Understanding High Stock Market Valuations: BofA's Analysis For Investors

Table of Contents

BofA's Key Findings on High Stock Market Valuations

BofA's recent research highlights several key factors driving current high stock market valuations. Understanding these factors is crucial for investors to make informed decisions about their portfolios.

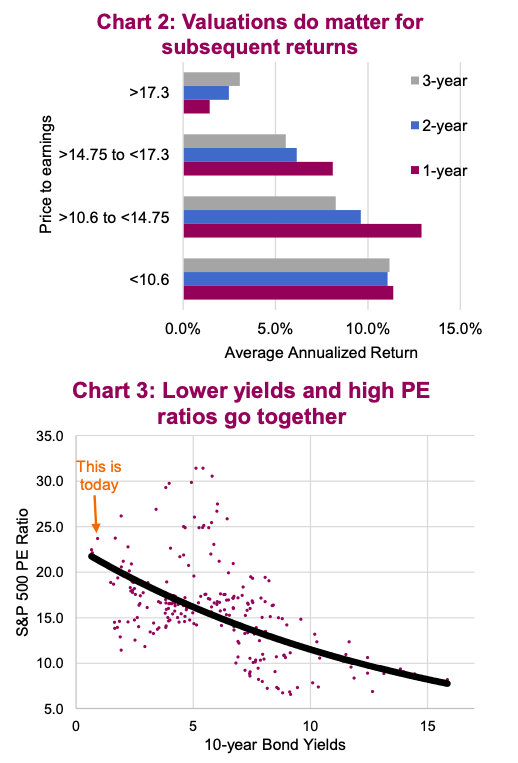

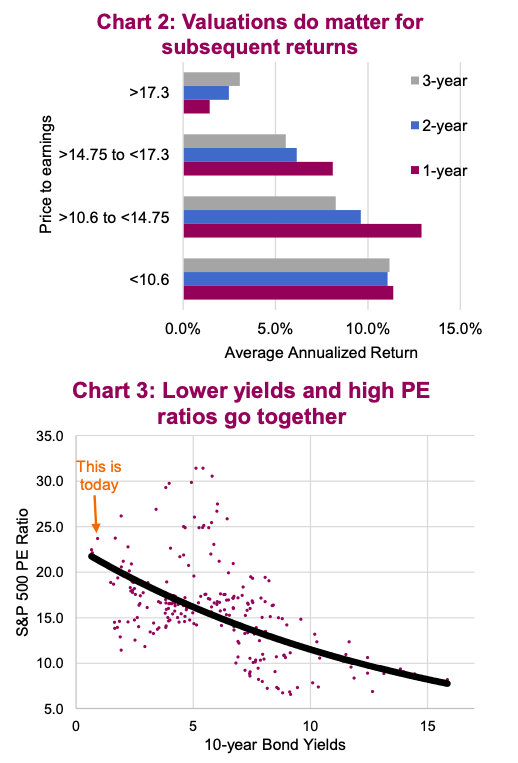

Elevated Price-to-Earnings Ratios (P/E)

The Price-to-Earnings ratio (P/E) is a key valuation metric that compares a company's stock price to its earnings per share. High P/E ratios generally suggest that investors are paying a premium for each dollar of earnings, indicating potentially high expectations for future growth. BofA's analysis reveals elevated P/E ratios across several sectors.

- Technology Sector: The technology sector consistently shows high P/E ratios, driven by anticipated future growth in areas like artificial intelligence and cloud computing. However, historical comparisons raise concerns about the sustainability of these high ratios.

- Consumer Discretionary Sector: Companies in the consumer discretionary sector, particularly those focused on e-commerce and luxury goods, also exhibit elevated P/E ratios. This reflects strong consumer spending but also increased susceptibility to economic downturns.

- Healthcare Sector: Innovation and aging populations drive demand in the healthcare sector. While offering growth potential, high P/E ratios in this sector warrant careful consideration of the risks associated with long-term growth projections.

BofA's predictions suggest a potential future adjustment in P/E ratios, although the timing and magnitude of this adjustment remain uncertain. Investors should closely monitor these ratios and consider their implications when making investment choices in the current market environment of high stock market valuations.

Impact of Low Interest Rates on Stock Valuations

There's an inverse relationship between interest rates and stock valuations. Low interest rates make borrowing cheaper for companies and encourage investors to seek higher returns in the stock market, pushing up valuations.

- Increased Investment in Stocks: Low interest rates reduce the attractiveness of low-risk investments like bonds, leading to a higher demand for stocks and consequently, increased valuations.

- Impact of Future Interest Rate Hikes: BofA analysts anticipate that future interest rate hikes by central banks could impact stock valuations negatively. Rising interest rates make borrowing more expensive and increase the attractiveness of fixed-income investments, potentially leading to a shift away from stocks.

- BofA's Perspective: BofA believes that the current low-interest-rate environment has significantly contributed to high stock market valuations and that a change in monetary policy could influence these valuations significantly.

Role of Quantitative Easing (QE) and Monetary Policy

Central bank policies, particularly quantitative easing (QE), have played a significant role in influencing stock market valuations. QE involves injecting liquidity into the financial system by purchasing assets, increasing the money supply.

- Increased Liquidity: QE programs increase the amount of money available in the market, often leading to increased demand for assets like stocks and subsequently higher valuations.

- BofA's View on Long-Term Effects: BofA's analysis acknowledges the significant impact of past QE programs on stock market valuations. However, the long-term effects and the sustainability of this influence remain areas of concern.

- Future Policy Changes: Any changes in monetary policy, such as a reduction or cessation of QE, could have a substantial impact on stock market valuations, potentially leading to increased volatility.

