Understanding The Dollar's Effect On Asian Currency Markets

Table of Contents

The Dollar as a Global Reserve Currency

The dollar's role as the world's primary reserve currency profoundly influences international trade and, consequently, Asian currency markets. Many countries in Asia hold substantial US dollar reserves, utilizing the dollar for a significant portion of their international transactions. This reliance creates a direct link between the dollar's value and the stability of Asian economies.

- Extensive Dollar Reserves: Many Asian nations maintain significant portions of their foreign exchange reserves in US dollars. This practice stems from the dollar's historical stability and its widespread acceptance in global commerce.

- Dominance in Asian Trade: A large volume of Asian trade is invoiced and settled in US dollars. This means that even companies conducting business primarily within Asia are exposed to dollar fluctuations. Changes in the dollar's value directly affect the profitability of these transactions.

- Reserve Valuation Impact: Fluctuations in the dollar's value directly impact the value of these US dollar reserves held by Asian central banks. A weakening dollar reduces the real value of these holdings, potentially impacting a country's ability to intervene in its currency markets or to meet its international obligations.

- Export and Import Prices: The dollar's value significantly impacts the price of imports and exports for Asian nations. A strong dollar makes Asian exports more expensive for global buyers, while a weak dollar makes imports more costly for Asian consumers.

