UK Luxury Sector: Brexit's Toll On EU Trade

Table of Contents

Increased Trade Barriers and Costs

Brexit introduced significant hurdles for UK luxury goods entering the EU market. New customs checks, tariffs, and extensive paperwork have dramatically increased the cost and complexity of exporting. These logistical challenges, ranging from delays at ports to increased shipping and warehousing costs, have placed a considerable strain on businesses. The impact extends across various luxury segments, including high-end fashion, bespoke jewelry, premium spirits, and luxury automobiles.

- Higher import duties on luxury goods: Increased tariffs significantly reduce profit margins, making UK luxury goods less competitive.

- Delays at customs leading to stock shortages: Extended waiting times at border checkpoints result in supply chain disruptions and lost sales.

- Increased administrative burden for businesses: The added paperwork and compliance requirements necessitate increased staffing and administrative costs.

- Higher transportation costs due to new border controls: Added logistical complexities and delays inflate transportation expenses.

The cumulative effect of these factors is a substantial increase in the overall cost of exporting luxury goods to the EU, squeezing profitability and hindering competitiveness. The added complexities are especially challenging for smaller luxury brands with fewer resources to navigate the new regulations.

Reduced Consumer Demand from the EU

The weakened pound post-Brexit has directly increased prices for EU consumers, impacting purchasing power. This price increase, coupled with increased import duties, makes UK luxury goods less attractive compared to competitors from within the EU or other regions. Furthermore, the uncertainty surrounding Brexit has negatively impacted tourism from the EU, reducing the footfall in UK luxury boutiques and impacting sales.

- Loss of price competitiveness in the EU market: The combination of a weaker pound and increased tariffs significantly reduces price competitiveness.

- Decreased tourism from the EU impacting sales: Reduced visitor numbers from the EU negatively impact sales within the UK luxury sector.

- Negative brand perception among EU consumers: Brexit-related uncertainty and negative media coverage can contribute to a decline in consumer confidence and brand perception.

This decline in demand represents a substantial threat to the UK luxury sector, highlighting the importance of proactive strategies to mitigate the negative impact on sales and market share.

Supply Chain Disruptions

Brexit has caused significant disruptions to the supply chains for UK luxury goods, particularly those reliant on EU-sourced materials or components. The free movement of goods and labor, a cornerstone of the pre-Brexit relationship with the EU, has been significantly hampered. This has resulted in increased reliance on less efficient alternative supply chains, potentially impacting the quality and availability of luxury products. Labor shortages, particularly in skilled trades crucial to luxury goods production, further exacerbate the challenges.

- Increased reliance on less efficient alternative supply chains: Sourcing materials and components from outside the EU often leads to higher costs and longer lead times.

- Difficulties in sourcing raw materials from the EU: Increased bureaucracy and border controls make sourcing EU-based materials more complex and expensive.

- Shortage of skilled labor impacting production: Difficulties in recruiting EU-based skilled workers have negatively impacted production capacity.

These supply chain issues represent a major obstacle for UK luxury brands, impacting production timelines, quality control, and overall profitability.

Adapting to the New Reality: Strategies for UK Luxury Businesses

Despite the challenges, UK luxury businesses are proactively adapting to the post-Brexit environment. Strategies employed include investing in technology to streamline customs processes, diversifying markets beyond the EU, strengthening relationships with EU distributors and retailers, and adapting pricing strategies to maintain competitiveness. Government support initiatives targeted at assisting businesses navigate these new trade complexities can also play a significant role in mitigating the negative impact.

