XRP Price Surge: Grayscale ETF Filing Fuels Record High Hopes

Table of Contents

H2: Grayscale's Bitcoin ETF Filing and its Ripple Effect on XRP

Grayscale's application for a Bitcoin ETF is arguably the most significant catalyst behind the recent XRP price surge. While seemingly unrelated at first glance, the approval of a Bitcoin ETF would have profound implications for the entire cryptocurrency market, including XRP. A successful Bitcoin ETF application would signify a major step towards broader regulatory acceptance of cryptocurrencies by the Securities and Exchange Commission (SEC).

This increased regulatory clarity could pave the way for the approval of other cryptocurrency ETFs, including a potential XRP ETF. This prospect is particularly enticing for institutional investors who have been hesitant to enter the crypto market due to regulatory uncertainty. The ripple effect would be substantial:

- Increased institutional investor interest in crypto: A Bitcoin ETF would unlock a flood of institutional capital into the crypto market, indirectly benefiting other cryptocurrencies like XRP.

- Potential for greater liquidity in the XRP market: Increased trading volume from institutional investors would significantly improve XRP's liquidity, making it easier to buy and sell.

- Enhanced regulatory clarity: The approval of a Bitcoin ETF would set a precedent for other cryptocurrencies, potentially leading to a more favorable regulatory environment for XRP and its parent company, Ripple.

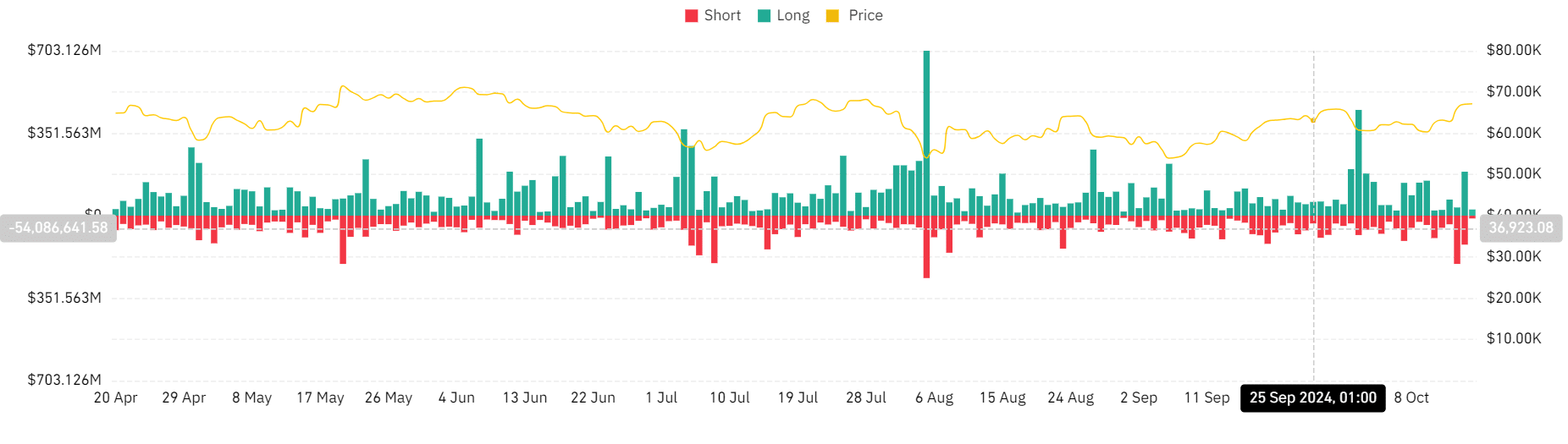

H2: Technical Analysis of the XRP Price Surge

Recent XRP price charts paint a compelling picture of a strong upward trend. We've witnessed a significant breakout from key resistance levels, accompanied by a notable increase in trading volume. This surge in trading activity suggests strong underlying buying pressure, further solidifying the bullish sentiment. Technical indicators like moving averages and the Relative Strength Index (RSI) are also showing positive momentum, supporting the potential for continued price increases.

