Hong Kong Uses US Dollar Reserves To Maintain Currency Peg

Table of Contents

The Hong Kong Dollar Peg Mechanism

Hong Kong operates under a linked exchange rate system, meaning the Hong Kong dollar is pegged to the US dollar within a narrow band. This means that the HKD is allowed to fluctuate within a very tight range against the USD. The Hong Kong Monetary Authority (HKMA), the city's central bank, is responsible for maintaining this peg. Its primary role is to ensure the HKD remains stable against the USD, preventing large swings in the exchange rate.

-

The Exchange Rate Band: The HKMA maintains the HKD at a rate of 7.75 to 7.85 HKD per 1 USD. Fluctuations outside this narrow band trigger HKMA intervention.

-

HKMA Intervention Methods: The HKMA uses its substantial US dollar reserves to intervene in the foreign exchange market. If the HKD weakens towards the upper limit of the band (7.85 HKD/USD), the HKMA buys HKD and sells USD, increasing demand for the HKD and pushing the exchange rate back down. Conversely, if the HKD strengthens towards the lower limit (7.75 HKD/USD), the HKMA sells HKD and buys USD, increasing the supply of HKD and weakening it.

-

Maintaining Confidence: The success of the peg hinges on market confidence. If confidence in the peg erodes, speculative attacks could overwhelm the HKMA's ability to defend it. Transparency and effective communication from the HKMA are crucial in maintaining this confidence.

The Crucial Role of US Dollar Reserves

Hong Kong's massive US dollar reserves are the cornerstone of the currency peg's stability. These reserves act as a buffer against market volatility and speculative attacks. They provide the HKMA with the necessary ammunition to defend the peg when faced with large inflows or outflows of capital. The scale of these reserves is significant, providing a strong defense against any potential threats to the stability of the HKD.

-

Defending the Peg: When facing pressure on the HKD, the HKMA uses its USD reserves to buy HKD, thereby increasing demand and supporting the exchange rate. This is crucial during periods of high market volatility, such as global economic crises or geopolitical uncertainty.

-

Risks of Depleting Reserves: While these reserves offer protection, depleting them excessively could signal a loss of confidence in the peg itself. A substantial drawdown of reserves might trigger further speculative attacks, potentially undermining the system.

-

Global Economic Impacts: Global economic events significantly impact Hong Kong's reserve levels. During times of global financial instability, there can be significant capital flight, putting pressure on the HKD and requiring the HKMA to utilize more of its reserves.

Economic Implications of the Currency Peg

The currency peg has had profound implications for Hong Kong's economy. While providing considerable benefits, it also presents certain limitations.

-

Benefits: The peg has fostered price stability, reduced inflation, and facilitated international trade and investment. The stability provided by the peg attracts foreign investment, supporting economic growth.

-

Drawbacks: The peg limits Hong Kong's monetary policy independence. The HKMA cannot adjust interest rates independently to respond to local economic conditions, as it must largely follow US monetary policy. This can make responding to local economic shocks more challenging.

-

Impact on Inflation and Interest Rates: Because the HKD follows the USD, Hong Kong's inflation and interest rates tend to mirror those in the US. This can lead to periods where monetary policy might not be ideally suited to local conditions.

-

Effect on International Trade and Investment: The currency peg simplifies international transactions, making Hong Kong an attractive hub for trade and investment. However, any shifts in US monetary policy can have significant ripple effects on Hong Kong's economy.

-

Challenges During Global Uncertainty: Global economic and geopolitical uncertainty poses challenges to maintaining the peg. Major global events can trigger capital flight and necessitate significant HKMA intervention.

Future Outlook and Challenges to the Hong Kong Dollar Peg

The long-term sustainability of the Hong Kong dollar peg remains a subject of ongoing debate. Several factors could pose future challenges to the system.

-

Geopolitical Risks: Geopolitical tensions between China and the US could potentially exert pressure on the peg, as could other international events.

-

Economic Shifts: Significant shifts in the global economic landscape could also create instability and affect the peg.

-

US Monetary Policy Changes: Changes in US interest rates can have knock-on effects on Hong Kong's economy and pressure the HKD.

-

Potential for Future Adjustments: While unlikely, it's not inconceivable that future adjustments to the peg mechanism could be considered to address any emerging challenges.

