What We Learned About Treasuries On April 8th

Table of Contents

Yield Curve Shifts and Their Implications

The shape of the yield curve, which illustrates the relationship between Treasury yields and their maturities, offers valuable insights into economic expectations. On April 8th, the yield curve's behavior provided important clues about the market's outlook.

Impact of Inflation Data

The release of inflation data on April 8th had an immediate and significant effect on Treasury yields.

- Analysis of Inflation and Treasury Yields: Higher-than-expected inflation generally leads to increased Treasury yields as investors demand higher returns to compensate for the erosion of purchasing power. Conversely, lower-than-expected inflation can push yields down.

- Specific Data and Deviations: [Insert specific inflation data released on April 8th, e.g., CPI, PPI, etc., and compare them to market expectations. Mention whether the data was higher or lower than anticipated and the magnitude of the surprise]. This [higher/lower] than expected data significantly impacted investor sentiment.

- Implications for Federal Reserve Policy: The inflation data released on April 8th influenced market expectations regarding future Federal Reserve policy. Higher-than-expected inflation might signal a more aggressive approach to interest rate hikes, potentially pushing Treasury yields higher. Conversely, lower-than-expected inflation could suggest a more dovish stance.

Steepening/Flattening of the Yield Curve

The yield curve's shape on April 8th provided additional insights. A steepening yield curve, where the difference between long-term and short-term yields increases, often suggests expectations of robust economic growth. Conversely, a flattening curve might foreshadow a slowdown or even a recession.

- Significance of Yield Curve Shape: The yield curve is a leading economic indicator. Its shape reflects market participants' expectations about future interest rates and economic growth.

- Implications for Economic Growth: On April 8th, [describe the observed steepening or flattening of the yield curve]. This suggests [interpret the implication for economic growth; e.g., expectations of stronger growth or concerns about a slowdown].

- Specific Yield Spreads: [Provide specific examples of yield spreads between different Treasury maturities, such as the 2-year/10-year spread or the 5-year/30-year spread. Analyze their change from previous days]. These spreads provide crucial information for assessing economic prospects.

Trading Volume and Volatility

Analyzing trading volume and volatility in the Treasury market on April 8th provides insights into market sentiment and potential price swings.

Unusual Trading Activity

[Describe any notable spikes or dips in trading volume for various Treasury securities on April 8th. Provide specific data or examples where possible].

- Reasons for Unusual Activity: Possible explanations for the unusual trading activity could include: [List potential reasons, such as specific news events (e.g., geopolitical developments, unexpected economic announcements), changes in investor sentiment, or large institutional trades].

- Impact of High/Low Trading Volume: High trading volume often correlates with increased price volatility, as more buyers and sellers are actively engaged in the market. Low volume may indicate less market activity and potentially lower volatility.

- Data Points: [Include data points to support the claims about trading volume and volatility; e.g., percentage change in volume compared to the previous day or the average daily volume].

Impact on Price Fluctuations

Changes in trading volume directly impact Treasury prices.

- Short-Term and Long-Term Price Implications: [Analyze the short-term and long-term impact of the volume changes on Treasury prices. For example, a sudden surge in volume might lead to short-term price swings, while sustained high volume could indicate a longer-term trend].

- Connection to Market Events: [Connect specific price movements to particular market events and news on April 8th].

- Charts/Graphs: [If available, include charts or graphs illustrating price fluctuations of different Treasury securities].

Investor Sentiment and Market Positioning

Understanding investor sentiment is crucial for interpreting Treasury market movements.

Risk-On/Risk-Off Sentiment

On April 8th, the prevailing investor sentiment was largely [describe the prevailing sentiment – risk-on or risk-off].

- Flight-to-Safety: During periods of uncertainty, investors often move towards safe-haven assets, like Treasuries, leading to increased demand and potentially lower yields (flight-to-safety).

- Shifts in Investor Preferences: [Analyze if investors showed a preference for specific Treasury maturities on April 8th. Did investors favor short-term, medium-term, or long-term Treasuries? Explain why].

- Institutional Investor Holdings: [If available, mention any significant changes in the holdings of major institutional investors in Treasuries on April 8th].

Impact on Future Treasury Market Outlook

The events of April 8th have significant implications for the future Treasury market.

- Potential Changes in Interest Rates: [Analyze potential changes in interest rates based on the day's events. Higher inflation might suggest further rate hikes].

- Forecast for Treasury Yields: [Provide a cautious forecast for the likely direction of Treasury yields in the coming weeks/months based on the analysis].

- Recommendations for Investors: [Offer some cautious recommendations for investors considering Treasury investments, such as diversifying their portfolio or focusing on specific maturities].

Conclusion

The Treasury market on April 8th exhibited notable shifts in yield curves, trading volumes, and investor sentiment. Understanding the interplay of these factors is crucial for navigating the complexities of the Treasury market. The interplay of inflation data, yield curve shape, and trading volume influenced investor decisions, leading to price fluctuations. Analyzing Treasuries April 8th data helps forecast potential changes in interest rates and informs investment strategies. Understanding the nuances of the Treasury market is crucial for informed investment. Stay updated on daily market shifts and learn more about how to effectively analyze data related to Treasuries April 8th and beyond.

