"Sell America": A Reassessment In Light Of Moody's 5% 30-Year Yield Prediction

Table of Contents

2. Moody's 5% 30-Year Yield Prediction: Implications for the "Sell America" Thesis

H2: Understanding Moody's Prediction:

Moody's 5% prediction for the 30-year Treasury yield stems from a complex interplay of factors. Their rationale centers on the expectation of persistent inflation, fueled by robust consumer demand and supply chain bottlenecks. The Federal Reserve's ongoing efforts to combat inflation through interest rate hikes are also a significant contributor. Furthermore, the growing US government debt burden adds to the pressure on long-term interest rates.

- Rising inflation: Persistent inflation erodes the purchasing power of future interest payments, pushing yields higher to compensate investors.

- Persistent deficits: Large and persistent government budget deficits increase the supply of Treasury bonds, potentially putting downward pressure on prices and upward pressure on yields.

- Potential recessionary risks: While aiming to curb inflation, the Fed's actions risk triggering a recession, which could lead to increased demand for safe-haven assets like US Treasuries, potentially limiting yield increases.

H2: Impact on US Treasury Bonds:

Higher yields, as predicted by Moody's, directly impact the attractiveness of US Treasury bonds. For existing bondholders, this translates to potential capital losses as bond prices inversely correlate with yields. Bonds purchased at lower yields will see their value decline as yields rise. This is particularly relevant for long-term bonds, which are more sensitive to yield changes.

- Decreased bond prices: Higher yields mean lower bond prices, impacting the value of existing holdings.

- Increased borrowing costs: Higher yields increase the cost of borrowing for businesses and consumers, potentially slowing economic growth.

- Flight to safety dynamics: In times of economic uncertainty, investors may flock to US Treasuries as a safe haven, which could partially offset the downward pressure on prices.

H2: Ripple Effects Across US Markets:

The impact of higher yields extends far beyond the Treasury bond market. Increased borrowing costs can dampen corporate investment and consumer spending, potentially leading to slower economic growth or even a recession. Higher mortgage rates, a direct consequence of higher yields, can cool the overheated housing market. The stock market is also likely to experience increased volatility as investors reassess valuations in light of the changed economic landscape.

- Stock market volatility: Higher interest rates generally increase the cost of capital for companies, reducing their profitability and potentially impacting stock valuations.

- Higher mortgage rates: Rising yields directly translate into higher mortgage rates, making homeownership less affordable and potentially cooling the real estate market.

- Reduced consumer spending: Higher borrowing costs for consumers can curb spending, potentially slowing economic growth.

3. Reassessing the "Sell America" Narrative: Is it Justified?

H2: Arguments for "Selling America":

The Moody's prediction, combined with other economic indicators, provides a compelling case for those advocating for a "Sell America" strategy. The high national debt, persistent inflation, and political uncertainty present considerable risks. The potential for a recession, combined with geopolitical risks, further fuels concerns.

- Political uncertainty: Political gridlock and policy uncertainty can negatively impact investor confidence.

- Geopolitical risks: Global conflicts and trade tensions pose significant risks to the US economy.

- Structural economic challenges: Issues such as income inequality and aging infrastructure present long-term challenges.

H2: Counterarguments and Nuances:

Despite these challenges, the "Sell America" narrative is not without counterarguments. The US economy still boasts strong fundamentals, including a highly innovative and technologically advanced sector. The global demand for US goods and services remains robust, supporting economic growth. Furthermore, specific sectors, like technology and renewable energy, may experience continued growth despite broader economic headwinds.

- Strong fundamentals: The US economy still possesses significant strengths, including a large and diversified market.

- Innovative industries: The US continues to lead in innovation, particularly in technology and healthcare.

- Global demand for US goods and services: The US remains a major exporter of goods and services, supporting economic growth.

H2: Diversification Strategies:

Rather than adopting an all-or-nothing approach, investors should consider a more nuanced strategy. Diversification across asset classes and geographies is crucial to mitigate risk and capitalize on opportunities. This includes exploring international markets and alternative investments to balance exposure to the US market.

- Global asset allocation: Diversifying investments geographically reduces dependence on the performance of the US economy.

