Trump's Ripple Post Fuels XRP Rally: Brazil's New Spot ETF Adds To Momentum

Table of Contents

Donald Trump's Ripple-Related Social Media Post and its Impact on XRP Price

Analyzing the Tweet

Donald Trump's unexpected mention of Ripple and XRP on social media sent shockwaves through the cryptocurrency world. While the exact wording of the tweet is crucial (and should be inserted here if available), its impact was undeniable. The tweet, regardless of its explicit content, likely injected a significant dose of positive sentiment into the market. This is particularly relevant given Trump's considerable social media following and influence on public opinion. Previous interactions, or lack thereof, with cryptocurrencies should also be considered, adding context to this seemingly random mention. Speculation about the motivations behind the tweet – from a genuine endorsement to strategic market manipulation – immediately flooded the internet, further amplifying the effect. (Insert links to credible news sources covering the event here).

- Exact wording of the tweet: [Insert tweet here if available]

- Previous Trump cryptocurrency interactions: [Insert details here. If none, state that.]

- Potential reasons behind the tweet: Endorsement, market speculation, unintentional influence.

- Credible news sources: [Insert links here]

Market Reaction to Trump's Statement

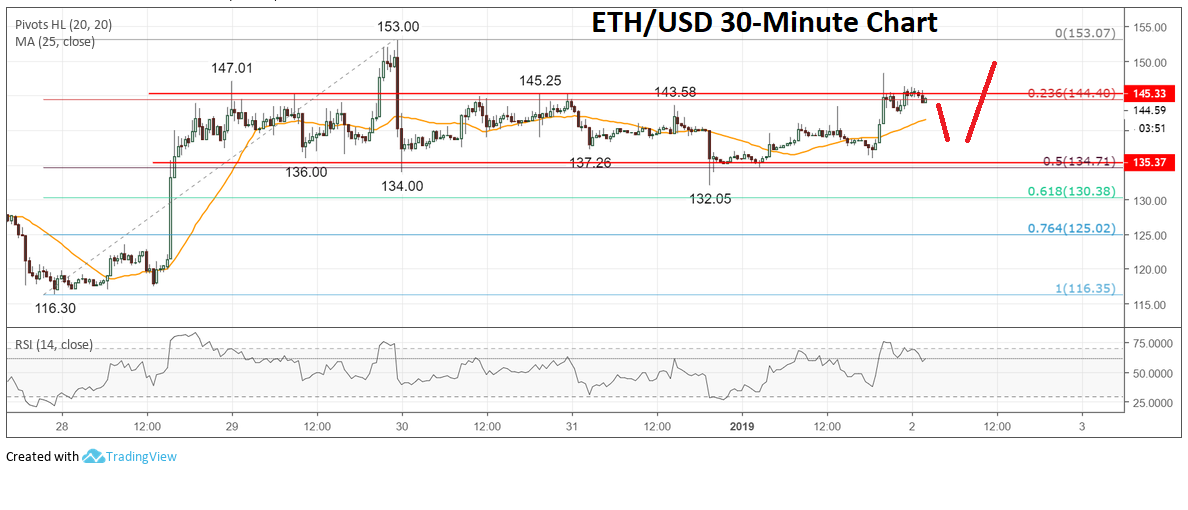

The immediate aftermath of Trump's post saw a dramatic surge in XRP's price. [Insert specific percentage increase here, e.g., "XRP experienced a 15% price jump within the hour following the tweet."] This was accompanied by a significant spike in trading volume, indicating heightened investor activity and market interest. [Insert screenshots of price charts showing the price surge and increased trading volume here]. For comparison, it's important to note how other cryptocurrencies reacted – did they experience similar boosts, or did XRP stand out? This differential response would indicate a unique impact from Trump’s tweet, rather than a general market upswing.

- Percentage increase in XRP price: [Insert specific percentage]

- Trading volume spikes: [Quantify the increase in trading volume]

- Other cryptocurrencies' reactions: [Comparative analysis]

- Screenshots of price charts: [Insert relevant charts here]

Brazil's First XRP Spot ETF and its Contribution to the Rally

Understanding the Significance of the Brazilian ETF

The launch of Brazil's first XRP spot ETF marks a significant milestone for the cryptocurrency. Spot ETFs, unlike futures-based ETFs, directly track the price of the underlying asset (in this case, XRP). This provides investors with a more straightforward and regulated way to gain exposure to XRP, increasing its accessibility and potentially boosting its legitimacy in the eyes of mainstream investors. [Details about the ETF provider should be included here, along with information about existing crypto ETFs and how this one compares, focusing on regulatory aspects and the overall market penetration]. The regulatory landscape in Brazil regarding cryptocurrencies also needs consideration; a supportive environment can contribute significantly to the ETF's success.

