The Shifting Sands Of Consumer Spending: Implications For Credit Card Issuers

Table of Contents

The Rise of Experiential Spending

Consumers are increasingly prioritizing experiences over material possessions. This shift from tangible goods to intangible experiences has profound implications for credit card issuers.

Shift from Material Goods to Experiences

This trend is evident in the growing demand for experiences such as travel, entertainment, and dining. This translates into several key changes for the credit card industry:

- Increased demand for travel rewards credit cards: Consumers are actively seeking cards that offer lucrative travel rewards, such as airline miles, hotel points, and travel credits, to finance their experiential pursuits.

- Growth in co-branded cards offering discounts on entertainment and experiences: Partnerships between credit card issuers and entertainment venues, restaurants, and other experience providers are on the rise, providing consumers with valuable discounts and perks.

- Need for personalized offers catering to experiential spending habits: Credit card issuers must leverage data analytics to understand individual consumer preferences and tailor offers accordingly. This includes targeted promotions for specific types of experiences and personalized reward programs.

Impact on Credit Card Utilization

While the shift towards experiential spending may lead to higher average transaction values, it could potentially result in lower overall transaction volume compared to purchases of material goods. This necessitates a strategic shift in how credit card issuers analyze and respond to consumer spending patterns:

- Issuers need to analyze spending data to identify experiential spending trends: Data analytics are crucial to understanding how consumers are spending their money and adapting marketing and reward programs accordingly.

- Targeted marketing campaigns focusing on experience-related rewards and benefits: Highlighting the value proposition of experience-based rewards will be essential in attracting and retaining customers.

The Influence of Inflation and Economic Uncertainty

Inflation and economic uncertainty significantly impact consumer spending habits, forcing consumers to become more discerning and value-driven.

Increased Focus on Value and Rewards

Economic instability compels consumers to seek maximum value for their money. This translates to:

- Greater demand for cashback and rewards programs: Consumers are actively seeking credit cards that offer generous cashback rewards, points systems, or other valuable incentives.

- Competitive pricing strategies become essential: Credit card issuers need to offer competitive interest rates and fees to attract and retain customers in a price-sensitive market.

- Emphasis on transparent fees and interest rates: Clear and upfront communication about fees and interest rates builds trust and fosters customer loyalty.

Impact on Credit Utilization and Delinquency

Periods of inflation and economic downturn can lead to increased credit card debt and higher delinquency rates. This necessitates a proactive approach from credit card issuers:

- Risk management strategies become crucial: Robust risk assessment models are needed to identify and mitigate potential risks associated with increased credit utilization and potential defaults.

- Proactive measures to assist customers facing financial hardship: Offering hardship programs, such as payment deferrals or reduced interest rates, can help retain customers and avoid delinquencies.

- Strategic partnerships with financial wellness providers: Collaborating with financial wellness providers can help educate customers about responsible credit card usage and financial management.

The Power of Fintech and Digital Payments

The rise of fintech and the increasing preference for digital payments are reshaping the consumer spending landscape.

The Rise of Buy Now, Pay Later (BNPL)

BNPL services are gaining traction, presenting both a threat and an opportunity for traditional credit card issuers:

- Strategic partnerships or development of internal BNPL offerings: Credit card issuers can either partner with BNPL providers or develop their own BNPL solutions to stay competitive.

- Understanding the implications of BNPL on credit utilization and risk: Careful consideration must be given to the impact of BNPL on credit utilization and risk management strategies.

Digital-First Consumer Behavior

Consumers increasingly prefer digital channels for banking and payments:

- Investment in user-friendly mobile apps and online platforms: A seamless and intuitive digital experience is crucial for attracting and retaining customers.

- Personalized digital marketing strategies: Targeted digital marketing campaigns can effectively reach consumers and promote relevant products and services.

- Enhanced security measures to combat fraud in the digital space: Robust security measures are crucial to protect customers from fraudulent activities in the digital environment.

