Wildfire Prediction Markets: Ethical Concerns And The LA Fires

Table of Contents

The Promise and Potential of Wildfire Prediction Markets

Prediction markets, essentially sophisticated betting systems, leverage the collective wisdom of participants to forecast future events. Applied to wildfire prediction, these markets incentivize individuals to analyze data, refine predictive models, and ultimately, generate more accurate forecasts than traditional methods. The potential benefits are substantial:

-

Improved Risk Assessment: More accurate predictions lead to better informed decisions regarding preventative measures and resource allocation, potentially saving lives and property. Sophisticated predictive modeling allows for a more nuanced understanding of wildfire risk, considering factors such as weather patterns, fuel loads, and topography.

-

Proactive Resource Allocation: By accurately predicting high-risk areas and periods, authorities can strategically deploy firefighters, equipment, and evacuation resources, maximizing their effectiveness. This proactive approach minimizes response times and improves overall preparedness.

-

Enhanced Community Preparedness: Accurate wildfire predictions enable communities to take timely preventative measures, such as creating defensible spaces around homes, developing robust evacuation plans, and investing in fire-resistant building materials. Early warnings also allow for proactive communication, educating residents on preparedness strategies.

-

Bullet Points:

- More accurate predictions than traditional methods, incorporating real-time data and diverse perspectives.

- Incentivizes data collection and analysis, leading to improved forecasting accuracy over time.

- Facilitates better insurance pricing and risk management, providing a more accurate reflection of actual risk.

Ethical Concerns Raised by Wildfire Prediction Markets

While the potential benefits of wildfire prediction markets are clear, significant ethical challenges must be addressed.

Market Manipulation and Insider Trading

The potential for manipulating market outcomes for personal gain is a significant concern. Individuals with privileged access to information—such as firefighters, meteorologists, or those with access to advanced weather models—could exploit this knowledge to unfairly profit.

- Bullet Points:

- Individuals with privileged information could unfairly profit from their insider knowledge, undermining the integrity of the market.

- Potential for coordinated efforts to artificially inflate or deflate predictions for speculative gains.

- Lack of transparency and robust regulation can create fertile ground for market manipulation and insider trading.

Data Bias and Inequality

Data bias presents a substantial ethical challenge. Historical data may not accurately reflect future wildfire behavior due to climate change and other factors. Moreover, limited data from marginalized communities might lead to inaccurate predictions for those areas.

- Bullet Points:

- Historical data may not accurately reflect future wildfire behavior due to climate change and evolving fire dynamics.

- Limited data from marginalized communities can result in inaccurate predictions and unequal distribution of resources.

- Biased algorithms can perpetuate existing inequalities, disproportionately impacting vulnerable populations.

The Commodification of Disaster

Perhaps the most profound ethical concern is the commodification of disaster. The act of profiting from the prediction of natural disasters raises questions about prioritizing profit over human safety and well-being.

- Bullet Points:

- Potential to trivialize human suffering and loss, reducing complex events to mere financial opportunities.

- Concerns about prioritizing profit over human safety and well-being.

- The need for ethical frameworks and guidelines to govern the use of such markets.

