Your Guide To Private Credit Jobs: 5 Do's And Don'ts

Table of Contents

5 DO'S for Securing Private Credit Jobs

DO 1: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the competitive world of private credit. Don't underestimate the power of personal connections.

- Build relationships with professionals: Attend industry events like conferences (e.g., SuperReturn, PEI) and seminars. These provide excellent opportunities for private credit networking and meeting potential employers.

- Leverage LinkedIn effectively: Optimize your LinkedIn profile to highlight your skills and experience in areas like financial modeling and credit analysis. Actively connect with recruiters and professionals working in private credit firms. Engage in relevant groups and discussions to increase your visibility.

- Informational interviews: Reach out to individuals working in private credit for informational interviews. These conversations provide invaluable insights into the industry and can open doors to potential job opportunities.

- Attend targeted events: Seek out private credit-focused networking events and workshops. These niche events offer focused opportunities to connect with relevant professionals.

Keywords: Private Credit Networking, Finance Networking, Industry Events, LinkedIn for Finance, Private Equity Networking

DO 2: Tailor Your Resume and Cover Letter to Specific Private Credit Roles

Your resume and cover letter are your first impression. Make them count by highlighting your relevant skills and experiences within the context of each specific job.

- Highlight relevant skills: Emphasize quantitative analysis, financial modeling, credit underwriting, and any experience with debt investing. Showcase your proficiency in relevant software (e.g., Excel, Bloomberg Terminal).

- Quantify your achievements: Use metrics whenever possible to demonstrate the impact of your work. Instead of saying "Improved efficiency," say "Improved efficiency by 15% through process optimization."

- Use strong action verbs: Use action verbs to showcase your capabilities. Instead of "Responsible for," use "Managed," "Developed," or "Led."

- Customize your application: Don't use a generic resume and cover letter. Customize each application to reflect the specific requirements and responsibilities outlined in the job description.

Keywords: Private Credit Resume, Finance Resume, Cover Letter for Finance Jobs, Credit Underwriting Resume, Financial Modeling Resume, Alternative Investment Resume

DO 3: Master the Art of the Private Credit Interview

The interview is your chance to shine. Thorough preparation is key to showcasing your skills and knowledge.

- Prepare for technical questions: Expect questions related to financial modeling, valuation (DCF, LBO modeling), credit analysis, and your understanding of debt investing. Practice these extensively.

- Practice behavioral questions: Be ready to answer behavioral interview questions focusing on teamwork, problem-solving, and decision-making. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Research the firm: Thoroughly research the firm, its investment strategies, and its recent transactions. Demonstrating genuine interest sets you apart.

- Prepare insightful questions: Asking thoughtful questions shows your engagement and initiative. Prepare a few questions about the firm's culture, investment strategy, or recent deals.

Keywords: Private Credit Interview, Finance Interview Questions, Behavioral Interview, Technical Interview, Investment Banking Interview

DO 4: Showcase Your Understanding of Private Credit Investment Strategies

Demonstrate a deep understanding of the private credit market and its various strategies.

- Familiarity with strategies: Show familiarity with various private credit strategies, such as direct lending, mezzanine financing, distressed debt, and unitranche financing.

- Credit risk assessment: Demonstrate your understanding of credit risk assessment, due diligence, and portfolio management processes within alternative investments.

- Market awareness: Stay updated on current market trends and economic conditions affecting the private credit sector. This demonstrates your commitment to continuous learning.

Keywords: Private Credit Strategies, Direct Lending, Mezzanine Financing, Distressed Debt, Credit Risk, Due Diligence, Unitranche Financing

DO 5: Obtain Relevant Certifications and Further Education

Investing in your professional development significantly enhances your prospects.

- Consider certifications: Consider pursuing the Chartered Financial Analyst (CFA) designation or other relevant certifications, such as the CAIA.

- Advanced degrees: An MBA or a master's degree in finance can significantly improve your chances.

- Continuous learning: Continuously expand your knowledge of private credit through online courses (Coursera, edX), workshops, and industry publications.

Keywords: CFA Charterholder, MBA Finance, Financial Certifications, Private Credit Education, CAIA

5 DON'TS for Securing Private Credit Jobs

DON'T 1: Neglect Networking Opportunities

Networking is not optional; it's essential. Actively seek out and engage in networking opportunities.

DON'T 2: Submit Generic Resumes and Cover Letters

Avoid generic applications. Tailor your materials to each specific role and company. This demonstrates your genuine interest and attention to detail.

