Sasol's 2023 Strategy Update: What Investors Need To Know

Table of Contents

Financial Performance and Outlook

Key Financial Highlights of 2023

Sasol's 2023 financial results revealed a mixed bag, reflecting the challenging global economic landscape. Analyzing the "Sasol financial results" is crucial for investors. Key highlights include:

- Revenue: [Insert actual revenue figures and percentage change compared to the previous year. Discuss factors influencing revenue growth or decline].

- Profit Margins: [Insert profit margin data and analysis. Explain any changes in margins and their contributing factors].

- Earnings Per Share (EPS): [Insert EPS figures and year-over-year comparison. Discuss the implications for shareholder returns].

- Return on Equity (ROE): [Provide ROE data and interpret its significance for investors].

- Debt Reduction: [Discuss Sasol's progress in reducing debt levels and its impact on the company's financial stability]. These key metrics help investors understand the overall financial health of the company and its ability to generate returns.

Analyzing this data in the context of broader market trends and industry benchmarks provides a more complete picture of Sasol's financial performance.

Future Financial Projections

Sasol's financial forecast for the coming year projects [Insert projected revenue, profit, and EPS growth figures]. The company anticipates growth in [Mention specific areas of anticipated growth, e.g., specific product lines or geographical markets]. However, the company acknowledges potential challenges including [Mention potential headwinds, e.g., fluctuating commodity prices, geopolitical risks, or regulatory changes]. Their "growth strategy" relies heavily on [Explain key growth strategies, e.g., operational efficiency improvements or strategic acquisitions]. The company's guidance regarding dividends and share buybacks will also be influential for investors looking for income potential.

Operational Efficiency and Sustainability Initiatives

Operational Improvements and Cost-Cutting Measures

Sasol is committed to "operational excellence" through various initiatives. These include:

- Process Improvement: [Detail specific process improvements implemented to enhance efficiency and reduce operational costs].

- Technology Adoption: [Discuss the implementation of new technologies to streamline operations and improve productivity].

- Cost Optimization: [Explain specific cost-cutting measures and their anticipated impact on profitability]. These efforts are central to Sasol's ability to remain competitive and improve profitability.

Environmental, Social, and Governance (ESG) Commitments

Sasol's "ESG performance" is a significant factor for environmentally conscious investors. Key initiatives include:

- Carbon Neutrality: [Describe Sasol's targets and strategies for reducing carbon emissions and its progress towards carbon neutrality].

- Renewable Energy Investments: [Detail investments in renewable energy sources and their contribution to a more sustainable energy mix].

- Sustainable Development: [Highlight Sasol's social responsibility initiatives and community engagement programs]. Sasol's commitment to "sustainable development" is crucial for its long-term viability and investor appeal. The company's recognition for its ESG efforts further strengthens its position in the market.

Strategic Growth and Diversification

Key Strategic Initiatives

Sasol's "strategic growth" strategy includes:

- Market Expansion: [Discuss plans to expand into new geographical markets or target new customer segments].

- Product Diversification: [Explain efforts to diversify its product portfolio to reduce reliance on any single product or market].

- Innovation: [Highlight investments in research and development to develop new technologies and products]. These initiatives will drive future growth and enhance the resilience of Sasol's business model. Any mergers, acquisitions, or joint ventures play a crucial role in this strategy.

Long-Term Vision and Goals

Sasol's "long-term strategy" is underpinned by [State Sasol's long-term vision and key strategic objectives]. The 2023 strategy update serves as a critical stepping stone toward achieving these "strategic objectives." It is designed to enhance the company's competitive position and create long-term value for shareholders.

Conclusion: Key Takeaways and Call to Action

Sasol's 2023 strategy update reveals a company navigating a complex energy landscape through a combination of financial prudence, operational efficiency improvements, and a commitment to sustainability. The financial projections suggest [summarize the key financial implications for investors]. The emphasis on "operational excellence" and ESG initiatives signals a long-term vision focused on both profitability and environmental responsibility. Potential risks and opportunities for investors include [mention specific risks and opportunities based on the analysis].

To stay informed about Sasol's progress in implementing its 2023 strategy, follow Sasol's 2023 strategy developments and learn more about Sasol's investor relations by visiting their website [Insert link to Sasol's investor relations website]. Understanding Sasol's strategic direction is vital for making informed investment decisions in this dynamic sector.

