Ripple (XRP) Price Surge: Will It Reach $3.40?

Table of Contents

Analyzing Ripple's Recent Price Performance

XRP Price History and Volatility

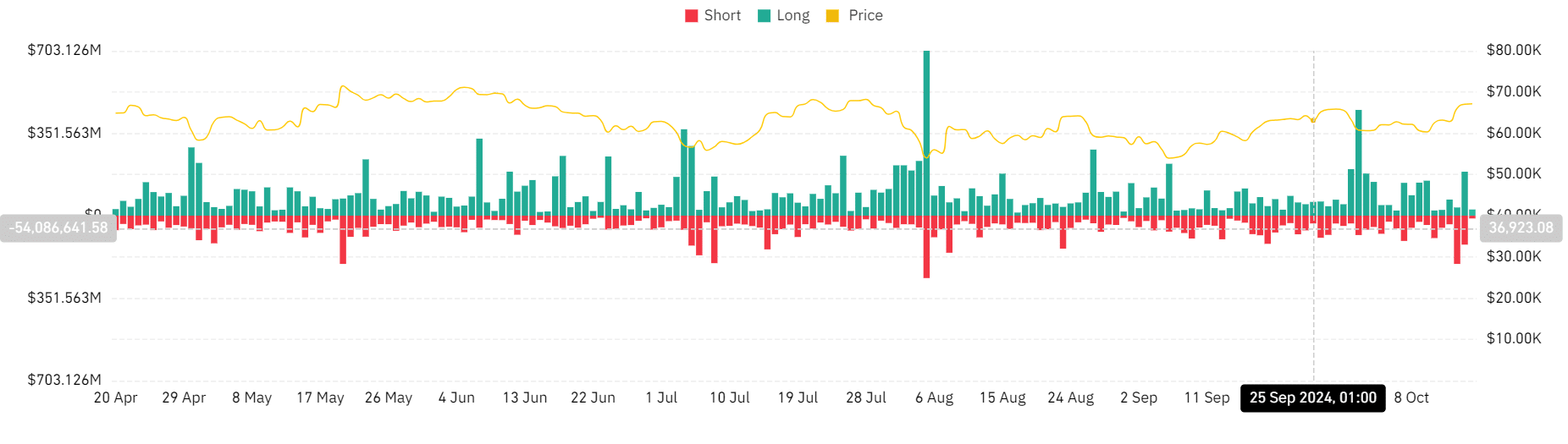

XRP's price history is marked by significant volatility. From its initial offering price to its all-time high, XRP has experienced dramatic swings, reflecting the inherent risk associated with cryptocurrency investments. Analyzing the XRP price chart reveals periods of explosive growth followed by sharp corrections.

- 2017 Bull Run: XRP experienced a remarkable surge, reaching a high of over $3.00 during the broader cryptocurrency market boom.

- 2018-2020 Consolidation: Following the 2017 peak, the price consolidated, largely trading sideways amidst regulatory uncertainty.

- Recent Volatility: The price has shown increased volatility in recent months, influenced by various market factors and legal developments.

Understanding this historical XRP volatility is crucial for assessing the potential for a future price increase. Studying the XRP historical data helps to identify patterns and trends, although it's important to remember that past performance is not indicative of future results. Consult reliable resources for up-to-date cryptocurrency price prediction models, keeping in mind their limitations.

Factors Contributing to the Current Price Increase

Several factors have contributed to XRP's recent price appreciation. These include:

- Positive Market Sentiment: Overall positive sentiment in the cryptocurrency market has boosted XRP's price.

- Regulatory Updates (or lack thereof): While the SEC lawsuit remains a factor, a lack of significantly negative news has contributed to a more positive outlook.

- Increased Adoption: Growing adoption of RippleNet by financial institutions is a significant driver.

- Technological Advancements: Continuous improvements to the XRP Ledger's scalability and efficiency have enhanced its appeal.

- Strategic Partnerships: Ripple's collaborations with various financial institutions have broadened its reach and strengthened its market position. Analyzing these XRP adoption rates, Ripple partnerships, and the impact of the SEC lawsuit is vital in understanding current price movements. This is all part of the broader cryptocurrency market analysis.

