The PwC Exodus: Assessing The Impact On Senegal, Gabon, Madagascar, And Other African Economies

Table of Contents

The recent departure of PricewaterhouseCoopers (PwC) from several African nations, including Senegal, Gabon, and Madagascar, has sent shockwaves through the business community. This unexpected “PwC Exodus Africa” raises significant concerns about the potential economic and social consequences for these countries and the broader implications for African economic development. This article delves into the immediate and long-term impacts of this significant event, examining the challenges and opportunities it presents.

Immediate Economic Impacts of the PwC Exodus

Loss of Expertise and Skilled Labor

PwC's withdrawal represents a substantial loss of highly skilled professionals in accounting, auditing, consulting, and tax services across affected African nations. This exodus of expertise undermines the quality of financial reporting and corporate governance, creating several immediate problems.

- Reduced capacity for tax collection: The loss of PwC's tax expertise directly impacts government revenue streams, potentially hindering public services and infrastructure development. Effective tax administration requires specialized knowledge, and this gap needs urgent attention.

- Increased difficulty in attracting foreign investment: Foreign investors often rely on established firms like PwC for due diligence and assurance. Their absence increases perceived risk, potentially deterring vital foreign direct investment (FDI). This is particularly crucial for economies reliant on FDI for growth.

- Potential for increased financial irregularities: The reduced capacity for auditing and oversight increases the risk of financial misconduct and weakens corporate accountability. This could lead to a decline in investor confidence and potentially damage the reputation of affected economies.

Disruption to Business Operations

Businesses that relied on PwC for various services, from audits to consulting, now face operational disruptions and increased costs. Finding suitable replacements can be challenging, particularly for Small and Medium-sized Enterprises (SMEs) lacking the resources and networks to access alternative providers swiftly.

- Increased transaction costs for businesses: Sourcing new service providers involves time-consuming searches, negotiations, and potential onboarding fees, creating additional financial burdens for companies.

- Delays in project completion: The transition period leads to delays in crucial business operations, impacting project timelines and potentially causing missed opportunities.

- Potential for loss of competitiveness: The disruption and added costs could impact a business's efficiency and competitiveness, potentially affecting its market share and profitability.

Long-Term Implications for African Economic Development

Impact on Foreign Investment

The PwC Exodus can significantly damage investor confidence, potentially leading to a decline in future FDI. This is particularly troubling given the critical role of FDI in driving economic growth and job creation across the African continent.

- Reduced inflows of capital: The loss of a globally recognized brand like PwC can signal instability and negatively impact perceptions of the investment climate.

- Slower economic growth: Reduced FDI leads to decreased investment in infrastructure, technology, and human capital, ultimately hindering economic progress.

- Diminished job creation: FDI is a significant engine for job creation; its reduction directly impacts employment opportunities and economic empowerment.

Implications for Governance and Transparency

PwC played a vital role in promoting good governance and transparency within the affected countries. Its absence weakens efforts to combat corruption and enhance the rule of law, with potentially far-reaching implications.

- Increased risk of financial misconduct: The reduced capacity for independent audits and oversight increases the vulnerability to fraud and embezzlement.

- Weakened institutional capacity: The loss of expertise in governance and regulatory frameworks weakens the ability of institutions to effectively function.

- Reduced accountability: The absence of strong auditing and oversight mechanisms diminishes accountability, fostering an environment conducive to corruption.

The Role of Local Firms and Capacity Building

The PwC Exodus presents an opportunity for local accounting and consulting firms to expand and fill the service gap. However, this requires a concerted effort to invest in capacity building and skills development to ensure these firms can meet the increased demand.

- Need for government support for local firms: Governments need to actively support local firms through incentives, training programs, and access to finance.

- Importance of investing in education and training: Investment in education and training programs is crucial to develop a skilled workforce capable of filling the expertise gap.

- Opportunities for partnerships and knowledge transfer: Facilitating partnerships between local and international firms can promote knowledge transfer and accelerate capacity building.