Featured Posts

-

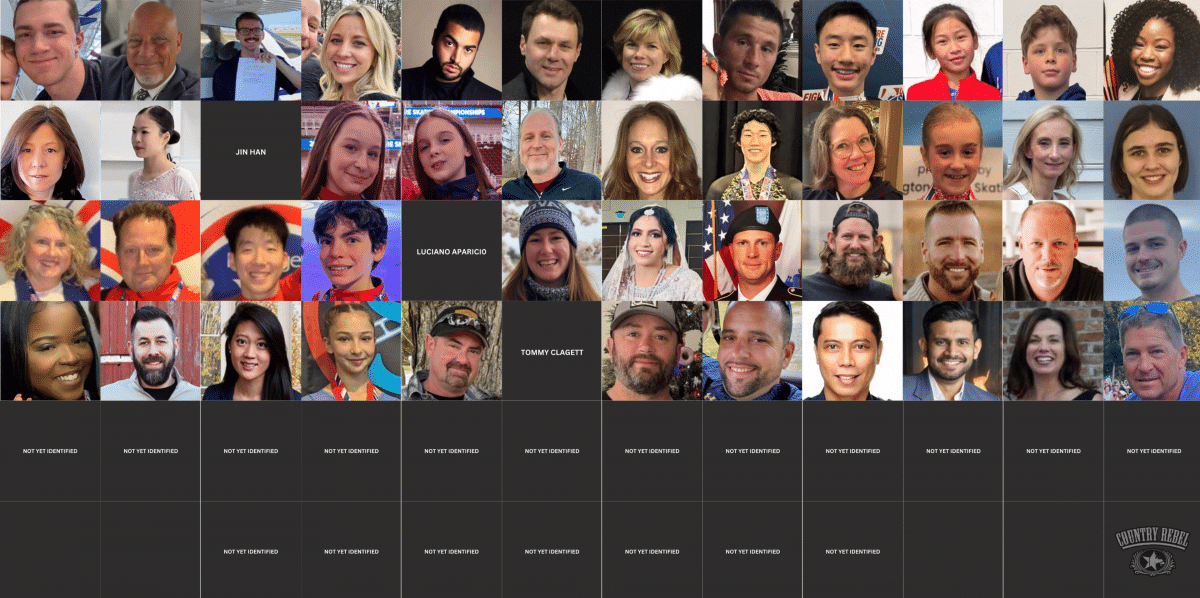

Fatal D C Helicopter Crash Examining The Pilots Actions And Training

Apr 29, 2025

Fatal D C Helicopter Crash Examining The Pilots Actions And Training

Apr 29, 2025 -

Can Film Tax Credits Boost Minnesotas Tv And Film Industry

Apr 29, 2025

Can Film Tax Credits Boost Minnesotas Tv And Film Industry

Apr 29, 2025 -

Nyt Spelling Bee March 15 2025 Find The Pangram And Answers

Apr 29, 2025

Nyt Spelling Bee March 15 2025 Find The Pangram And Answers

Apr 29, 2025 -

Ais Limited Thinking A Revealing Look At Artificial Intelligence

Apr 29, 2025

Ais Limited Thinking A Revealing Look At Artificial Intelligence

Apr 29, 2025 -

Analysis The Republican Divisions Threatening Trumps Tax Agenda

Apr 29, 2025

Analysis The Republican Divisions Threatening Trumps Tax Agenda

Apr 29, 2025

Latest Posts

-

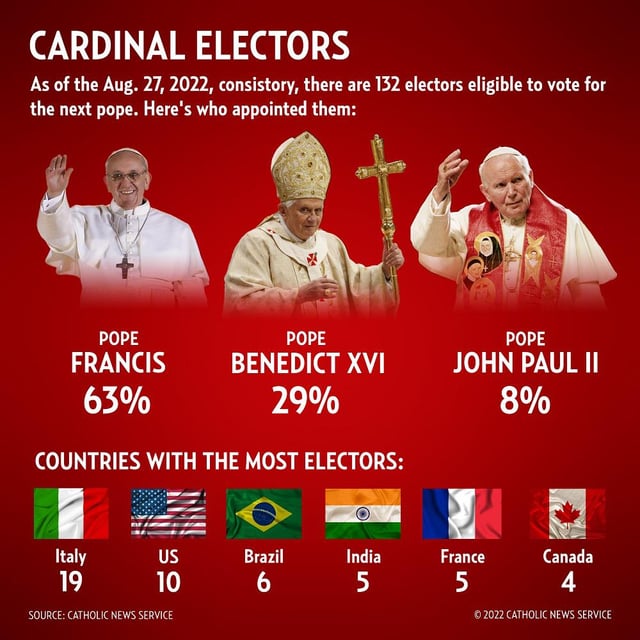

Papal Conclave Convicted Cardinals Unexpected Demand

Apr 29, 2025

Papal Conclave Convicted Cardinals Unexpected Demand

Apr 29, 2025 -

Cardinals Conclave Voting Rights A Legal Battle

Apr 29, 2025

Cardinals Conclave Voting Rights A Legal Battle

Apr 29, 2025 -

Cardinal Maintains Entitlement To Vote In Next Papal Election

Apr 29, 2025

Cardinal Maintains Entitlement To Vote In Next Papal Election

Apr 29, 2025 -

Papal Conclave Debate Surrounds Convicted Cardinals Voting Rights

Apr 29, 2025

Papal Conclave Debate Surrounds Convicted Cardinals Voting Rights

Apr 29, 2025 -

Cardinal Convicted Of Specific Crime Seeks To Participate In Papal Conclave

Apr 29, 2025

Cardinal Convicted Of Specific Crime Seeks To Participate In Papal Conclave

Apr 29, 2025