Conclusion

The changing dynamics of consumer spending present significant challenges and opportunities for credit card issuers. Understanding the shift towards experiential spending, managing the risks associated with economic uncertainty, and adapting to the rise of fintech and digital payments are crucial for maintaining competitiveness and profitability. By leveraging data analytics, investing in innovative technologies, and proactively managing risk, credit card issuers can successfully navigate the shifting sands of consumer spending and thrive in this evolving market. To stay ahead, continuous monitoring of consumer spending trends and proactive adaptation to these changes are essential.

Featured Posts

-

Bof As View Are High Stock Market Valuations A Cause For Concern

Apr 24, 2025

Bof As View Are High Stock Market Valuations A Cause For Concern

Apr 24, 2025 -

Faa Study Focuses On Collision Risks At Las Vegas Airport

Apr 24, 2025

Faa Study Focuses On Collision Risks At Las Vegas Airport

Apr 24, 2025 -

Is Betting On Natural Disasters Like The La Wildfires A Sign Of The Times

Apr 24, 2025

Is Betting On Natural Disasters Like The La Wildfires A Sign Of The Times

Apr 24, 2025 -

Tesla Q1 Earnings Net Income Down 71 Amidst Political Headwinds

Apr 24, 2025

Tesla Q1 Earnings Net Income Down 71 Amidst Political Headwinds

Apr 24, 2025 -

President Trump No Immediate Plans To Replace Fed Chair Powell

Apr 24, 2025

President Trump No Immediate Plans To Replace Fed Chair Powell

Apr 24, 2025

Latest Posts

-

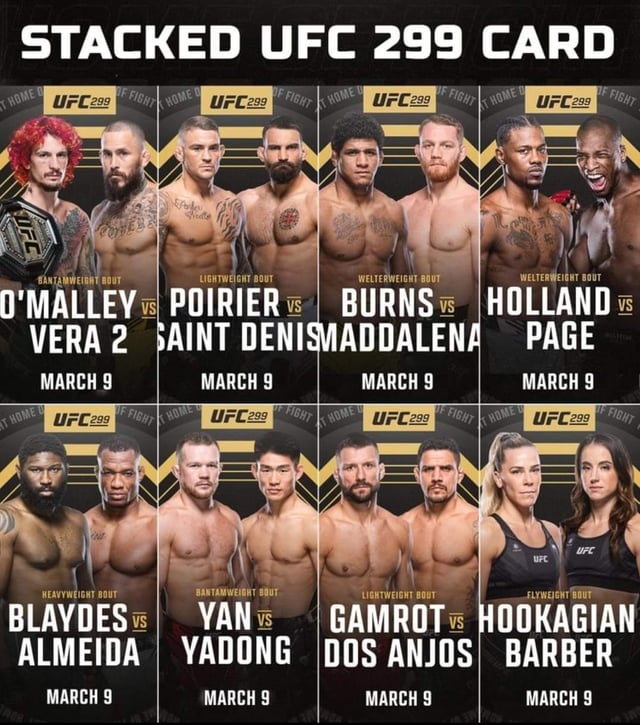

Ufc 315 Fight Card Preview Key Fights And Potential Outcomes

May 12, 2025

Ufc 315 Fight Card Preview Key Fights And Potential Outcomes

May 12, 2025 -

February 21st Nba Cavaliers Vs Knicks Expert Picks And Odds Analysis

May 12, 2025

February 21st Nba Cavaliers Vs Knicks Expert Picks And Odds Analysis

May 12, 2025 -

Nba Cavaliers Vs Knicks Betting Preview And Prediction For February 21st

May 12, 2025

Nba Cavaliers Vs Knicks Betting Preview And Prediction For February 21st

May 12, 2025 -

Ufc 315 Complete Fight Card Breakdown For Tonights Event

May 12, 2025

Ufc 315 Complete Fight Card Breakdown For Tonights Event

May 12, 2025 -

Cavaliers Vs Knicks Game Picks Odds And Prediction February 21

May 12, 2025

Cavaliers Vs Knicks Game Picks Odds And Prediction February 21

May 12, 2025