Trump Attacks Fed Chair Powell: Calls For Termination

Table of Contents

The relationship between the President and the Federal Reserve is inherently complex. The Fed, responsible for setting interest rates and managing the money supply, operates with a degree of independence designed to shield monetary policy from short-term political considerations. However, the President's influence is undeniable, particularly through appointments to the Federal Reserve Board. This article aims to dissect Trump's attacks on Powell, examining the potential consequences and the broader implications for the US economy and the Federal Reserve’s independence.

Trump's Criticisms of Jerome Powell

Allegations of Interest Rate Hikes

Trump consistently criticized Powell's decision to raise interest rates, viewing these increases as detrimental to his economic agenda and reelection prospects. He believed higher rates hampered economic growth and dampened the stock market, ultimately impacting his popularity.

- Example 1: In a tweet from July 2018, Trump directly blamed Powell for slowing economic growth.

- Example 2: During a press conference in November 2018, Trump stated that Powell was making a "big mistake" by raising interest rates.

- Example 3: Numerous interviews and public speeches reiterated these sentiments.

Powell, however, argued that the rate hikes were necessary to combat inflation and maintain long-term economic stability. Economic data at the time, such as rising inflation indicators and strong employment figures, arguably supported his decisions. The debate highlights the inherent tension between short-term political gains and long-term economic health.

Accusations of Slowing Economic Growth

Trump frequently asserted that Powell's policies were directly responsible for slowing economic growth, potentially leading to job losses and even a recession. He framed Powell's actions as an intentional sabotage of his administration's achievements.

- Quote 1: Trump stated, "[Powell] is raising interest rates too fast. It's hurting our economy."

- Quote 2: He accused Powell of creating a "witch hunt" against his economic policies.

While some economists agreed that higher interest rates could dampen growth, others argued that Powell's actions were necessary to prevent runaway inflation and a potential economic crisis in the long run. The timing and scale of rate hikes remain a subject of debate amongst economic experts.

Calls for Powell's Termination

Trump's most controversial action was his repeated calls for Powell's dismissal. He openly considered removing Powell from his position, citing his dissatisfaction with monetary policy decisions.

- Instance 1: Multiple news reports documented Trump's private discussions regarding Powell's potential removal.

- Instance 2: Public statements hinted at Trump's frustration and consideration of replacing Powell.

The President's power to remove the Fed Chair is limited. While the President appoints Fed governors, removing a sitting Chair would set a dangerous precedent, severely undermining the Fed's independence and potentially triggering a significant market downturn.

Impact on the Economy and Financial Markets

Market Volatility and Uncertainty

Trump's attacks on Powell contributed significantly to market volatility and uncertainty. Investors reacted negatively to the perceived political interference in the central bank's operations.

- Example 1: Stock markets experienced significant fluctuations following Trump's public criticisms of Powell.

- Example 2: The US dollar experienced increased volatility.

The uncertainty fueled by Trump's actions increased risk aversion among investors, impacting investment decisions and potentially hindering economic growth.

International Implications

The political instability stemming from Trump's actions had significant international implications. Global investors viewed the attacks as a threat to the stability of the US economy and the global financial system.

- Impact 1: International confidence in the US dollar declined.

- Impact 2: Foreign investment in US assets decreased.

These actions damaged US credibility and its standing in the global financial community, highlighting the interconnected nature of domestic and international economics.

The Importance of an Independent Federal Reserve

Protecting the Fed from Political Interference

The independence of the Federal Reserve is paramount for maintaining a stable and predictable economy. Political interference in monetary policy can lead to short-sighted decisions that ultimately harm long-term economic health.

- Example 1: Historically, instances of political interference in central banks have resulted in inflationary spirals and economic instability.

- Example 2: Countries with less independent central banks often experience higher levels of inflation and greater economic volatility.

Maintaining the Fed's autonomy ensures that monetary policy decisions are based on sound economic principles rather than political expediency, safeguarding the long-term economic well-being of the nation.

