Analyzing The Economic Fallout: Stocks And The 'Liberation Day' Tariffs

Table of Contents

Immediate Market Reaction to the 'Liberation Day' Tariffs

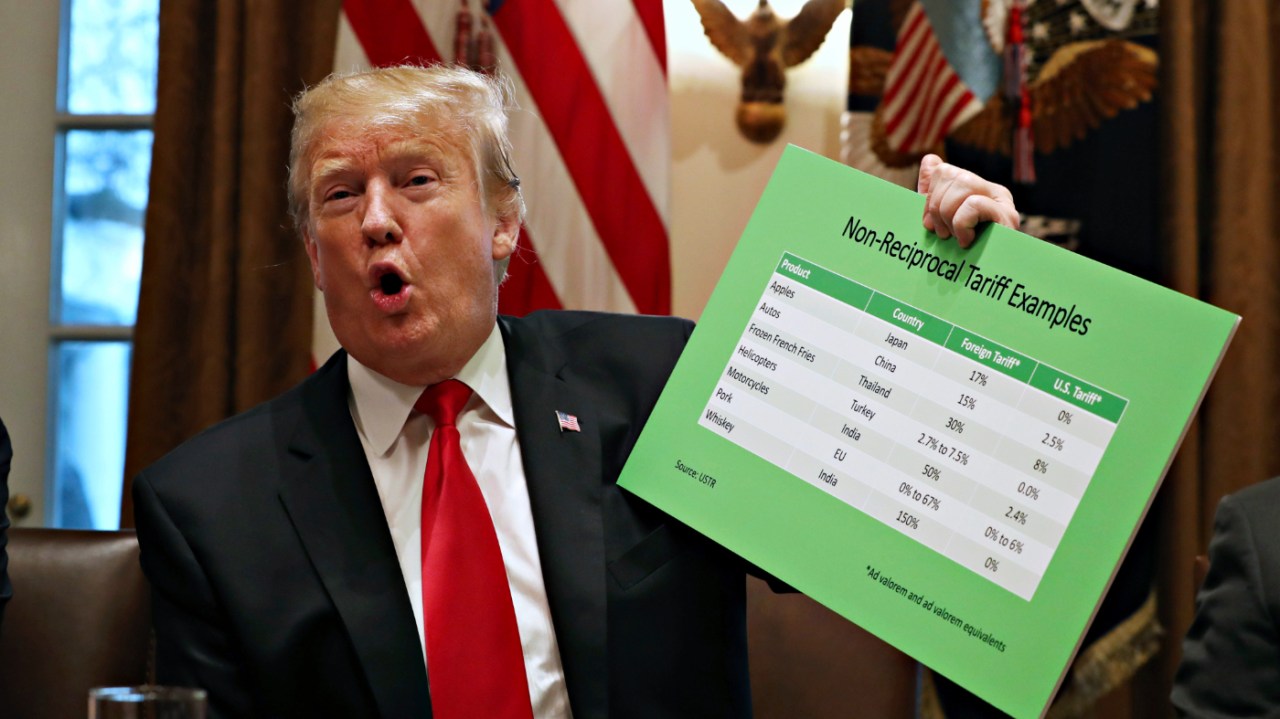

The announcement of the "Liberation Day" tariffs triggered an immediate and significant reaction in global stock markets. The initial impact was characterized by heightened volatility and uncertainty, reflecting investor concerns about the potential economic consequences. This immediate impact, measurable in the movements of key market indices, provides a crucial insight into the short-term effects of the tariffs.

- Sharp decline in specific sectors immediately affected by the tariffs. Industries directly impacted by the tariffs, such as manufacturing and import/export businesses reliant on the affected goods, experienced the most dramatic declines. For instance, the technology sector, heavily reliant on imported components, witnessed a significant drop in its stock valuations.

- Increased market volatility and trading volume. The uncertainty surrounding the long-term implications led to increased market volatility, with sharp price swings throughout the day. Trading volume also surged as investors reacted swiftly to the news, attempting to adjust their portfolios to mitigate potential losses.

- Flight to safety: investors moving into safer assets like government bonds. As risk aversion increased, investors moved their capital into safer havens such as government bonds, pushing bond yields down. This reflects a general decline in confidence in the market's short-term prospects.

