact Of Buffett's Retirement On Berkshire Hathaway's Apple Holdings

Table of Contents

Berkshire Hathaway's Apple Investment Under Buffett

Berkshire Hathaway's Apple investment is a legendary success story, a testament to Buffett's keen eye for value and his patient, long-term investment approach. The initial investment, begun in 2016, was a departure from some of Berkshire's more traditional holdings, representing a foray into the tech sector. However, Buffett's belief in Apple's brand strength, loyal customer base, and robust business model proved prescient. The investment quickly grew to become one of Berkshire's largest holdings, representing a significant portion of its overall portfolio.

Buffett's investment philosophy, rooted in value investing and a long-term perspective, perfectly aligned with Apple's trajectory. He recognized Apple's strong competitive advantage, its ability to generate recurring revenue through its services ecosystem, and its massive potential for future growth. This contrasts with some of Berkshire Hathaway's other, more traditional investments in industries like insurance and railroads.

- Key dates and milestones:

- 2016: Berkshire Hathaway begins accumulating Apple shares.

- 2018: Berkshire Hathaway's Apple stake surpasses $50 billion.

- 2020: Apple becomes Berkshire Hathaway's largest holding.

- Quantifiable data: Berkshire Hathaway's Apple investment has yielded billions of dollars in profits, significantly contributing to the company's overall growth. The precise figures fluctuate with market conditions, but the growth has been substantial.

- Quotes from Buffett: Numerous quotes from Buffett highlight his admiration for Apple's business model and management team, emphasizing the long-term value he sees in the company.

The Succession Plan and its Potential Impact

The succession plan at Berkshire Hathaway is a complex matter, involving a team of experienced investment managers rather than a single successor to fill Buffett's enormous shoes. Greg Abel and Ajit Jain are currently considered to be the two leading candidates for the CEO role. Their investment philosophies, while aligned with Berkshire's overall principles of long-term value investing, may differ subtly from Buffett's approach. While a complete shift in investment strategy is unlikely, adjustments are possible.

- Profiles of key individuals: Greg Abel and Ajit Jain have extensive experience within Berkshire Hathaway. Understanding their investment approaches and track records provides valuable insights into potential future investment decisions.

- Past investment decisions: Analyzing past investment decisions made by Abel and Jain offers clues regarding their investment style and potential preferences. This includes understanding their tolerance for risk and their approach to sector diversification.

- Potential scenarios for Apple holdings: Under new management, several scenarios are plausible: maintaining the current substantial holding, gradually reducing the stake to diversify the portfolio, or even increasing the position, given Apple's continuing strength.

Market Reactions and Investor Sentiment

News regarding Buffett's retirement and the transition of leadership at Berkshire Hathaway has generated considerable market interest. Initial reactions were mixed, with some investors expressing concerns about the potential impact on Berkshire's investment strategy. However, the overall response has been relatively calm, reflecting confidence in the succession plan and the management team's capabilities.

- Stock price performance: Tracking the stock price performance of both Berkshire Hathaway and Apple before and after significant announcements related to Buffett's retirement provides valuable data.

- Analyst opinions: Financial analysts have offered diverse predictions regarding the future of Berkshire Hathaway's Apple holdings. Analyzing these diverse viewpoints is essential for a comprehensive understanding of market sentiment.

- Potential market volatility: The future direction of Berkshire Hathaway's Apple holdings could introduce a degree of market volatility, impacting both companies' stock prices.

Long-Term Outlook for Berkshire Hathaway's Apple Holdings

The long-term outlook for Berkshire Hathaway's Apple holdings remains uncertain but positive. Apple's continued innovation, strong brand recognition, and expanding services business present opportunities for future growth. However, potential risks remain, including competition in the tech sector and broader macroeconomic factors.

- Apple's future growth potential: Analyzing Apple's product roadmap, market share in key sectors, and expansion into new markets provides a foundation for assessing the company's future growth potential.

- Risks associated with the tech sector: Factors such as regulatory scrutiny, geopolitical instability, and the cyclical nature of the technology industry pose potential risks to Apple and Berkshire Hathaway's investment.

- Alternative investment opportunities: Berkshire Hathaway may seek to diversify its portfolio, exploring alternative investment opportunities in other sectors.

