Private Credit Jobs: 5 Do's And Don'ts For Success

Table of Contents

Private credit refers to lending activities outside the traditional banking system, often involving direct lending to companies, real estate projects, or other assets. Roles within private credit encompass a wide range of positions, from entry-level Analyst and Associate positions to senior-level Portfolio Manager and Principal roles. Each position requires a unique skillset, but certain core competencies are essential for success across the board. This article focuses on providing guidance for all those aspiring to or already working in private credit jobs.

5 DOs for Success in Private Credit Jobs

DO 1: Develop Strong Financial Modeling Skills

Proficiency in financial modeling is paramount for success in private credit jobs. This goes beyond basic spreadsheet skills; it requires advanced expertise in tools like Excel, Bloomberg Terminal, and Argus. You need a firm grasp of LBO modeling (Leveraged Buyout), discounted cash flow (DCF) analysis, and other sophisticated valuation techniques.

- Practice consistently: Use real-world case studies to hone your abilities. Many publicly available datasets and case studies exist for practice.

- Seek mentorship: Get feedback from experienced professionals on your models; constructive criticism is invaluable.

- Stay updated: The industry constantly evolves. Stay abreast of best practices and new modeling techniques through continued learning and professional development.

DO 2: Network Strategically within the Private Credit Industry

Networking is crucial for securing and advancing in private credit jobs. Attend industry conferences, participate in networking events, and actively engage on platforms like LinkedIn. Building relationships with professionals in private equity, investment banking, and related fields can open doors to opportunities.

- Join industry associations: Become a member of organizations like the American Securitization Forum or other relevant groups.

- Engage online: Participate in industry-specific forums and discussions to broaden your network and learn from others.

- Follow key players: Follow influential figures and companies on social media to keep your finger on the pulse of the industry.

DO 3: Master Due Diligence and Credit Analysis

Due diligence is the cornerstone of successful private credit investing. It involves rigorously assessing the creditworthiness of potential borrowers and the risks associated with each investment opportunity. This includes detailed financial statement analysis, comprehensive industry research, and qualitative assessments of management teams and operational capabilities.

- Understand credit metrics: Develop a strong understanding of key metrics like leverage ratios, interest coverage, and debt-to-equity ratios.

- Interpret financial statements: Become adept at analyzing financial statements, identifying trends, and uncovering potential red flags.

- Identify risks and opportunities: Practice identifying key risks and potential rewards within each investment proposal.

DO 4: Cultivate Excellent Communication and Presentation Skills

In private credit, you'll need to effectively communicate complex financial information to both technical and non-technical audiences. This requires clear, concise written and verbal communication skills, coupled with strong presentation abilities.

- Practice presentations: Practice presenting your findings to diverse audiences, tailoring your approach to their understanding.

- Develop storytelling: Learn to weave a compelling narrative around your data to keep your audience engaged.

- Seek feedback: Always seek feedback on your presentations and refine your communication style accordingly.

DO 5: Demonstrate a Strong Work Ethic and Adaptability

The private credit industry demands a strong work ethic and a proactive attitude. Long hours are common, and resilience is essential to navigate the challenges. Adaptability is crucial, as market conditions and investment strategies can change rapidly.

- Embrace the pace: Be prepared for a fast-paced and demanding work environment.

- Show initiative: Demonstrate initiative and a willingness to take on new responsibilities.

- Be open to feedback: Continuously seek feedback and use it to improve your performance.

5 DON'Ts for Success in Private Credit Jobs

DON'T 1: Neglect Continuous Learning and Development

The private credit landscape is constantly evolving, with new regulations, technologies, and market trends emerging regularly. Neglecting continuous learning will quickly leave you behind.

DON'T 2: Underestimate the Importance of Teamwork

Private credit is inherently collaborative. Strong interpersonal skills and a collaborative approach are crucial for success.

DON'T 3: Ignore Risk Management Principles

Risk management is paramount in private credit. A thorough understanding of risk assessment and mitigation strategies is non-negotiable.

DON'T 4: Lack Attention to Detail

Accuracy and precision are paramount in all aspects of private credit, from financial modeling to due diligence reports. Overlooking details can lead to significant errors.

DON'T 5: Be Unwilling to Take Calculated Risks

While prudent risk management is vital, a willingness to take calculated risks is also essential for seizing opportunities and achieving success in the private credit industry.

Securing Your Future in Private Credit Jobs

Successfully navigating the world of private credit jobs requires mastering financial modeling, building a strong network, understanding due diligence and credit analysis, communicating effectively, and demonstrating a robust work ethic and adaptability. Avoiding common pitfalls like neglecting continuous learning, underestimating teamwork, ignoring risk management, lacking attention to detail, and shunning calculated risks is equally vital.

Ready to launch your successful career in private credit jobs? Start by mastering financial modeling and networking strategically today! The path may be challenging, but the rewards in this dynamic industry are substantial for those who are prepared.

