Indian Industries Under Pressure: The Threat Of Reciprocal Tariffs

Table of Contents

Impact on Key Export-Oriented Sectors

Reciprocal tariffs, essentially tit-for-tat trade barriers, pose a significant threat to India's export-oriented industries. The imposition of tariffs by trading partners can lead to reduced demand for Indian goods, increased competition, and ultimately, economic hardship.

Textile Industry

The Indian textile industry, a major employment generator, is particularly vulnerable to reciprocal tariffs.

- Reduced Demand: Reciprocal tariffs could significantly reduce demand for Indian textiles in key markets like the US and Europe, leading to unsold inventory and decreased production.

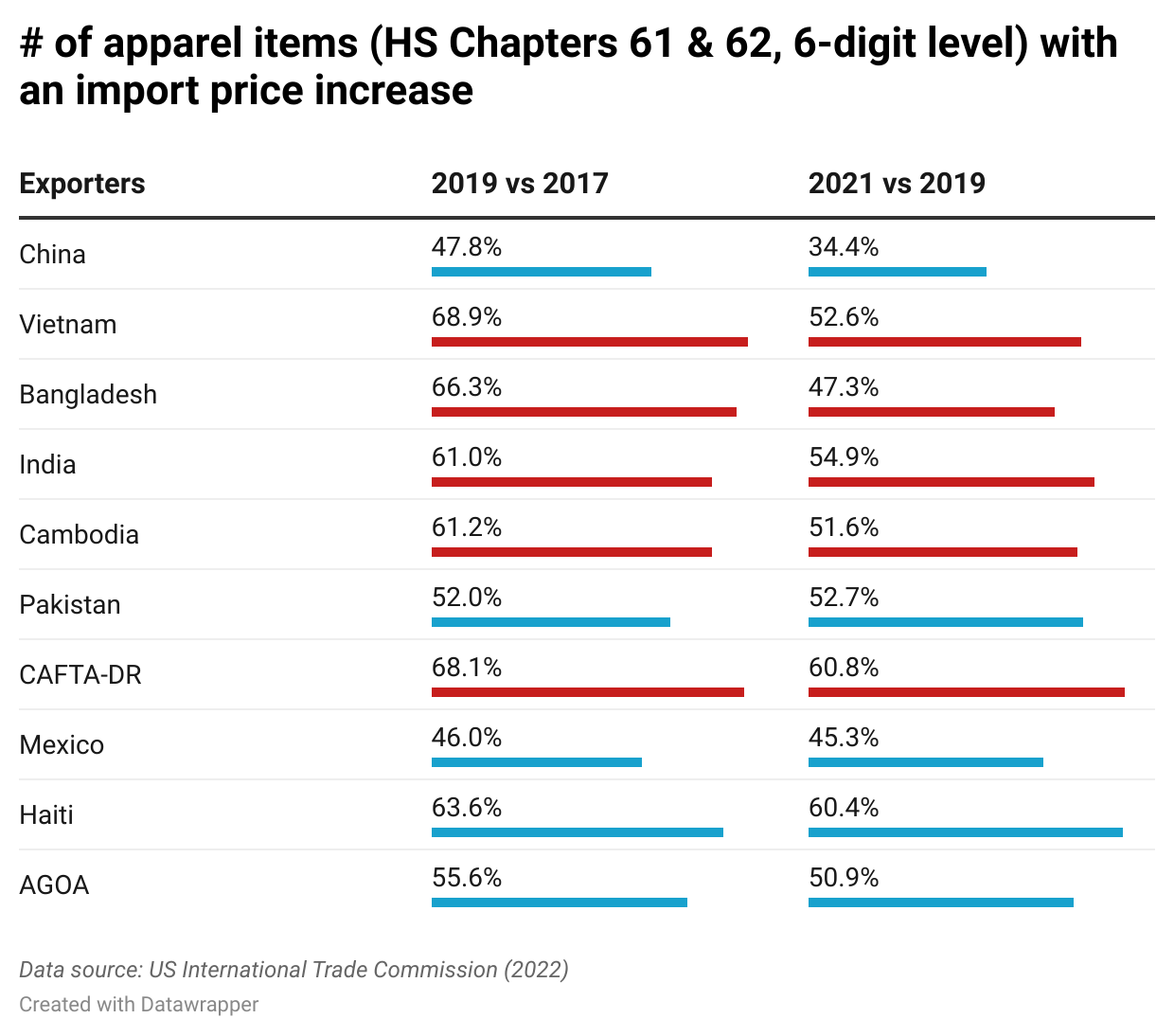

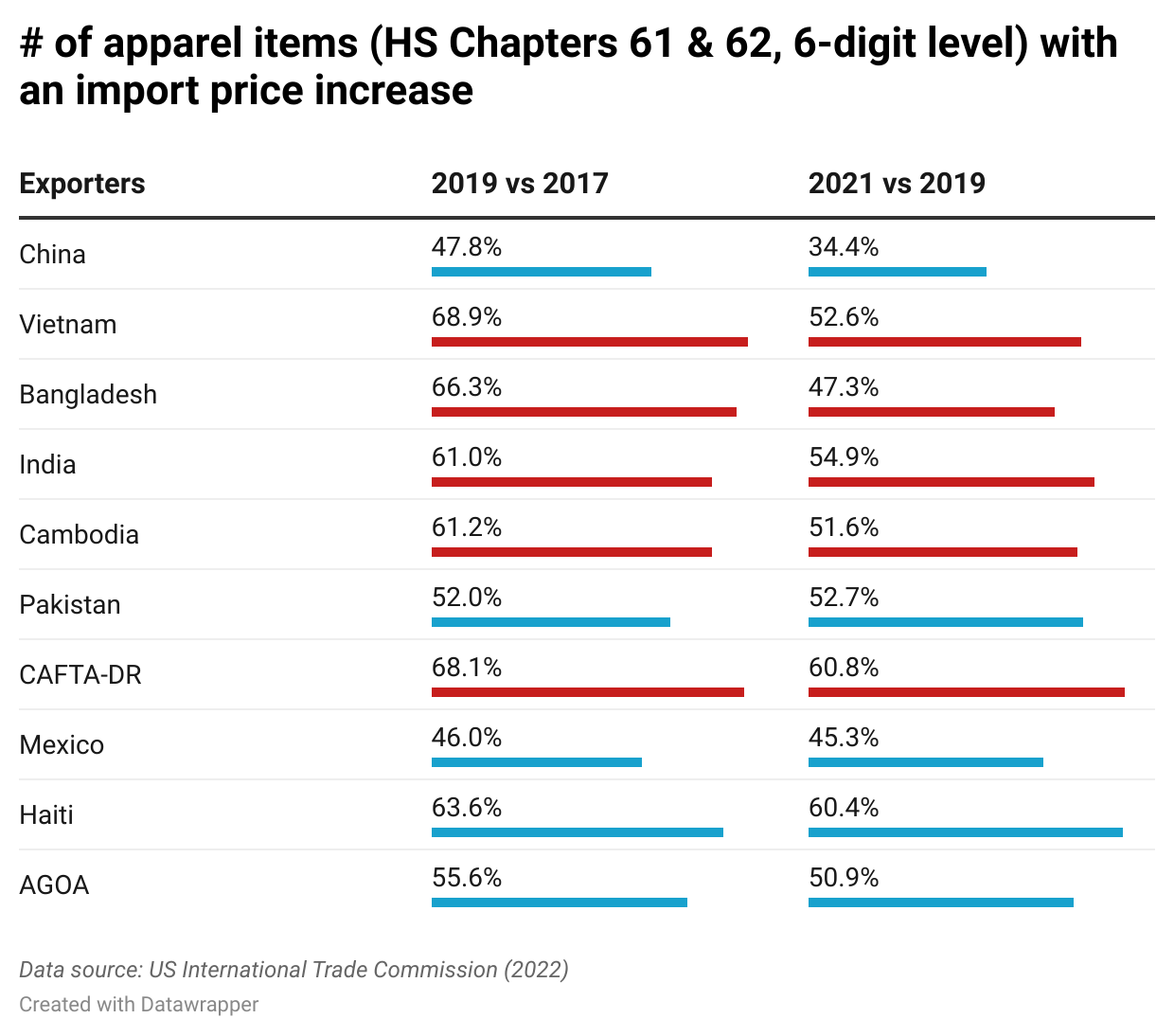

- Increased Competition: Countries with preferential trade agreements gain a competitive edge, further squeezing the margins of Indian textile exporters. This intensifies competition from countries like Bangladesh and Vietnam.

- Job Losses and Reduced Revenue: Decreased export orders directly translate into job losses in the textile sector, impacting livelihoods and reducing vital export revenue for the country.

- Need for Diversification: Exploring new markets in Africa and South America, and focusing on niche products and higher value-added textiles, are crucial for mitigating the impact of reciprocal tariffs.

