Three Common Financial Mistakes Women Make

Table of Contents

Underestimating the Importance of Retirement Planning

Retirement planning is often overlooked, particularly by women. This can have devastating consequences on long-term financial security. Let's examine two key aspects:

Delayed Saving

The impact of delayed saving on long-term retirement goals is substantial. Statistics consistently show women having lower retirement savings compared to men. This disparity stems from several factors:

- Lower average salaries: The gender pay gap directly impacts the amount women can save each year.

- Career breaks for family: Many women take time off work to raise children or care for family members, interrupting their saving and investment contributions.

- Lack of access to retirement planning resources: Women may have less access to financial education and resources, hindering their ability to make informed retirement planning decisions.

The power of compounding interest is undeniable. Starting early, even with small contributions, significantly increases your retirement savings over time. Maximize your contributions to employer-sponsored retirement plans like 401(k)s and consider opening an IRA (Individual Retirement Account) to supplement your savings.

Insufficient Investment Knowledge

A lack of investment knowledge is another significant hurdle for women. This often results from:

- Fear of investing: Many women feel intimidated by the complexities of the investment world.

- Lack of confidence: A lack of confidence in their financial abilities can lead to inaction and missed opportunities.

- Reliance on others for financial decisions: Women may rely too heavily on partners or family members for financial decisions, neglecting to actively participate in their own financial planning.

Educating yourself about investing is key. Utilize online resources, attend workshops, and consider seeking professional advice from a financial advisor specializing in women's financial planning. They can provide personalized guidance and help you create a tailored investment strategy.

Neglecting Emergency Funds and Debt Management

A stable financial foundation requires both emergency savings and effective debt management. Let's look at common pitfalls in these areas:

Lack of Emergency Savings

The absence of an emergency fund leaves women vulnerable to unexpected financial setbacks. Consider these scenarios:

- Unexpected job loss: Having savings ensures financial stability during a job search.

- Medical emergencies: Unexpected medical bills can quickly drain savings if not prepared for.

- Home repairs: Unexpected home repairs can be expensive and create financial strain.

Aim to save 3-6 months' worth of living expenses in an emergency fund. Start small and gradually increase your savings. Even small, consistent contributions make a difference over time.

Poor Debt Management

High-interest debt, particularly credit card debt, can have long-term negative consequences.

- High-interest rates: High-interest rates quickly accumulate, making it difficult to pay off debt.

- Accumulating debt: Carrying high balances makes it harder to save and invest.

- Difficulty saving: Debt payments often consume a significant portion of income, leaving little for savings.

Explore debt management strategies such as the debt snowball or debt avalanche methods. Consider seeking credit counseling or debt consolidation to simplify your payments and potentially lower interest rates.

Ignoring the Power of Financial Education and Professional Help

Financial literacy and professional guidance are crucial for achieving long-term financial success.

Lack of Financial Literacy

Limited financial knowledge hinders effective decision-making. This includes:

- Difficulty understanding financial statements: Understanding financial statements is crucial for tracking expenses and making informed decisions.

- Investment options: Lack of knowledge about different investment options can lead to poor investment choices.

- Insurance policies: Understanding various insurance policies is essential for protecting your assets and well-being.

Continuously learning about personal finance is essential. Utilize numerous resources available: books, websites, online courses, and workshops specifically designed for women's financial literacy are all valuable tools.

Hesitation to Seek Professional Advice

Many women hesitate to seek professional financial advice, but it offers significant benefits:

- Personalized financial planning: Financial advisors create a personalized plan tailored to your specific goals and circumstances.

- Unbiased advice: They provide unbiased advice, free from emotional influences.

- Accountability: Working with an advisor provides accountability and helps you stay on track.

Financial advisors can assist with retirement planning, investment strategies, and debt management, providing invaluable support and guidance.

Conclusion

Understanding and avoiding these three common financial mistakes – underestimating retirement planning, neglecting emergency funds and debt management, and ignoring the power of financial education and professional help – is crucial for women's financial well-being. Proactive financial planning, continuous learning, and utilizing available resources are key to building a strong financial future. Take the first step towards improving your financial well-being today! Create a budget, open a savings account, and consider scheduling a consultation with a financial advisor specializing in women's financial planning. Start building a secure financial future for yourself – don't let these common financial mistakes women make hold you back.