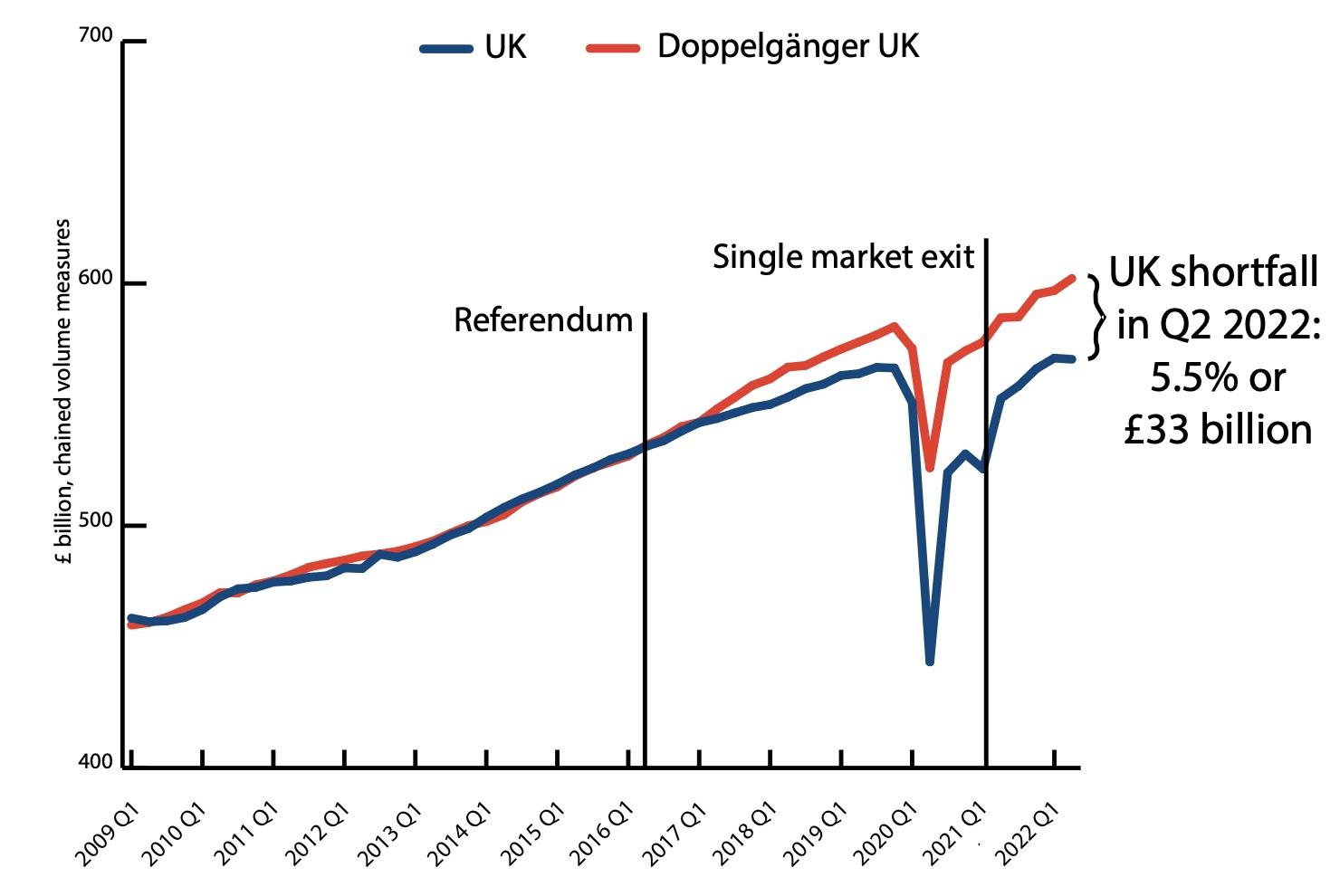

Conclusion: Navigating the Challenges of Post-Brexit UK Luxury Trade

Brexit has undeniably imposed significant challenges on the UK luxury sector's trade with the EU. Increased trade barriers, reduced consumer demand, and supply chain disruptions have created a complex and financially impactful situation. The ability to adapt and implement effective strategies is crucial for the survival and prosperity of many businesses within this important sector. To navigate this challenging new environment, researching available government support and exploring innovative solutions is essential. Understanding the intricacies of post-Brexit trade and adapting accordingly is paramount. We encourage you to explore further resources on government support for businesses impacted by Brexit, focusing specifically on aid for the luxury goods sector, and to consider diversifying your market strategy to lessen your dependence on EU trade. Further research into Brexit's impact on the wider UK economy and contacting relevant business support organisations is also highly recommended. The future of the UK luxury sector hinges on proactively addressing the challenges presented by Brexit's impact on EU trade.