- Analysis of initial analyst reactions and predictions. Initial reactions from market analysts were largely negative, with many predicting further volatility and a potential negative impact on economic growth. Forecasts varied depending on the analyst's assumptions about the extent and duration of the tariffs.

Sector-Specific Impacts of the 'Liberation Day' Tariffs

The "Liberation Day" tariffs did not affect all sectors equally. A sectoral analysis reveals a nuanced picture, with some industries faring worse than others. Understanding these differentiated impacts is crucial for comprehending the full economic fallout.

- Impact on manufacturing and import/export businesses. Manufacturing businesses heavily reliant on imported components or exporting goods to the affected markets suffered the most significant negative consequences. Supply chain disruptions further exacerbated these challenges.

- Analysis of the effect on consumer goods prices. The tariffs inevitably led to increased prices for consumer goods, squeezing household budgets and potentially dampening consumer spending. The extent of price increases varied across different product categories.

- Potential job losses in affected sectors. Businesses struggling to cope with reduced demand and increased costs were forced to consider measures such as workforce reductions, leading to potential job losses.

- Discussion of any government intervention or support measures. The government's response to the economic fallout, including potential intervention or support measures aimed at mitigating the negative impacts, will play a significant role in shaping the long-term consequences.

The Role of Geopolitical Uncertainty

The negative impact of the "Liberation Day" tariffs was significantly exacerbated by prevailing geopolitical uncertainty. International trade tensions and the risk of retaliatory measures from other countries added another layer of complexity, further undermining investor confidence.

- Impact of international trade tensions on investor confidence. The escalation of trade tensions fostered a climate of uncertainty, making investors hesitant to commit to long-term investments. This uncertainty directly impacts market stability and economic growth.

- Analysis of the effect on global supply chains. The tariffs disrupted global supply chains, forcing companies to reconsider their sourcing strategies and leading to delays and increased costs. These disruptions ripple across the global economy.

- Potential for further economic repercussions in other countries. The impact of the "Liberation Day" tariffs extends far beyond the directly affected countries. Retaliatory measures and disruptions to global trade could have significant repercussions in other nations.

Long-Term Economic Consequences and Recovery Prospects

The long-term economic consequences of the "Liberation Day" tariffs remain uncertain, but several potential scenarios warrant consideration. The path to economic recovery will depend on various factors, including the government's policy response, the resilience of affected industries, and the evolution of global geopolitical dynamics.

- Potential for inflation due to increased import costs. The tariffs led to increased costs for imported goods, potentially contributing to inflationary pressures within the economy. This can further erode consumer purchasing power.

- Risk of a global economic slowdown or recession. The combined effect of trade disruptions, reduced investor confidence, and potentially increased inflation poses a risk of a global economic slowdown or even a recession.

- Analysis of potential long-term shifts in global trade relationships. The "Liberation Day" tariffs may trigger significant shifts in global trade relationships, potentially leading to the formation of new trade blocs and alliances.

- Discussion of potential policy responses to mitigate negative impacts. Government policy responses, such as targeted support for affected industries or efforts to stimulate economic growth, will play a vital role in determining the speed and nature of economic recovery.

Conclusion:

The "Liberation Day" tariffs have undeniably created significant economic fallout, with immediate and potentially long-lasting effects on stock markets and various economic sectors. The impact extends beyond immediate market volatility, encompassing concerns about inflation, global trade relationships, and geopolitical uncertainty. Understanding these complex economic repercussions is critical for investors and policymakers alike. Further analysis of the evolving situation, coupled with careful monitoring of "Liberation Day" tariff impacts and their ripple effects, is crucial for navigating this period of economic uncertainty. Stay informed about the latest developments regarding the "Liberation Day" tariffs and their ongoing effects on the global economy.