- ETF provider details: [Insert details about the company launching the ETF]

- Spot ETF explanation: [Clearly define and explain a spot ETF]

- Regulatory landscape in Brazil: [Analyze Brazilian crypto regulations]

- Impact on broader cryptocurrency adoption: [Discuss potential implications for Brazil and Latin America]

Market Analysis: ETF Launch and XRP Price Correlation

The correlation between the Brazilian ETF launch and XRP price movements should be examined carefully. Did the launch coincide with any notable price spikes? [Include charts and graphs illustrating price changes before and after the launch date. Analyze trading volume changes in this period as well.] Investor sentiment surrounding the ETF launch – positive press, anticipation among investors – played a crucial role. Any regulatory hurdles faced by the ETF, or anticipated ones, should also be factored into the analysis as they might influence price volatility.

- Charts and graphs: [Insert charts illustrating price and volume changes]

- Investor sentiment: [Describe prevailing opinions]

- Trading volume changes: [Quantify the changes]

- Regulatory hurdles: [Discuss any obstacles faced or anticipated]

Overall Market Sentiment and Future Predictions for XRP

Analyzing the Combined Effect of Trump's Post and the Brazilian ETF

The combined impact of Trump's post and the Brazilian ETF on XRP's price is likely synergistic. The tweet created a wave of positive sentiment, while the ETF launch provided a legitimate and accessible investment vehicle for mainstream investors. Determining which event had a more significant influence requires a nuanced analysis, weighing the short-term impact of the tweet against the long-term implications of the ETF launch. Was the initial price jump primarily driven by speculation fueled by Trump's post, with the ETF contributing to sustained growth?

- Positive factors: Increased investor interest, regulatory progress, increased accessibility.

- Negative factors: Market volatility, regulatory uncertainty, ongoing Ripple lawsuit.

- Expert opinions and market forecasts: [Include insights from credible sources]

Long-Term Outlook and Investment Strategies

The long-term outlook for XRP remains uncertain, as it’s subject to the volatility inherent in the cryptocurrency market. While the recent events suggest increased potential, investors should exercise caution and conduct thorough due diligence before making any investment decisions. "Buy the dip" strategies, among others, are often employed in volatile markets like this, but investors must carefully weigh the risks.

- Investment strategies: [Mention relevant strategies with appropriate disclaimers.]

- Disclaimer: Cryptocurrency investments carry inherent risks, including the possibility of significant losses.

Conclusion

The recent XRP rally, fueled by Donald Trump's social media post and the launch of Brazil's first XRP spot ETF, highlights the intertwined nature of social media influence and regulatory developments in shaping cryptocurrency market dynamics. Both events contributed to a significant increase in XRP's price and trading volume, but understanding their individual and combined impacts is crucial for navigating this volatile market. Remember to stay informed about both market events and regulatory shifts before making any investment decisions related to XRP and other cryptocurrencies. Conduct thorough research and only invest what you can afford to lose. Stay tuned for further updates on the XRP market and continue to research before investing in this volatile cryptocurrency market.

Featured Posts

-

Jayson Tatum Reflects On Larry Birds Influence A Celtics Perspective

May 08, 2025

Jayson Tatum Reflects On Larry Birds Influence A Celtics Perspective

May 08, 2025 -

Ethereum Price Analysis Resilience And Potential For Growth

May 08, 2025

Ethereum Price Analysis Resilience And Potential For Growth

May 08, 2025 -

Unseen Fillion A Pivotal Wwii Performance Before His Rookie Fame

May 08, 2025

Unseen Fillion A Pivotal Wwii Performance Before His Rookie Fame

May 08, 2025 -

Neymar Podria Volver Con Brasil Analisis De La Prelista Para El Partido Contra Argentina

May 08, 2025

Neymar Podria Volver Con Brasil Analisis De La Prelista Para El Partido Contra Argentina

May 08, 2025 -

A Cryptocurrencys Unexpected Strength During The Trade War

May 08, 2025

A Cryptocurrencys Unexpected Strength During The Trade War

May 08, 2025