The Impact Of Trump's XRP Endorsement On Institutional Investors

Table of Contents

Increased Institutional Interest in XRP

Trump's seemingly positive remarks about XRP could significantly alter how institutional investors view the cryptocurrency. Previously hesitant due to perceived risks, institutions might now reassess XRP's potential.

Shifting Investment Strategies

Trump's endorsement might encourage a reassessment of XRP's risk profile by institutional investors, potentially leading to increased allocation in portfolios previously averse to the cryptocurrency.

- Increased confidence: The association with a prominent figure like Trump can boost confidence, especially among investors who may be influenced by his public pronouncements.

- Higher return potential: The perceived risk might be outweighed by the potential for substantially higher returns, leading to a shift in investment strategies.

- Diversification: Institutional investors might see XRP as a means to diversify their cryptocurrency holdings beyond Bitcoin and Ethereum, incorporating this alternative crypto asset into their portfolios.

Enhanced Market Liquidity

Increased institutional interest in XRP, fueled by Trump's endorsement, could dramatically improve market liquidity.

- Increased trading volume: Large-scale buying and selling activities by institutions will naturally increase the overall trading volume of XRP.

- Improved price discovery: Greater liquidity generally leads to more efficient price discovery, reflecting the true market value of the asset more accurately.

- Reduced volatility (potentially): While short-term volatility might initially increase, a larger, more stable institutional presence could potentially lead to reduced price fluctuations in the long term.

Navigating Regulatory Uncertainty

The ongoing SEC lawsuit against Ripple casts a long shadow over XRP's future, regardless of Trump's endorsement. This legal uncertainty is a major factor institutional investors must consider.

The Ongoing SEC Lawsuit

The SEC lawsuit against Ripple remains a significant hurdle. A favorable outcome could dramatically increase XRP's value, while an unfavorable decision could severely damage it. Trump's endorsement doesn't eliminate this risk.

- Impact of a potential settlement: The terms of any SEC settlement will significantly influence investor confidence. A strong settlement could be bullish for XRP, while a less favorable one could lead to significant sell-offs.

- Risk mitigation strategies: Institutional investors will need sophisticated risk mitigation strategies to navigate this uncertainty, potentially including hedging or diversification tactics.

- Due diligence: Thorough legal due diligence and expert legal counsel become even more crucial when dealing with assets facing significant regulatory challenges.

Potential for Regulatory Changes

Trump's influence, even outside of the presidency, could indirectly shape future cryptocurrency regulations in the US, potentially creating a more favorable environment for XRP.

- Political influence: His continued public statements and potential lobbying efforts could indirectly influence regulatory bodies.

- Crypto-friendly framework (potential): This could lead to a more lenient or even crypto-friendly regulatory framework, benefiting XRP and other cryptocurrencies.

- Ongoing uncertainty: The extent of this influence and the ultimate direction of future regulations remains highly uncertain.

Market Volatility and Price Predictions

Trump's statement has already introduced a degree of volatility to the XRP market. Institutional investors need to incorporate this unpredictable element into their strategies.

Short-Term Price Fluctuations

The immediate impact of Trump's endorsement has been reflected in short-term price fluctuations in the XRP market.

- Price spikes and corrections: We've seen short-term price spikes followed by corrections as the market digests the news and assesses the implications.

- Technical analysis: Institutional investors will rely heavily on technical analysis and robust risk management strategies to navigate this volatility.

- Algorithmic trading: High-frequency trading algorithms and other automated trading systems will likely be impacted by these short-term price swings.

Long-Term Market Outlook

Predicting the long-term impact of Trump's endorsement on XRP's price is speculative. Numerous factors will play a role.

- Fundamental analysis: A combination of fundamental analysis (evaluating the underlying technology and adoption) and technical analysis is critical for a long-term outlook.

- Adoption rate: The broader adoption of XRP by businesses and its integration into payment systems will significantly influence its long-term price.

- Global economic conditions: Macroeconomic factors and global financial market conditions will also influence XRP's performance.