Pharmaceutical Industry

India's generic drug industry, a global leader, is also susceptible to the negative impacts of reciprocal tariffs.

- Impact on Generic Drug Exports: Reciprocal tariffs can increase the cost of Indian generic drugs in importing countries, reducing their competitiveness against locally produced or other internationally sourced drugs.

- Increased Pricing Pressure: The increased cost and reduced market share can lead to significant pricing pressure, eroding the profitability of Indian pharmaceutical companies.

- Retaliatory Tariffs: The imposition of tariffs on Indian pharmaceuticals might trigger retaliatory tariffs from importing countries, further escalating the trade dispute and harming the industry.

- Navigating Market Access: Strategic partnerships, regulatory compliance in target markets, and focusing on innovative drug development are crucial for maintaining market access and navigating price competition.

Agricultural Products

India's agricultural sector, a cornerstone of its economy, is also vulnerable to the ripple effects of reciprocal tariffs.

- Impact on Exports: Exports of rice, spices, tea, and other agricultural commodities could face significant hurdles due to increased tariffs in importing countries.

- Price Volatility: The agricultural sector is inherently vulnerable to fluctuations in global prices and trade policies, making it susceptible to the unpredictable nature of reciprocal tariffs.

- Trade Agreement Negotiation: Negotiating favorable trade agreements and securing market access through diversification are essential to mitigate the impact of these tariffs.

- Farmer Support: Government support through subsidies, improved infrastructure, and better access to technology is vital to bolster the resilience of farmers facing these challenges.

Government Response and Policy Implications

The Indian government needs to adopt a proactive and multifaceted approach to address the threat of reciprocal tariffs.

Negotiating Trade Agreements

- Bilateral and Multilateral Negotiations: Engaging in robust bilateral and multilateral trade negotiations is crucial to secure favorable trade terms and avoid retaliatory measures. Strengthening existing agreements like the Regional Comprehensive Economic Partnership (RCEP) is vital.

- Avoiding Retaliation: Strategic diplomacy and effective negotiation are key to preventing escalation and minimizing the impact of reciprocal tariffs.

- New Trade Partnerships: Exploring and forging new trade partnerships with countries less prone to imposing protectionist measures is essential for diversification.

Domestic Policy Adjustments

- Industry Incentives: Providing targeted incentives and support packages to affected industries can help them adapt and remain competitive in the global market.

- Investment in Technology and Infrastructure: Investing in modernizing infrastructure and adopting advanced technologies can enhance the competitiveness of Indian industries.

- Skill Development: Investing in skill development and workforce training programs can equip workers with the necessary skills to adapt to changing market conditions.

Diversification Strategies

- Market Diversification: Reducing over-reliance on specific export markets by actively exploring new markets and trade opportunities is paramount.

- Domestic Consumption: Promoting domestic consumption and reducing reliance on exports can also help cushion the impact of reciprocal tariffs.

The Long-Term Economic Outlook

The impact of reciprocal tariffs on India's long-term economic outlook is a cause for serious concern.

GDP Growth Projections

- Reduced Growth: Reciprocal tariffs could significantly dampen India's GDP growth projections by reducing export revenue, investment, and overall economic activity.

- Employment Impact: Slower economic growth directly translates into lower job creation and potentially job losses across various sectors.

Inflationary Pressures

- Increased Prices: Increased tariffs on imported goods lead to higher prices for consumers, potentially fueling inflation and reducing consumer spending.

- Economic Activity: Inflationary pressures can negatively affect overall economic activity by reducing consumer confidence and investment.