Featured Posts

-

Five Year Bitcoin Forecast 1 500 Potential Gains

May 08, 2025

Five Year Bitcoin Forecast 1 500 Potential Gains

May 08, 2025 -

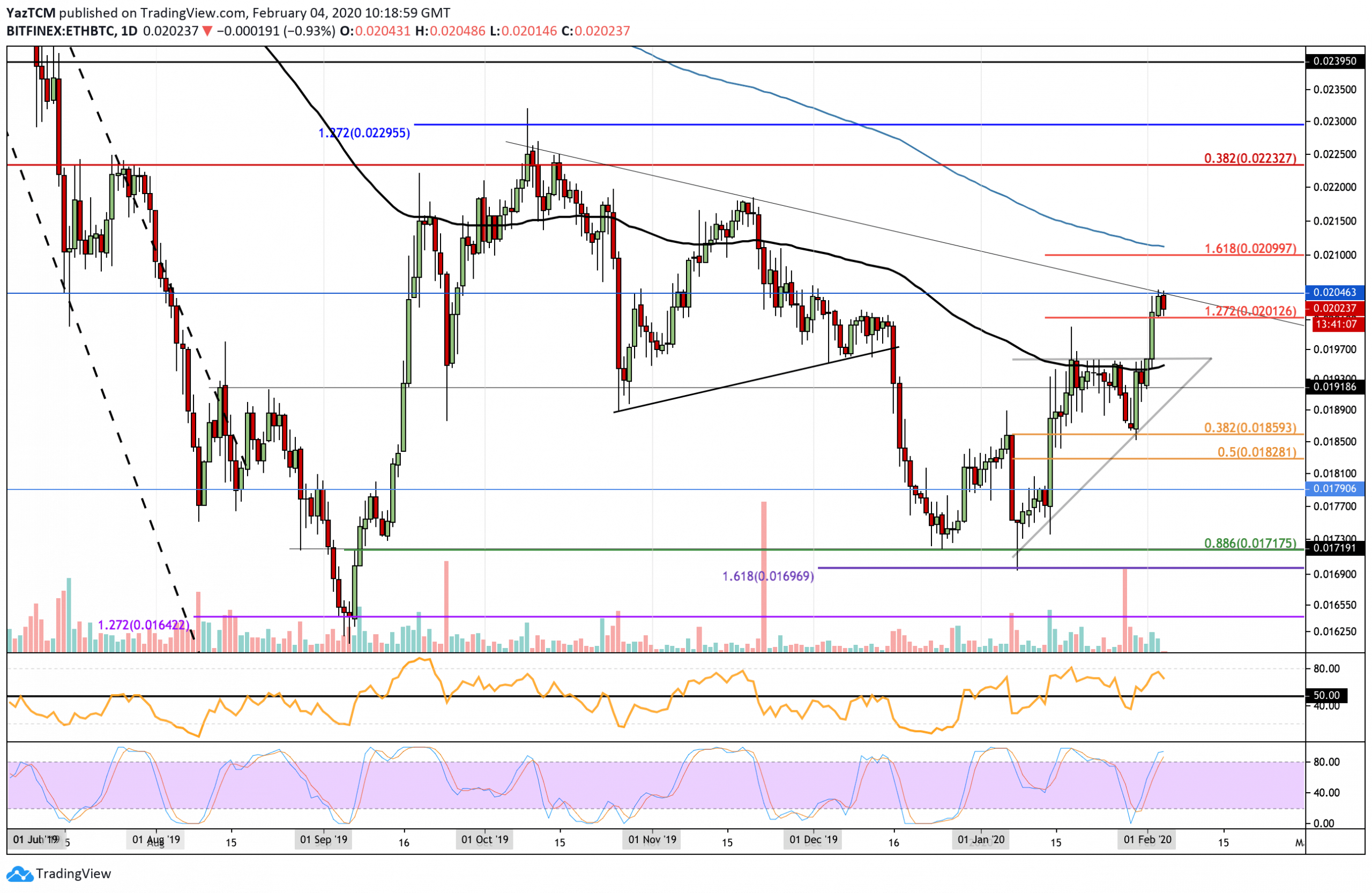

Ethereum Price Analysis Resistance Broken 2 000 In Sight

May 08, 2025

Ethereum Price Analysis Resistance Broken 2 000 In Sight

May 08, 2025 -

Andor Season 1 Where To Watch Episodes Before Season 2 Premieres Hulu And You Tube

May 08, 2025

Andor Season 1 Where To Watch Episodes Before Season 2 Premieres Hulu And You Tube

