Will The Fed Hold Rates? Analyzing Economic Pressures On Monetary Policy

Table of Contents

Inflationary Pressures and the Fed's Mandate

Persistent Inflation

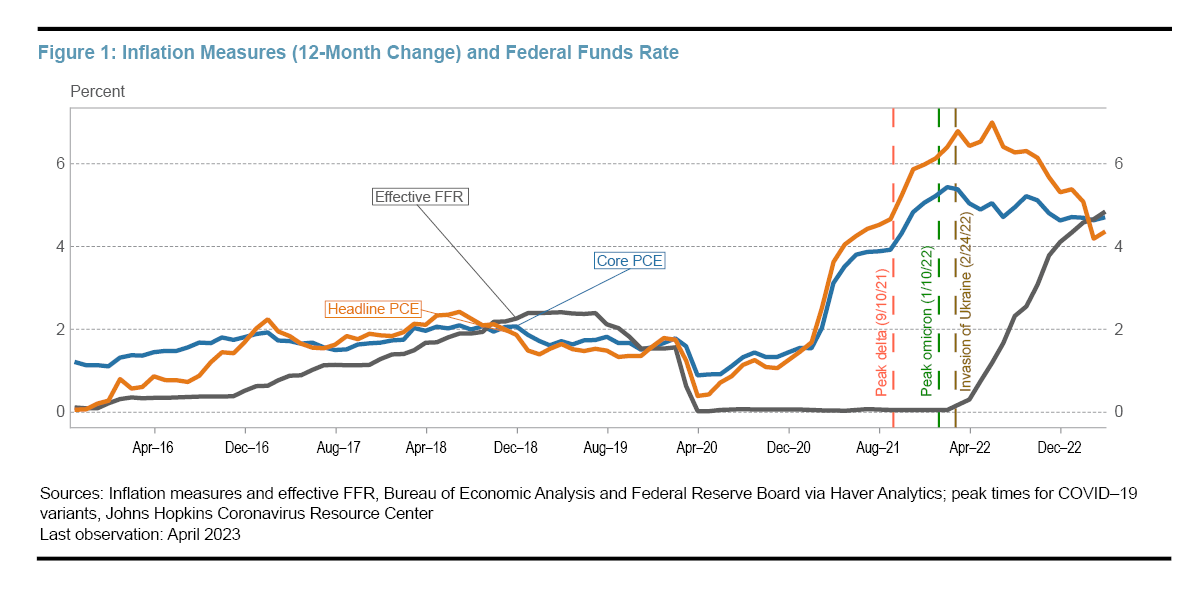

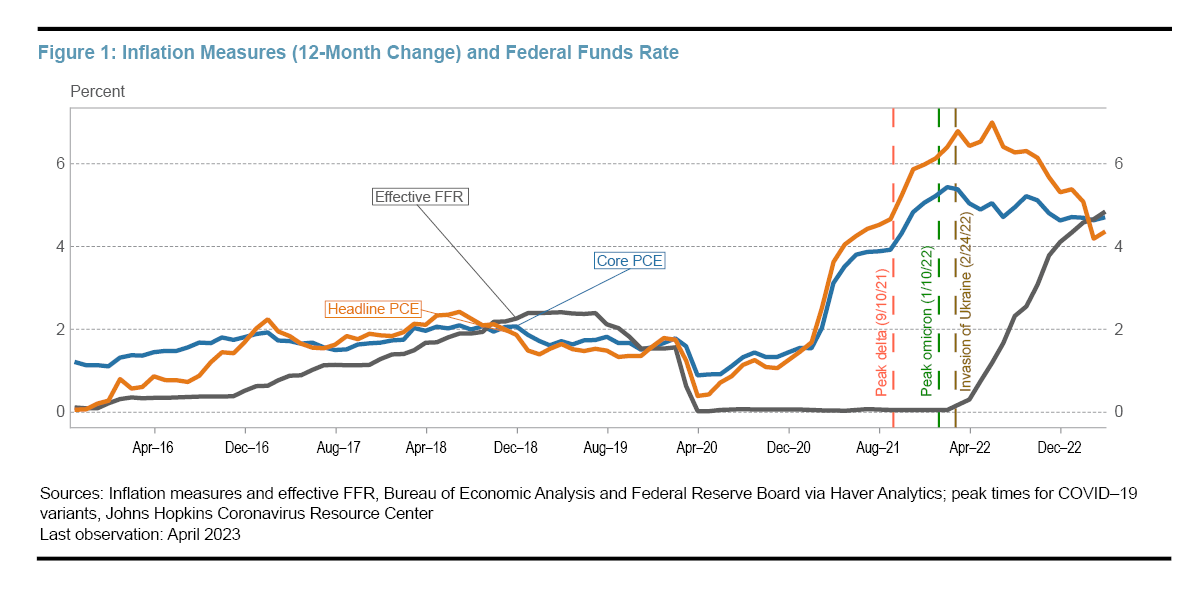

Inflation remains a persistent concern. The current inflation rate, while showing signs of cooling in some sectors, still significantly exceeds the Federal Reserve's target. Several factors contribute to this persistent inflation:

- Supply Chain Disruptions: Ongoing global supply chain bottlenecks continue to impact the availability and price of goods.