Featured Posts

-

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025 -

Abn Amro Us Import Tariffs Slash Dutch Food Exports

May 21, 2025

Abn Amro Us Import Tariffs Slash Dutch Food Exports

May 21, 2025 -

Cassis Blackcurrant From Berry To Bottle A Journey Of Flavor

May 21, 2025

Cassis Blackcurrant From Berry To Bottle A Journey Of Flavor

May 21, 2025 -

Amazon Faces Quebec Labour Tribunal Over Warehouse Closings And Union Dispute

May 21, 2025

Amazon Faces Quebec Labour Tribunal Over Warehouse Closings And Union Dispute

May 21, 2025 -

Gmas Ginger Zee Addresses Critics Comments On Her Appearance

May 21, 2025

Gmas Ginger Zee Addresses Critics Comments On Her Appearance

May 21, 2025

Latest Posts

-

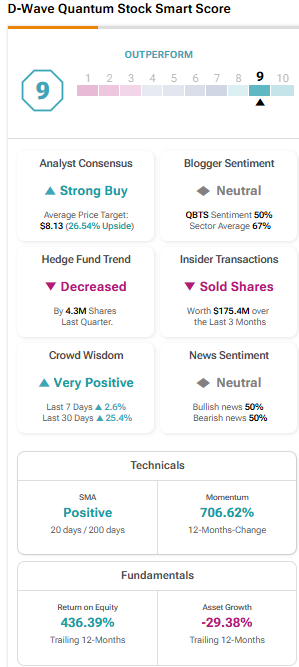

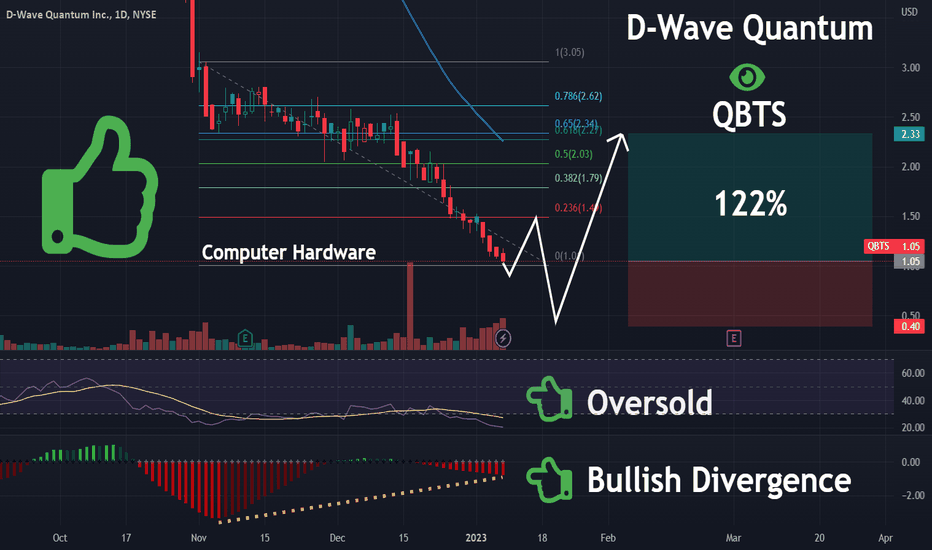

D Wave Quantum Qbts Stock Market Performance A Deep Dive Into Recent Gains

May 21, 2025

D Wave Quantum Qbts Stock Market Performance A Deep Dive Into Recent Gains

May 21, 2025 -

Understanding The D Wave Quantum Qbts Stock Jump Key Factors

May 21, 2025

Understanding The D Wave Quantum Qbts Stock Jump Key Factors

May 21, 2025 -

Will Qbts Stock Rise Or Fall After The Next Earnings Announcement

May 21, 2025

Will Qbts Stock Rise Or Fall After The Next Earnings Announcement

May 21, 2025 -

Should You Invest In D Wave Quantum Qbts Stock Now

May 21, 2025

Should You Invest In D Wave Quantum Qbts Stock Now

May 21, 2025 -

D Waves Qbts Quantum Leap Ai Powered Drug Discovery Through Quantum Computing

May 21, 2025

D Waves Qbts Quantum Leap Ai Powered Drug Discovery Through Quantum Computing

May 21, 2025