Examining XRP's Price: The Role Of The Derivatives Market

Table of Contents

Understanding XRP Derivatives Markets

XRP derivatives are financial contracts whose value is derived from the price of XRP. These instruments allow traders to speculate on future XRP price movements or hedge against price risk. The most common types include:

-

XRP Futures Contracts: These agreements obligate the buyer to purchase (or the seller to sell) a specific amount of XRP at a predetermined price on a future date. XRP futures contracts contribute significantly to price discovery, reflecting market expectations about future XRP prices.

-

XRP Options Contracts: These give the buyer the right, but not the obligation, to buy (call option) or sell (put option) XRP at a specific price (strike price) on or before a certain date (expiration date). XRP options are valuable tools for hedging against price fluctuations and for speculative trading.

-

Over-the-Counter (OTC) XRP Derivatives: These are privately negotiated contracts, typically between institutional investors, offering flexibility but lacking the transparency of exchange-traded derivatives.

Key exchanges offering XRP derivatives include (but are not limited to) [Insert examples of relevant exchanges here, linking to them where appropriate]. Trading volumes on these exchanges provide valuable insights into market sentiment and liquidity.

The XRP derivatives market features both centralized and decentralized exchanges. Centralized exchanges offer higher liquidity and regulatory oversight, while decentralized exchanges prioritize transparency and user autonomy, but often lack the same level of liquidity. The choice between them depends on the trader's risk tolerance and priorities.

The Impact of Derivatives on XRP Price Volatility

Derivative trading significantly influences XRP price volatility. The mechanisms involved are:

-

Leverage: Derivatives allow traders to control a large amount of XRP with a relatively small investment. This leverage magnifies both profits and losses, leading to amplified price swings.

-

Short Selling: In the derivatives market, traders can bet against XRP's price by short selling. If the price falls, they profit; if it rises, they incur losses. Short selling pressure can contribute to downward price movements.

-

Institutional Investors: Large institutional investors trading XRP derivatives can exert significant influence on price. Their actions, often driven by sophisticated algorithms and macroeconomic factors, can trigger substantial market movements.

-

Historical Examples: [Insert examples of historical events where derivative trading notably impacted XRP's price, including specific dates and price changes. Cite reliable sources].

Hedging and Speculation in the XRP Derivatives Market

XRP derivatives serve two primary purposes: hedging and speculation.

-

Hedging: Businesses that hold XRP or are exposed to XRP price fluctuations can utilize derivatives, such as options, to protect themselves against potential losses. For example, a company accepting XRP payments can buy put options to limit its downside risk.

-

Speculation: Many traders employ XRP derivatives to speculate on future price movements. They might use futures contracts to bet on a price increase or use options to profit from price volatility irrespective of the direction.

Market sentiment and news events strongly influence derivative trading activity. Positive news about XRP adoption or technological advancements can drive up demand for derivatives, increasing the price. Conversely, negative news or regulatory uncertainty can lead to selling pressure and price declines. However, leveraging XRP derivatives for both hedging and speculation carries inherent risks, including the potential for substantial losses.

Regulatory Landscape and its Influence on XRP Derivatives

The regulatory environment surrounding XRP derivatives is complex and constantly evolving.

-

Regulatory Impact: Changes in regulations concerning cryptocurrencies can significantly impact XRP derivative trading volumes. Stricter regulations can stifle trading activity, while relaxed rules can attract more participants.

-

Global Regulatory Bodies: Different countries and regions have varying regulatory frameworks for crypto derivatives. The actions of bodies such as the SEC (Securities and Exchange Commission) in the US and other similar regulatory bodies worldwide significantly impact the XRP derivatives market.

-

Future Regulatory Developments: The future regulatory landscape will likely shape the XRP derivatives market significantly. Increased clarity and standardization may attract more institutional investors, enhancing liquidity and reducing risk.

-

Risks of Unregulated Markets: Trading XRP derivatives on unregulated platforms exposes traders to increased risks, including fraud, manipulation, and the absence of investor protection.

Conclusion:

The price of XRP is intricately linked to the activity within its derivatives market. Understanding the mechanics of futures, options, and other derivative instruments, along with the influence of regulatory frameworks and market sentiment, is crucial for anyone seeking to navigate this complex and dynamic market. By carefully analyzing the interplay between XRP's underlying technology, its adoption, and the dynamics of its derivatives market, investors can make more informed decisions. To stay abreast of the latest developments in the XRP market and the evolving role of derivatives, continue researching and analyzing market trends – keep examining XRP's price and its relationship to the derivatives market for a comprehensive understanding.