-

Technological Advancements: The rise of cryptocurrencies and other digital assets presents new potential challenges to traditional currency systems, including the HKD peg.

Conclusion: Understanding Hong Kong's Currency Peg and its Reliance on US Dollar Reserves

Hong Kong's currency peg to the US dollar, maintained through skillful management of substantial US dollar reserves by the HKMA, has been a cornerstone of its economic success for decades. The system, while offering stability and attracting foreign investment, also presents limitations on monetary policy independence and faces potential future challenges related to geopolitical risks and global economic shifts. Understanding this intricate system – the Hong Kong dollar peg and its reliance on USD reserves – is crucial for comprehending Hong Kong's economic future. Stay informed on the latest developments regarding Hong Kong's currency peg and its management of US dollar reserves. Understanding this dynamic relationship is crucial for comprehending Hong Kong's economic future. For further information, consult resources from the Hong Kong Monetary Authority (HKMA) and reputable financial news outlets.

Featured Posts

-

Hong Kong Intervenes To Defend Currency Peg With Us Dollar Purchases

May 04, 2025

Hong Kong Intervenes To Defend Currency Peg With Us Dollar Purchases

May 04, 2025 -

Australia Votes Albaneses Labor Party Leads In Election Polls

May 04, 2025

Australia Votes Albaneses Labor Party Leads In Election Polls

May 04, 2025 -

Cuomos 3 Million Nuclear Startup Investment Unreported Stock Options Revealed

May 04, 2025

Cuomos 3 Million Nuclear Startup Investment Unreported Stock Options Revealed

May 04, 2025 -

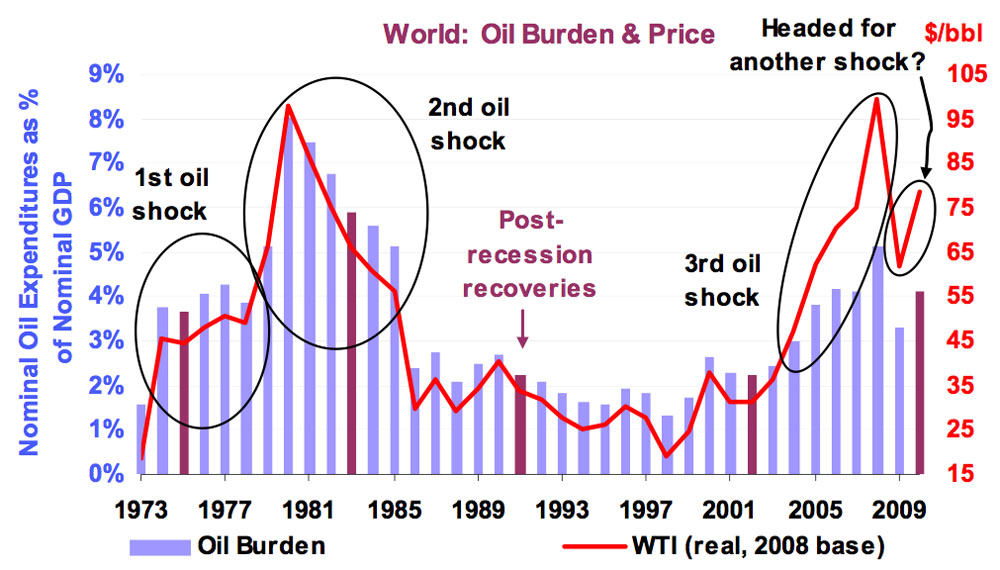

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025 -

The Untapped Potential Of Middle Management Fostering Growth And Productivity

May 04, 2025

The Untapped Potential Of Middle Management Fostering Growth And Productivity

May 04, 2025

Latest Posts

-

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Event

May 04, 2025

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Event

May 04, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Investigation

May 04, 2025

16 Million Fine For T Mobile A Three Year Data Breach Investigation

May 04, 2025 -

Massive Office365 Data Breach Nets Hacker Millions Authorities Reveal

May 04, 2025

Massive Office365 Data Breach Nets Hacker Millions Authorities Reveal

May 04, 2025 -

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

May 04, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

May 04, 2025 -

Cybercriminal Makes Millions Targeting Executive Office365 Accounts

May 04, 2025

Cybercriminal Makes Millions Targeting Executive Office365 Accounts

May 04, 2025