Featured Posts

-

Man Utd Makes Approach For 62 5m Rated Arsenal And Chelsea Target

May 20, 2025

Man Utd Makes Approach For 62 5m Rated Arsenal And Chelsea Target

May 20, 2025 -

Descente De La Brigade De Controle Rapide Bcr Les Marches D Abidjan Sous Haute Surveillance

May 20, 2025

Descente De La Brigade De Controle Rapide Bcr Les Marches D Abidjan Sous Haute Surveillance

May 20, 2025 -

Femicide A Growing Crisis And What We Can Do

May 20, 2025

Femicide A Growing Crisis And What We Can Do

May 20, 2025 -

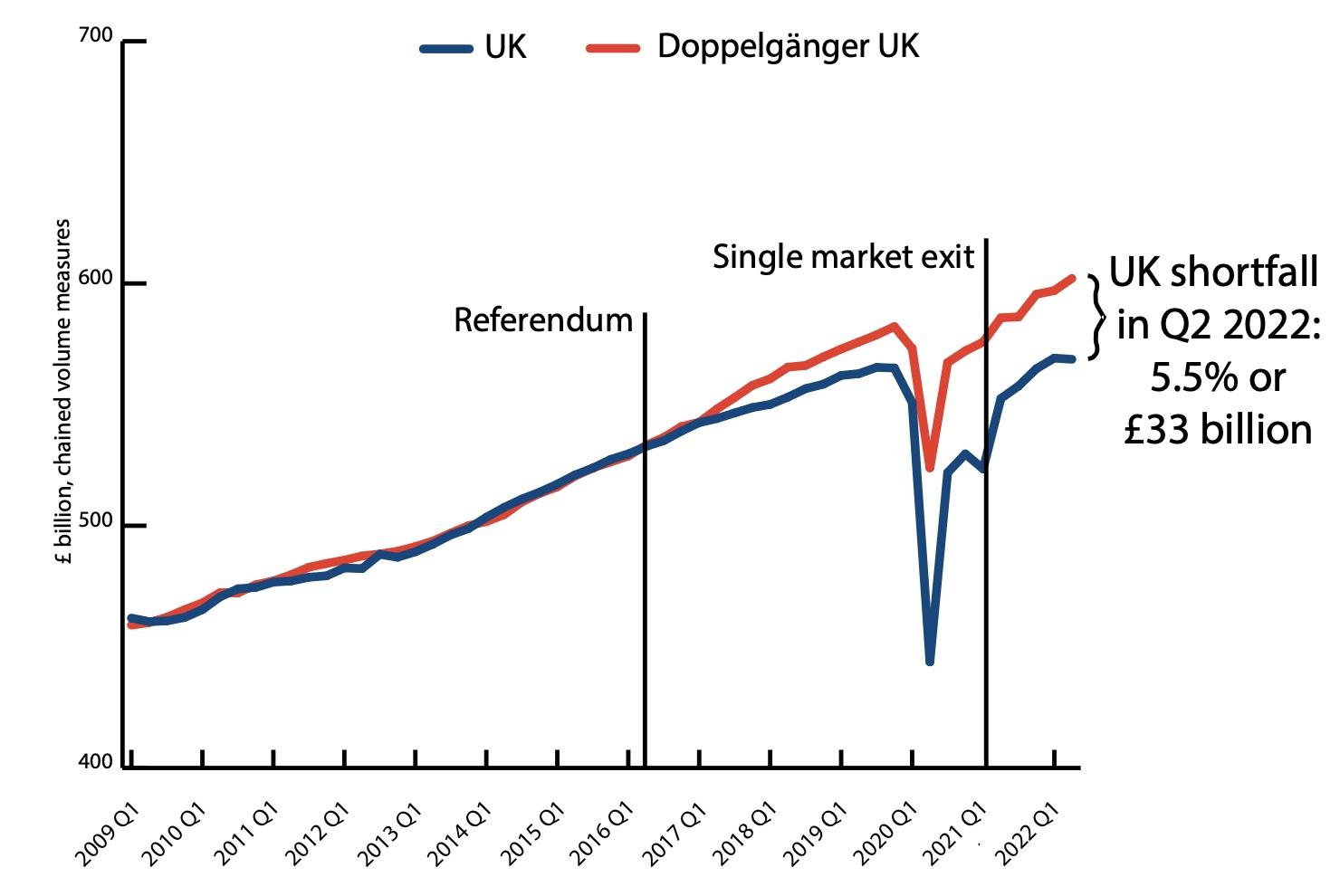