The Case of the LA Fires: A Real-World Example

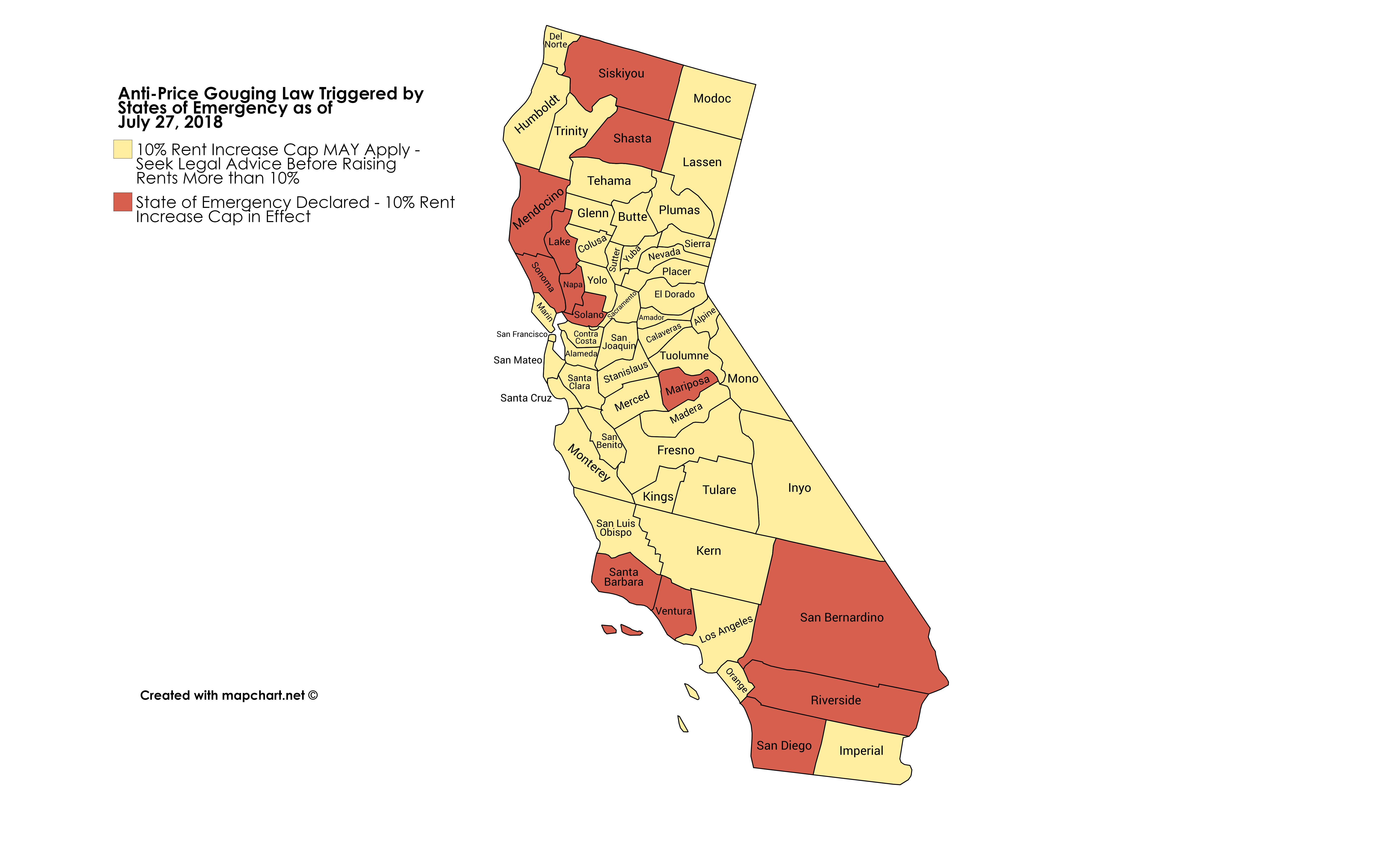

The unique challenges presented by the LA fires highlight the complexities of applying wildfire prediction markets. The dense population, urbanization, and the unpredictable Santa Ana winds create a high-risk environment.

- Bullet Points:

- Dense population and urbanization increase the potential for catastrophic losses.

- Santa Ana winds create highly unpredictable and dangerous fire conditions.

- Challenges of land management and fire prevention in a complex urban landscape.

Regulation and Best Practices for Wildfire Prediction Markets

To mitigate the ethical concerns, robust regulatory frameworks and best practices are crucial. Transparency, accountability, and independent oversight are paramount.

- Bullet Points:

- Strict regulations against insider trading and market manipulation are essential.

- Mechanisms to ensure data accuracy, address bias, and promote inclusivity are necessary.

- Independent audits of prediction market algorithms and data are crucial for maintaining market integrity.

- Public access to data and prediction models promotes transparency and accountability.

Conclusion

Wildfire prediction markets hold immense potential for improving wildfire risk assessment and community safety. However, the ethical challenges associated with market manipulation, data bias, and the commodification of disaster are significant and cannot be ignored. The specific context of the LA fires underscores the urgent need for careful consideration and robust regulation. Further research on mitigating these ethical concerns is crucial for responsible implementation and to avoid exacerbating existing inequalities. Let's work together to ensure that wildfire prediction markets serve humanity, not the other way around. The responsible development and regulation of wildfire prediction markets are essential for harnessing their potential while safeguarding vulnerable communities and mitigating the risks of exploitation.

Featured Posts

-

Reconsidering Your Layoff Responding To A Rehire Offer

Apr 26, 2025

Reconsidering Your Layoff Responding To A Rehire Offer

Apr 26, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Star Speaks Out

Apr 26, 2025

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Star Speaks Out

Apr 26, 2025 -

Pentagon Leaks And Internal Disputes Hegseth Faces Polygraph Fallout

Apr 26, 2025

Pentagon Leaks And Internal Disputes Hegseth Faces Polygraph Fallout

Apr 26, 2025 -

Stock Market Today Dow Futures Fluctuate Chinas Economic Support Amidst Tariff Tensions

Apr 26, 2025

Stock Market Today Dow Futures Fluctuate Chinas Economic Support Amidst Tariff Tensions

