Understanding The Credit Score Impact Of Unpaid Student Loans

Table of Contents

How Unpaid Student Loans Affect Your Credit Score

Unpaid student loans significantly impact your creditworthiness, potentially hindering your financial future. Understanding this process is crucial to protecting your credit score.

The Reporting Process

Lenders report your student loan payment activity to the three major credit bureaus: Equifax, Experian, and TransUnion. This reporting is critical as it forms a significant part of your credit history.

- Timing: Late payments are typically reported after 30 days of delinquency. More severe delinquencies, leading to default, are reported sooner.

- Negative Marks: Late payments, missed payments, and ultimately, default, result in negative marks on your credit report. These marks drastically reduce your credit score.

- Credit Utilization: While not directly impacting your score in the same way as late payments, having a high debt-to-income ratio (DTI) due to unpaid student loans can negatively impact your creditworthiness by showing lenders that you are overextended financially.

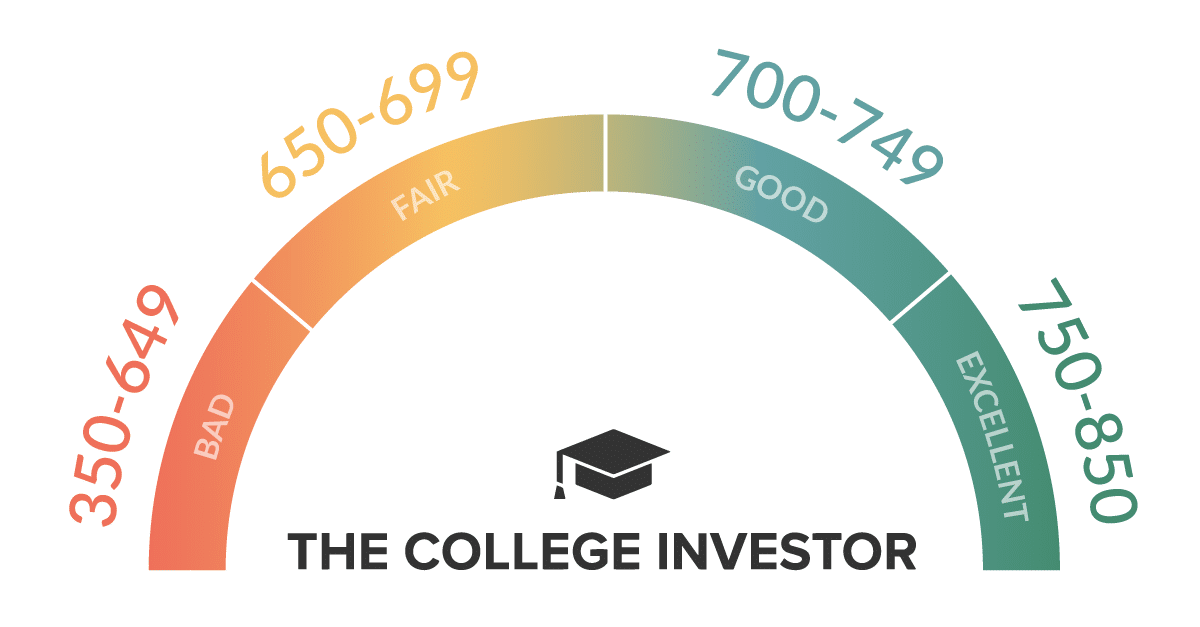

Negative Impacts on Credit Score

Unpaid student loans directly translate to a lower credit score. A lower credit score significantly limits your financial options.

- Lower Credit Score: Each negative mark on your report lowers your score, potentially by dozens or even hundreds of points, depending on the severity and duration of the delinquency.

- Difficulty Getting Loans: Lenders view individuals with poor credit scores as higher risks. This makes it difficult to qualify for loans – mortgages, auto loans, and even credit cards – or to secure favorable interest rates.

- Higher Interest Rates: Even if you qualify for a loan with a poor credit score, the interest rates will likely be substantially higher, resulting in significantly increased borrowing costs over the life of the loan. For example, a low credit score could lead to an extra 2-5% or more on your interest rate for a mortgage, making a considerable difference over the life of the loan.

Understanding Default

Defaulting on student loans is a serious event with severe consequences. Default occurs when you fail to make payments for an extended period, typically 9 months or longer, according to federal guidelines.

- Consequences of Default: Default results in wage garnishment, where a portion of your paycheck is directly seized to repay the debt. It can also lead to tax refund offset, where your tax refund is used to repay your loans. Furthermore, your creditworthiness will be severely damaged, possibly for years.

- Damage to Creditworthiness: Defaulting on a student loan can lead to a significant drop in your credit score, making it extremely difficult to obtain credit for many years to come. This can impact your ability to rent an apartment, get a job that requires a security clearance, or even obtain certain insurance policies.

Strategies for Managing Unpaid Student Loans

Proactive management of your student loan debt is crucial to preserving your credit score and financial well-being.

Contacting Your Lender

Open communication with your student loan servicer is paramount. Don't ignore collection notices; instead, reach out to explore available options.

- Repayment Plans: Explore different repayment plans, including income-driven repayment (IDR) plans, which base your monthly payments on your income and family size.

- Deferment and Forbearance: These options temporarily suspend or reduce your payments, but interest may still accrue. They are short-term solutions, not long-term fixes.