Featured Posts

-

Coldplays Top Ranked Concert An Unforgettable Show Of Music Lights And Love

May 22, 2025

Coldplays Top Ranked Concert An Unforgettable Show Of Music Lights And Love

May 22, 2025 -

Sound Perimeter And Collective Identity The Power Of Shared Music

May 22, 2025

Sound Perimeter And Collective Identity The Power Of Shared Music

May 22, 2025 -

Love Monster And Emotional Intelligence Teaching Children About Feelings

May 22, 2025

Love Monster And Emotional Intelligence Teaching Children About Feelings

May 22, 2025 -

Nices Aquatic Future An Olympic Standard Swimming Pool Project

May 22, 2025

Nices Aquatic Future An Olympic Standard Swimming Pool Project

May 22, 2025 -

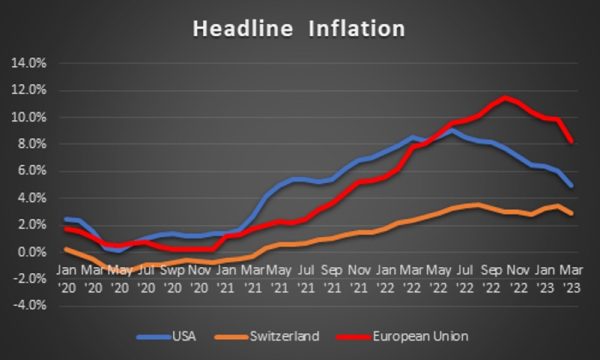

Bank Of Canadas Inflation Dilemma Rising Core Prices Force Tough Choices

May 22, 2025

Bank Of Canadas Inflation Dilemma Rising Core Prices Force Tough Choices

May 22, 2025

Latest Posts

-

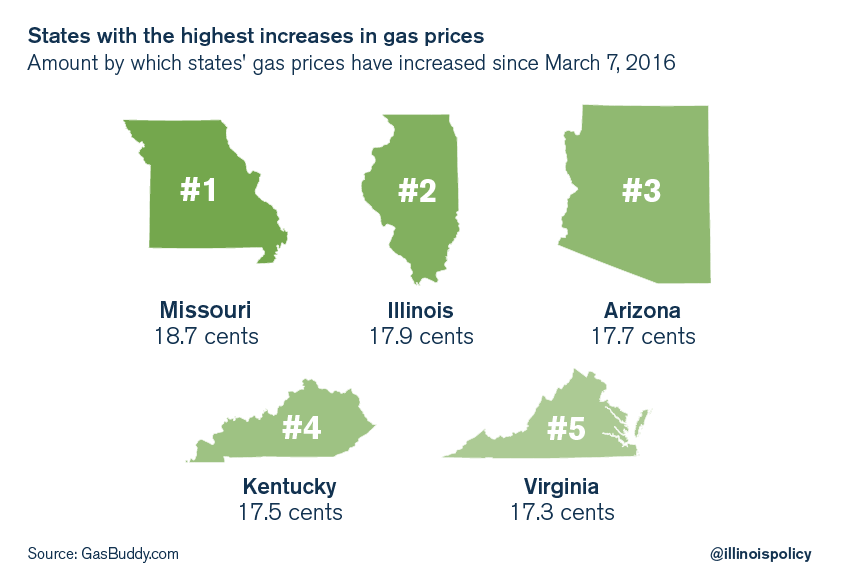

2 98 Per Gallon Wisconsin Gas Prices Rise 3 Cents

May 22, 2025

2 98 Per Gallon Wisconsin Gas Prices Rise 3 Cents

May 22, 2025 -

Wisconsin Gas Prices Average 2 98 A 3 Cent Increase

May 22, 2025

Wisconsin Gas Prices Average 2 98 A 3 Cent Increase

May 22, 2025 -

Economic Concerns Push Gas Prices Down National Average Nears 3

May 22, 2025

Economic Concerns Push Gas Prices Down National Average Nears 3

May 22, 2025 -

Lower Gas Prices In Illinois Reflect National Decline

May 22, 2025

Lower Gas Prices In Illinois Reflect National Decline

May 22, 2025 -

Lower Gas Prices In Toledo This Week

May 22, 2025

Lower Gas Prices In Toledo This Week

May 22, 2025