XRP Whale's 20M Token Acquisition: Bullish Signal Or Strategic Move?

Table of Contents

Analyzing the Bullish Case for XRP

The acquisition of 20M XRP by a single whale raises several bullish possibilities.

Increased Demand and Price Pressure

Large-scale purchases like this can significantly impact market dynamics. The sudden increase in demand for XRP can exert upward pressure on its price. This is because:

- Reduced Supply: A whale buying 20M XRP directly reduces the available supply in the market. This scarcity can drive up the price, particularly if other investors perceive this as a bullish signal and follow suit.

- Order Book Impact: The purchase could wipe out significant sell orders on exchanges, potentially eliminating immediate downward pressure on the XRP price. This leaves less resistance for further price increases.

- Positive Ripple News & Regulatory Developments: A confluence of positive news, such as favorable regulatory developments or advancements in Ripple's technology, could amplify the impact of the whale's purchase, creating a stronger bullish trend. Positive XRP news always enhances investor sentiment. An improved XRP price prediction becomes more likely under these circumstances. The XRP market cap could also benefit from this increased bullish sentiment.

Whale Accumulation as a Confidence Indicator

Many believe that whale accumulation is a strong confidence indicator. The theory suggests that large investors wouldn't invest heavily unless they believe in the asset's long-term value. However, it's crucial to remember:

- Not a Guarantee: Whale activity is not a foolproof predictor of future price movements. Market forces, regulatory changes, and unforeseen events can still impact XRP's price significantly.

- Other Market Factors: Always consider the broader market context. A positive overall cryptocurrency market trend will likely amplify the impact of whale purchases, while a negative trend might dampen their effect. XRP investor sentiment, therefore, needs to be evaluated holistically.

Exploring the Strategic Move Hypothesis

While the bullish interpretation is compelling, there are equally valid reasons to view the 20M XRP acquisition as a purely strategic move.

Long-Term Investment Strategy

The whale might be adopting a long-term investment strategy, completely independent of short-term price fluctuations. This could be driven by:

- Belief in Ripple's Technology: The investor may have faith in Ripple's underlying technology and its long-term potential to disrupt the cross-border payment system. The XRP price future, in their view, is bright.

- Anticipation of Regulatory Clarity: Uncertainty surrounding XRP's regulatory status is a significant factor. A long-term holder might be accumulating XRP in anticipation of future regulatory clarity, believing the price will appreciate significantly afterwards. This constitutes a long-term XRP investment strategy.

Hedging Against Market Volatility

Diversification is key in the cryptocurrency market. Holding XRP could be a hedging strategy:

- Reducing Portfolio Risk: The whale may be diversifying their portfolio, reducing their overall risk by adding XRP to their holdings. This is a form of XRP risk management.

- Protection from other Asset Losses: A decline in other crypto assets may prompt a strategic move into a relatively stable, albeit volatile, asset like XRP. This enhances cryptocurrency portfolio diversification. XRP volatility, while a factor, is mitigated by the overall strategy.

Other Potential Strategic Reasons (e.g., DeFi Activities, Staking)

Beyond traditional investment, there could be other motivations:

- XRP DeFi Participation: The acquired XRP could be used in various decentralized finance (DeFi) projects that utilize XRP as collateral or for liquidity provision.

- XRP Staking: Some platforms offer staking rewards for holding XRP. This could be a motivation for the significant acquisition. The utility of XRP is expanding beyond mere transactional use.

The Importance of Context and Further Analysis

Interpreting this 20M XRP acquisition requires careful consideration of various factors.

Considering On-Chain Data

Analyzing on-chain metrics like transaction volume, network activity, and the distribution of XRP holdings can provide invaluable insights. This XRP on-chain analysis offers a more objective view than relying solely on the price action.

Following Ripple's Legal Battles

The ongoing legal battles between Ripple and the SEC significantly impact XRP's price and investor sentiment. Understanding the progress of the Ripple lawsuit is crucial for interpreting whale actions. This XRP news analysis is essential.