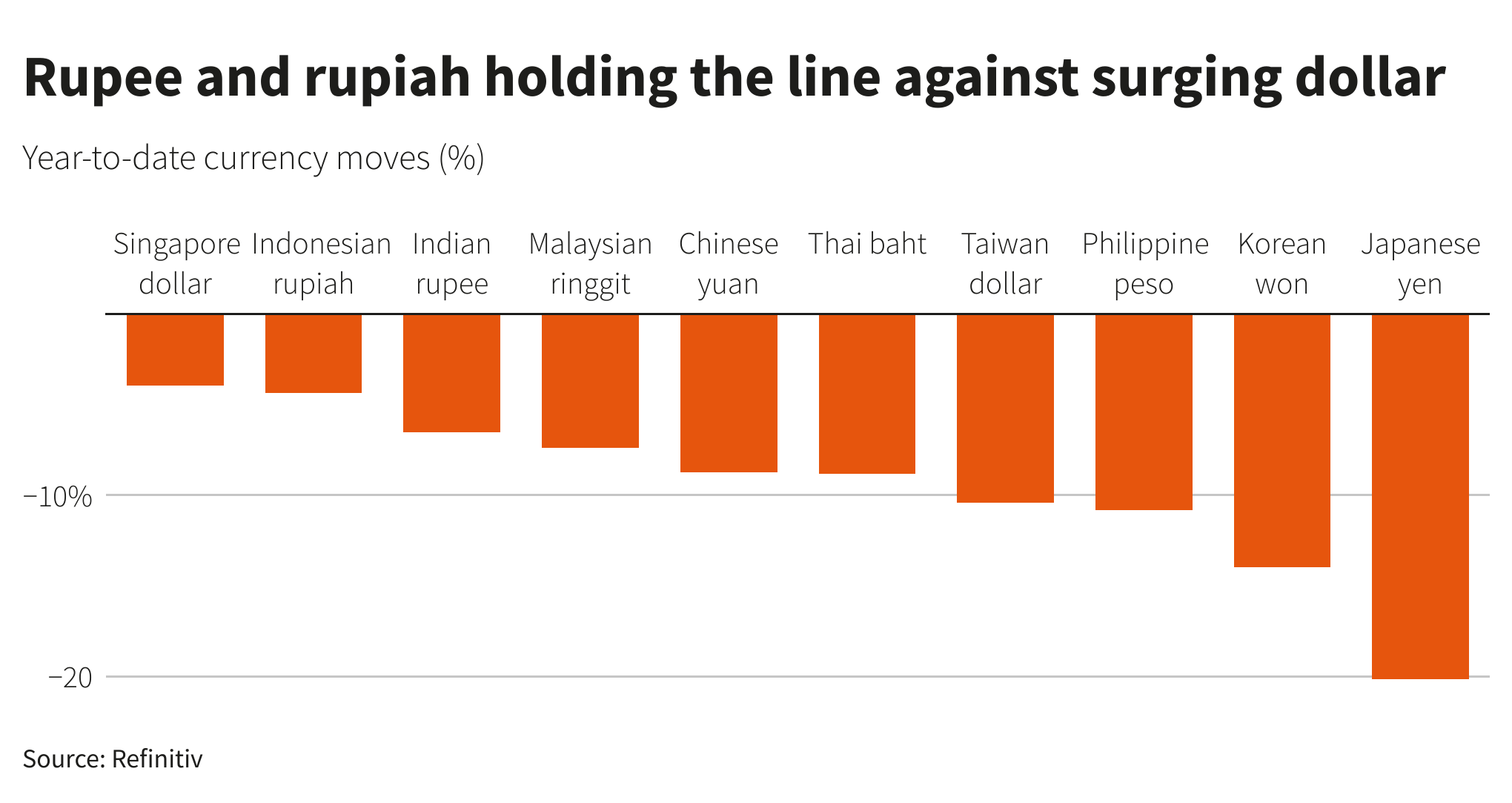

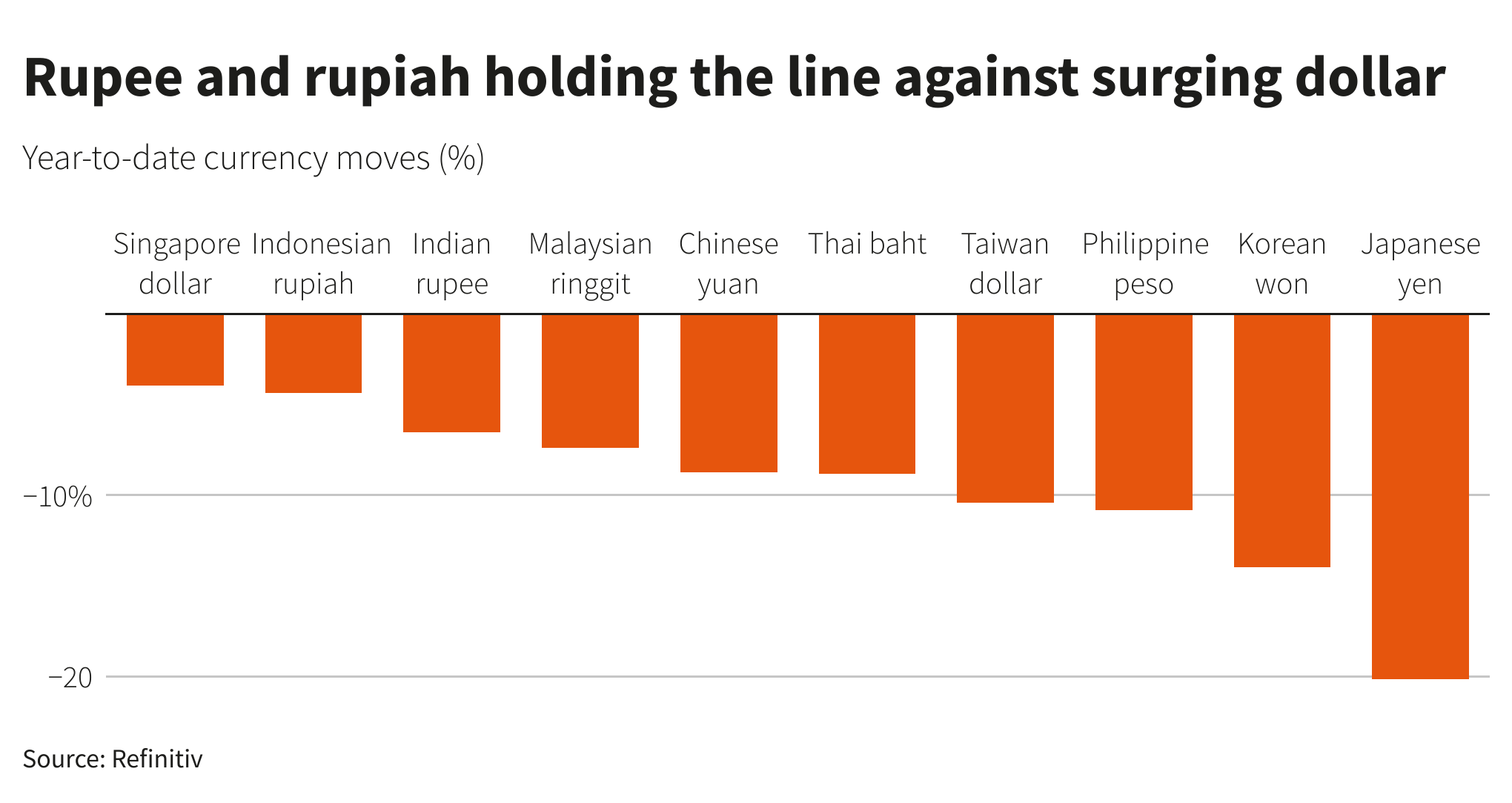

Direct Impact on Asian Currency Exchange Rates

A strong correlation exists between the strength of the US dollar and the value of Asian currencies. Generally, a stronger dollar leads to weaker Asian currencies, and vice versa. This relationship is a direct consequence of the dollar's role in international trade and finance.

- Dollar Strength and Asian Currency Weakness: When the dollar strengthens against other major currencies, it typically leads to a weakening of Asian currencies. This is because the demand for dollars increases, pushing up the dollar's value relative to other currencies, including those of Asian nations.

- Dollar Weakness and Asian Currency Strength: Conversely, when the dollar weakens, Asian currencies tend to appreciate. This occurs because the demand for dollars decreases, lowering its value relative to other currencies.

- Historical Examples: Examining historical data reveals a clear pattern: periods of dollar strength often coincide with weakening Asian currencies, and periods of dollar weakness are often associated with strengthening Asian currencies. Charts depicting the relationship between the US Dollar Index (DXY) and major Asian currencies like the Japanese Yen or Chinese Yuan would visually demonstrate this correlation.

- Currency Pairs: Traders closely monitor currency pairs like USD/JPY (US dollar/Japanese yen), USD/CNY (US dollar/Chinese yuan), and USD/INR (US dollar/Indian rupee) to gauge the dollar's influence on Asian currencies.

Impact on Inflation and Interest Rates

Dollar movements significantly influence inflation and interest rates in Asian economies. Changes in the dollar's value directly affect the cost of imports and exports, influencing price levels and prompting central banks to adjust monetary policy.

- Import Costs: A strong dollar makes dollar-denominated imports cheaper for Asian countries, potentially reducing inflation. Conversely, a weak dollar makes imports more expensive, potentially increasing inflation.

- Inflationary Pressures: These fluctuations in import prices directly impact inflation rates in Asia. Central banks must consider these external factors when setting monetary policy.

- Interest Rate Adjustments: To counter inflationary pressures stemming from dollar movements, Asian central banks may adjust interest rates. Higher interest rates can curb inflation but might also slow economic growth.

- Currency Wars: Significant dollar fluctuations can sometimes lead to competitive devaluations among Asian nations, a situation often referred to as "currency wars," where countries try to gain a competitive edge by weakening their own currencies.

Indirect Effects Through Global Capital Flows

Dollar movements influence investor behavior and capital flows into and out of Asia. Investors often shift their capital toward assets denominated in stronger currencies, leading to significant capital flows based on the dollar's performance.

