Will QBTS Stock Rise Or Fall After The Next Earnings Announcement?

Table of Contents

Analyzing QBTS's Recent Performance and Trends

To predict the potential impact of the next earnings announcement on QBTS stock, we must first analyze the company's recent performance and prevailing trends.

QBTS Revenue, Earnings, and Profitability

Examining QBTS's financial health is paramount. We need to look at key metrics to gauge its recent performance.

- Year-over-year revenue growth: Has QBTS shown consistent revenue growth, or have there been periods of decline? A strong upward trend indicates positive momentum.

- Changes in net income: Analyzing changes in net income reveals the company's profitability. Increasing net income suggests efficient operations and strong financial health, positive for QBTS stock price.

- Impact of cost-cutting measures (if any): Cost-cutting initiatives can significantly influence profitability. Determining their effectiveness is key to assessing QBTS's future financial outlook.

- Comparison to competitor performance: Benchmarking QBTS against its competitors provides a clearer picture of its relative performance within the industry. Outperforming competitors suggests a strong competitive advantage.

Analyzing this data provides a clear picture of QBTS revenue, QBTS earnings, and QBTS profitability, all vital indicators for future stock performance.

QBTS Market Position and Competitive Landscape

Understanding QBTS's position within its industry is crucial for predicting its future trajectory.

- Market share: A dominant market share indicates a strong position and potential for continued growth. However, a declining market share may signal challenges ahead.

- Competitive threats: Identifying key competitors and their strategies helps determine potential threats to QBTS's market share and profitability.

- New product launches: Successful new product launches can significantly boost revenue and market share.

- Technological advancements impacting the sector: Adapting to technological changes is essential for survival in a dynamic industry. QBTS's ability to innovate can greatly influence its future performance.

A thorough analysis of QBTS competitors, QBTS market share, and QBTS competitive advantage in light of industry trends is critical for evaluating QBTS stock’s potential.

Factors Influencing the Next Earnings Announcement

Several factors beyond QBTS's internal performance influence the next earnings announcement and the subsequent market reaction.

QBTS Earnings Expectations and Analyst Predictions

Market sentiment is heavily influenced by analyst predictions and the consensus EPS (earnings per share) estimates.

- Consensus EPS estimates: This represents the average earnings per share predicted by analysts. Beating this estimate could positively impact QBTS stock price.

- Range of analyst price targets: Analyst price targets provide a range of potential stock prices based on their forecasts. A wide range suggests significant uncertainty.

- Potential for earnings surprises (positive or negative): An earnings surprise (either exceeding or falling short of expectations) can trigger significant price volatility in QBTS stock.

Monitoring QBTS earnings expectations, QBTS analyst ratings, and QBTS price targets will provide a clear picture of market sentiment.

Macroeconomic Factors and Market Sentiment

Broader economic conditions and overall market sentiment significantly impact stock performance, irrespective of individual company results.

- Interest rate hikes: Higher interest rates can negatively impact market valuations, potentially affecting QBTS stock, regardless of the earnings report.

- Inflation: High inflation can erode consumer spending and corporate profits, impacting QBTS's financial performance.

- Overall market volatility: A volatile market increases uncertainty, potentially leading to greater price swings in QBTS stock.

- Investor confidence: Positive investor sentiment generally supports higher stock prices, while negative sentiment can lead to declines.

Understanding the interplay between market sentiment, economic indicators, and the impact of interest rates on QBTS stock volatility is crucial for a comprehensive analysis.

Potential Scenarios and Investment Strategies

Based on the factors discussed, several scenarios are possible following the next earnings announcement.