- Strategic diversification: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) minimizes risk.

- Risk management: Implementing effective risk management strategies is crucial in navigating uncertain economic times.

4. Conclusion: Navigating the Uncertainties of "Sell America"

Moody's 5% yield prediction underscores the complexities of the current economic environment. While arguments for "selling America" exist, the US economy retains significant strengths. A knee-jerk reaction based solely on the "Sell America" narrative is unwise. Instead, investors should adopt a well-informed, long-term investment strategy that includes thorough US market analysis and careful risk assessment. By employing financial planning techniques and focusing on long-term investment goals, and ensuring appropriate diversification, investors can navigate the uncertainties and potentially capitalize on both risks and opportunities. Carefully analyze your portfolio and adjust your investment strategy accordingly to ensure alignment with your risk tolerance and long-term financial objectives. Don't simply "Sell America"—plan strategically for a secure financial future.

Featured Posts

-

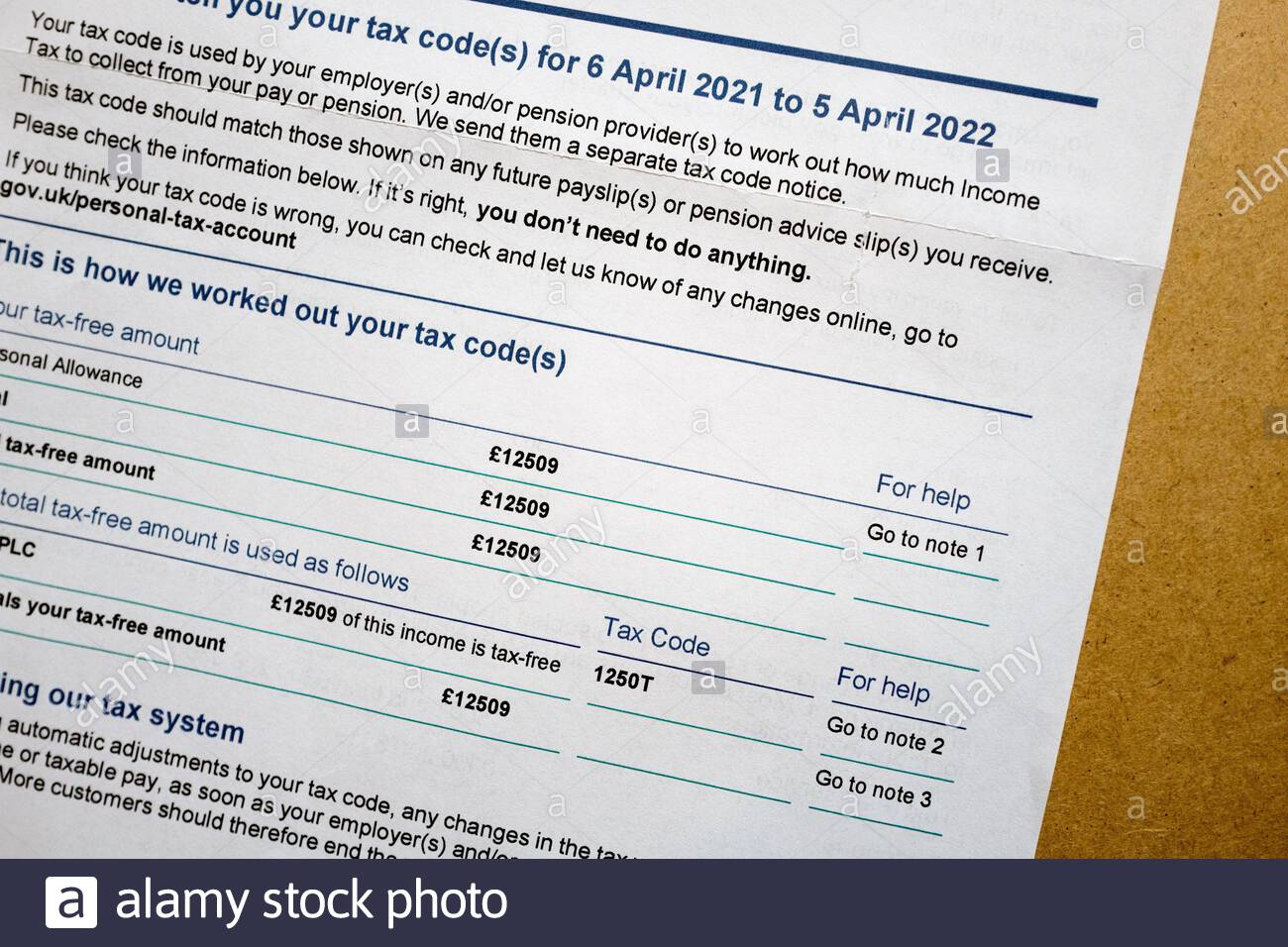

Hmrc Letters To High Earners Thousands Affected By 23 000 Threshold

May 20, 2025

Hmrc Letters To High Earners Thousands Affected By 23 000 Threshold