Potential Risks Associated with High Stock Market Valuations

While high stock market valuations can indicate strong economic performance, they also carry inherent risks. Investors need to understand and manage these risks effectively.

Market Corrections and Volatility

Overvalued markets are susceptible to corrections, periods of sharp declines in prices.

- Likelihood of Corrections: Given the current high valuations, BofA acknowledges a heightened risk of market corrections. The magnitude and duration of any correction remain uncertain.

- Impact on Investor Portfolios: Market corrections can significantly impact investors' portfolios, leading to substantial losses, especially for those holding highly valued stocks.

- BofA's Volatility Predictions: BofA predicts increased volatility in the market, suggesting investors should prepare for potential price swings and adjust their investment strategies accordingly.

Impact of Inflation on Stock Prices

Rising inflation erodes the purchasing power of money and can negatively impact stock market performance.

- Impact on Corporate Earnings: Inflation increases the cost of production for companies, potentially reducing their profitability and impacting investor sentiment.

- BofA's Assessment of Inflationary Pressures: BofA closely monitors inflationary pressures and their potential impact on stock valuations, advising investors to consider this factor in their investment decisions.

- Investor Sentiment: High inflation can decrease investor confidence, leading to a sell-off in the market and a reduction in valuations.

Geopolitical and Economic Uncertainty

External factors such as geopolitical events and economic uncertainty can significantly influence stock market valuations.

- Market Downturns: Geopolitical instability and economic uncertainty often trigger market downturns, as investors seek safer investments.

- BofA's Perspective on Global Landscape: BofA carefully assesses the current global landscape, highlighting the potential impact of geopolitical risks and economic uncertainty on stock valuations.

- Risk Management Strategies: Investors should incorporate robust risk management strategies to mitigate the potential impact of these external factors.

BofA's Recommendations for Investors

BofA provides valuable recommendations to help investors navigate the challenges posed by high stock market valuations.

Diversification Strategies

Diversification is crucial to mitigate risk in any market, but especially in one characterized by high valuations.

- Asset Class Diversification: Spread investments across different asset classes such as stocks, bonds, real estate, and alternative investments to reduce the impact of market fluctuations in any single asset.

- Sector Diversification: Don't concentrate investments in a single sector. Diversify across various sectors to reduce the risk associated with sector-specific downturns.

Long-Term Investment Approach

A long-term investment horizon allows investors to ride out short-term market volatility.

- Weathering Short-Term Fluctuations: A long-term perspective helps mitigate the impact of short-term market corrections and fluctuations.

- BofA's Advice on Long-Term Investments: BofA advises investors to maintain a long-term investment strategy, focusing on the fundamental value of their holdings rather than reacting to short-term market swings.

Risk Management Techniques

Employing appropriate risk management techniques is critical in a high-valuation market.

- Stop-Loss Orders: Use stop-loss orders to limit potential losses on individual investments.

- Position Sizing: Carefully manage position sizes to avoid excessive risk exposure in any single investment.

- BofA's Recommended Risk Management Techniques: BofA emphasizes the importance of utilizing appropriate risk management techniques, including diversification and stop-loss orders, to navigate the increased volatility associated with high stock market valuations.

Conclusion:

BofA's analysis of high stock market valuations provides crucial insights for investors. While attractive opportunities may exist, the elevated valuations are driven by factors like low interest rates and quantitative easing, creating increased risks such as market corrections and inflationary pressures. BofA recommends a diversified investment approach, a long-term perspective, and robust risk management strategies. By understanding these factors and following BofA's recommendations, investors can make more informed decisions regarding their portfolios in the context of high stock market valuations. Remember to consult with a financial advisor to create a personalized investment strategy tailored to your risk tolerance and financial goals.

Featured Posts

-

Gaza Prisoner Release Plea From Ex Israeli Female Soldiers

May 26, 2025

Gaza Prisoner Release Plea From Ex Israeli Female Soldiers

May 26, 2025 -

This Dad Rowed To Raise 2 2 Million For His Sons Treatment A True Story Of Dedication

May 26, 2025

This Dad Rowed To Raise 2 2 Million For His Sons Treatment A True Story Of Dedication

May 26, 2025 -

Navigate The Private Credit Job Market 5 Dos And Don Ts For Success

May 26, 2025

Navigate The Private Credit Job Market 5 Dos And Don Ts For Success

May 26, 2025 -

Lewis Hamiltons Impact The F1 Rule Change He Influenced

May 26, 2025

Lewis Hamiltons Impact The F1 Rule Change He Influenced

May 26, 2025 -

Debat Enthoven Le Pen La Morale Publique Selon Enthoven Et La Comparaison Avec Ramadan

May 26, 2025

Debat Enthoven Le Pen La Morale Publique Selon Enthoven Et La Comparaison Avec Ramadan

May 26, 2025

Latest Posts

-

Rayan Cherki Liverpools Scouting Interest Intensifies

May 28, 2025

Rayan Cherki Liverpools Scouting Interest Intensifies

May 28, 2025 -

Winning The Euromillions Financial Planning For A 202m Jackpot

May 28, 2025

Winning The Euromillions Financial Planning For A 202m Jackpot

May 28, 2025 -

The 202 Million Euromillions Understanding The Odds And Prizes

May 28, 2025

The 202 Million Euromillions Understanding The Odds And Prizes

May 28, 2025 -

Record Breaking 202m Euromillions Your Guide To Winning Big

May 28, 2025

Record Breaking 202m Euromillions Your Guide To Winning Big

May 28, 2025 -

Lotto Jackpot Winner Winning Ticket Sold At This Shop Prize Unclaimed

May 28, 2025

Lotto Jackpot Winner Winning Ticket Sold At This Shop Prize Unclaimed

May 28, 2025