UK Luxury Exports To The EU: The Brexit Bottleneck

Table of Contents

Increased Bureaucracy and Customs Delays

Navigating the post-Brexit landscape for UK luxury exports to the EU has become significantly more complex. The sheer volume of paperwork required for customs declarations has increased exponentially. This includes detailed product descriptions, certificates of origin, and compliance with various EU regulations, all of which adds substantial administrative overhead.

The resulting processing times have lengthened considerably, causing significant delays in supply chains. This impacts not just the delivery schedules but also the overall customer experience. Luxury consumers expect timely and efficient service; delays tarnish brand reputation and erode customer loyalty.

- Increased administrative costs for businesses: The cost of employing specialized customs brokers and navigating complex regulations adds significant financial burdens.

- Longer delivery times leading to potential stockouts: Delayed shipments can lead to empty shelves at luxury boutiques across the EU, resulting in lost sales opportunities.

- Risk of damaged or spoiled goods during extended transit: The longer journey time increases the vulnerability of delicate luxury items to damage or spoilage.

- Difficulty in tracking shipments efficiently: The complexity of the new customs procedures makes it challenging to track shipments in real-time, creating uncertainty and anxiety for both businesses and customers.

These delays specifically impact luxury goods requiring careful handling and precise timing, such as high-end watches requiring specialized transport, bespoke clothing with intricate details, and fine wines needing climate-controlled shipping.

Tariff and Non-Tariff Barriers

Brexit has introduced new tariff and non-tariff barriers that significantly impact UK luxury exports to the EU. Tariffs, or taxes on imported goods, directly increase the cost of UK luxury products sold within the EU, making them less competitive compared to domestically produced alternatives.

Beyond tariffs, non-tariff barriers, such as sanitary and phytosanitary (SPS) regulations, pose further challenges. These regulations, designed to protect human, animal, and plant health, require extensive documentation and compliance procedures, adding layers of complexity and cost.

- Increased costs reducing profit margins: The combined effect of tariffs and non-tariff barriers shrinks profit margins, squeezing the profitability of luxury businesses.

- Price increases making UK luxury goods less competitive: To offset increased costs, businesses may be forced to raise prices, reducing their competitiveness in the already saturated European market.

- Complex regulations leading to compliance challenges: Understanding and complying with the intricate web of EU regulations requires specialized expertise and significant investment.

- Examples of specific tariffs and non-tariff barriers: Specific tariffs may affect high-value items like jewelry or certain types of spirits, while SPS regulations could significantly impact the export of certain food products or organic cosmetics.

Impact on UK Luxury Brands

The consequences of Brexit-related barriers on UK luxury brands are significant and multifaceted. Lost revenue and reduced market share are directly attributable to the added costs and delays in the supply chain. This financial strain can have profound effects on employment within the sector, potentially leading to job losses and reduced investment.

However, some brands have implemented strategies to mitigate these challenges. Establishing EU distribution centers, for example, allows them to bypass some of the customs hurdles and speed up delivery times.

- Case studies of specific luxury brands affected: Research into the financial performance reports of publicly traded UK luxury brands reveals a consistent negative trend post-Brexit.

- Impact on brand reputation due to delivery delays: Delayed deliveries can damage a luxury brand's carefully cultivated image of exclusivity and impeccable service.

- Job losses and reduced investment in the sector: The reduced profitability of the luxury sector may lead to job cuts and a decrease in investments in research, development, and marketing.

- Examples of successful adaptation strategies: Strategic partnerships with EU-based logistics providers and investments in advanced customs management software are proving to be effective strategies.

The Future of UK Luxury Exports to the EU

The future of UK luxury exports to the EU hinges on proactive solutions and strategic adaptation. Exploring and leveraging free trade agreements, whenever possible, is crucial to minimize tariffs and streamline customs procedures. Investing in technology, such as advanced customs management software and streamlined supply chain management systems, will significantly improve efficiency. Adapting supply chains, including establishing EU-based distribution centers, will also help reduce delivery times and costs.

