China's Impact On BMW And Porsche: Market Slowdown And Strategic Adjustments

Table of Contents

The Chinese Automotive Market Slowdown: A Deep Dive

Several factors contribute to the slowdown in the China automotive market. Firstly, economic headwinds, including reduced consumer spending and a cooling property market, have dampened demand for luxury vehicles. Government policies, particularly those focused on emission control and promoting domestic brands, also play a significant role. Furthermore, evolving Chinese consumer trends show a preference for electric vehicles (EVs) and a greater focus on value and technological innovation. Finally, increased competition from rapidly developing domestic automakers puts pressure on established international brands.

- Economic Factors: A slower GDP growth rate in China directly impacts consumer spending power, affecting demand for luxury goods, including high-end vehicles.

- Government Policies: Stringent emission regulations and supportive policies for domestic EV manufacturers create challenges for established players.

- Shifting Consumer Preferences: Young Chinese consumers increasingly prioritize electric and technologically advanced vehicles, demanding innovation from luxury brands.

- Intense Domestic Competition: The rise of strong domestic brands like BYD and NIO presents significant competition in the Chinese market.

The impact is evident in sales figures. While precise numbers fluctuate, both BMW and Porsche have reported declines in China auto sales compared to previous years' growth trajectories. This slowdown highlights the urgent need for adaptation and strategic pivoting. The surge in the EV market China further underscores the necessity of embracing electric mobility.

BMW's Strategic Response to the Chinese Market Challenges

BMW has responded proactively to the challenges in the China automotive market. Their response focuses on several key strategies:

- Investment in EV Production and Infrastructure: BMW has made substantial investments in building electric vehicle production facilities and expanding its charging infrastructure network in China. This signifies a commitment to catering to the growing demand for EVs.

- Localization Strategies: BMW has deepened its partnerships with local suppliers and adapted its models to better suit the preferences of Chinese consumers. This localization minimizes production costs and streamlines distribution.

- Marketing and Branding: BMW has intensified its marketing efforts, tailoring its messaging to appeal to the evolving preferences of Chinese consumers, focusing on digital marketing and social media engagement.

- Cost Optimization: While specifics aren't publicly available, it's likely BMW has implemented some cost-cutting measures to maintain profitability in the face of reduced sales.

Porsche's Strategic Response to the Chinese Market Challenges

Porsche's response to the China automotive market slowdown shares similarities with BMW’s but also reflects its distinct brand identity.

- Electric Vehicle Focus: Porsche is aggressively expanding its range of electric vehicles in China, including models specifically designed with the Chinese market in mind. They are also investing in charging infrastructure.

- Premium Brand Enhancement: Porsche emphasizes enhancing the customer experience and maintaining its exclusive brand image in China. This focus on luxury and exclusivity remains crucial.

- Attracting Younger Consumers: Porsche is actively targeting younger Chinese consumers through targeted marketing campaigns, emphasizing innovation and digital connectivity.

- Strategic Pricing and Sales: Porsche is likely making adjustments to its pricing and sales strategies to remain competitive without compromising its brand positioning.

Comparative Analysis: BMW vs. Porsche in China

Both BMW and Porsche are adapting to the China automotive market challenges, but their approaches differ. BMW's strategy focuses on broad-based localization and an extensive EV rollout, prioritizing volume. Porsche, on the other hand, maintains a focus on premium branding and targeted EV offerings, aiming to preserve its exclusive image. The effectiveness of each strategy will be determined by long-term market performance. Future challenges include navigating the evolving regulatory landscape and maintaining profitability amidst intense competition. Opportunities lie in further localization, developing innovative EV technologies tailored to Chinese consumer preferences, and leveraging the growing demand for sustainable mobility.

China's Continued Impact on BMW and Porsche – Looking Ahead

The China automotive market slowdown has undeniably impacted BMW and Porsche, forcing both brands to undertake significant strategic adjustments. Both have focused on localizing production, investing in electric vehicle technologies, and adapting to changing consumer preferences. The long-term success of these strategies remains to be seen, but adapting to the realities of the Chinese market is crucial for their future growth. The China automotive market outlook suggests continued evolution, and both BMW and Porsche must remain agile and responsive to succeed. To stay informed on China's impact on BMW and Porsche, we recommend following industry publications and analyst reports specializing in the Chinese automotive market. The future of luxury car sales in China is dynamic, and both companies will continue to navigate this evolving landscape.