- Energy Price Volatility: Fluctuations in energy prices, exacerbated by geopolitical events, exert considerable upward pressure on inflation.

- Strong Consumer Demand: Robust consumer spending, fueled by factors such as pent-up demand and a strong labor market, continues to contribute to inflationary pressures.

Recent inflation data, including the Consumer Price Index (CPI) and the Producer Price Index (PPI), reveal a mixed picture. While headline inflation may be moderating, core inflation (excluding volatile food and energy prices) remains stubbornly high. This persistent core inflation signals that underlying price pressures are still significant. This raises the question: Will the Fed hold rates given this persistent inflation?

The Fed's Inflation Target

The Federal Reserve has a publicly stated inflation target of 2%. Current inflation rates are considerably above this target, putting pressure on the Fed to continue its efforts to cool the economy. The Fed's primary tools for combating inflation include:

- Interest Rate Hikes: Increasing the federal funds rate makes borrowing more expensive, slowing down economic activity and reducing demand-pull inflation.

- Quantitative Tightening: Reducing the Fed's balance sheet by allowing bonds to mature without replacement decreases the money supply, further curbing inflation.

The risks associated with the Fed's actions are significant. Overshooting the inflation target could lead to a prolonged recession, while undershooting it risks entrenching high inflation. The delicate balance the Fed must strike is a crucial factor in determining whether they will hold rates or further adjust them.

Employment Data and the Labor Market

Job Growth and Unemployment

The labor market continues to show strength, with robust job growth and a low unemployment rate. Recent employment reports reveal:

- Strong Job Creation: The economy has added a significant number of jobs in recent months.

- Low Unemployment Rate: The unemployment rate remains historically low.

- Wage Growth: Wage growth, while showing signs of moderation, is still above levels consistent with the Fed's inflation target. This contributes to inflationary pressure as higher wages can lead to businesses raising prices to maintain profit margins.

The strong labor market is a positive economic indicator, but it also presents a challenge for the Fed. High employment levels can contribute to inflationary pressures, making it difficult for the Fed to solely focus on inflation control.

The Fed's Dual Mandate

The Fed operates under a dual mandate: maintaining price stability and maximizing employment. These are often competing goals. Addressing high inflation might necessitate measures that could negatively impact employment, potentially slowing job growth or even leading to a recession.

- Balancing Act: The Fed must carefully balance the risks of inflation and unemployment.

- Recessionary Risks: Aggressive interest rate hikes to curb inflation could trigger a recession.

Global Economic Uncertainty and Geopolitical Risks

Global Economic Slowdown

Global economic growth is slowing, posing risks to the US economy. Several factors contribute to this slowdown:

- Global Supply Chain Disruptions: These disruptions continue to hinder economic activity worldwide.

- Recessions in Major Economies: The possibility of recessions in major economies, such as Europe, could negatively impact US exports and growth.

A global economic slowdown could impact the Fed's decision-making. A weaker global economy may reduce the need for aggressive interest rate hikes.

Geopolitical Factors

Geopolitical events, particularly the war in Ukraine, create significant uncertainty and directly impact the US economy.

- Energy Prices: The war has caused significant spikes in energy prices, fueling inflation.

- Supply Chain Disruptions: The conflict has further disrupted global supply chains.

These geopolitical factors add complexity to the Fed's decision-making process, as they create unpredictable shocks to the economy.

Conclusion

Will the Fed hold rates? The answer is far from straightforward. This analysis highlights the complex interplay between persistent inflation, a strong labor market, and significant global economic uncertainties. While inflation remains a primary concern, the Fed must also consider the potential negative consequences of overly aggressive interest rate hikes on employment and the overall economy. The Fed's decisions will depend on incoming economic data and the evolving economic landscape. Recent data suggests a moderation in inflation, but the path ahead remains uncertain.

The central question, "Will the Fed hold rates?", remains open for debate. Careful monitoring of inflation, employment data, and global developments is crucial. Stay tuned for further updates on the Fed's decisions and continue to analyze the factors impacting the question "Will the Fed hold rates?" for a deeper understanding of the economy. For further research, consult the Federal Reserve's website and other reputable economic data sources.

Featured Posts

-

Palantir Technology Stock Should You Invest Before May 5th

May 09, 2025

Palantir Technology Stock Should You Invest Before May 5th

May 09, 2025 -

Dakota Johnson And Melanie Griffith Shine At Materialists Screening

May 09, 2025

Dakota Johnson And Melanie Griffith Shine At Materialists Screening

May 09, 2025 -

Palantir Stock A Pre May 5th Investment Strategy

May 09, 2025

Palantir Stock A Pre May 5th Investment Strategy

May 09, 2025 -

Jessica Tarlovs Sharp Rebuke Of Jeanine Pirro Over Canada Trade Dispute

May 09, 2025

Jessica Tarlovs Sharp Rebuke Of Jeanine Pirro Over Canada Trade Dispute

May 09, 2025 -

Young Thugs Reaction To Not Like U Name Drop After Prison Release

May 09, 2025

Young Thugs Reaction To Not Like U Name Drop After Prison Release

May 09, 2025