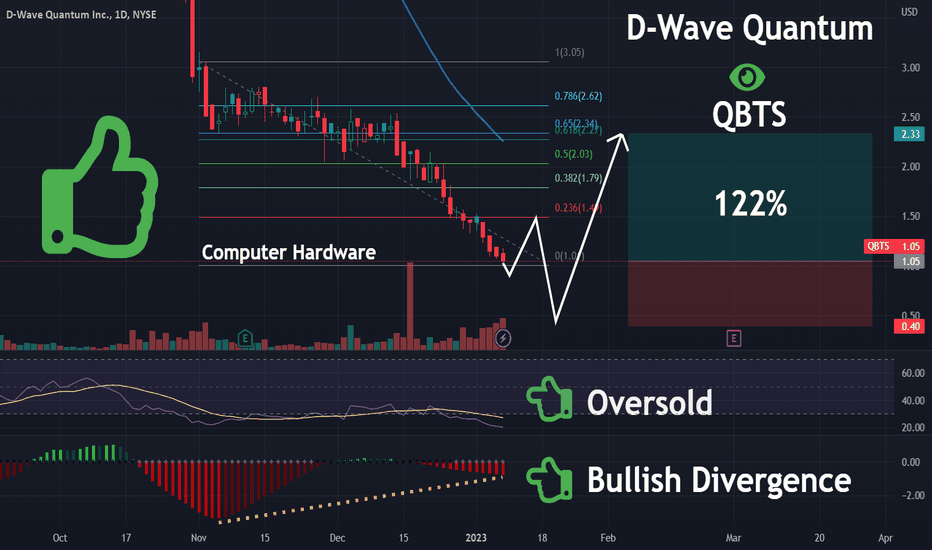

Upside Potential and Bullish Case for QBTS Stock

Several factors could lead to a significant rise in QBTS stock price:

- Beating earnings expectations: Exceeding analyst consensus EPS estimates would likely trigger a positive market reaction.

- Positive future guidance: Optimistic projections for future revenue and earnings growth instill investor confidence.

- Successful product launches: Successful new product introductions can boost revenue and market share, positively impacting the stock price.

- Strategic acquisitions: Acquisitions that enhance the company’s competitiveness or expand into new markets can also lead to a stock price increase.

Investors anticipating a QBTS stock price increase should focus on these bullish indicators.

Downside Risks and Bearish Case for QBTS Stock

Conversely, several factors could contribute to a decline in QBTS stock price:

- Missing earnings expectations: Falling short of expectations would likely lead to a negative market reaction.

- Negative future guidance: Pessimistic projections for future performance can significantly dampen investor enthusiasm.

- Increased competition: Intensified competition could erode market share and profitability.

- Unforeseen challenges: Unexpected events (e.g., supply chain disruptions, regulatory issues) can negatively impact QBTS's performance.

Understanding these risks is crucial for a balanced QBTS investment strategy. Investors should assess QBTS stock price decline risks carefully.

Conclusion

The potential rise or fall of QBTS stock after the next earnings announcement depends on a complex interplay of factors, including QBTS's financial performance, market expectations, and broader economic conditions. Analyzing QBTS revenue, QBTS earnings, QBTS profitability, and the competitive landscape are critical for determining the future of QBTS stock. Thorough due diligence is necessary to assess the potential upside and downside risks. The upcoming QBTS earnings announcement presents both opportunities and risks. Conduct thorough due diligence and consider your own risk tolerance before making any investment decisions concerning QBTS stock. Stay informed about QBTS stock and the market to make the most well-informed decisions.

Featured Posts

-

Hell City Votre Brasserie Pour Le Hellfest Et Au Dela

May 21, 2025

Hell City Votre Brasserie Pour Le Hellfest Et Au Dela

May 21, 2025 -

Abn Amro Financiert Transferz Een Innovatief Digitaal Platform

May 21, 2025

Abn Amro Financiert Transferz Een Innovatief Digitaal Platform

May 21, 2025 -

Iatroi Patras Efimeries Savvatokyriakoy

May 21, 2025

Iatroi Patras Efimeries Savvatokyriakoy

May 21, 2025 -

Occasionverkopen Abn Amro Flink Gestegen Door Meer Autobezitters

May 21, 2025

Occasionverkopen Abn Amro Flink Gestegen Door Meer Autobezitters

May 21, 2025 -

The Return Of Tyler Bate To Wwe Television Everything We Know

May 21, 2025

The Return Of Tyler Bate To Wwe Television Everything We Know

May 21, 2025

Latest Posts

-

The Goldbergs Characters Episodes And Lasting Legacy

May 22, 2025

The Goldbergs Characters Episodes And Lasting Legacy

May 22, 2025 -

Bp Chief Executives Pay Drops By 31 Percent

May 22, 2025

Bp Chief Executives Pay Drops By 31 Percent

May 22, 2025 -

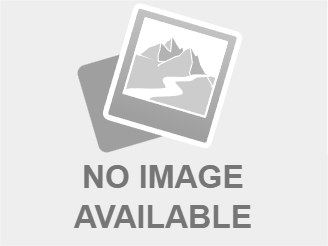

Saskatchewan Political Panel Discussion The Costco Campaign Controversy

May 22, 2025

Saskatchewan Political Panel Discussion The Costco Campaign Controversy

May 22, 2025 -

Bp Ceo Pay Cut A 31 Decrease In Executive Compensation

May 22, 2025

Bp Ceo Pay Cut A 31 Decrease In Executive Compensation

May 22, 2025 -

Costco And Saskatchewan Politics Examining A Recent Campaign

May 22, 2025

Costco And Saskatchewan Politics Examining A Recent Campaign

May 22, 2025