Featured Posts

-

Trumps Tax Bill Faces Uncertain Future Amidst Republican Divisions

Apr 29, 2025

Trumps Tax Bill Faces Uncertain Future Amidst Republican Divisions

Apr 29, 2025 -

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025 -

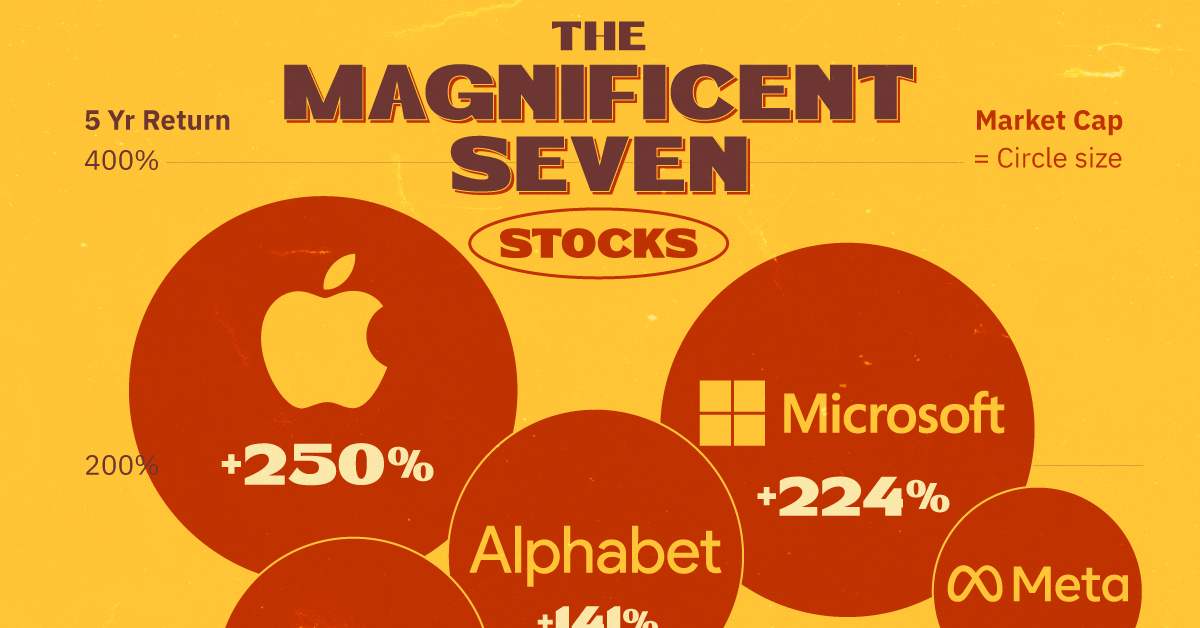

Seven Tech Titans A 2 5 Trillion Market Value Plunge In 2024

Apr 29, 2025

Seven Tech Titans A 2 5 Trillion Market Value Plunge In 2024

Apr 29, 2025 -

Mlb 160km

Apr 29, 2025

Mlb 160km

Apr 29, 2025 -

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025

Latest Posts

-

Techs Top Seven Analyzing A 2 5 Trillion Market Value Loss

Apr 29, 2025

Techs Top Seven Analyzing A 2 5 Trillion Market Value Loss

Apr 29, 2025 -

The Magnificent Sevens 2024 Losses A 2 5 Trillion Market Cap Drop

Apr 29, 2025

The Magnificent Sevens 2024 Losses A 2 5 Trillion Market Cap Drop

Apr 29, 2025 -

2 5 Trillion Evaporated The Market Value Decline Of The Magnificent Seven

Apr 29, 2025

2 5 Trillion Evaporated The Market Value Decline Of The Magnificent Seven

Apr 29, 2025 -

Seven Tech Titans A 2 5 Trillion Market Value Plunge In 2024

Apr 29, 2025

Seven Tech Titans A 2 5 Trillion Market Value Plunge In 2024

Apr 29, 2025 -

Magnificent Seven Stocks 2 5 Trillion In Lost Market Value This Year

Apr 29, 2025

Magnificent Seven Stocks 2 5 Trillion In Lost Market Value This Year

Apr 29, 2025