Foreign Investment Implications

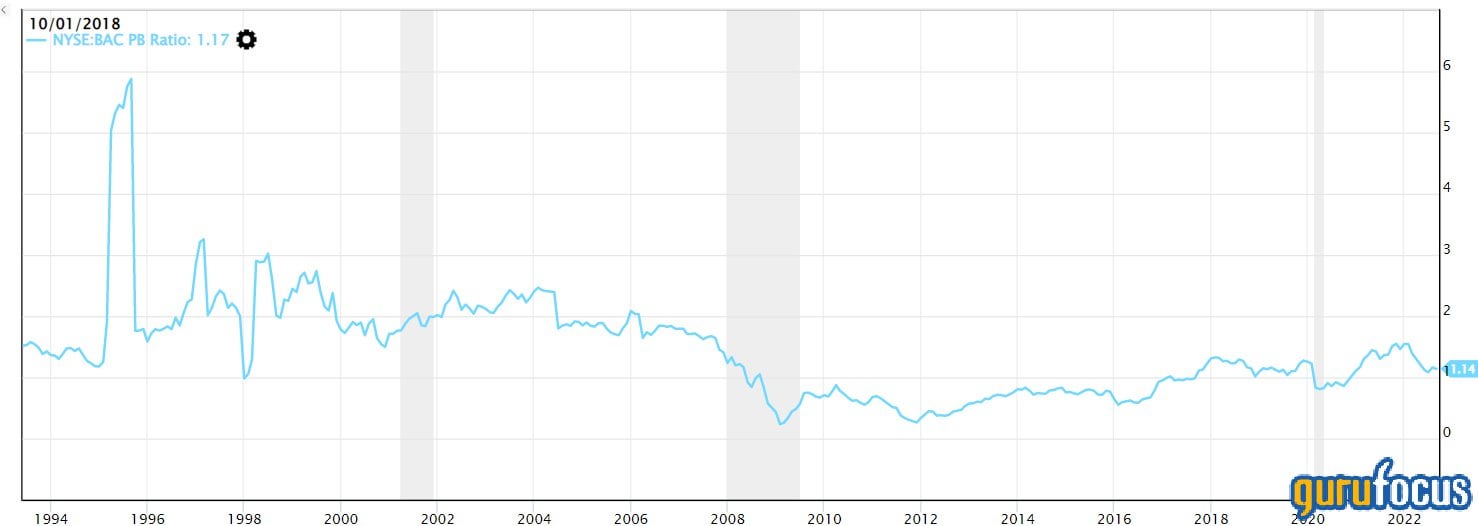

- Reduced FDI: The uncertainty and negative economic consequences of reciprocal tariffs can deter foreign direct investment (FDI) inflows into India.

- Investor Sentiment: The impact on investor sentiment and confidence in the Indian market could have long-term consequences for economic growth.

Conclusion

The threat of reciprocal tariffs poses a serious challenge to several key Indian industries. Navigating these challenges requires a multifaceted approach, including proactive government policies, strategic industry diversification, and robust trade negotiations. Failing to address the issue of reciprocal tariffs India faces could lead to significant economic repercussions. Therefore, immediate and decisive action is needed to mitigate the risks and secure India's long-term economic prosperity. Understanding the nuances of reciprocal tariffs and their impact on Indian industries is crucial for policymakers, businesses, and investors alike. Let's work towards a future where Indian industries thrive despite the challenges of global trade. Effective management of reciprocal tariffs is key to India's continued economic success.

Featured Posts

-

Sehitlerimizin Anisina Fatih Erbakan In Kibris La Ilgili Aciklamasi

May 15, 2025

Sehitlerimizin Anisina Fatih Erbakan In Kibris La Ilgili Aciklamasi

May 15, 2025 -

The Countrys Top New Business Locations A Geographic Analysis

May 15, 2025

The Countrys Top New Business Locations A Geographic Analysis

May 15, 2025 -

Times Kaysimon Pagkypria Sygkrisi And Fthinotera Pratiria

May 15, 2025

Times Kaysimon Pagkypria Sygkrisi And Fthinotera Pratiria

May 15, 2025 -

Kibris Ta Coezuem Stefanos Stefanu Nun Potansiyel Katkisi

May 15, 2025

Kibris Ta Coezuem Stefanos Stefanu Nun Potansiyel Katkisi

May 15, 2025 -

Are Stretched Stock Market Valuations Justified Bof As Take

May 15, 2025

Are Stretched Stock Market Valuations Justified Bof As Take

May 15, 2025

Latest Posts

-

Rfk Jr S Pesticide Criticism Faces Pushback From Trump Administration

May 15, 2025

Rfk Jr S Pesticide Criticism Faces Pushback From Trump Administration

May 15, 2025 -

Trump Officials Push Back Against Rfk Jr S Pesticide Claims

May 15, 2025

Trump Officials Push Back Against Rfk Jr S Pesticide Claims

May 15, 2025 -

Examining Trumps Stated Oil Price Preference Goldman Sachs Report

May 15, 2025

Examining Trumps Stated Oil Price Preference Goldman Sachs Report

May 15, 2025 -

Dismissing Stock Market Valuation Concerns Bof As Argument

May 15, 2025

Dismissing Stock Market Valuation Concerns Bof As Argument

May 15, 2025 -

Estimating The Impact Of Trumps Tariffs On Californias Revenue

May 15, 2025

Estimating The Impact Of Trumps Tariffs On Californias Revenue

May 15, 2025