Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

Understanding the Amundi MSCI World II UCITS ETF Dist and its NAV

The Amundi MSCI World II UCITS ETF Dist is an exchange-traded fund (ETF) that tracks the MSCI World Index, providing broad exposure to global equities. Its investment strategy focuses on replicating the index's performance, aiming to offer diversified investment across developed markets worldwide. This ETF also features a distribution policy, meaning it pays out dividends periodically.

The NAV, or Net Asset Value, represents the total value of the ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF Dist, the NAV is calculated daily by Amundi using the closing prices of the underlying assets within the MSCI World Index. This calculation incorporates the value of all the stocks held within the ETF, adjusted for any expenses or liabilities.

It's vital to understand the difference between NAV and market price. The market price is the price at which the ETF is currently trading on the exchange, influenced by supply and demand. The NAV, however, represents the intrinsic value of the ETF's holdings. While ideally, the market price should closely track the NAV, discrepancies can occur due to market fluctuations and trading activity.

- Key characteristics of the Amundi MSCI World II UCITS ETF Dist: Global diversification, low expense ratio, dividend distribution, tracks the MSCI World Index.

- Factors influencing the daily NAV calculation: Closing prices of underlying assets, currency exchange rates (if applicable), accrued income, and ETF expenses.

- Importance of understanding the ETF's expense ratio in relation to NAV growth: The expense ratio directly impacts the NAV, as these costs are deducted from the fund's assets. A lower expense ratio generally contributes to better NAV growth.

Where to Find the Amundi MSCI World II UCITS ETF Dist NAV

Accessing the Amundi MSCI World II UCITS ETF Dist NAV is straightforward thanks to several reliable sources:

- Official ETF provider website: Amundi's website is the primary source for official NAV data. [Insert Amundi's relevant website link here].

- Major financial news websites and portals: Sites like Google Finance, Yahoo Finance, and Bloomberg often provide real-time or end-of-day NAV information for ETFs.

- Brokerage platforms and trading apps: Most brokerage accounts display the current NAV alongside the market price of your holdings.

- Dedicated financial data providers (e.g., Bloomberg, Refinitiv): Professional financial data providers offer comprehensive data, including historical NAV information.

It’s crucial to note that slight discrepancies might exist between different data sources due to timing differences or data processing variations. However, the differences should be minimal. Always prioritize official sources like the ETF provider's website for the most accurate information.

Interpreting the Amundi MSCI World II UCITS ETF Dist NAV Data

Understanding NAV changes requires analyzing both short-term and long-term trends. Positive percentage changes indicate NAV growth, while negative changes represent a decrease in value. These changes are directly related to the performance of the underlying assets in the MSCI World Index.

The relationship between NAV, market price, and bid-ask spread is important to note. The bid-ask spread represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. A wider spread can lead to temporary discrepancies between the market price and NAV.

Analyzing NAV in isolation isn't sufficient for comprehensive performance assessment. Consider other metrics like total return (which includes dividends) and dividend yield to gain a holistic view of your investment's performance. Compare the NAV performance to the benchmark index (MSCI World Index) to gauge how well the ETF is tracking its target.

- Analyzing short-term and long-term NAV trends: Identify periods of growth and decline to understand the ETF's performance patterns.

- Understanding the impact of currency fluctuations on NAV (if applicable): If the ETF holds assets in multiple currencies, exchange rate movements can impact the NAV.

- Comparing NAV performance to benchmark indices (MSCI World Index): Assess how effectively the ETF tracks its benchmark index.

Using NAV to Make Informed Investment Decisions

The Amundi MSCI World II UCITS ETF Dist NAV is a valuable tool for investment decisions, but it shouldn't be the sole determinant. Use the NAV to evaluate the ETF's performance against its stated objectives – tracking the MSCI World Index. Regularly monitoring the NAV helps you assess if the ETF is meeting your expectations. The impact of reinvesting distributions should also be considered, as this can contribute to long-term NAV growth.

However, remember that using NAV alone is insufficient for making investment decisions. Broader market conditions, your personal risk tolerance, and investment goals are all crucial factors. Diversification across asset classes is essential for mitigating risk.

- Using NAV to evaluate the ETF's performance against its objectives: Compare NAV changes to the MSCI World Index performance.

- Considering the impact of reinvesting distributions on NAV growth: Reinvesting dividends can enhance long-term NAV growth.

- Importance of diversification and risk management: Don't rely solely on one investment; diversify your portfolio.