Conclusion

Trump's XRP endorsement presents a complex scenario for institutional investors. Increased interest and potential liquidity improvements are counterbalanced by the ongoing SEC lawsuit and inherent market volatility. A thorough understanding of the regulatory landscape and comprehensive risk assessment are crucial for institutions considering XRP investments. The decision to invest requires a careful weighing of potential gains against substantial risks. Further research into the evolving impact of Trump's XRP endorsement is essential for informed decision-making. Don't miss out on understanding the potential of XRP, but proceed with caution and conduct thorough due diligence.

Featured Posts

-

Nba Anthony Edwards Self Promotional Media Stunt During Randle Interview

May 07, 2025

Nba Anthony Edwards Self Promotional Media Stunt During Randle Interview

May 07, 2025 -

Controversy Erupts After Yankee Broadcasters Attack On Mariners

May 07, 2025

Controversy Erupts After Yankee Broadcasters Attack On Mariners

May 07, 2025 -

Clippers Rally Insufficient In Defeat To Cavaliers

May 07, 2025

Clippers Rally Insufficient In Defeat To Cavaliers

May 07, 2025 -

Steelers Combine Performance Securing Pickens Future Successor

May 07, 2025

Steelers Combine Performance Securing Pickens Future Successor

May 07, 2025 -

El Papel De La Cooperacion Administrativa En La Graduacion De Los Paises Menos Adelantados

May 07, 2025

El Papel De La Cooperacion Administrativa En La Graduacion De Los Paises Menos Adelantados