Conclusion

Trump's attacks on Fed Chair Powell represent a significant challenge to the independence of the Federal Reserve. His criticisms, ranging from allegations of interest rate hikes to calls for Powell's termination, created significant market volatility, international uncertainty, and raised concerns about the long-term health of the US economy. The key takeaway is the critical need to protect the Fed from political interference to maintain economic stability. Understanding the Federal Reserve's role and the importance of its independence is crucial for informed civic engagement. Learn more about the Federal Reserve and the ongoing debate surrounding "Trump's attacks on Fed Chair Powell" to ensure a stable and prosperous future for the US economy.

Featured Posts

-

L Europe Et Les Marches Decryptage De La Relation Complexe Selon Amandine Gerard

Apr 23, 2025

L Europe Et Les Marches Decryptage De La Relation Complexe Selon Amandine Gerard

Apr 23, 2025 -

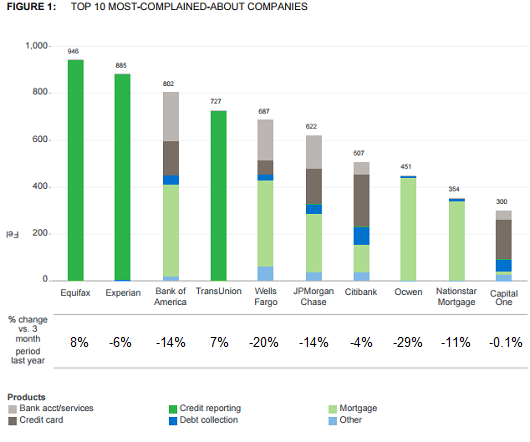

Equifax Reports Better Than Expected Profits Maintains Macroeconomic Risk Assessment

Apr 23, 2025

Equifax Reports Better Than Expected Profits Maintains Macroeconomic Risk Assessment

Apr 23, 2025 -

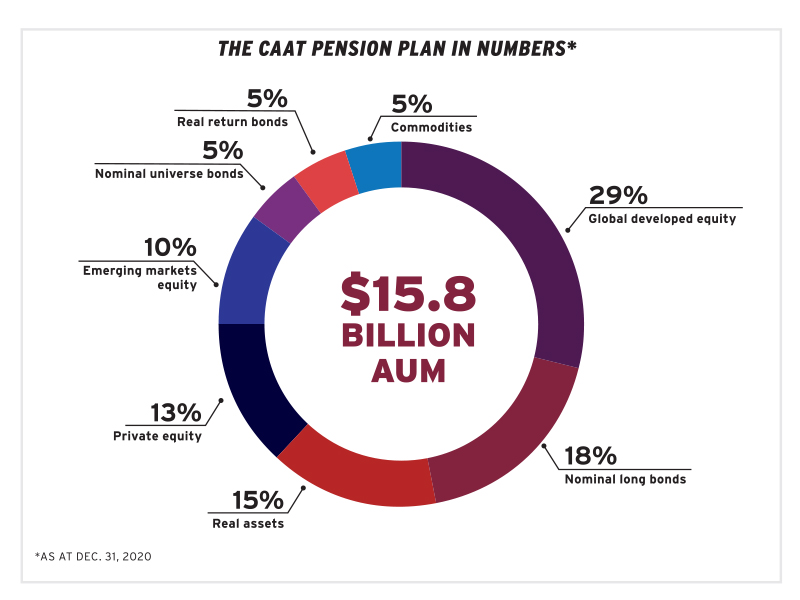

Caat Pension Plan Targets Growth Through Canadian Private Investments

Apr 23, 2025

Caat Pension Plan Targets Growth Through Canadian Private Investments

Apr 23, 2025 -

Canadian Private Investment A Key Focus For Caat Pension Plan

Apr 23, 2025

Canadian Private Investment A Key Focus For Caat Pension Plan

Apr 23, 2025 -

Morning Retail Nutriscore Quels Industriels Jouent Vraiment Le Jeu

Apr 23, 2025

Morning Retail Nutriscore Quels Industriels Jouent Vraiment Le Jeu

Apr 23, 2025