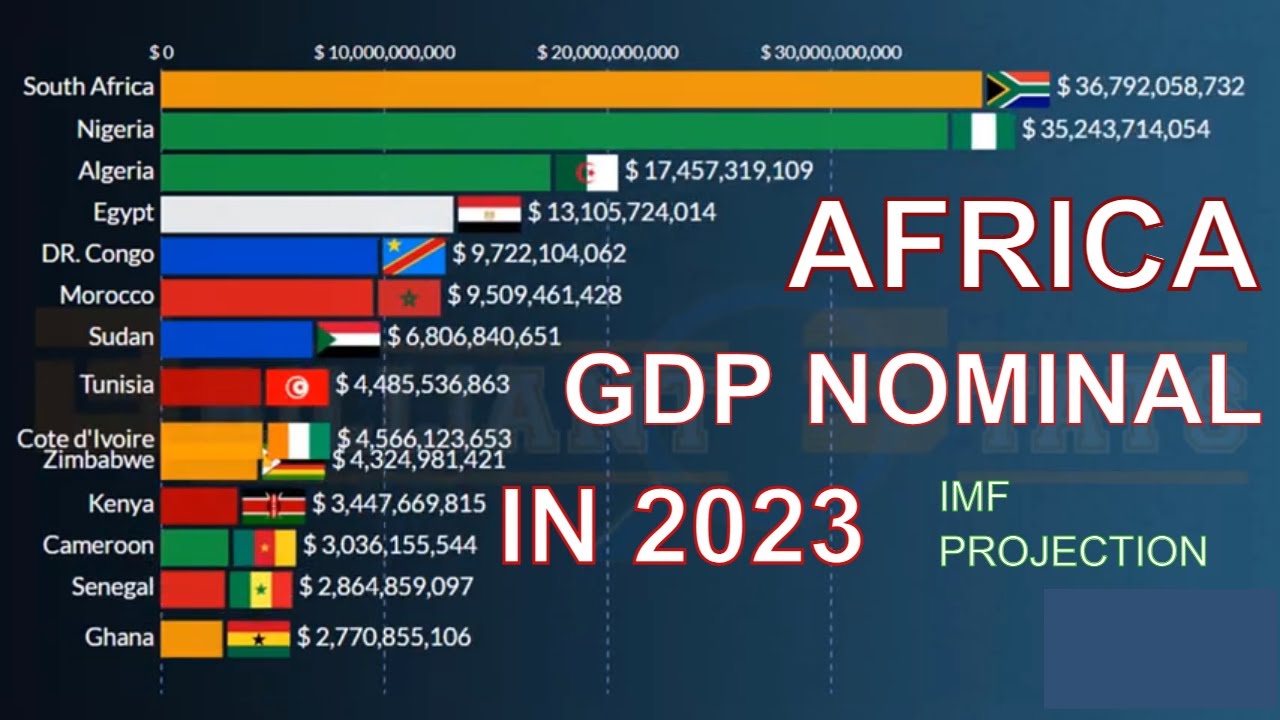

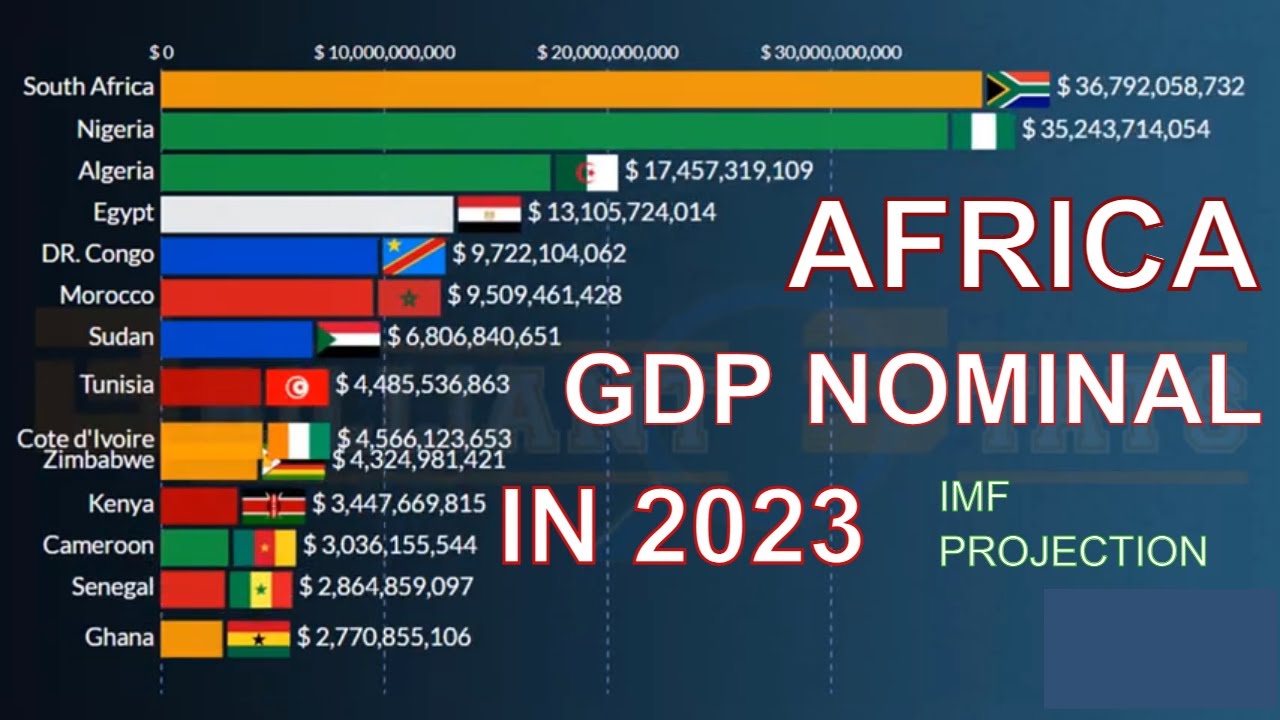

Case Studies: Senegal, Gabon, and Madagascar

[This section would include detailed case studies for each country, analyzing the specific impacts of the PwC exodus, the size and scope of PwC's operations, sectors affected, government responses, and recovery strategies. Data on the number of employees, revenue generated by PwC in each country, and specific examples of affected businesses would be included here.]

Conclusion

The PwC Exodus has significant implications for Senegal, Gabon, Madagascar, and other African economies. The loss of expertise, disruption to business operations, and potential impact on foreign investment pose serious challenges. However, this also presents opportunities for local firms and necessitates focused efforts on capacity building and improved governance. Understanding the full ramifications of this “PwC Exodus Africa” is crucial. Further research and analysis are needed to develop effective strategies to mitigate the negative impacts and harness opportunities for sustainable economic development. Let's continue to monitor the situation and support initiatives that strengthen African economies in the wake of this significant event. We must work collaboratively to ensure the resilience and future growth of African businesses and economies following this significant disruption to the professional services sector.

Featured Posts

-

Louisville Declares State Of Emergency Tornado Aftermath And Major Flooding Predicted

Apr 29, 2025

Louisville Declares State Of Emergency Tornado Aftermath And Major Flooding Predicted