May 08, 2025 -

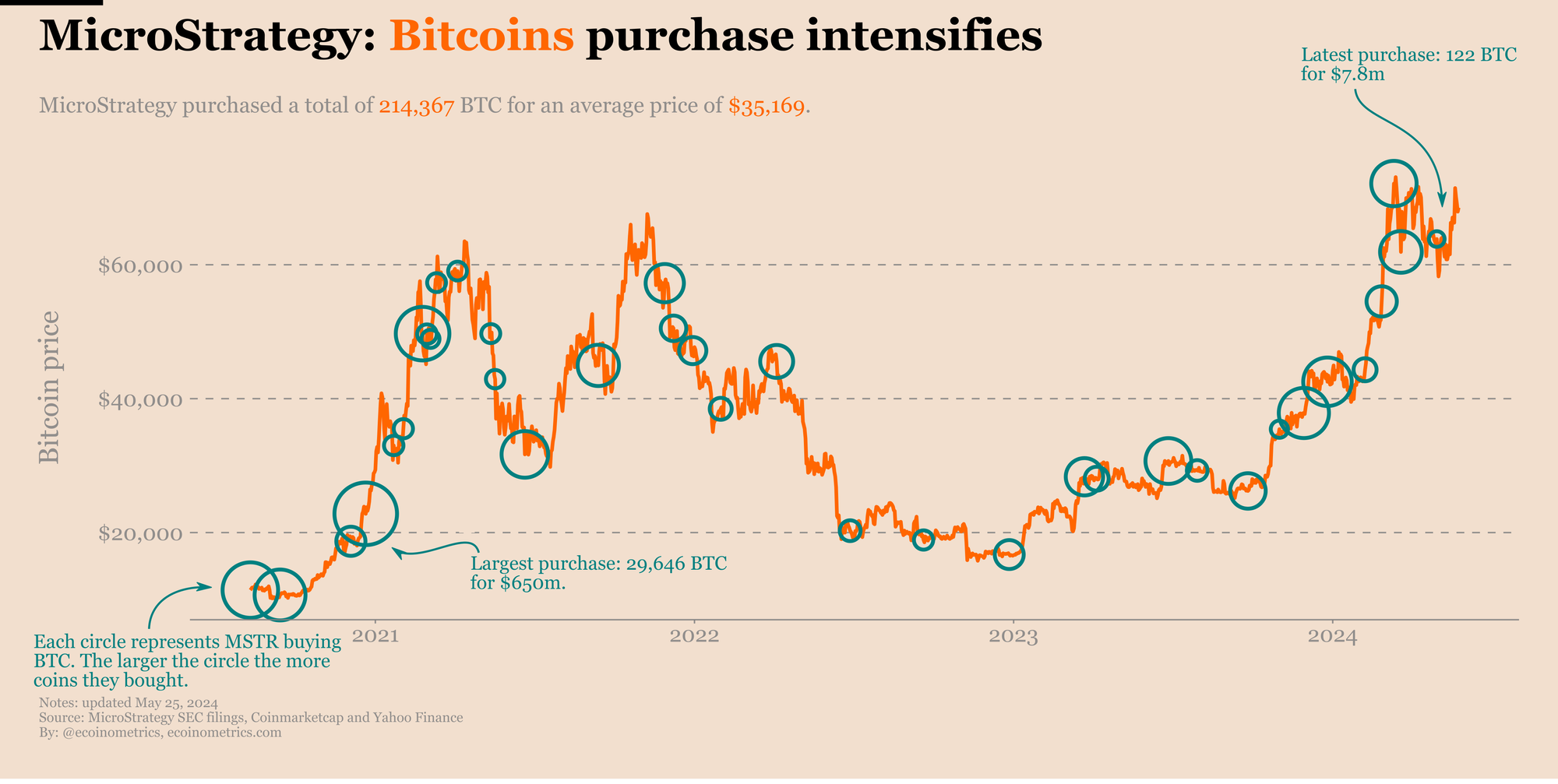

Bitcoin Vs Micro Strategy Stock Which To Invest In For 2025

May 08, 2025

Bitcoin Vs Micro Strategy Stock Which To Invest In For 2025

May 08, 2025 -

Aj Aym Aym Ealm Ky 12 Wyn Brsy Mnayy Jaye Gy

May 08, 2025

Aj Aym Aym Ealm Ky 12 Wyn Brsy Mnayy Jaye Gy

May 08, 2025