Conclusion

Regularly tracking the Amundi MSCI World II UCITS ETF Dist NAV is a cornerstone of effective investment management. By understanding how NAV is calculated, where to find reliable data, and how to interpret it, you can make more informed investment choices. Remember to consider the NAV alongside other performance metrics and your overall investment strategy.

Regularly monitor the Amundi MSCI World II UCITS ETF Dist NAV and other key performance indicators to optimize your investment strategy. Learn more about efficient Amundi MSCI World II UCITS ETF Dist NAV tracking techniques by [link to further resources or relevant pages].

Featured Posts

-

Dazi Ue Borse In Caduta Minacce Di Reazioni Senza Limiti

May 24, 2025

Dazi Ue Borse In Caduta Minacce Di Reazioni Senza Limiti

May 24, 2025 -

Prezzi Moda Usa Analisi Dell Impatto Dei Dazi Sulle Importazioni

May 24, 2025

Prezzi Moda Usa Analisi Dell Impatto Dei Dazi Sulle Importazioni

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Locations For A Tranquil Getaway

May 24, 2025 -

Kak Izglezhda Konchita Vurst Dnes Promeni Sled Evroviziya

May 24, 2025

Kak Izglezhda Konchita Vurst Dnes Promeni Sled Evroviziya

May 24, 2025 -

Tathyr Atfaq Altjart Byn Alsyn Walwlayat Almthdt Ela Mwshr Daks

May 24, 2025

Tathyr Atfaq Altjart Byn Alsyn Walwlayat Almthdt Ela Mwshr Daks

May 24, 2025

Latest Posts

-

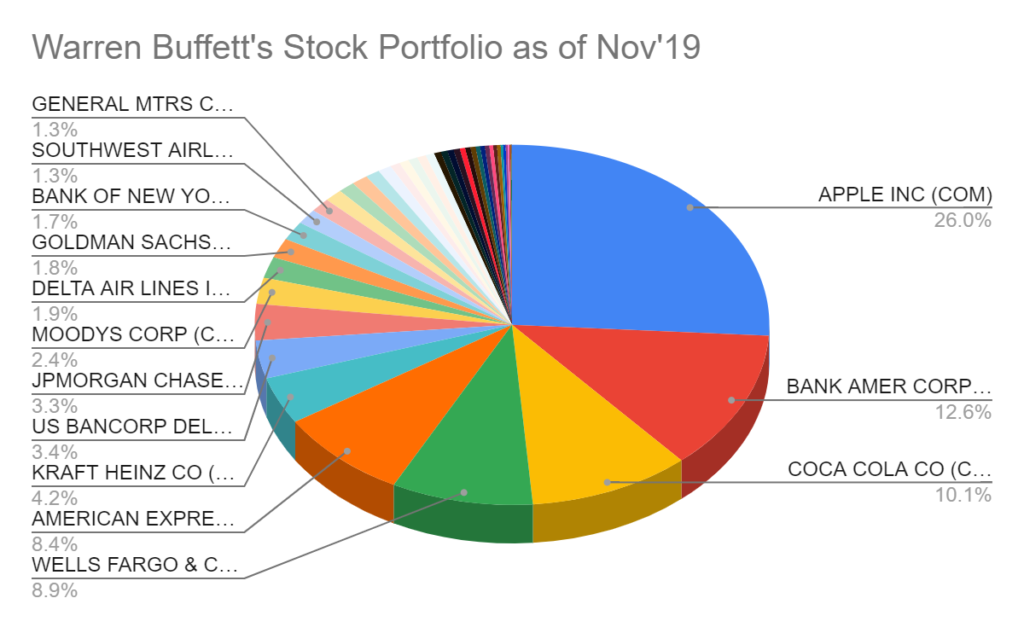

Apple Stock Price How Tariffs Affected Buffetts Investment

May 24, 2025

Apple Stock Price How Tariffs Affected Buffetts Investment

May 24, 2025 -

Buffetts Apple Holdings A Post Trump Tariff Analysis

May 24, 2025

Buffetts Apple Holdings A Post Trump Tariff Analysis

May 24, 2025 -

Apples Resilience Withstanding The Impact Of Tariffs

May 24, 2025

Apples Resilience Withstanding The Impact Of Tariffs

May 24, 2025 -

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025 -

The Future Of Apple Navigating Trump Tariff Impacts

May 24, 2025

The Future Of Apple Navigating Trump Tariff Impacts

May 24, 2025