Man United And Arsenal Battle For Matheus Cunha

May 20, 2025

Man United And Arsenal Battle For Matheus Cunha

May 20, 2025 -

Big Bear Ai Bbai Stock Price Decline In 2025 A Deep Dive

May 20, 2025

Big Bear Ai Bbai Stock Price Decline In 2025 A Deep Dive

May 20, 2025

Latest Posts

-

Big Bear Ai Stock A Detailed Investment Analysis

May 20, 2025

Big Bear Ai Stock A Detailed Investment Analysis

May 20, 2025 -

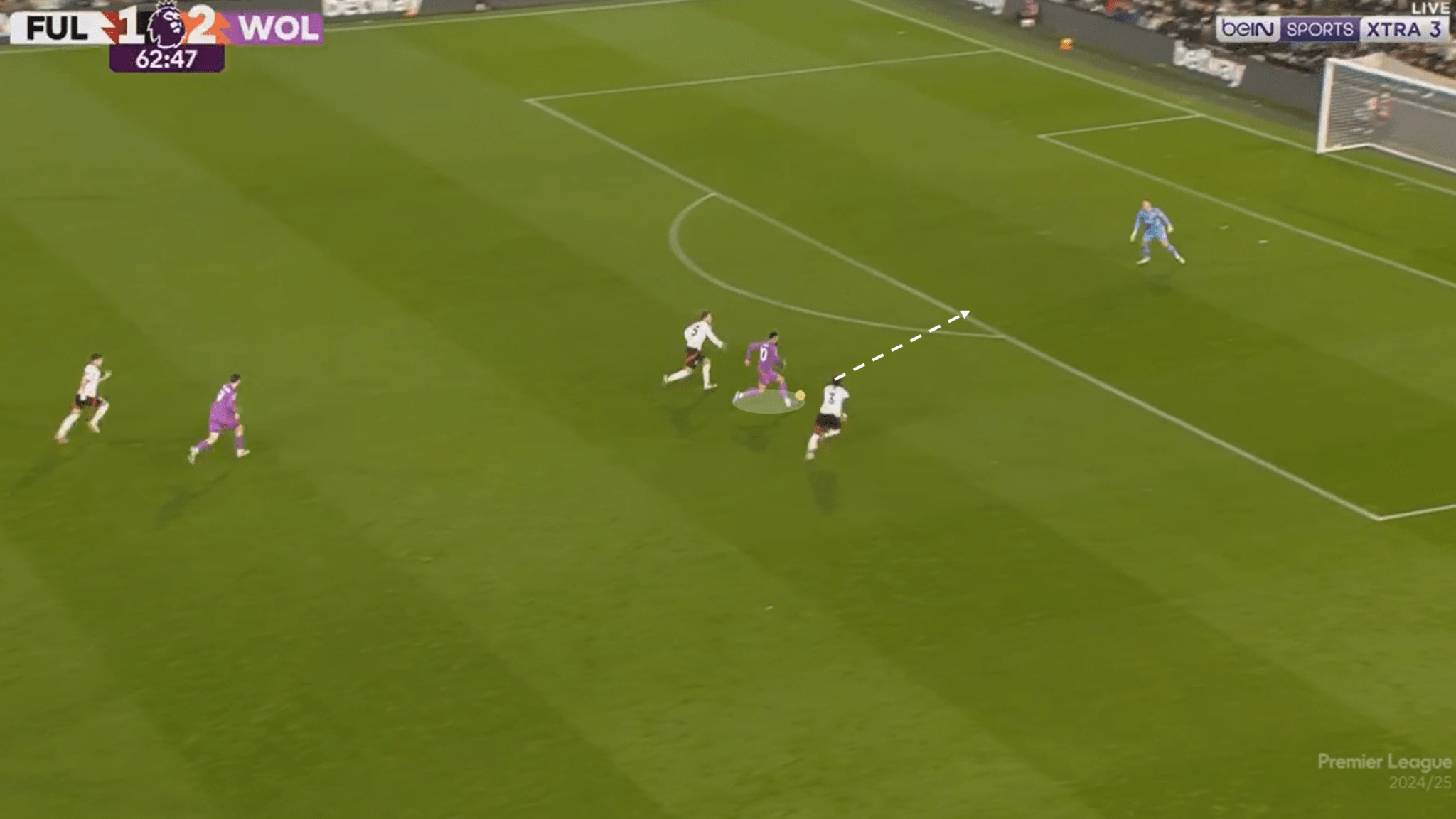

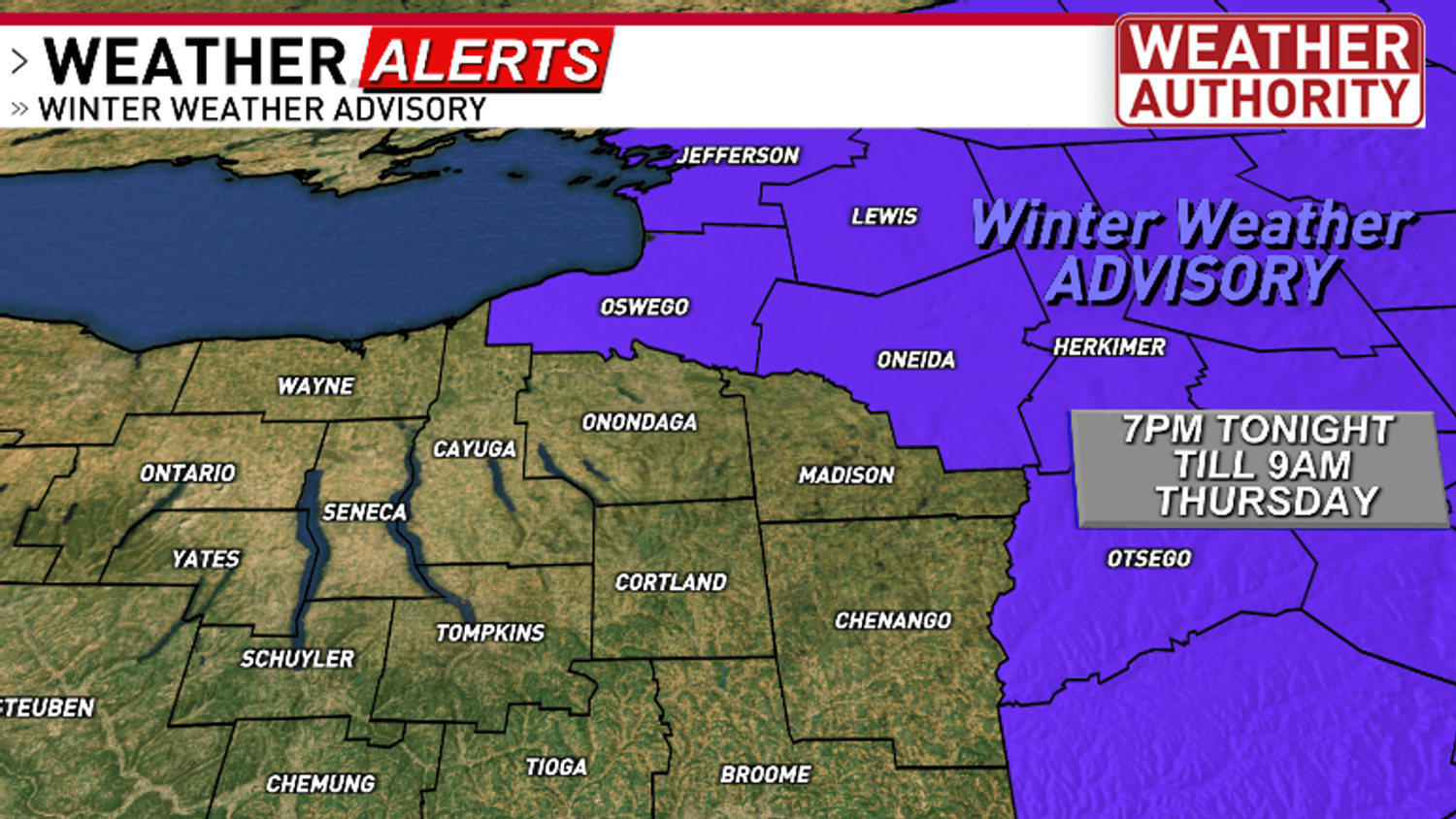

Understanding Winter Weather Advisories And Their Impact On School Schedules

May 20, 2025

Understanding Winter Weather Advisories And Their Impact On School Schedules

May 20, 2025 -

Navigating Winter Weather Advisories School Decisions And Safety Tips

May 20, 2025

Navigating Winter Weather Advisories School Decisions And Safety Tips

May 20, 2025 -

Big Bear Ai Holdings Inc Analyzing The Recent Securities Lawsuit

May 20, 2025

Big Bear Ai Holdings Inc Analyzing The Recent Securities Lawsuit

May 20, 2025 -

Should You Buy Big Bear Ai Stock Investing Insights

May 20, 2025

Should You Buy Big Bear Ai Stock Investing Insights

May 20, 2025