DON'T 3: Underprepare for Private Credit Interviews

Thorough preparation is crucial. Practice answering common interview questions and research the firm extensively.

DON'T 4: Lack Understanding of Private Credit Market Dynamics

Stay informed about current market trends and economic conditions. Demonstrate your awareness during interviews.

DON'T 5: Ignore Professional Development

Continuous learning and professional development are crucial for success in this ever-evolving field.

Conclusion

Securing a rewarding career in private credit demands a proactive and strategic approach. By following these five "dos" and avoiding the five "don'ts," you significantly increase your chances of landing your dream private credit job. Remember to network strategically, tailor your applications, prepare thoroughly for interviews, and continuously expand your knowledge and skills within the exciting world of finance jobs and alternative investments. Don't delay—start implementing these strategies today and take the first step towards a successful career in the exciting world of private credit. Begin your journey towards a fulfilling private credit career now!

Featured Posts

-

Trump Claims Judicial Review Of Tariffs Is Impossible

May 03, 2025

Trump Claims Judicial Review Of Tariffs Is Impossible

May 03, 2025 -

Fortnite Server Status Update 34 40 Maintenance And Downtime

May 03, 2025

Fortnite Server Status Update 34 40 Maintenance And Downtime

May 03, 2025 -

From Scatological Data To Engaging Podcast The Power Of Ai

May 03, 2025

From Scatological Data To Engaging Podcast The Power Of Ai

May 03, 2025 -

Laura Keller Biquini E Tantra Yoga Em Retiro Espiritual

May 03, 2025

Laura Keller Biquini E Tantra Yoga Em Retiro Espiritual

May 03, 2025 -

270 M Wh Bess Project Financing In Belgiums Competitive Energy Market

May 03, 2025

270 M Wh Bess Project Financing In Belgiums Competitive Energy Market

May 03, 2025

Latest Posts

-

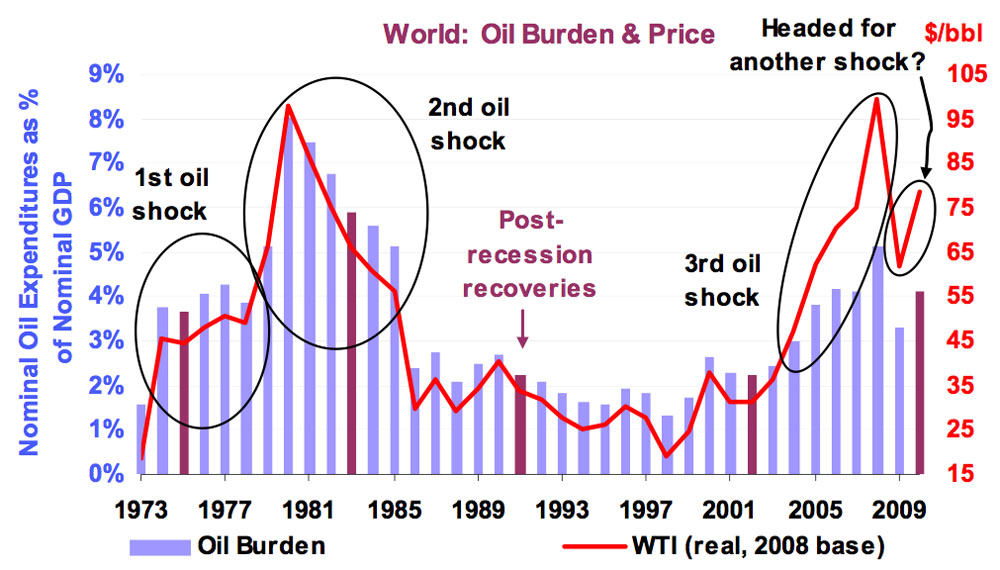

The Airline Industrys Vulnerability To Oil Supply Chain Instability

May 04, 2025

The Airline Industrys Vulnerability To Oil Supply Chain Instability

May 04, 2025 -

Oil Price Volatility And Its Effect On Airline Profitability

May 04, 2025

Oil Price Volatility And Its Effect On Airline Profitability

May 04, 2025 -

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025 -

Tomatin Affordable Housing Strathdearn Community Project Marks Significant Progress

May 04, 2025

Tomatin Affordable Housing Strathdearn Community Project Marks Significant Progress

May 04, 2025 -

Pupils Celebrate Groundbreaking Of New Tomatin Affordable Housing In Strathdearn

May 04, 2025

Pupils Celebrate Groundbreaking Of New Tomatin Affordable Housing In Strathdearn

May 04, 2025