German DAX Soars: Can Wall Street's Recovery Spoil The Celebration?

Table of Contents

The German DAX's Impressive Ascent

The German DAX index has showcased remarkable growth in recent weeks, registering a [insert specific percentage increase]% increase over the past [insert timeframe, e.g., three months]. This robust performance can be attributed to several key factors:

- Strong Export Performance: Germany, a major exporter, has benefited from increased global demand for its goods, particularly in [mention specific sectors like automotive or machinery]. This has significantly boosted the earnings of many DAX-listed companies.

- Robust Domestic Demand: The German domestic market has also shown resilience, with consumer spending remaining relatively strong despite inflationary pressures. This internal demand further supports economic growth and fuels the DAX's rise.

- Government Policies: Supportive government policies, including [mention specific policies like investment incentives or infrastructure projects], have also contributed to the positive economic climate and boosted investor confidence.

The top-performing sectors within the DAX during this period include:

- Automotive

- Chemicals

- Technology

- Industrials

Wall Street's Potential Influence on the German DAX

The current state of the US economy and its potential trajectory are critical factors influencing the German DAX. A strong Wall Street recovery could trigger a global wave of optimism, potentially further boosting the DAX. However, a continued decline or unexpected downturn on Wall Street could negatively impact investor sentiment, leading to capital flight and potentially dampening the DAX's positive momentum.

The correlation between US and German stock markets isn't always direct, but significant interdependence exists. Global investors often consider the US market a bellwether for global economic health. Therefore, a major shift in Wall Street could influence investor decisions regarding the DAX, regardless of the underlying strength of the German economy.

Analyzing Key Sectors within the German DAX

Analyzing specific sectors within the DAX provides a more nuanced understanding of the index's performance and potential vulnerabilities:

Automotive Industry

The German automotive industry, a cornerstone of the DAX, is particularly sensitive to global economic shifts. Supply chain disruptions, changes in consumer demand, and global competition all impact the performance of companies like Volkswagen and BMW. Their resilience in the face of these challenges will significantly influence the overall DAX performance.

Technology Sector

The technology sector within the DAX mirrors global trends, with close ties to the NASDAQ. The performance of German technology companies is often intertwined with the successes and failures of their US counterparts. Their future trajectory will depend heavily on innovation, technological breakthroughs, and overall global investor sentiment towards technology stocks.

Industrial Production

Germany's robust industrial production sector is a key driver of the DAX. However, external pressures like energy costs, raw material prices, and geopolitical instability can significantly affect its output and, consequently, the overall DAX performance.

Risk Factors and Potential Downsides

Despite the impressive recent gains, several risk factors could hinder the DAX's continued growth:

- Geopolitical Instability: Global geopolitical tensions, such as the ongoing war in Ukraine, can negatively impact investor confidence and trigger market volatility.

- Inflationary Pressures: Persistently high inflation could erode consumer spending and corporate profits, potentially leading to a market correction.

- Rising Interest Rates: Increased interest rates, implemented by central banks to combat inflation, can reduce borrowing and investment, slowing economic growth.

These factors, combined with the potential for a global market downturn, highlight the need for cautious optimism regarding the future performance of the German DAX.

The Future of the German DAX – Navigating Uncertainty

The German DAX's recent surge is undoubtedly impressive, but the potential influence of Wall Street's recovery, or lack thereof, introduces considerable uncertainty. While strong economic fundamentals support the DAX's continued growth, potential risks like geopolitical instability and inflationary pressures cannot be ignored. Therefore, celebrating the current success should be tempered with caution. Staying informed about global market trends, particularly the interconnectedness of the DAX and Wall Street, is crucial for investors navigating this dynamic environment. Learn more about investing in the German DAX and navigating market volatility to make informed decisions.

Featured Posts

-

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par I Odna Data

May 24, 2025

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par I Odna Data

May 24, 2025 -

Chto Udalos Nashemu Pokoleniyu Vzglyad Na Sovremennost

May 24, 2025

Chto Udalos Nashemu Pokoleniyu Vzglyad Na Sovremennost

May 24, 2025 -

Apple Stock Under Pressure Q2 Earnings Report Looms

May 24, 2025

Apple Stock Under Pressure Q2 Earnings Report Looms

May 24, 2025 -

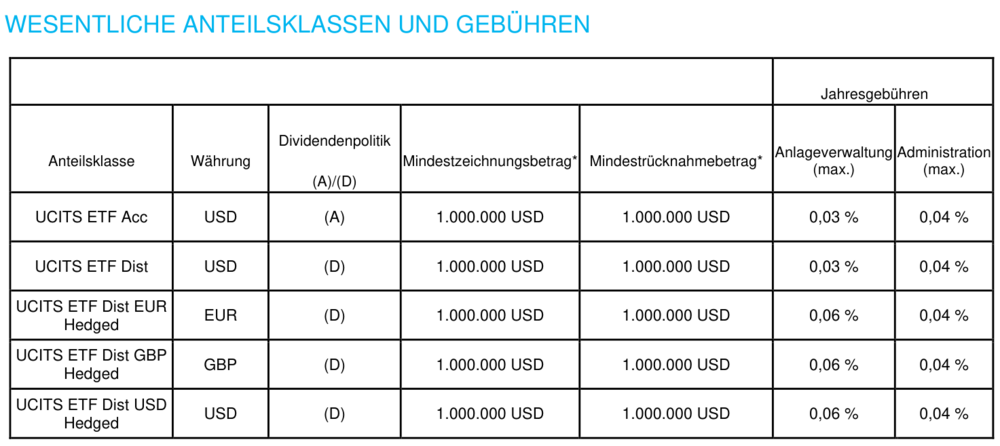

Investing In Amundi Msci All Country World Ucits Etf Usd Acc Nav Considerations

May 24, 2025

Investing In Amundi Msci All Country World Ucits Etf Usd Acc Nav Considerations

May 24, 2025 -

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup Revealed

May 24, 2025

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup Revealed

May 24, 2025

Latest Posts

-

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 24, 2025

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 24, 2025 -

Buffetts Apple Investment Impact Of Trump Tariffs

May 24, 2025

Buffetts Apple Investment Impact Of Trump Tariffs

May 24, 2025 -

Apple Stock Forecast One Analyst Sees 254 Should You Buy Now

May 24, 2025

Apple Stock Forecast One Analyst Sees 254 Should You Buy Now

May 24, 2025 -

Apple Stock Suffers Setback Amidst Tariff Announcement

May 24, 2025

Apple Stock Suffers Setback Amidst Tariff Announcement

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025