- Capital Flight: A strong dollar often encourages capital outflows from Asia, as investors seek higher returns in dollar-denominated assets. This can put downward pressure on Asian currencies and stock markets.

- Capital Inflows: Conversely, a weak dollar can attract capital inflows into Asia, as investors look for opportunities in potentially undervalued Asian assets. This can lead to increased investment in Asian stock markets and boost Asian currencies.

- Stock Market Impact: The dollar's strength or weakness significantly affects Asian stock markets. A strong dollar tends to negatively impact the performance of Asian equities, while a weak dollar can have a positive effect.

- Foreign Direct Investment (FDI): FDI flows into Asia are also influenced by dollar movements. A strong dollar might deter FDI, while a weak dollar might make Asian investments more attractive to foreign investors.

Specific Examples of Asian Currencies Affected

The dollar's influence varies across different Asian currencies due to unique economic structures, policies, and vulnerabilities.

- Japanese Yen (JPY): The JPY's sensitivity to dollar movements is significant due to Japan's large trade surplus and substantial dollar holdings.

- Chinese Yuan (CNY): While the CNY is increasingly internationalized, its exchange rate remains managed, reducing the direct impact of dollar movements compared to freely floating currencies.

- Indian Rupee (INR): The INR is sensitive to dollar movements, influenced by India's reliance on imports and its large foreign exchange reserves.

- South Korean Won (KRW): The KRW is susceptible to dollar fluctuations due to its significant reliance on exports and its exposure to global capital flows.

Each of these currencies demonstrates a unique response to changes in the dollar's value, highlighting the complexity of the relationship between the dollar and Asian currencies. Analyzing the specific vulnerabilities and strengths of each currency against the dollar is crucial for informed decision-making.

Conclusion

The US dollar's influence on Asian currency markets is undeniable and multifaceted. Its role as a reserve currency, coupled with direct and indirect effects on exchange rates, inflation, interest rates, and capital flows, creates a complex dynamic. Understanding these intricate relationships is critical for navigating the Asian economic landscape. Stay informed about the dollar's effect on Asian currencies to make informed investment and business decisions. Continue to learn about the nuances of global currency markets and their impact on your financial strategies – understanding the dollar's effect on Asian currencies is key to long-term success.

