US Credit Rating Cut: Dow Futures And Dollar React

Table of Contents

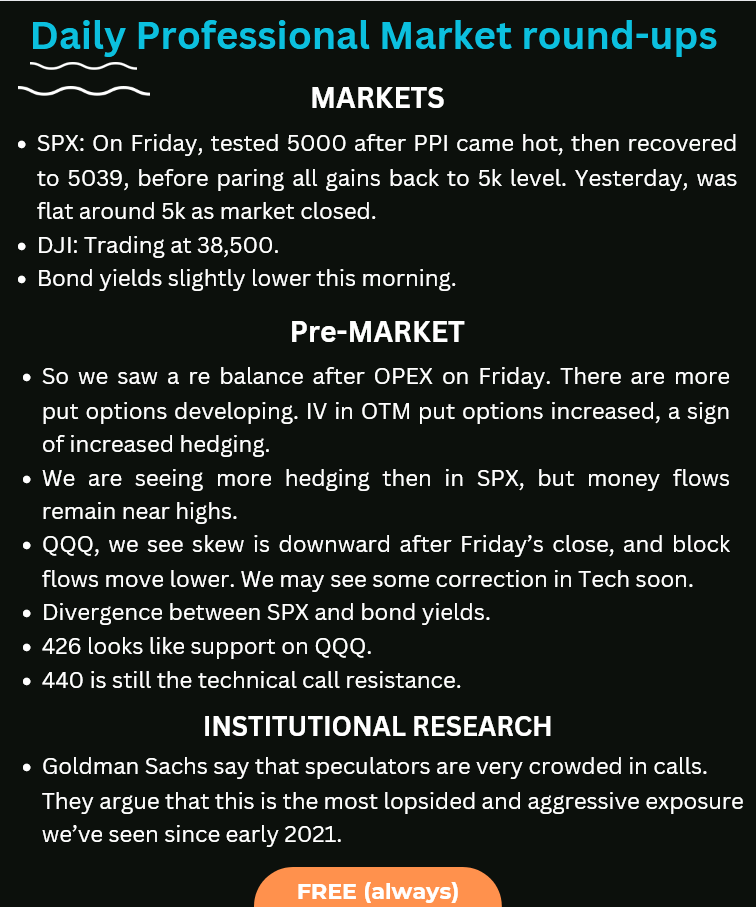

Immediate Market Reactions to the US Credit Rating Cut

The announcement of the US credit rating cut triggered a swift and significant response across global financial markets. The immediate impact was felt most acutely in the futures markets and the value of the US dollar.

Dow Futures Plunge

The announcement triggered a sharp decline in Dow futures contracts, reflecting investor concerns about the weakened economic outlook following the US credit rating cut.

- Pre-market trading saw significant sell-offs, indicating a negative sentiment among traders anticipating further economic instability.

- The potential for further declines depends heavily on the market's overall response and the government's reaction to the downgrade and the implications of a US credit rating cut. A swift and decisive policy response could help mitigate further losses.

- Increased volatility is expected in the short term as investors grapple with the implications of the downgrade and reassess their portfolios in light of the US credit rating cut.

US Dollar Weakness

The US dollar experienced a significant weakening against other major currencies following the rating cut. This reflects a loss of confidence in the US economy's stability.

- Safe-haven assets like gold and other currencies (particularly those of countries with stronger credit ratings) saw increased demand as investors sought to protect their capital from the fallout of the US credit rating cut.

- Uncertainty about the US economy's future, fueled by the US credit rating cut, significantly impacted investor confidence in the dollar.

- The long-term impact on the dollar's value remains to be seen, and depends on factors like the Federal Reserve's response and the government's ability to address the underlying issues that led to the US credit rating cut.

Flight to Safety

Investors reacted to the US credit rating cut by seeking refuge in safer assets, such as government bonds of countries with higher credit ratings.

- This shift reflects a broader concern about the stability of the US economy in the wake of the US credit rating cut.

- The increased demand for safe havens puts upward pressure on the prices of these assets and puts downward pressure on riskier assets, such as stocks.

- This flight to safety could further destabilize the market, particularly if the trend continues and confidence in the US economy remains low after the US credit rating cut.

Underlying Causes of the US Credit Rating Downgrade

The downgrade wasn't a sudden event but rather the culmination of several long-standing issues within the US economy and government.

Mounting National Debt

The escalating national debt played a significant role in the credit rating agency's decision to downgrade the US credit rating.

- Repeated failure to address the debt ceiling crisis, leading to near-defaults on US government debt, significantly contributed to the downgrade.

- Concerns about the government's ability to manage its finances effectively, particularly in light of the ongoing political battles over the debt ceiling, played a major role in the US credit rating cut.

- Political gridlock hindering the implementation of effective fiscal policy contributed to the perception of fiscal irresponsibility.

Political Polarization and Fiscal Irresponsibility

Deep political divisions and a lack of consensus on fiscal policy exacerbated the problems leading to the US credit rating cut.

- Failure to implement long-term solutions for budget deficits and unsustainable spending patterns undermined investor confidence.

- Erosion of confidence in the government's ability to manage its finances responsibly was a significant factor in the rating agency’s decision.

- The impact of partisan politics on economic stability became a major concern, contributing to the US credit rating cut.

Deteriorating Governance Indicators

The rating agencies also cited concerns about weakening governance indicators as a factor in the US credit rating cut.

- This includes factors such as political stability and the predictability of government policy, both of which have been negatively impacted by increasing political polarization.

- Concerns over the long-term fiscal sustainability of the country, given the rising national debt and the lack of bipartisan cooperation on fiscal matters, were central to the US credit rating cut.