Featured Posts

-

Julius Randles Impact On The Lakers A Timberwolves Perspective

May 07, 2025

Julius Randles Impact On The Lakers A Timberwolves Perspective

May 07, 2025 -

Daily Lotto Results Sunday 4th May 2025

May 07, 2025

Daily Lotto Results Sunday 4th May 2025

May 07, 2025 -

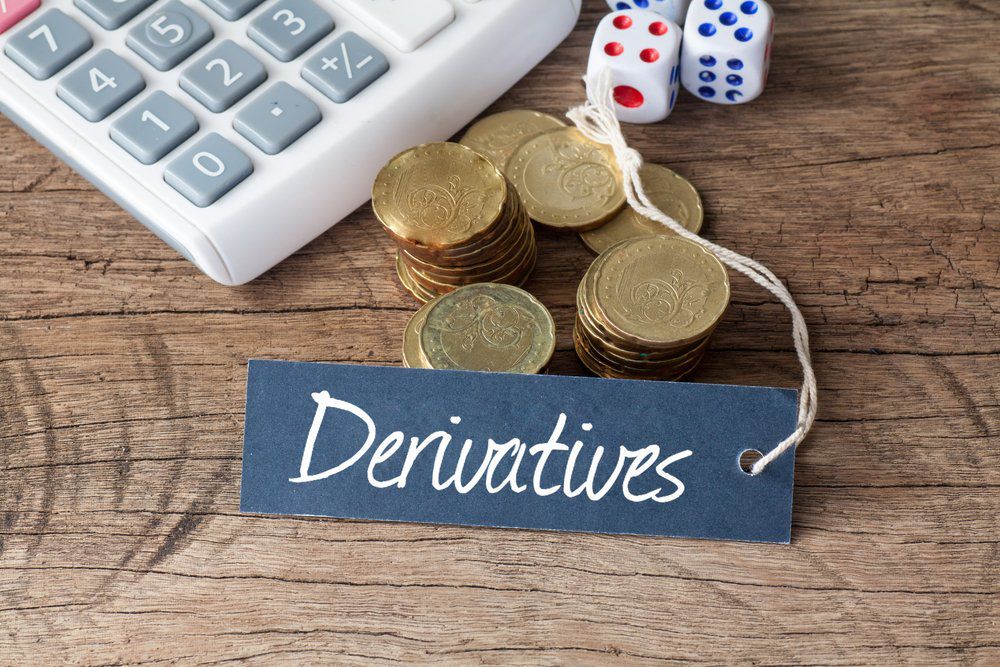

Interest Rate Cuts Expected In Thailand Following Negative Inflation

May 07, 2025

Interest Rate Cuts Expected In Thailand Following Negative Inflation

May 07, 2025 -

2 1 0 1

May 07, 2025

2 1 0 1

May 07, 2025 -

50 000 Fine For Anthony Edwards Nba Addresses Players Vulgar Remarks

May 07, 2025

50 000 Fine For Anthony Edwards Nba Addresses Players Vulgar Remarks

May 07, 2025

Latest Posts

-

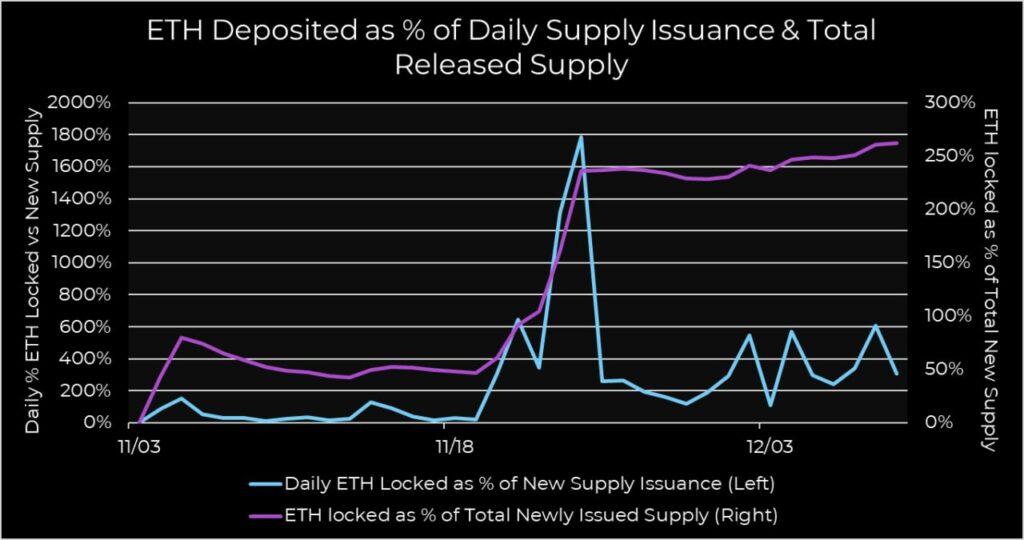

Ethereum Price Prediction Significant Eth Accumulation Fuels Bullish Sentiment

May 08, 2025

Ethereum Price Prediction Significant Eth Accumulation Fuels Bullish Sentiment

May 08, 2025 -

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025 -

Ethereum Transaction Volume Spikes Analysis Of Recent Network Activity

May 08, 2025

Ethereum Transaction Volume Spikes Analysis Of Recent Network Activity

May 08, 2025 -

Sharp Rise In Ethereum Address Activity A 10 Jump In Two Days

May 08, 2025

Sharp Rise In Ethereum Address Activity A 10 Jump In Two Days

May 08, 2025 -

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025