May 07, 2025

Latest Posts

-

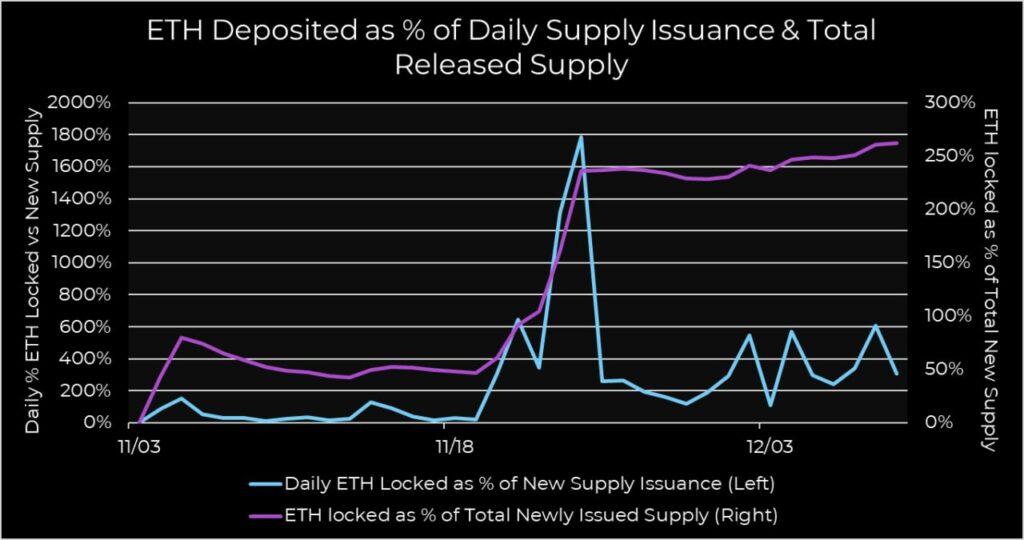

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025 -

Ethereum Transaction Volume Spikes Analysis Of Recent Network Activity

May 08, 2025

Ethereum Transaction Volume Spikes Analysis Of Recent Network Activity

May 08, 2025 -

Sharp Rise In Ethereum Address Activity A 10 Jump In Two Days

May 08, 2025

Sharp Rise In Ethereum Address Activity A 10 Jump In Two Days

May 08, 2025 -

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025 -

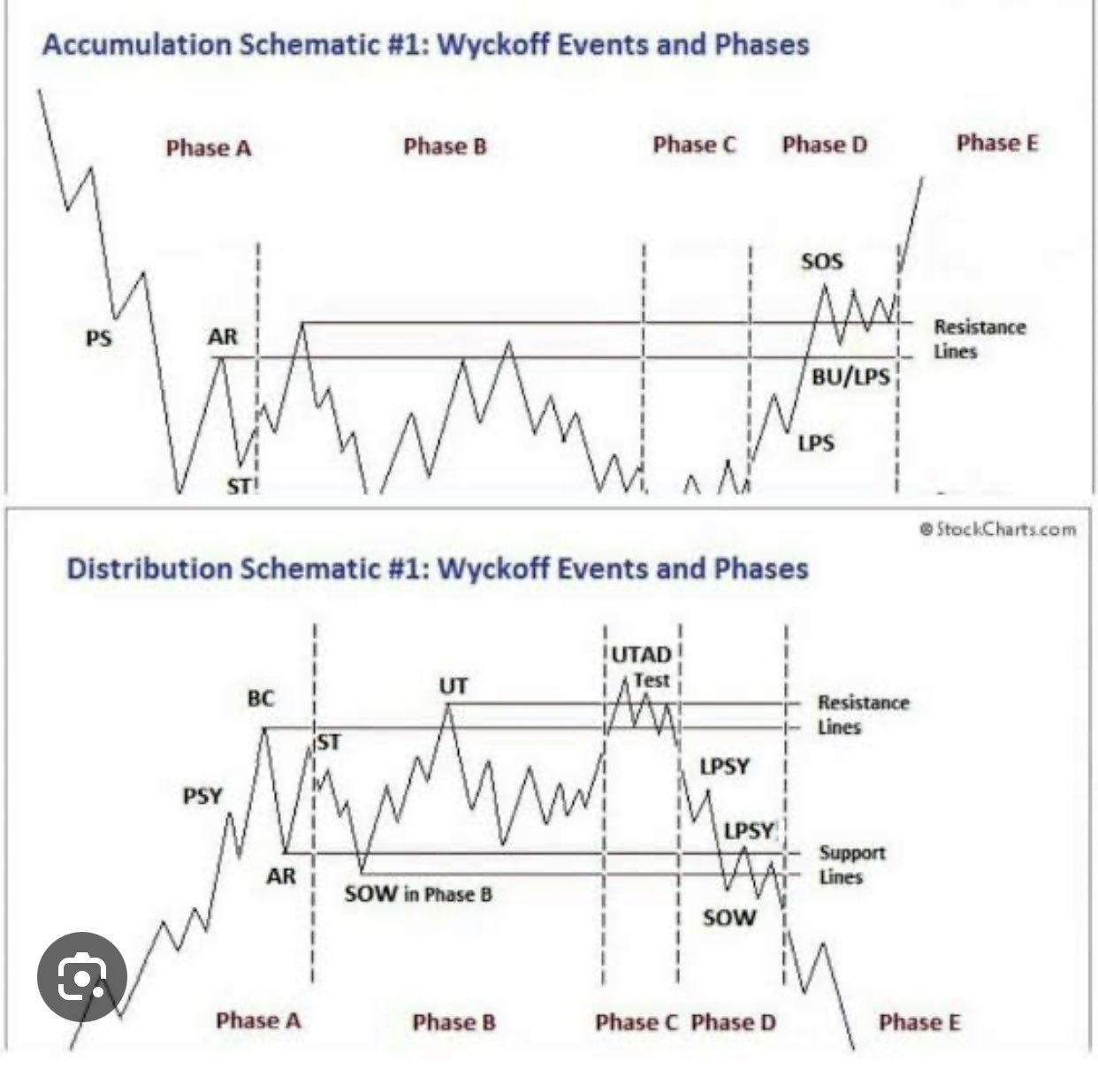

Ethereum Price 2 700 Within Reach As Wyckoff Accumulation Nears Completion

May 08, 2025

Ethereum Price 2 700 Within Reach As Wyckoff Accumulation Nears Completion

May 08, 2025