Featured Posts

-

How To Watch Celtics Vs Heat Live Stream And Tv Guide

May 06, 2025

How To Watch Celtics Vs Heat Live Stream And Tv Guide

May 06, 2025 -

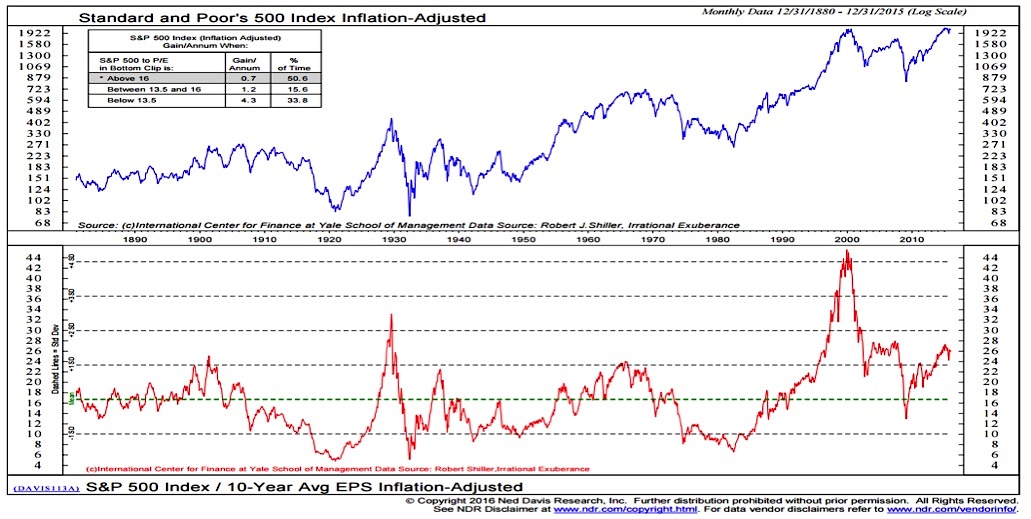

Stock Market Valuations Bof As Reassurance For Investors

May 06, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 06, 2025 -

The Controversy Surrounding Ddgs Dont Take My Son Diss Track

May 06, 2025

The Controversy Surrounding Ddgs Dont Take My Son Diss Track

May 06, 2025 -

Mindy Kaling Quebra O Silencio Anos De Idas E Vindas Com Ex De The Office

May 06, 2025

Mindy Kaling Quebra O Silencio Anos De Idas E Vindas Com Ex De The Office

May 06, 2025 -

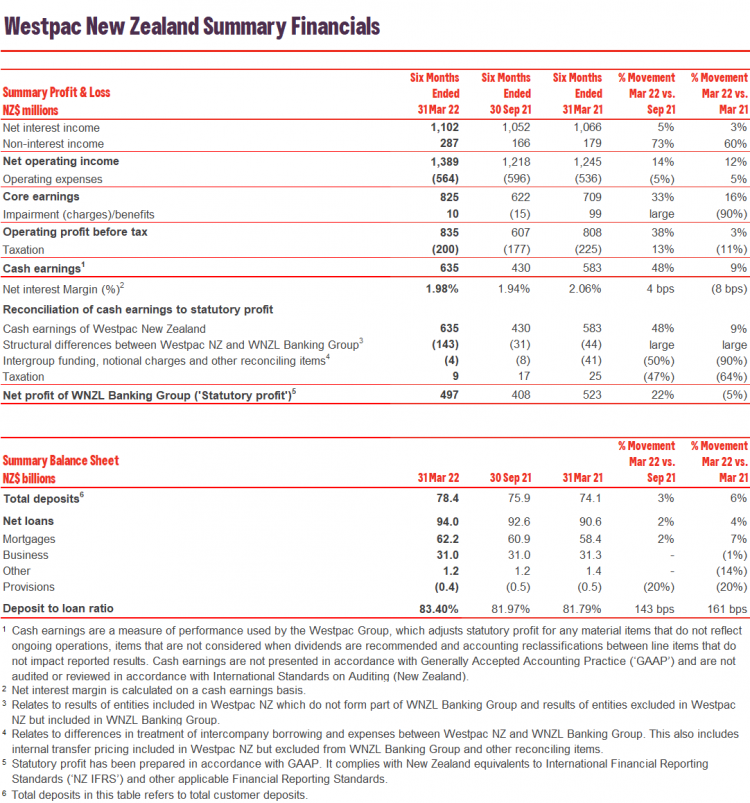

Analysis Of Westpac Wbc Earnings Margin Compression And Future Outlook

May 06, 2025

Analysis Of Westpac Wbc Earnings Margin Compression And Future Outlook

May 06, 2025

Latest Posts