Factors that Could Push XRP to $3.40

Positive Regulatory Developments

A resolution to the ongoing SEC lawsuit, favorable regulatory decisions, and increased regulatory clarity globally could significantly boost investor confidence and fuel a Ripple (XRP) price surge. This increased XRP regulation certainty would attract institutional investors and encourage wider adoption. The outcome of the SEC Ripple lawsuit will heavily influence future price action. The broader context of cryptocurrency regulation and blockchain technology adoption are also key.

Increased Institutional Adoption

The involvement of institutional investors is a pivotal factor in driving significant price increases. Increased usage of XRP by major financial institutions, facilitated by RippleNet, could trigger substantial demand and propel the price towards $3.40. Analyzing the adoption rates of financial institutions and the potential for future partnerships is crucial to assess this possibility. The growth of RippleNet and its impact on XRP adoption are essential factors to consider.

Technological Advancements and Ripple's Ecosystem Growth

Ongoing technological advancements within Ripple's ecosystem, such as improvements to XRP technology, enhanced blockchain scalability, increased XRP utility, and the development of new use cases, will attract developers and users. This continuous cryptocurrency innovation will support sustained price growth. Improvements to RippleNet improvements are a key factor in this technological growth.

Challenges and Headwinds that Could Hinder XRP's Price

Regulatory Uncertainty

Regulatory uncertainty remains a significant challenge. Ongoing legal battles, potential future regulations, and varying regulatory landscapes across different jurisdictions could impact investor sentiment and hinder price appreciation. This regulatory risk and the ongoing XRP legal issues need careful consideration within the context of the broader global regulatory environment for cryptocurrencies.

Market Volatility and General Crypto Market Sentiment

The cryptocurrency market is inherently volatile, and XRP's price is susceptible to broader market trends. Fluctuations in the Bitcoin price, overall market sentiment, and macroeconomic factors significantly influence investor behavior and can lead to price corrections. A thorough risk assessment is crucial.

Competition within the Cryptocurrency Market

XRP faces competition from other cryptocurrencies, including alternative payment tokens and blockchain solutions. The competitive landscape, encompassing various altcoins and blockchain alternatives, could limit XRP's price growth. Analyzing the degree of cryptocurrency competition is vital.

Conclusion: The Ripple (XRP) Price Surge: A Realistic Assessment?

Whether XRP will reach $3.40 is uncertain. While positive regulatory developments, increased institutional adoption, and technological advancements could drive a significant price surge, regulatory uncertainty, market volatility, and competition present considerable challenges. The potential for a Ripple (XRP) price surge exists, but investors should carefully weigh the potential rewards against the inherent risks.

Stay informed about the latest developments in the Ripple (XRP) ecosystem to make informed decisions about your XRP investments. Conduct thorough research and consider seeking professional financial advice before investing in any cryptocurrency. Remember, investing in cryptocurrencies involves significant risk, and you could lose some or all of your investment.

Featured Posts

-

Filming Begins This Summer Jenna Ortega And Glen Powells New Fantasy Movie

May 07, 2025

Filming Begins This Summer Jenna Ortega And Glen Powells New Fantasy Movie

May 07, 2025 -

Pittsburgh Steelers Trade Rumors Swirl Around Star Wide Receiver

May 07, 2025

Pittsburgh Steelers Trade Rumors Swirl Around Star Wide Receiver

May 07, 2025 -

Ayesha Currys Marriage First Her Comments Spark Debate

May 07, 2025

Ayesha Currys Marriage First Her Comments Spark Debate

May 07, 2025 -

Nba Slaps Anthony Edwards With 50 000 Fine Following Fan Confrontation

May 07, 2025

Nba Slaps Anthony Edwards With 50 000 Fine Following Fan Confrontation

May 07, 2025 -

The Trae Young Travel Was It A Missed Call

May 07, 2025

The Trae Young Travel Was It A Missed Call

May 07, 2025

Latest Posts

-

67 Million Ethereum Liquidation Event Implications And Market Outlook

May 08, 2025

67 Million Ethereum Liquidation Event Implications And Market Outlook

May 08, 2025 -

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025 -

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025 -

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025 -

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025