- Negotiating Payment Arrangements: Work with your lender to negotiate a more manageable payment plan, potentially lowering your monthly payments or extending the repayment period.

Debt Consolidation

Consolidating your student loans combines multiple loans into a single loan, potentially simplifying repayment and lowering interest rates. However, this is not a solution for everyone.

- Types of Consolidation: Federal consolidation programs are available through the government, while private lenders offer their own consolidation options.

- Factors to Consider: Before consolidating, compare interest rates, fees, and the length of the repayment period. Consolidating high-interest loans with lower-interest ones will lead to greater long-term savings.

- Impact on Credit Score: While consolidation itself may not immediately improve your score, consistent on-time payments on the consolidated loan will positively impact your credit report over time.

Seeking Professional Help

Consider seeking professional guidance from a certified credit counselor or financial advisor.

- Benefits of Professional Guidance: They can offer tailored advice based on your individual circumstances, helping you create a realistic budget and repayment strategy.

- Reputable Organizations: Look for counselors certified by the National Foundation for Credit Counseling (NFCC) or a similar reputable organization.

- Potential Costs: Credit counseling services may have associated fees, but the long-term benefits can significantly outweigh the costs.

Rebuilding Your Credit After Unpaid Student Loans

Rebuilding your credit after the damage caused by unpaid student loans takes time and effort, but it's achievable.

Consistent Payments

Consistently making on-time payments on all your debts, including the student loans, is crucial for improving your credit score.

- Strategies for Consistency: Automate payments, set up payment reminders, and create a detailed budget to track income and expenses.

- Budgeting Tips: Use budgeting apps or spreadsheets to monitor spending, identify areas where you can cut back, and ensure you have sufficient funds for your student loan payments.

- Positive Impact: Consistent on-time payments will positively reflect on your credit report over time, leading to gradual improvement of your credit score.

Monitoring Your Credit Report

Regularly reviewing your credit reports from all three major bureaus is essential for identifying and correcting any errors.

- Obtaining a Free Credit Report: You're entitled to a free credit report from each bureau annually at AnnualCreditReport.com.

- What to Look For: Check for inaccuracies, such as incorrect payment history, incorrect account information, or fraudulent accounts.

- Disputing Inaccuracies: Immediately dispute any errors you find with the respective credit bureau.

Credit-Building Strategies

Several strategies can help you rebuild your credit after the negative impact of unpaid student loans.

- Secured Credit Cards: These cards require a security deposit, which serves as your credit limit. On-time payments build your credit history and demonstrate responsible credit usage.

- Credit-Builder Loans: These are small loans specifically designed to help people build credit. Regular payments improve your credit score over time.

- Timeframe for Improvement: Rebuilding your credit takes time; significant improvements may not be noticeable for six months or longer. Persistence and responsible financial behavior are key.

Conclusion

Unpaid student loans significantly impact your credit score and can have long-term financial repercussions. Proactive management, including open communication with your lender, exploring repayment options, and seeking professional guidance, is crucial. Consistently making on-time payments, monitoring your credit report, and employing credit-building strategies are vital for rebuilding your credit after facing the challenges of unpaid student loans. Don't let unpaid student loans derail your financial future. Contact your lender today to explore repayment options and start improving your credit score. Start understanding the impact of unpaid student loans now!

Featured Posts

-

Tsx Composite Index Hits Record High What It Means For Canadian Investors

May 17, 2025

Tsx Composite Index Hits Record High What It Means For Canadian Investors

May 17, 2025 -

The Thibodeau Bridges Communication Breakdown And Resolution

May 17, 2025

The Thibodeau Bridges Communication Breakdown And Resolution

May 17, 2025 -

2025s Leading No Kyc Casinos Play Without Id Verification

May 17, 2025

2025s Leading No Kyc Casinos Play Without Id Verification

May 17, 2025 -

Ontario Budget Reveals 14 6 Billion Deficit Breakdown And Implications

May 17, 2025

Ontario Budget Reveals 14 6 Billion Deficit Breakdown And Implications

May 17, 2025 -

30 Tariffs On China Evaluating The Long Term Economic Effects Of Trumps Trade Policy

May 17, 2025

30 Tariffs On China Evaluating The Long Term Economic Effects Of Trumps Trade Policy

May 17, 2025

Latest Posts

-

186 Milyon Dolar Novak Djokovic In Gelir Kaynagi Detaylari

May 17, 2025

186 Milyon Dolar Novak Djokovic In Gelir Kaynagi Detaylari

May 17, 2025 -

The Fortnite Backwards Music Update A Player Perspective

May 17, 2025

The Fortnite Backwards Music Update A Player Perspective

May 17, 2025 -

37 Yasindaki Novak Djokovic In Efsanevi Performansi

May 17, 2025

37 Yasindaki Novak Djokovic In Efsanevi Performansi

May 17, 2025 -

Evrobasket Pripreme Srbija Igra Generalnu Probu U Bajernovoj Dvorani

May 17, 2025

Evrobasket Pripreme Srbija Igra Generalnu Probu U Bajernovoj Dvorani

May 17, 2025 -

Novak Djokovic In Muhtesem Zenginligi 186 Milyon Dolar Kazandi

May 17, 2025

Novak Djokovic In Muhtesem Zenginligi 186 Milyon Dolar Kazandi

May 17, 2025