-

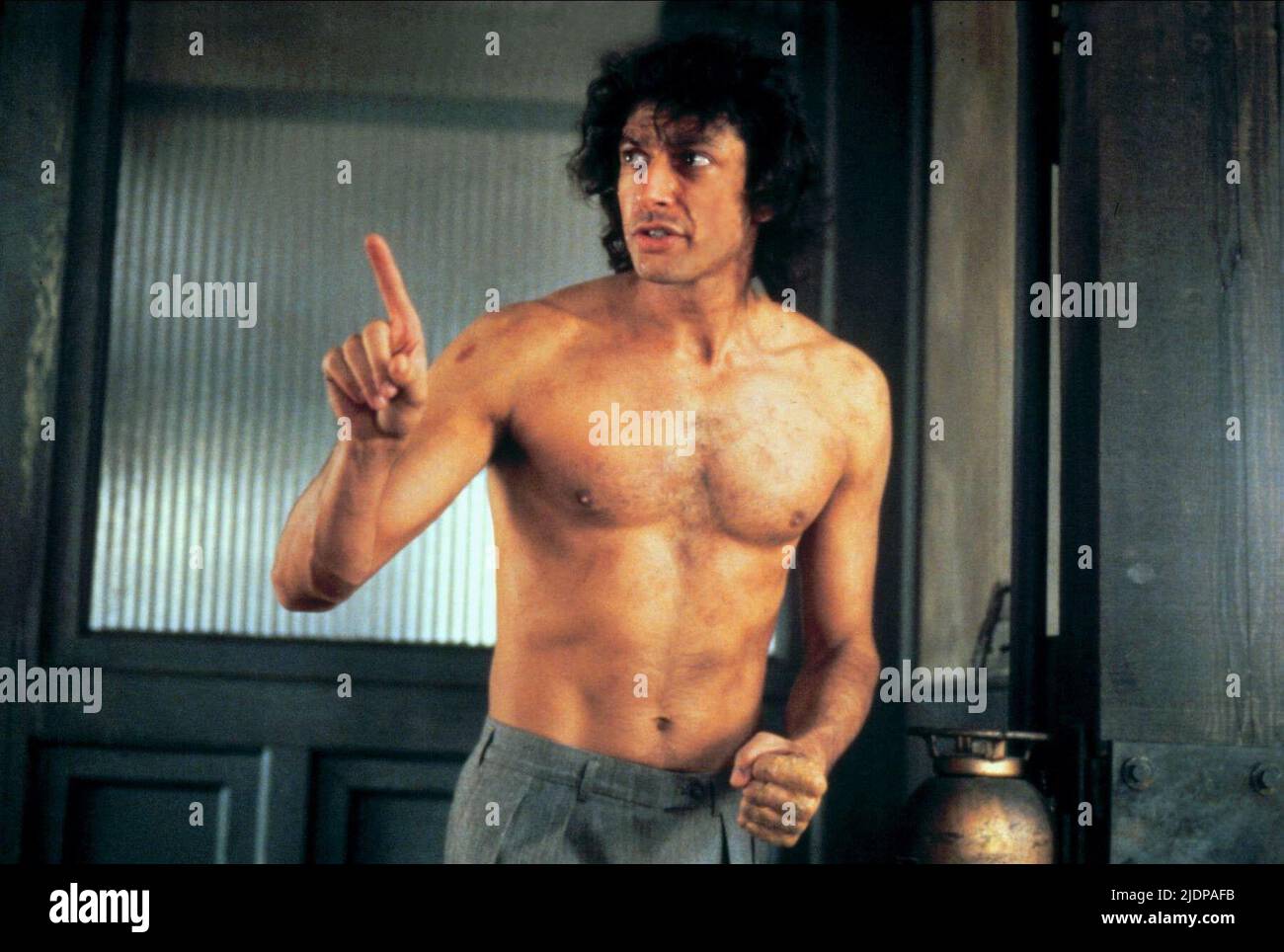

The Fly 1986 Jeff Goldblums Performance And Its Oscar Snub

May 06, 2025

The Fly 1986 Jeff Goldblums Performance And Its Oscar Snub

May 06, 2025 -

A Look Back The History And Significance Of Independence Day

May 06, 2025

A Look Back The History And Significance Of Independence Day

May 06, 2025 -

Getting To Know Emilie Livingston Jeff Goldblums Wife Age And Family Details

May 06, 2025

Getting To Know Emilie Livingston Jeff Goldblums Wife Age And Family Details

May 06, 2025 -

Independence Day Traditions And Activities Across The Nation

May 06, 2025

Independence Day Traditions And Activities Across The Nation

May 06, 2025 -

Exploring Jeff Goldblums Family Life With Wife Emilie Livingston And Their Children

May 06, 2025

Exploring Jeff Goldblums Family Life With Wife Emilie Livingston And Their Children

May 06, 2025