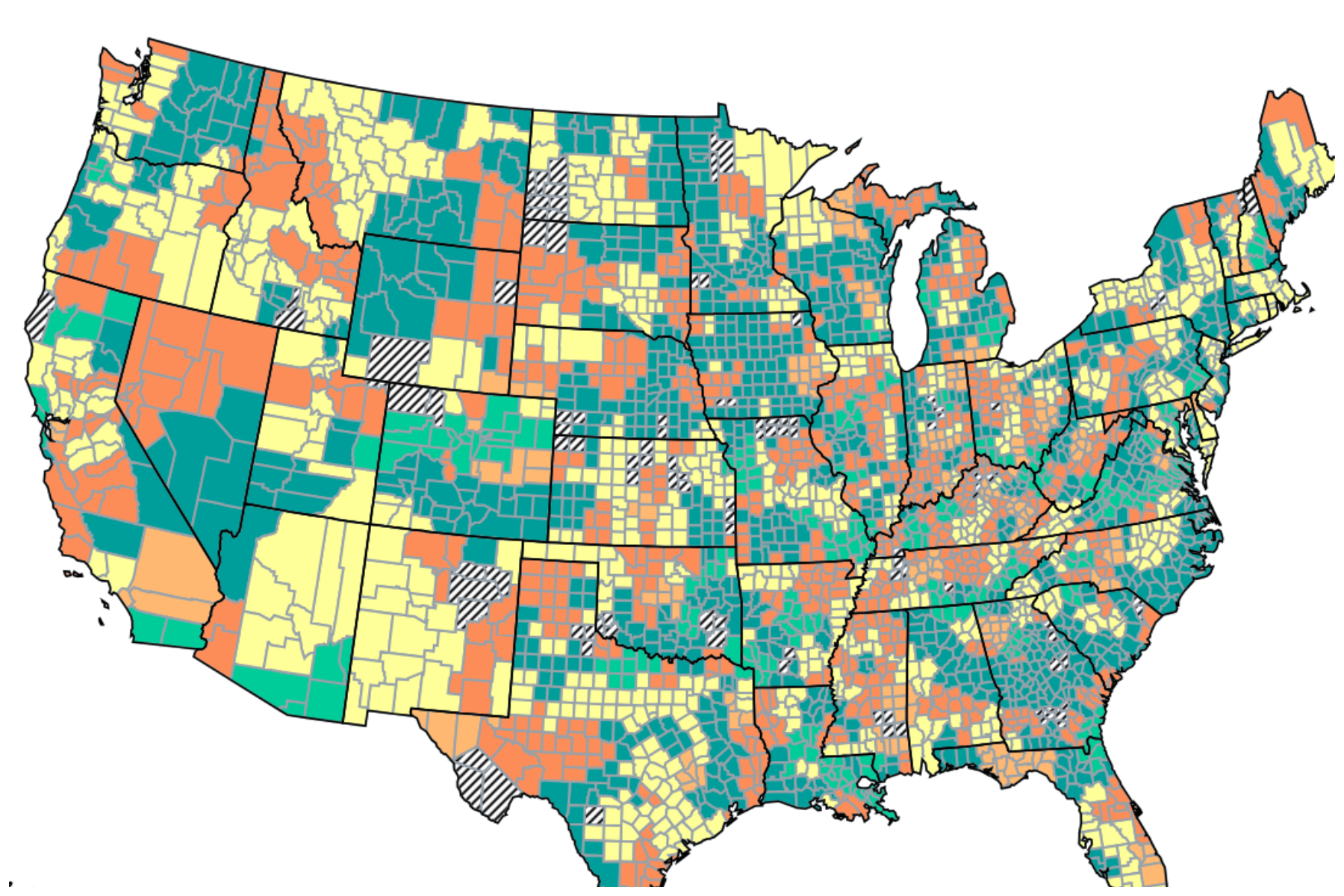

Where To Invest: A Map Of The Country's Rising Business Hotspots

Table of Contents

Tech Hubs: Silicon Valleys in the Making

The technology sector is a driving force of economic growth, and several regions are emerging as significant tech investment hotspots. These areas boast a thriving startup ecosystem, attracting venture capital and fostering innovation. Successful tech investments require identifying regions with a strong talent pool, supportive government initiatives, and a vibrant entrepreneurial spirit. Looking for where to invest in tech? Consider these factors:

- Rapid growth in startup activity and venture capital funding: The influx of capital signifies a belief in the region's potential for high returns. Look for areas with consistently increasing VC funding rounds and a high density of newly-founded tech companies.

- Presence of major tech companies and incubators: Established tech giants often act as magnets, attracting further investment and talent. Incubators and accelerators provide crucial support for early-stage startups.

- Strong talent pool of skilled engineers and developers: A readily available workforce of skilled professionals is essential for sustained technological growth. Universities and technical colleges producing graduates with in-demand skills are key indicators.

- Government initiatives supporting technological innovation: Tax breaks, grants, and other government incentives can significantly boost the appeal of a region for tech investments.

- Examples of successful tech startups in these regions: The existence of successful, high-growth startups validates the region's potential as a thriving tech hub.

Bullet Points:

- City A (e.g., Austin, TX): Strong in AI and Fintech, attracting significant venture capital and boasting a large pool of skilled engineers.

- City B (e.g., Seattle, WA): Focus on software development and gaming, fueled by the presence of major tech companies like Amazon and Microsoft.

- City C (e.g., Denver, CO): Emerging hub for renewable energy technology, benefiting from government support and abundant natural resources.

