The Ultra Wealthy And The Luxury Real Estate Market: Navigating Current Chaos

Table of Contents

Shifting Market Dynamics

The luxury real estate market, traditionally a haven for secure investment, is currently facing significant headwinds. Understanding these dynamics is crucial for UHNWIs seeking to make informed decisions.

Interest Rate Hikes and Their Impact

Rising interest rates are significantly impacting the luxury property market. The increased cost of borrowing is making luxury properties less accessible, leading to buyer hesitancy and a slowdown in sales.

- Decreased mortgage availability: Lenders are tightening lending criteria, making it harder to secure mortgages, especially for high-value properties.

- Impact on investment properties: The higher cost of borrowing reduces the potential return on investment for luxury properties purchased as rental income generators.

- Shift in buyer preferences towards cash purchases: With financing becoming more challenging, cash transactions are becoming increasingly prevalent in the luxury sector.

Data from the National Association of Realtors shows a direct correlation between interest rate increases and a decrease in luxury home sales. For example, a 1% increase in interest rates corresponded to a reported X% decrease in sales of properties over $1 million in Q[Quarter] [Year].

Geopolitical Uncertainty and its Influence

Global instability, including geopolitical conflicts, inflation, and political uncertainty, profoundly affects UHNWI investment decisions in luxury real estate.

- Safe haven assets: Luxury properties in stable political and economic environments are increasingly seen as safe haven assets, offering a hedge against global uncertainty.

- Diversification strategies: UHNWIs are diversifying their real estate portfolios, spreading investments across different geographical locations and property types to minimize risk.

- Increased demand for properties in politically stable regions: Countries with strong rule of law and stable economies are experiencing increased demand for luxury properties.

The war in Ukraine, for instance, has led to a surge in demand for luxury properties in Switzerland and other politically stable European countries, as UHNWIs seek secure investments.

Evolving Preferences of Ultra-High-Net-Worth Individuals

The desires of UHNWIs are also evolving, shaping the luxury real estate landscape.

Demand for Sustainable and Eco-Friendly Properties

Sustainability is no longer a niche concern; it's a key driver in luxury real estate. UHNWIs are increasingly seeking properties with eco-conscious features.

- Green certifications: Properties with LEED or BREEAM certifications are highly sought after.

- Smart home technology: Energy-efficient smart home systems are becoming standard in luxury developments.

- Focus on renewable energy sources: Solar panels, geothermal energy, and other renewable energy options are crucial features for many buyers.

Luxury developments are now showcasing innovative sustainable designs and technologies, attracting environmentally conscious UHNWIs.

The Rise of Experiential Luxury

Beyond bricks and mortar, UHNWIs prioritize unique experiences. The concept of “experiential luxury” is transforming the market.

- Increased demand for lifestyle properties: Vineyard estates, private islands, and properties with access to exclusive amenities are in high demand.

- Emphasis on privacy and exclusivity: Secluded locations and enhanced security features are essential elements.

- Importance of location and surrounding environment: Proximity to cultural attractions, recreational activities, and natural beauty are key considerations.

Properties offering unique experiences, such as a private ski chalet with direct access to the slopes or a beachfront villa with a private helipad, are commanding premium prices.

Strategies for Navigating the Current Market

Navigating the complexities of the current luxury real estate market demands a strategic approach.

Working with Specialized Brokers and Advisors

Engaging experienced professionals is paramount for UHNWIs. Specialized brokers and advisors offer invaluable expertise.

- Due diligence: Thorough research and due diligence are crucial to avoid potential pitfalls.

- Negotiation strategies: Expert negotiators can secure favorable terms and prices.

- Understanding market trends: Staying abreast of market trends is critical for making informed investment decisions.

- Legal and tax considerations: Navigating the legal and tax complexities of international luxury property transactions requires specialized knowledge.

A holistic approach, integrating legal, financial, and real estate expertise, is essential for successful luxury property investment.

Diversification and Risk Management

Diversification is key to mitigating risk in a volatile market. UHNWIs are employing various strategies:

- International property investments: Spreading investments across different countries to reduce exposure to regional market fluctuations.

- Alternative assets: Investing in alternative assets, such as art, collectibles, and private equity, to further diversify portfolios.

- Hedging strategies: Implementing strategies to protect against potential losses due to market volatility.

Expert opinions suggest a well-diversified portfolio is crucial for weathering the current market uncertainties.

Conclusion

The ultra-wealthy and the luxury real estate market are inextricably linked. Navigating the current market requires understanding the impact of interest rate hikes, geopolitical uncertainty, and the evolving preferences of UHNWIs. Successfully navigating the current challenges in the luxury real estate market requires expert guidance. Connect with a specialist today to explore your options for investing in luxury real estate, understanding luxury property market trends, and developing effective ultra-high-net-worth individual's real estate strategies.