Featured Posts

-

Smartphone Samsung Galaxy S25 Ultra 1 To Une Reduction De 13

May 28, 2025

Smartphone Samsung Galaxy S25 Ultra 1 To Une Reduction De 13

May 28, 2025 -

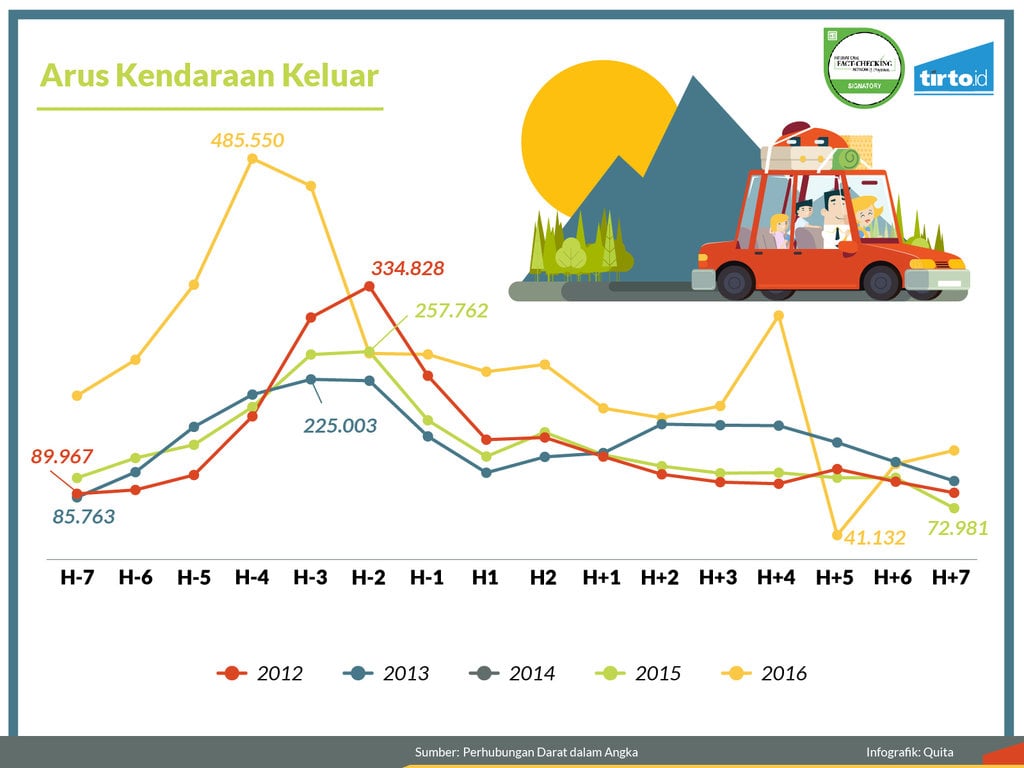

Arus Balik Mudik Masuk Bali Diprediksi 5 6 April 2025 Persiapan Dan Antisipasi

May 28, 2025

Arus Balik Mudik Masuk Bali Diprediksi 5 6 April 2025 Persiapan Dan Antisipasi

May 28, 2025 -

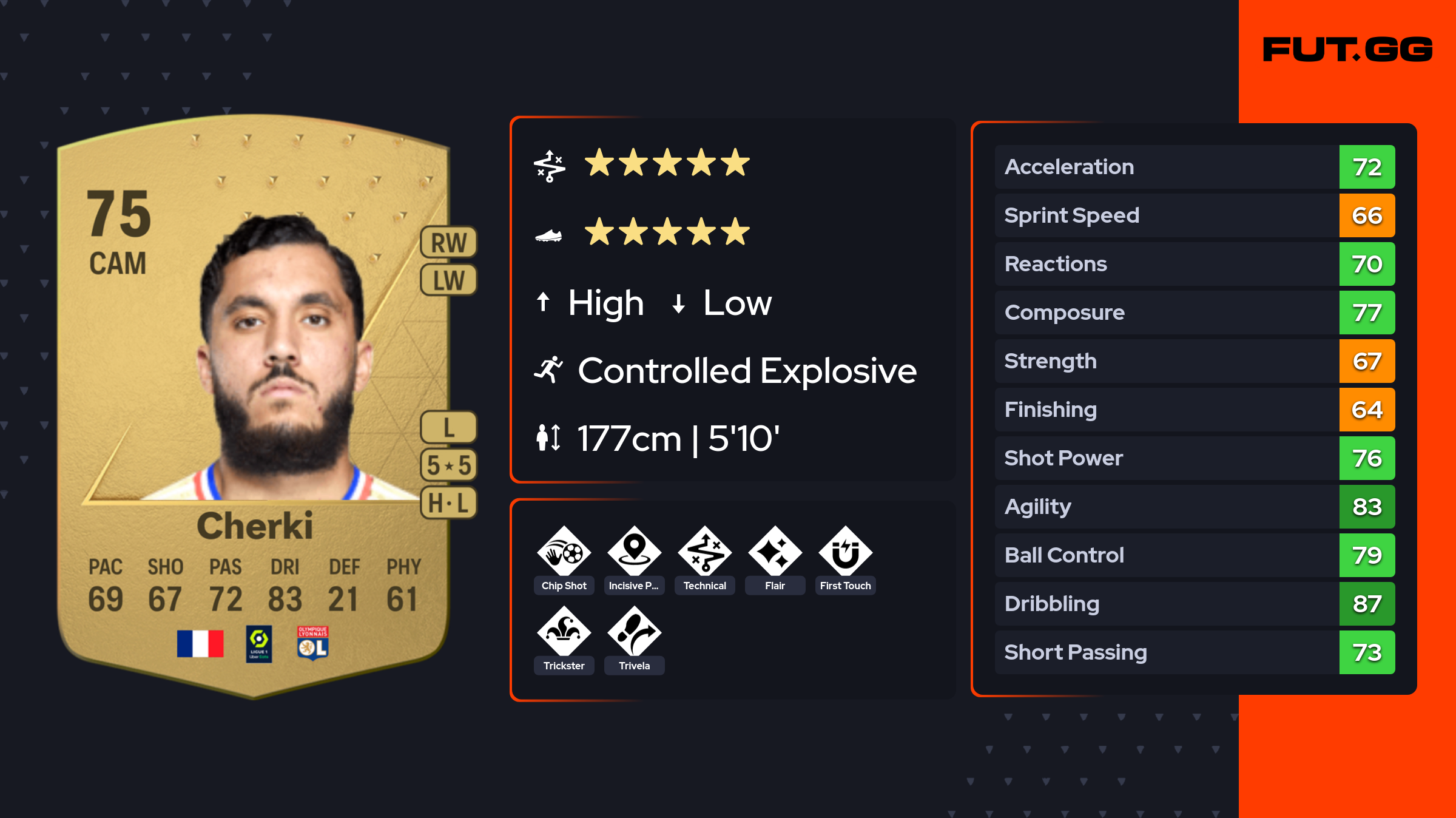

Rayan Cherki To Manchester United A Summer Transfer On The Cards

May 28, 2025

Rayan Cherki To Manchester United A Summer Transfer On The Cards

May 28, 2025 -

Rute Baru Saudia Bali Terhubung Langsung Ke Jeddah

May 28, 2025

Rute Baru Saudia Bali Terhubung Langsung Ke Jeddah

May 28, 2025 -

Pacers Vs Hawks Injury Report Game Day Update March 8th

May 28, 2025

Pacers Vs Hawks Injury Report Game Day Update March 8th

May 28, 2025