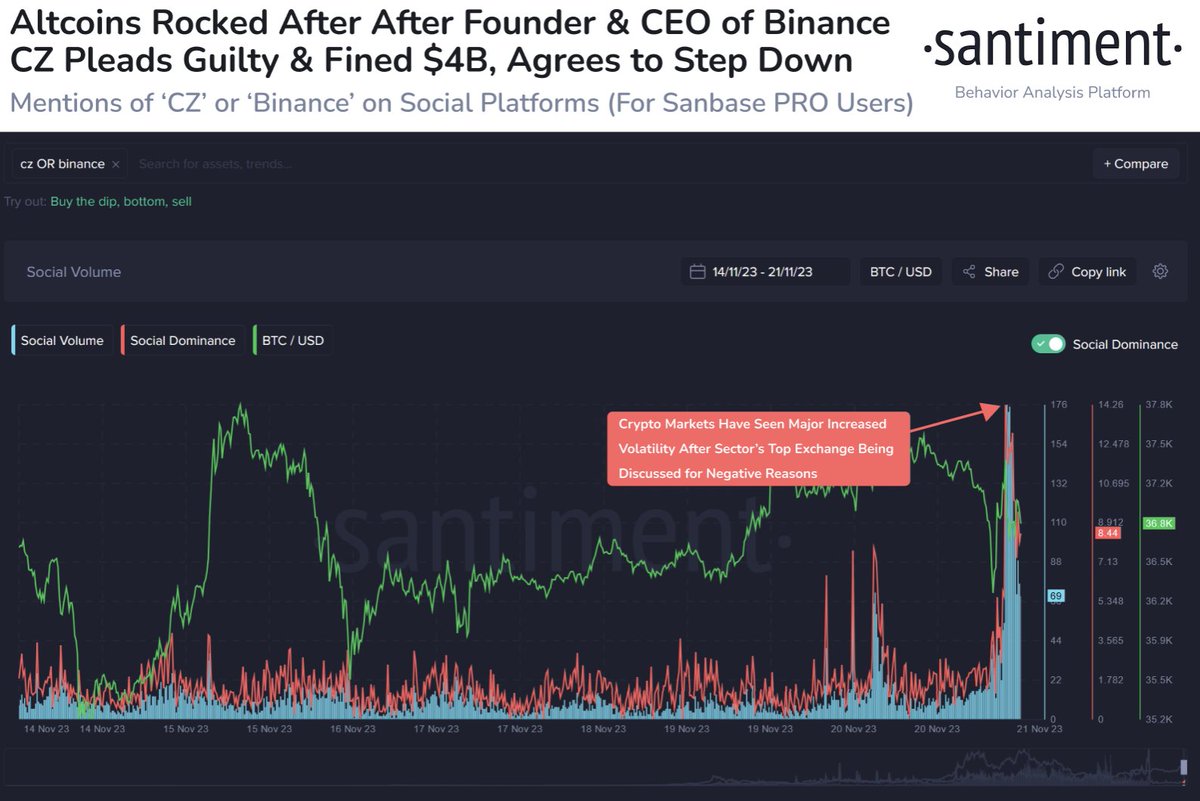

Monitoring Market Sentiment and News

Paying close attention to overall market sentiment and any relevant news surrounding XRP is essential. This holistic approach helps prevent misinterpretations of isolated events like whale activity.

Conclusion: Interpreting the XRP Whale's Actions – A Cautious Approach

The 20M XRP acquisition presents a complex scenario. Both the bullish signal and strategic move hypotheses hold merit. It's crucial to avoid making impulsive decisions based solely on whale activity. The cryptocurrency market is notoriously volatile, and even experienced investors can be wrong. Thorough research is crucial before investing in XRP or any other cryptocurrency. Stay informed about future XRP whale activity and continue your research into the implications of this significant XRP purchase. Conduct your own diligent research to form your informed opinion on the significance of the XRP whale's 20M token acquisition.

Featured Posts

-

Improved Playoff Results Julius Randles Mission With Minnesota

May 07, 2025

Improved Playoff Results Julius Randles Mission With Minnesota

May 07, 2025 -

Seattle Mariners Dominant First Inning Delivers 14 0 Win Against Miami Marlins

May 07, 2025

Seattle Mariners Dominant First Inning Delivers 14 0 Win Against Miami Marlins

May 07, 2025 -

Wybor Papieza Ks Sliwinski O Zaskakujacych Mechanizmach Konklawe

May 07, 2025

Wybor Papieza Ks Sliwinski O Zaskakujacych Mechanizmach Konklawe

May 07, 2025 -

Spion Peter Tazelaar Zijn Leven Als Soldaat Van Oranje Een Biografie

May 07, 2025

Spion Peter Tazelaar Zijn Leven Als Soldaat Van Oranje Een Biografie

May 07, 2025 -

Krizis V Vatikane Buduschee Papstva Posle Frantsiska

May 07, 2025

Krizis V Vatikane Buduschee Papstva Posle Frantsiska

May 07, 2025

Latest Posts

-

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025 -

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025 -

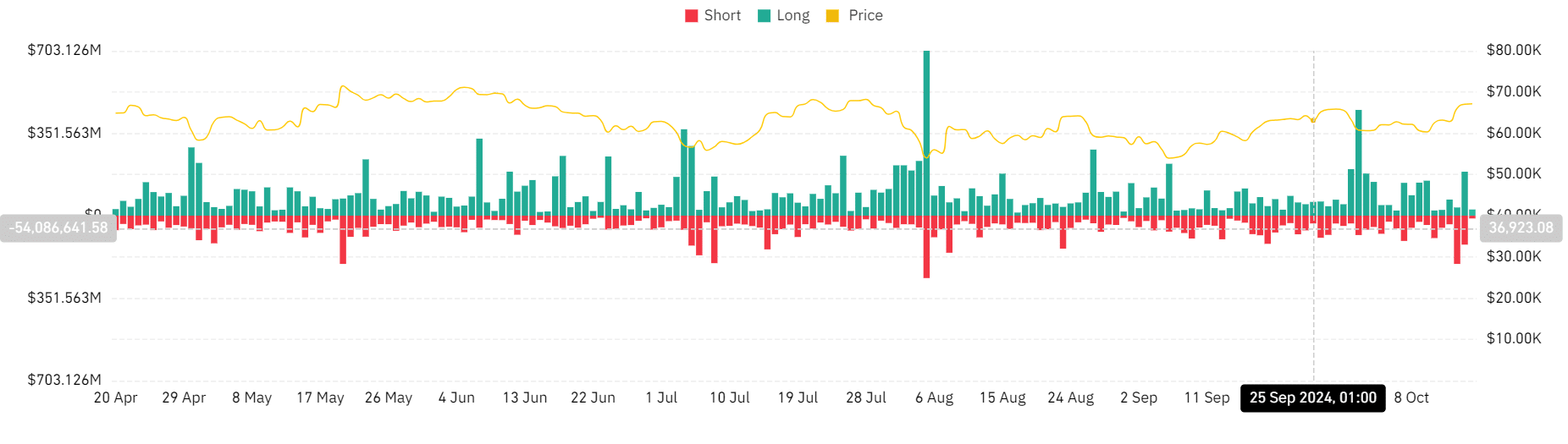

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025 -

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025 -

11 Million Eth Accumulated Implications For Ethereum Price

May 08, 2025

11 Million Eth Accumulated Implications For Ethereum Price

May 08, 2025