The Stark Math On The GOP Tax Plan: Deficit Impact Analysis

Table of Contents

Projected Revenue Losses Under the GOP Tax Plan

The GOP tax plan projects significant revenue losses stemming from substantial cuts to both corporate and individual income taxes. Let's examine the key contributors to this projected GOP Tax Plan Deficit.

Corporate Tax Rate Cuts

A cornerstone of the plan is the reduction in the corporate tax rate. This decrease, from 35% to 21%, is projected to significantly impact government revenue.

- Size of the Tax Cut: The sheer magnitude of this reduction represents a massive decrease in potential tax revenue.

- Expected Corporate Behavior: Proponents argue this cut will incentivize businesses to repatriate overseas profits and increase investment, boosting economic growth. However, critics question the extent of this effect and point to the possibility of increased shareholder payouts rather than investment.

- Revenue Loss Estimations: Various sources provide different estimations of revenue loss. For example, the Tax Policy Center projected a decrease in corporate tax revenue exceeding $1 trillion over 10 years under a similar plan. These projections vary based on different assumptions regarding corporate behavior and economic growth.

Individual Income Tax Cuts

The plan also includes substantial cuts to individual income taxes, affecting various income brackets and utilizing changes to deductions.

- Specific Changes: Key changes include an increased standard deduction, impacting lower and middle-income families, and adjustments to tax brackets. The expansion of the child tax credit is another significant element.

- Demographic Impact: The plan's effects vary across different income groups, with lower-income households potentially benefiting more from the increased standard deduction, while higher-income households benefit more from changes in marginal tax rates.

- Behavioral Responses: The impact of these changes depends on how individuals respond. Will they increase savings and investment, or will they primarily increase consumption? Predicting behavioral changes accurately is crucial for reliable revenue projections.

Impact of Economic Growth Projections

A central argument in favor of the GOP tax plan is that the tax cuts will stimulate economic growth, ultimately offsetting the revenue losses. However, this relies on several key assumptions.

- Assumptions Underlying Growth Projections: The plan's supporters claim the tax cuts will lead to increased investment, job creation, and higher wages, thus boosting economic activity.

- Uncertainty Associated with Predictions: Economic forecasting is inherently uncertain. The actual growth generated by the tax cuts could be significantly higher or lower than projected, leading to substantially different outcomes for the deficit. Various economic models show a wide range of potential outcomes, highlighting this uncertainty.

- Potential for Lower-Than-Expected Growth: If economic growth fails to meet the optimistic projections, the revenue shortfall could be even larger than initially anticipated, exacerbating the GOP Tax Plan Deficit.

Increased National Debt and Deficit

The projected revenue losses directly translate into a significant increase in the national debt and deficit.

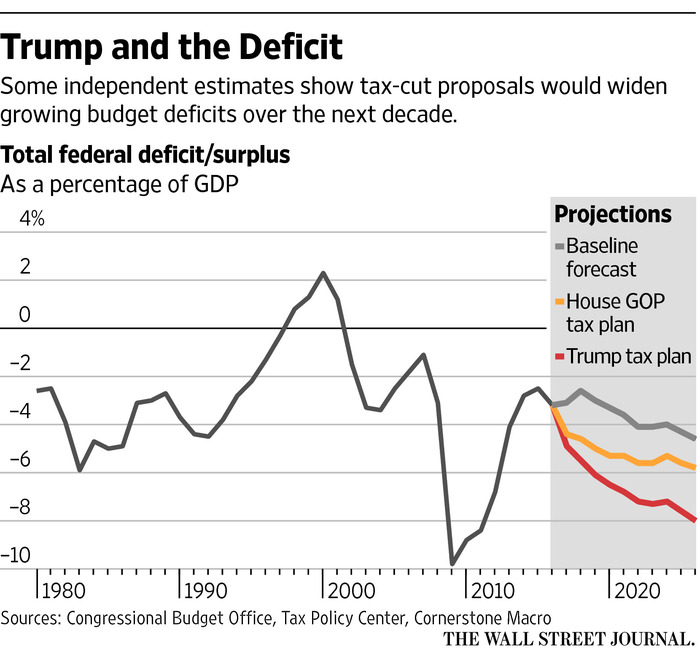

Baseline Deficit Projections

Credible sources provide alarming projections regarding the increase in the national deficit.