- Breakout from key resistance levels: XRP has decisively broken through several significant resistance levels, suggesting a strong bullish trend.

- Increased trading volume: Higher trading volume confirms the price movement is not merely speculative but driven by genuine buying interest.

- Positive momentum indicators: Technical indicators like the RSI and moving averages point towards continued upward momentum.

H2: Fundamental Factors Driving XRP's Growth

Beyond the technical aspects, the underlying fundamentals of XRP are contributing to its growth. XRP's utility as a bridge currency for facilitating cross-border payments through RippleNet is gaining traction, with more and more financial institutions adopting the technology. Furthermore, the ongoing legal battle between Ripple and the SEC, while uncertain, has shown some positive developments lately, boosting investor confidence.

- Growing adoption of RippleNet by financial institutions: Increased adoption by major financial institutions validates XRP's utility and strengthens its position in the market.

- Potential for increased usage of XRP in cross-border payments: As more institutions integrate RippleNet, the demand for XRP as a transaction currency is expected to rise.

- Positive outcomes in the Ripple vs. SEC lawsuit: Recent developments in the lawsuit have injected optimism into the XRP market, reducing investor uncertainty.

H2: Investor Sentiment and Market Speculation

The current XRP price surge is significantly influenced by positive investor sentiment and market speculation. Social media platforms are buzzing with discussions about XRP, fueled by news of the Grayscale ETF filing and positive developments in the Ripple case. This escalating positive media coverage and increased social media interest are driving speculative trading activity, pushing the price even higher.

- Increased positive media coverage: Favorable news coverage contributes significantly to the bullish sentiment surrounding XRP.

- Growing social media interest: Increased social media engagement reflects rising interest and anticipation from retail investors.

- Speculative trading activity: While speculation can be risky, it plays a significant role in amplifying price movements in the current market environment.

Conclusion:

The XRP price surge is a multifaceted event driven by a confluence of factors. Grayscale's Bitcoin ETF filing, positive technical indicators, strengthening fundamentals, and a surge in positive investor sentiment have all contributed to this remarkable increase. The potential for further price increases is real, especially if the Grayscale application is successful and the Ripple case concludes favorably. However, it's crucial to remember that the cryptocurrency market is inherently volatile.

The XRP price surge is a significant event that demands careful attention. Stay informed about further developments in the Grayscale ETF filing and Ripple's legal battle to navigate this exciting period in the XRP market. Conduct thorough research and consult with financial advisors before investing in XRP.

Featured Posts

-

Svetovy Pohar 2028 Rusko Vs Slovensko Nhl A Boj O Ucast

May 07, 2025

Svetovy Pohar 2028 Rusko Vs Slovensko Nhl A Boj O Ucast

May 07, 2025 -

Ahtfal Wyl Smyth Bywm Mylad Jaky Shan Dhk Rqs Wghnae

May 07, 2025

Ahtfal Wyl Smyth Bywm Mylad Jaky Shan Dhk Rqs Wghnae

May 07, 2025 -

Spectre Divides End Mountaintop Studios Closure And Game Shutdown

May 07, 2025

Spectre Divides End Mountaintop Studios Closure And Game Shutdown

May 07, 2025 -

Budowa Drog S8 I S16 Wizja Nawrockiego Zrownowazonego Rozwoju

May 07, 2025

Budowa Drog S8 I S16 Wizja Nawrockiego Zrownowazonego Rozwoju

May 07, 2025 -

The Papal Conclave A Detailed Explanation Of The Pope Selection Process

May 07, 2025

The Papal Conclave A Detailed Explanation Of The Pope Selection Process

May 07, 2025

Latest Posts

-

67 Million Ethereum Liquidation Event Implications And Market Outlook

May 08, 2025

67 Million Ethereum Liquidation Event Implications And Market Outlook

May 08, 2025 -

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025 -

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025 -

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025 -

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025