Featured Posts

-

Diddy Trial Update Cassie Ventura Grilled On Relationship With Sean Combs

May 17, 2025

Diddy Trial Update Cassie Ventura Grilled On Relationship With Sean Combs

May 17, 2025 -

Formal Trade Deal On The Horizon Chinas Ambassador Signals Interest In Canada Partnership

May 17, 2025

Formal Trade Deal On The Horizon Chinas Ambassador Signals Interest In Canada Partnership

May 17, 2025 -

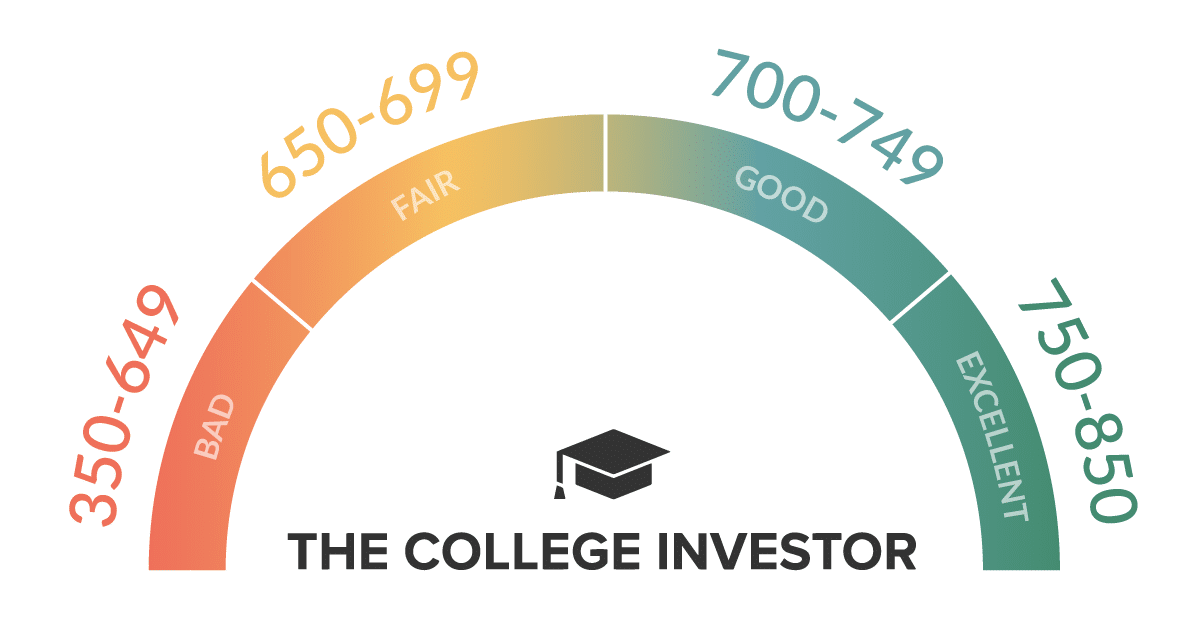

Understanding The Credit Score Impact Of Unpaid Student Loans

May 17, 2025

Understanding The Credit Score Impact Of Unpaid Student Loans

May 17, 2025 -

Paramount Sets China Release For Mission Impossible Film

May 17, 2025

Paramount Sets China Release For Mission Impossible Film

May 17, 2025 -

Protsvetanie V Perepolnennom Industrialnom Parke Prakticheskie Sovety

May 17, 2025

Protsvetanie V Perepolnennom Industrialnom Parke Prakticheskie Sovety

May 17, 2025

Latest Posts

-

Wednesdays Market Winners Rockwell Automation Among Top Performers

May 17, 2025

Wednesdays Market Winners Rockwell Automation Among Top Performers

May 17, 2025 -

Stock Market Movers Rockwell Automation Angi Borg Warner And More

May 17, 2025

Stock Market Movers Rockwell Automation Angi Borg Warner And More

May 17, 2025 -

Rockwell Automations Strong Q Quarter Number Results Drive Stock Higher

May 17, 2025

Rockwell Automations Strong Q Quarter Number Results Drive Stock Higher

May 17, 2025 -

Significant Increase In Indian Real Estate Investment 47 In Q1 2024

May 17, 2025

Significant Increase In Indian Real Estate Investment 47 In Q1 2024

May 17, 2025 -

Stock Market Winners Rockwell Automation Angi Borg Warner And More

May 17, 2025

Stock Market Winners Rockwell Automation Angi Borg Warner And More

May 17, 2025