- Figures from Reputable Sources: The Congressional Budget Office (CBO) and the Committee for a Responsible Federal Budget (CRFB) have released independent analyses projecting substantial increases in the deficit over the next decade and beyond. Their estimates should be considered when assessing the potential impact.

- Projected Increases Over Time: These projections illustrate the compounding effect of the annual deficits, leading to a substantially larger national debt over the long term. The 10-year and 20-year projections show a marked increase in the debt under this plan.

Long-Term Fiscal Sustainability

The substantial increase in the national debt raises serious concerns about long-term fiscal sustainability.

- Consequences of Higher Debt Levels: Higher debt levels lead to increased interest payments, potentially crowding out other essential government spending on crucial programs like infrastructure, education, and healthcare.

- Potential Credit Rating Downgrade: A significantly higher national debt could also negatively impact the US credit rating, increasing borrowing costs for the government and potentially harming the overall economy.

- Reduced Government Spending: The need to service the increased debt could necessitate cuts in other areas of the federal budget, creating trade-offs between debt servicing and other crucial government functions.

Alternative Analyses and Perspectives

It's important to acknowledge alternative perspectives on the economic effects of the GOP tax plan.

Criticisms and Counterarguments

While this analysis highlights the projected increase in the deficit, it's important to note that supporters of the plan offer counterarguments.

- Supply-Side Economics: Proponents often cite supply-side economics, arguing that the tax cuts will stimulate economic growth to a degree that offsets revenue losses. They believe that lower taxes incentivize businesses and individuals to work harder, invest more, and create jobs, leading to higher overall tax revenues in the long run.

- Differing Economic Models: Different economic models and assumptions can lead to widely varying predictions of the plan's impact on the economy and the deficit. It's important to critically examine the underlying assumptions of any economic analysis.

Conclusion

This analysis of the GOP tax plan reveals a stark reality: the proposed tax cuts are projected to significantly increase the national deficit and debt. While proponents argue that economic growth will offset these losses, the uncertainty surrounding these projections necessitates a careful evaluation of the plan's long-term fiscal consequences. Understanding the potential impact of the GOP Tax Plan Deficit is crucial for informed civic engagement and responsible policymaking. Further research and analysis are needed to fully comprehend the ramifications of this significant legislative proposal. Continue your investigation into the GOP tax plan deficit impact by consulting reputable sources and engaging in informed discussions on the implications of this significant fiscal policy.

Featured Posts

-

Unraveling The Mysteries A Look At Agatha Christies Poirot Novels

May 20, 2025

Unraveling The Mysteries A Look At Agatha Christies Poirot Novels

May 20, 2025 -

Naissance D Une Petite Fille Pour Michael Schumacher

May 20, 2025

Naissance D Une Petite Fille Pour Michael Schumacher

May 20, 2025 -

Watch Suki Waterhouses Funny Tik Tok About Twinks

May 20, 2025

Watch Suki Waterhouses Funny Tik Tok About Twinks

May 20, 2025 -

Biarritz Analyse Du Conseil Municipal Budget Locations Saisonnieres Et Sainte Eugenie

May 20, 2025

Biarritz Analyse Du Conseil Municipal Budget Locations Saisonnieres Et Sainte Eugenie

May 20, 2025 -

See Paulina Gretzkys Playdate Mini Dress

May 20, 2025

See Paulina Gretzkys Playdate Mini Dress

May 20, 2025

Latest Posts

-

D Wave Quantum Qbts Stock Drop Unpacking Mondays Sharp Decline

May 20, 2025

D Wave Quantum Qbts Stock Drop Unpacking Mondays Sharp Decline

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 20, 2025 -

Gretzkys Allegiance To Trump Analyzing The Fallout And Its Long Term Effects

May 20, 2025

Gretzkys Allegiance To Trump Analyzing The Fallout And Its Long Term Effects

May 20, 2025 -

Did Wayne Gretzkys Loyalty Cost Him His Legacy A Look At His Trump Association

May 20, 2025

Did Wayne Gretzkys Loyalty Cost Him His Legacy A Look At His Trump Association

May 20, 2025 -

The Gretzky Trump Connection Impact On The Hockey Icons Image

May 20, 2025

The Gretzky Trump Connection Impact On The Hockey Icons Image

May 20, 2025