Apr 26, 2025 -

200 Million Tariff Burden Colgate Cl Reports Reduced Sales And Profits

Apr 26, 2025

200 Million Tariff Burden Colgate Cl Reports Reduced Sales And Profits

Apr 26, 2025

Latest Posts

-

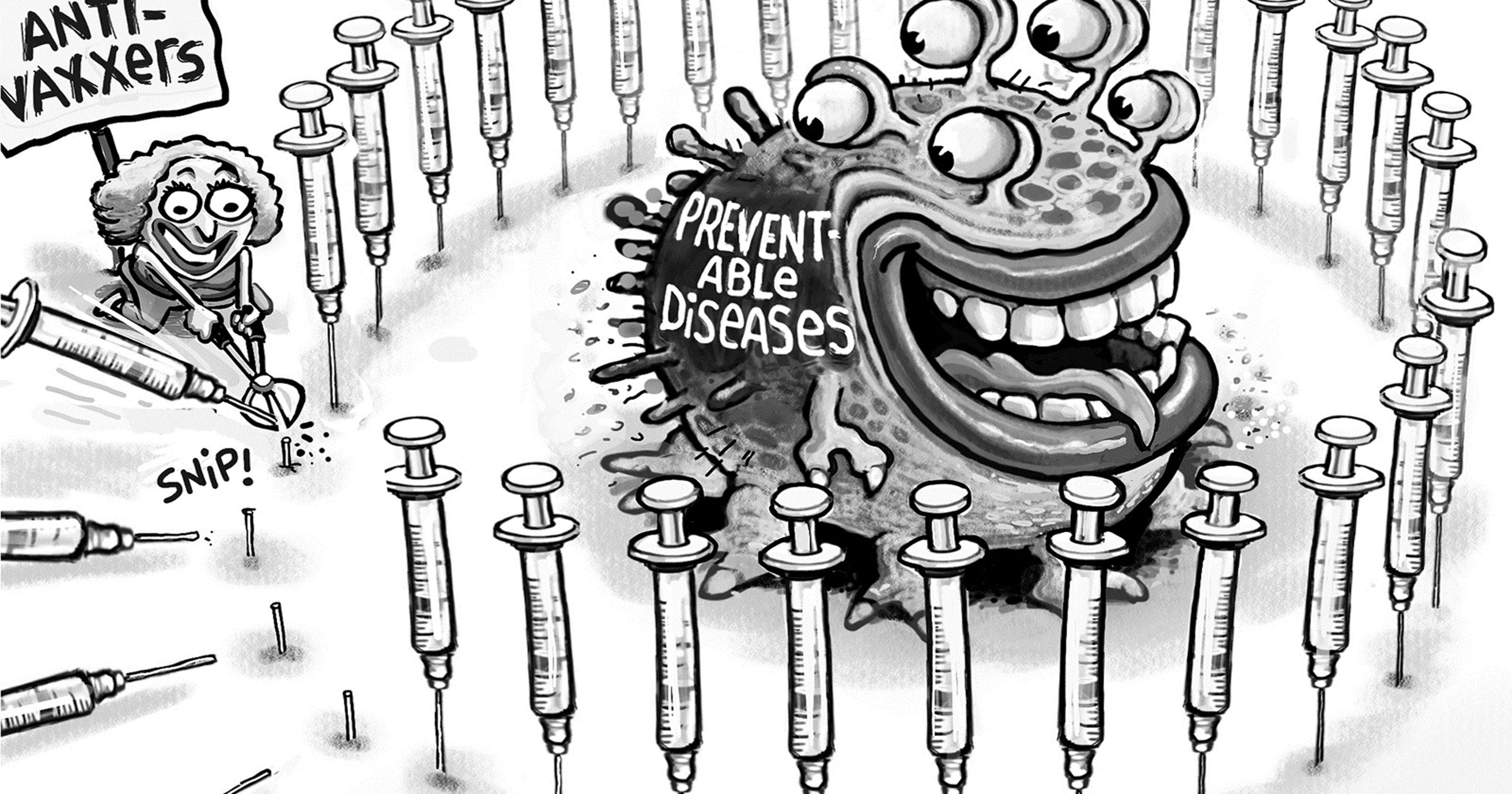

Cdc Vaccine Study Is A Discredited Agent Involved

Apr 27, 2025

Cdc Vaccine Study Is A Discredited Agent Involved

Apr 27, 2025 -

Cdcs New Vaccine Study Hire Concerns Over Misinformation Agent

Apr 27, 2025

Cdcs New Vaccine Study Hire Concerns Over Misinformation Agent

Apr 27, 2025 -

Controversial Choice Vaccine Skeptic Appointed To Lead Immunization Autism Research

Apr 27, 2025

Controversial Choice Vaccine Skeptic Appointed To Lead Immunization Autism Research

Apr 27, 2025 -

Concerns Raised Over Anti Vaccination Advocates Role In Autism Study

Apr 27, 2025

Concerns Raised Over Anti Vaccination Advocates Role In Autism Study

Apr 27, 2025 -

Public Outcry Anti Vaxxer Appointed To Lead Autism Research

Apr 27, 2025

Public Outcry Anti Vaxxer Appointed To Lead Autism Research

Apr 27, 2025