Apr 29, 2025 -

The Dysprosium Shortage A Looming Threat To Electric Vehicle Production

Apr 29, 2025

The Dysprosium Shortage A Looming Threat To Electric Vehicle Production

Apr 29, 2025 -

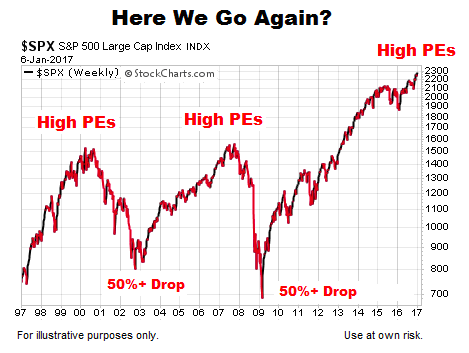

Understanding Elevated Stock Market Valuations A Bof A Analysis

Apr 29, 2025

Understanding Elevated Stock Market Valuations A Bof A Analysis

Apr 29, 2025 -

Adhd En Levensverwachting Klopt Het Dat Volwassenen Met Adhd Korter Leven

Apr 29, 2025

Adhd En Levensverwachting Klopt Het Dat Volwassenen Met Adhd Korter Leven

Apr 29, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Guidance

Apr 29, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

Apr 29, 2025

Latest Posts

-

Free Streaming Of Ru Pauls Drag Race Season 17 Episode 8 No Cable Subscription Required

Apr 30, 2025

Free Streaming Of Ru Pauls Drag Race Season 17 Episode 8 No Cable Subscription Required

Apr 30, 2025 -

Wickedness Unleashed Ru Pauls Drag Race Season 17 Episode 8 Preview

Apr 30, 2025

Wickedness Unleashed Ru Pauls Drag Race Season 17 Episode 8 Preview

Apr 30, 2025 -

Ru Pauls Drag Race Live 1000th Performance A Global Livestream Event

Apr 30, 2025

Ru Pauls Drag Race Live 1000th Performance A Global Livestream Event

Apr 30, 2025 -

Watch Ru Pauls Drag Race Season 17 Episode 8 Online Free No Cable Needed

Apr 30, 2025

Watch Ru Pauls Drag Race Season 17 Episode 8 Online Free No Cable Needed

Apr 30, 2025 -

Nba Legend And Ru Pauls Drag Race An Unlikely Godfather Relationship

Apr 30, 2025

Nba Legend And Ru Pauls Drag Race An Unlikely Godfather Relationship

Apr 30, 2025