May 20, 2025 -

Changes To Hmrc Tax Codes And Their Impact On Savings

May 20, 2025

Changes To Hmrc Tax Codes And Their Impact On Savings

May 20, 2025 -

Situatsiya Pechalnaya Drug Mikhaelya Shumakhera Rasskazal O Ego Sostoyanii

May 20, 2025

Situatsiya Pechalnaya Drug Mikhaelya Shumakhera Rasskazal O Ego Sostoyanii

May 20, 2025 -

Charles Leclercs Ferrari Situation Pre Imola Update

May 20, 2025

Charles Leclercs Ferrari Situation Pre Imola Update

May 20, 2025 -

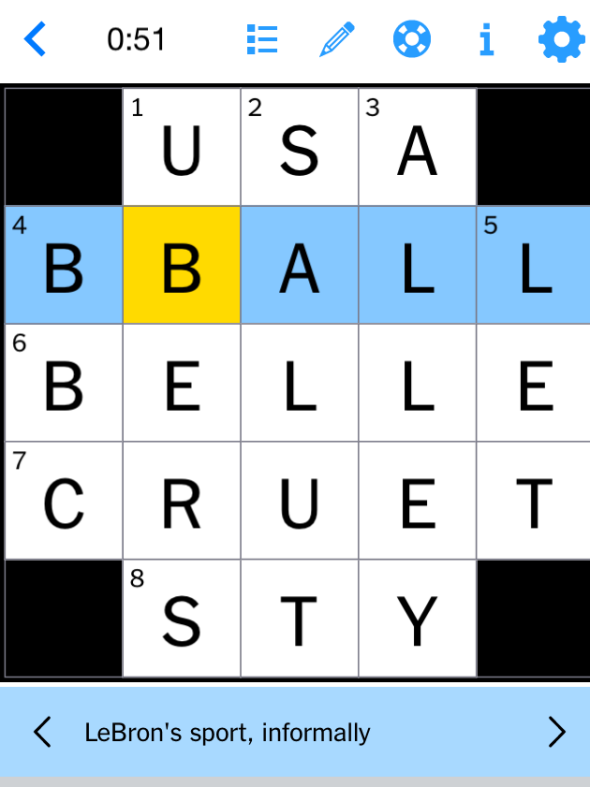

Finding The Answers Nyt Mini Crossword March 13 2025

May 20, 2025

Finding The Answers Nyt Mini Crossword March 13 2025

May 20, 2025

Latest Posts

-

Mondays Market Sell Off Analyzing The Impact On D Wave Quantum Qbts

May 20, 2025

Mondays Market Sell Off Analyzing The Impact On D Wave Quantum Qbts

May 20, 2025 -

Understanding D Wave Quantum Qbts Stocks Significant Monday Dip

May 20, 2025

Understanding D Wave Quantum Qbts Stocks Significant Monday Dip

May 20, 2025 -

D Wave Quantum Qbts Stock Drop Unpacking Mondays Sharp Decline

May 20, 2025

D Wave Quantum Qbts Stock Drop Unpacking Mondays Sharp Decline

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 20, 2025 -

Gretzkys Allegiance To Trump Analyzing The Fallout And Its Long Term Effects

May 20, 2025

Gretzkys Allegiance To Trump Analyzing The Fallout And Its Long Term Effects

May 20, 2025