Conclusion: The Future of Berkshire Hathaway's Apple Investment Post-Buffett

Buffett's retirement marks a significant turning point for Berkshire Hathaway, introducing uncertainty surrounding the future management of its massive Apple investment. While a dramatic shift in investment strategy is unlikely, subtle changes are possible, impacting both the company's portfolio and market perception. The long-term prospects for Berkshire Hathaway's Apple holdings remain positive, given Apple's underlying strength, but risks inherent in the tech sector must be considered. The future direction will hinge on the decisions of the new leadership team, making it crucial to monitor developments related to "Buffett's Retirement" and its impact on Berkshire Hathaway's Apple holdings. To stay informed about this pivotal development and its implications for both companies, continue following financial news and analysis. Understanding the evolving landscape of Berkshire Hathaway's Apple holdings is vital for any serious investor.

Featured Posts

-

Robust Retail Sales Figures Delay Anticipated Bank Of Canada Rate Cut

May 25, 2025

Robust Retail Sales Figures Delay Anticipated Bank Of Canada Rate Cut

May 25, 2025 -

News Corp A Deep Dive Into Undervalued And Underappreciated Holdings

May 25, 2025

News Corp A Deep Dive Into Undervalued And Underappreciated Holdings

May 25, 2025 -

England Airpark And Alexandria International Airport Promoting Local And International Travel With Ae Xplore

May 25, 2025

England Airpark And Alexandria International Airport Promoting Local And International Travel With Ae Xplore

May 25, 2025 -

Nippon U S Steel Deal A Deep Dive Into Trumps Decision And Its Significance

May 25, 2025

Nippon U S Steel Deal A Deep Dive Into Trumps Decision And Its Significance

May 25, 2025 -

Record High For Dax Frankfurt Equities Show Strong Opening

May 25, 2025

Record High For Dax Frankfurt Equities Show Strong Opening

May 25, 2025

Latest Posts

-

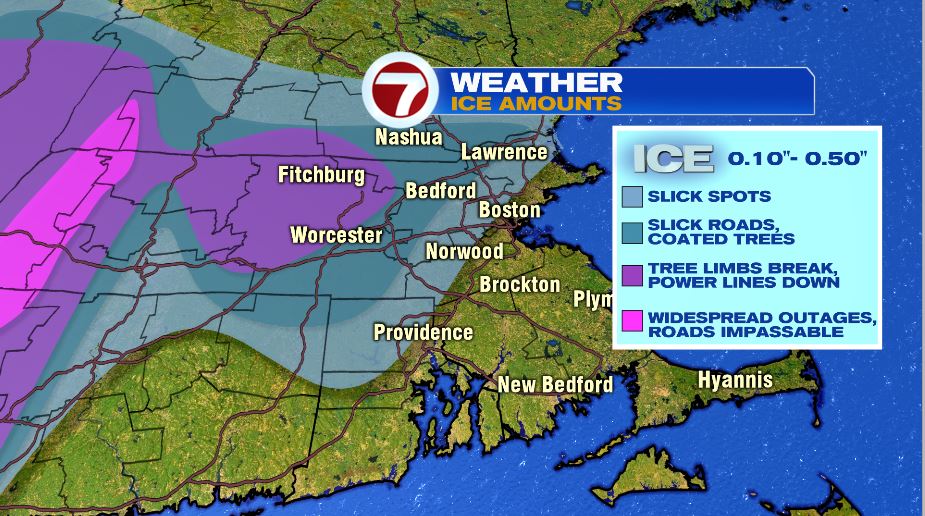

Hampshire And Worcester Counties Prepare For Flash Flooding Thursday Night

May 25, 2025

Hampshire And Worcester Counties Prepare For Flash Flooding Thursday Night

May 25, 2025 -

Thursday Night Flash Flood Warning Hampshire And Worcester Counties Impacted

May 25, 2025

Thursday Night Flash Flood Warning Hampshire And Worcester Counties Impacted

May 25, 2025 -

Pennsylvania Flash Flood Watch Extended Through Thursday

May 25, 2025

Pennsylvania Flash Flood Watch Extended Through Thursday

May 25, 2025 -

Flash Flood Watch Issued For Hampshire And Worcester Thursday Night Storms

May 25, 2025

Flash Flood Watch Issued For Hampshire And Worcester Thursday Night Storms

May 25, 2025 -

Significant Downpours Cause Flash Flood Warning In Pennsylvania

May 25, 2025

Significant Downpours Cause Flash Flood Warning In Pennsylvania

May 25, 2025