Latest Posts

-

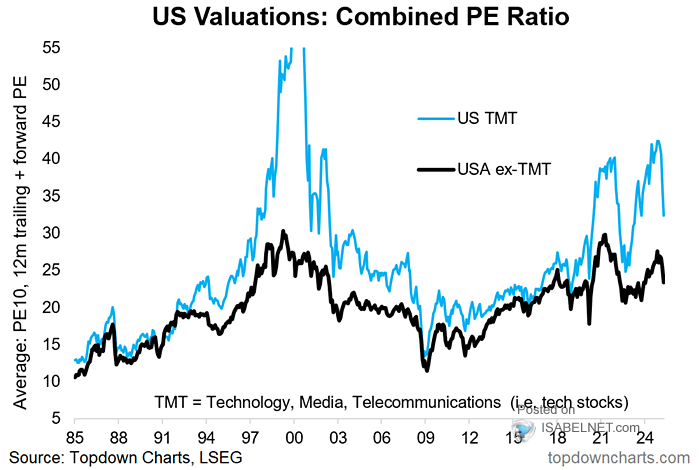

Investor Concerns About High Stock Market Valuations Bof As Rebuttal

May 30, 2025

Investor Concerns About High Stock Market Valuations Bof As Rebuttal

May 30, 2025 -

Addressing High Stock Market Valuations A Bof A Analysis For Investors

May 30, 2025

Addressing High Stock Market Valuations A Bof A Analysis For Investors

May 30, 2025 -

Land Your Dream Job 5 Dos And Don Ts In The Private Credit Industry

May 30, 2025

Land Your Dream Job 5 Dos And Don Ts In The Private Credit Industry

May 30, 2025 -

Investment Opportunities A Map Of The Countrys Emerging Business Hubs

May 30, 2025

Investment Opportunities A Map Of The Countrys Emerging Business Hubs

May 30, 2025 -

San Franciscos Anchor Brewing Company To Close Its Doors

May 30, 2025

San Franciscos Anchor Brewing Company To Close Its Doors

May 30, 2025