Crucially, government support and collaboration between businesses and policymakers are vital. Clearer guidelines, simplified customs procedures, and targeted financial support can help alleviate the burden on UK luxury brands.

Conclusion

The challenges facing UK luxury exports to the EU are substantial, directly stemming from Brexit-related barriers. The increased bureaucracy, tariffs, and non-tariff barriers have resulted in significant losses for the UK luxury sector. Addressing these issues is paramount to ensuring the continued success and competitiveness of UK luxury goods on the European market. Understanding the complexities of UK luxury exports to the EU is crucial for businesses to thrive. By implementing strategic solutions and advocating for policy changes, the UK can overcome the Brexit bottleneck and regain its competitive edge in the European market.

Featured Posts

-

Dzhenifr Lorns Stana Mayka Za Vtori Pt

May 20, 2025

Dzhenifr Lorns Stana Mayka Za Vtori Pt

May 20, 2025 -

Visita Familiar Schumacher En Suiza Tras Viaje Desde Mallorca

May 20, 2025

Visita Familiar Schumacher En Suiza Tras Viaje Desde Mallorca

May 20, 2025 -

Support Grows For Mick Schumachers Cadillac Bid A Champions Endorsement

May 20, 2025

Support Grows For Mick Schumachers Cadillac Bid A Champions Endorsement

May 20, 2025 -

Porsches Trilemma Ferrari Performance Mercedes Prestige And Trade War Realities

May 20, 2025

Porsches Trilemma Ferrari Performance Mercedes Prestige And Trade War Realities

May 20, 2025 -

Get The Answers Nyt Mini Crossword Hints April 26 2025

May 20, 2025

Get The Answers Nyt Mini Crossword Hints April 26 2025

May 20, 2025

Latest Posts

-

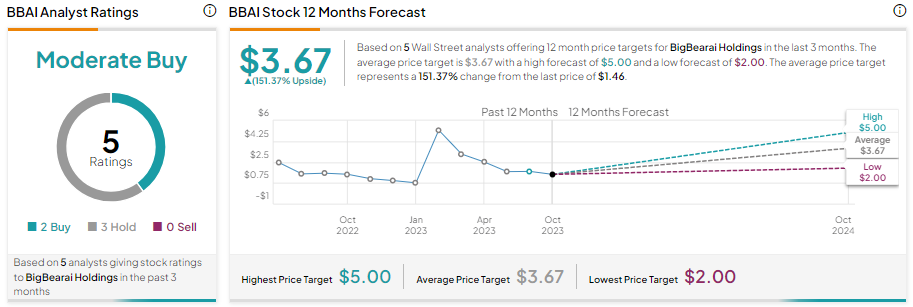

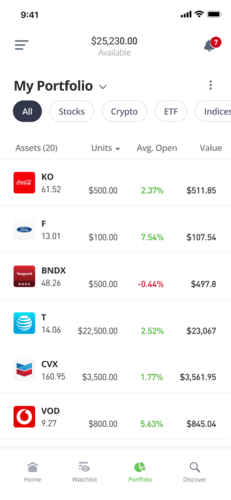

Big Bear Ai Holdings Inc Bbai A Top Ai Penny Stock Pick

May 20, 2025

Big Bear Ai Holdings Inc Bbai A Top Ai Penny Stock Pick

May 20, 2025 -

Invest In This Ai Quantum Computing Stock A Single Powerful Reason

May 20, 2025

Invest In This Ai Quantum Computing Stock A Single Powerful Reason

May 20, 2025 -

The 2025 Decline Of Big Bear Ai Bbai An In Depth Look

May 20, 2025

The 2025 Decline Of Big Bear Ai Bbai An In Depth Look

May 20, 2025 -

Ai Quantum Computing Stock One Compelling Reason To Buy Low

May 20, 2025

Ai Quantum Computing Stock One Compelling Reason To Buy Low

May 20, 2025 -

Analyzing The Reasons Behind Big Bear Ai Bbai S 2025 Stock Plunge

May 20, 2025

Analyzing The Reasons Behind Big Bear Ai Bbai S 2025 Stock Plunge

May 20, 2025