Manufacturing and Logistics Powerhouses: Supply Chain Strongholds

Manufacturing and logistics are fundamental to a strong economy. Investing in these sectors requires identifying regions with robust infrastructure, a skilled workforce, and access to key transportation routes. These areas often benefit from government incentives designed to attract manufacturing businesses. When considering where to invest in manufacturing and logistics, evaluate:

- Strategic location and access to major transportation routes: Proximity to ports, railways, and highways is critical for efficient movement of goods.

- Government incentives for manufacturing businesses: Tax breaks, subsidies, and streamlined regulations can significantly reduce costs and improve profitability.

- Skilled workforce and lower labor costs compared to other areas: A skilled workforce reduces training costs and ensures efficient production.

- Growth in specific manufacturing sectors (e.g., automotive, pharmaceuticals): Focusing on sectors with strong growth potential can yield higher returns.

- Examples of successful manufacturing companies in these regions: The presence of established manufacturers indicates a stable and supportive business environment.

Bullet Points:

- Region X (e.g., Midwest US): Booming automotive manufacturing, supported by a strong supplier network and skilled workforce.

- Region Y (e.g., California's Central Valley): Strong focus on food processing and export, driven by agricultural abundance and strategic location.

- Region Z (e.g., Gulf Coast): Strategic port location boosting logistics, facilitating global trade and attracting related businesses.

Renewable Energy and Sustainable Investments: The Green Revolution

The global shift towards renewable energy presents significant investment opportunities. Regions with abundant natural resources, supportive government policies, and a growing demand for clean energy solutions are particularly attractive. For those considering where to invest in sustainable businesses, key factors include:

- Government support for renewable energy projects: Tax credits, subsidies, and streamlined permitting processes accelerate project development.

- Abundant natural resources (solar, wind, etc.): Regions with ample solar, wind, or geothermal resources offer lower energy production costs.

- Growing demand for clean energy solutions: A strong and growing demand for clean energy ensures a stable market for renewable energy projects.

- Investment opportunities in solar farms, wind farms, and other renewable energy projects: Diversification within the renewable energy sector reduces risk and enhances portfolio resilience.

- Examples of successful renewable energy businesses in these regions: Successful projects demonstrate the viability of renewable energy investments in a specific area.

Bullet Points:

- State A (e.g., California): Leading in solar energy development, with extensive solar farms and a robust solar technology industry.

- State B (e.g., Texas): Significant wind energy potential, leveraging vast plains for wind farm installations.

- State C (e.g., Nevada): Focus on geothermal energy projects, utilizing geothermal resources for electricity generation.

Real Estate and Infrastructure Boom: Building for the Future

Real estate and infrastructure development are closely linked to population growth and economic expansion. Regions with robust infrastructure projects and growing populations often offer attractive real estate investment opportunities. When deciding where to invest in real estate, consider:

- Population growth and increased demand for housing and commercial spaces: Population growth drives demand for residential and commercial properties, leading to potential price appreciation.

- Government investments in infrastructure projects (roads, railways, etc.): Improved infrastructure increases property values and attracts businesses.

- Opportunities for investment in commercial real estate and residential developments: Identifying areas with high demand and potential for future appreciation is crucial.

- Potential for high returns on real estate investments: Careful analysis of market trends and future projections can maximize investment returns.

- Analysis of current market trends and future projections: Understanding market dynamics and future growth forecasts is vital for informed investment decisions.

Bullet Points:

- City D (e.g., New York City): Rapid urban development and high property values, though also with high competition.

- City E (e.g., Atlanta, GA): Major infrastructure projects driving growth, including transportation improvements and new developments.

- City F (e.g., Austin, TX): Attractive real estate market for both residential and commercial properties, fueled by tech sector growth and population influx.

Conclusion

This article has explored some of the most promising rising business hotspots across the country, highlighting diverse investment opportunities in technology, manufacturing, renewable energy, and real estate. By carefully considering these factors and conducting thorough due diligence, investors can make informed decisions and capitalize on the significant growth potential these regions offer.

Call to Action: Ready to discover more about where to invest and unlock lucrative returns? Begin your research today and explore the exciting investment opportunities available in these rising business hotspots. Identify the sector that aligns with your investment goals and start building your portfolio in these dynamic and promising markets. Understanding the nuances of each emerging market is key to successful investment in rising business hotspots.

Featured Posts

-

Clippers Last Ditch Effort Fails In Loss To Cavaliers

May 07, 2025

Clippers Last Ditch Effort Fails In Loss To Cavaliers

May 07, 2025 -

The Ovechkin Effect Mentorship For Russian Nhl Players

May 07, 2025

The Ovechkin Effect Mentorship For Russian Nhl Players

May 07, 2025 -

Stansted Airport New Direct Flights To Casablanca

May 07, 2025

Stansted Airport New Direct Flights To Casablanca

May 07, 2025 -

Kyle Harrison And Carson Whisenhunt The Future Of The San Francisco Giants

May 07, 2025

Kyle Harrison And Carson Whisenhunt The Future Of The San Francisco Giants

May 07, 2025 -

Sonys Ps 5 Pro What We Know About The New Console

May 07, 2025

Sonys Ps 5 Pro What We Know About The New Console

May 07, 2025

Latest Posts

-

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025 -

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025 -

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025 -

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025 -

11 Million Eth Accumulated Implications For Ethereum Price

May 08, 2025

11 Million Eth Accumulated Implications For Ethereum Price

May 08, 2025