- The impact of political gridlock on long-term economic planning and the implementation of sound fiscal policies contributed heavily to the downgrade.

Potential Long-Term Consequences of the US Credit Rating Cut

The US credit rating cut has far-reaching implications that will likely impact the US and global economies for years to come.

Higher Borrowing Costs

The downgrade will likely lead to higher borrowing costs for the US government.

- Increased interest rates on government bonds will increase the cost of servicing the national debt.

- This will impact the overall cost of government spending and could necessitate cuts in other areas.

- Potential implications for future economic growth include slower economic expansion due to reduced government spending and investment.

Inflationary Pressures

The increased borrowing costs could contribute to inflationary pressures.

- Impact on consumer prices and the cost of living is a significant concern, potentially leading to further economic hardship for many Americans.

- The potential for further economic instability due to higher inflation rates is a significant risk.

- The Federal Reserve's response to inflationary pressures will be crucial in mitigating the long-term impact of the US credit rating cut.

Global Economic Uncertainty

The US credit rating cut creates uncertainty in the global economy.

- Impact on global financial markets and investor confidence is already evident, causing ripples throughout the world economy.

- Potential for contagion effects in other countries, particularly those with close economic ties to the US, is a significant concern.

- The need for coordinated international efforts to address the crisis and mitigate the global impact of the US credit rating cut is paramount.

Conclusion

The US credit rating cut is a watershed moment with far-reaching consequences for the US economy and global financial markets. The immediate reactions, including the Dow futures plunge and the weakening of the dollar, highlight the gravity of the situation. Understanding the underlying causes – from mounting national debt to political gridlock – is crucial to mitigating the long-term risks. The potential for higher borrowing costs, inflationary pressures, and increased global uncertainty necessitates careful monitoring and proactive measures. Staying informed about developments related to the US credit rating cut is essential for investors and policymakers alike. Continue to follow reputable financial news sources for up-to-date information and analysis on this evolving situation.

Featured Posts

-

Who Is Paulina Gretzky Dustin Johnsons Wife Career And Family

May 21, 2025

Who Is Paulina Gretzky Dustin Johnsons Wife Career And Family

May 21, 2025 -

Hout Bay Fcs Success The Klopp Connection

May 21, 2025

Hout Bay Fcs Success The Klopp Connection

May 21, 2025 -

The Goldbergs A Nostalgic Look Back At 80s Family Life

May 21, 2025

The Goldbergs A Nostalgic Look Back At 80s Family Life

May 21, 2025 -

Updated The Trans Australia Run World Record Challenge

May 21, 2025

Updated The Trans Australia Run World Record Challenge

May 21, 2025 -

Moodys Downgrade Impact On Dow Futures And Dollar

May 21, 2025

Moodys Downgrade Impact On Dow Futures And Dollar

May 21, 2025

Latest Posts

-

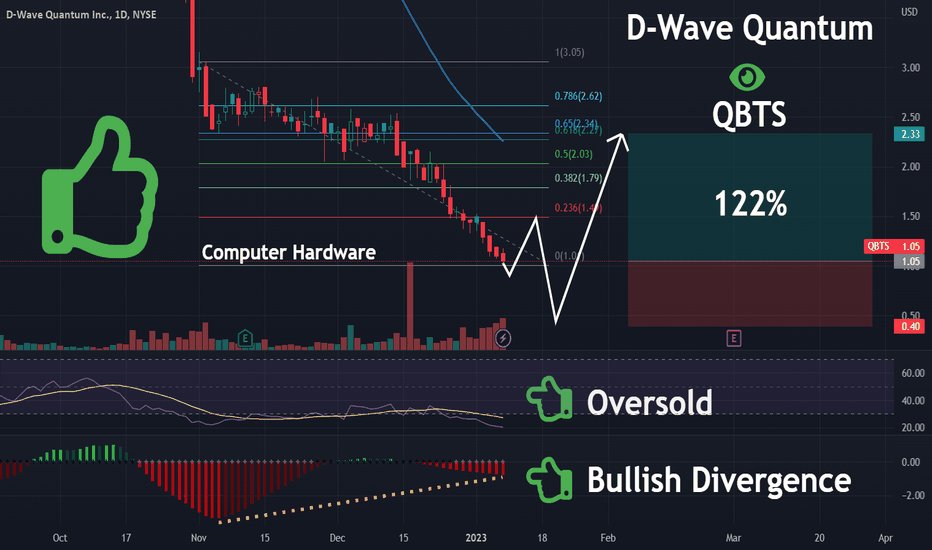

D Wave Quantum Qbts Stock Market Activity Explaining Todays Significant Increase

May 21, 2025

D Wave Quantum Qbts Stock Market Activity Explaining Todays Significant Increase

May 21, 2025 -

Why Did D Wave Quantum Qbts Stock Price Rise Today An In Depth Analysis

May 21, 2025

Why Did D Wave Quantum Qbts Stock Price Rise Today An In Depth Analysis

May 21, 2025 -

2025 Market Analysis Deconstructing The D Wave Quantum Qbts Stock Fall

May 21, 2025

2025 Market Analysis Deconstructing The D Wave Quantum Qbts Stock Fall

May 21, 2025 -

Factors Contributing To The D Wave Quantum Inc Qbts Stock Slump Of 2025

May 21, 2025

Factors Contributing To The D Wave Quantum Inc Qbts Stock Slump Of 2025

May 21, 2025 -

Understanding D Wave Quantums Qbts Stock Performance On Monday

May 21, 2025

Understanding D Wave Quantums Qbts Stock Performance On Monday

May 21, 2025