Ryanair Flags Tariff Wars As Top Growth Risk, Unveils Share Buyback Program

Table of Contents

Ryanair's Concerns Regarding Tariff Wars

Ryanair's declaration that tariff wars pose the biggest threat to its growth underscores the escalating challenges facing the airline sector. These "tariff wars" aren't literal conflicts, but rather a complex interplay of rising costs and increased competition. Several factors contribute to this challenging environment:

-

Soaring Fuel Prices: The volatile nature of fuel prices significantly impacts operating margins. Increased fuel costs directly translate to higher operational expenses, squeezing profitability and potentially leading to increased ticket prices for consumers.

-

Escalating Airport Charges: Many airports are increasing their charges for airlines, adding to the operational burden. These rising fees, coupled with fuel costs, directly affect an airline's ability to offer competitive ticket pricing.

-

Government Regulations and Taxes: Governments worldwide are increasingly implementing regulations aimed at mitigating the environmental impact of air travel. These measures, such as carbon taxes or stricter emission standards, add to the financial pressures faced by airlines.

-

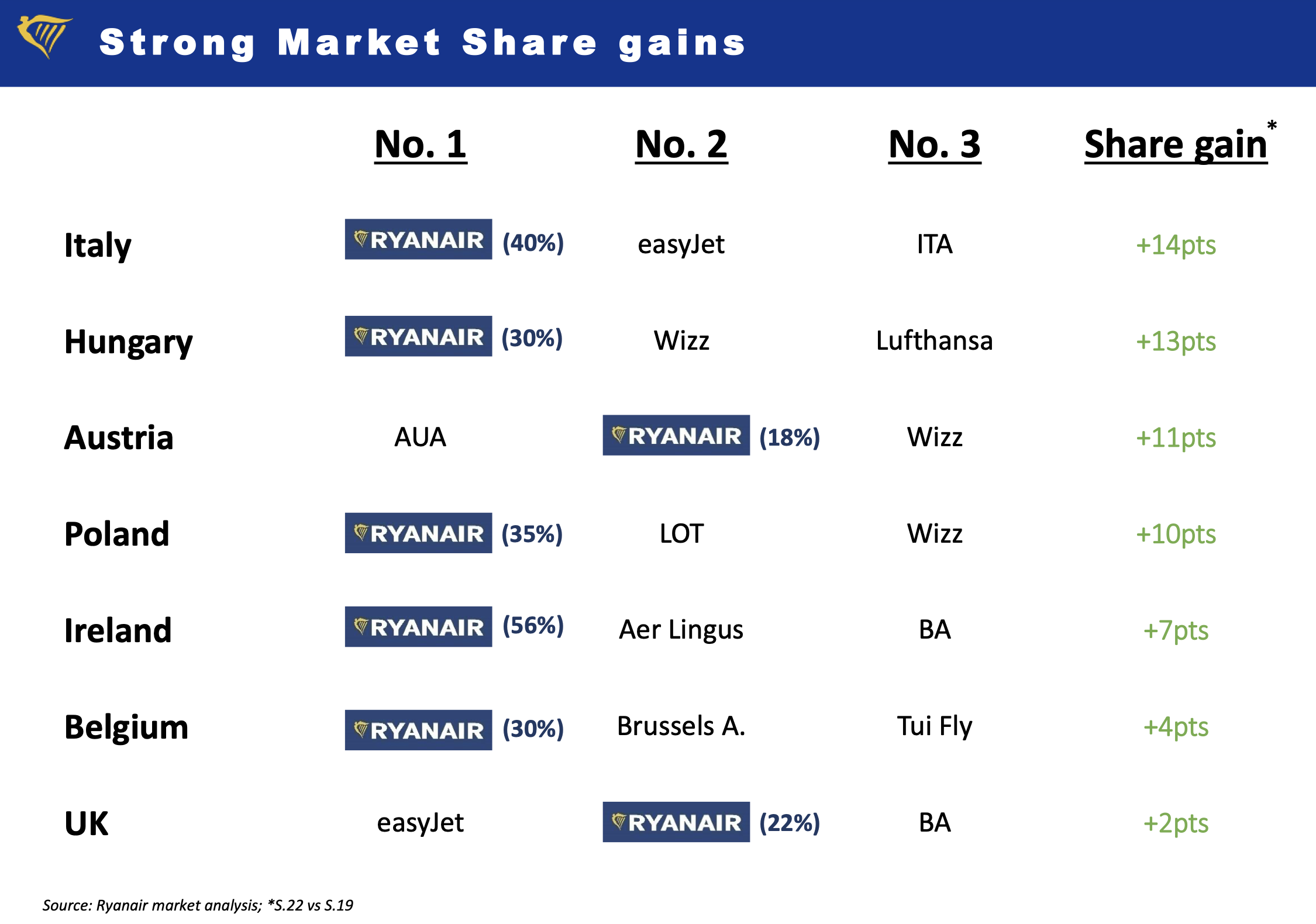

Intense Competition: The low-cost carrier market is fiercely competitive. Ryanair faces pressure from other budget airlines constantly vying for market share through aggressive pricing strategies, further exacerbating the challenges posed by rising costs.

The Strategic Implications of the Share Buyback Program

Despite acknowledging the significant risk posed by tariff wars, Ryanair's announcement of a share buyback program signals a degree of confidence in its long-term prospects. This strategic move serves several key purposes:

-

Demonstrating Confidence: The share buyback is a clear indication that Ryanair's management believes the company is fundamentally strong and well-positioned to weather the current storm. It’s a vote of confidence in their future performance.

-

Boosting Shareholder Value: By repurchasing its own shares, Ryanair reduces the number of outstanding shares. This, in turn, potentially increases earnings per share (EPS), leading to higher returns for existing shareholders.

-

Improving Investor Sentiment: In a market concerned about rising costs and economic uncertainty, a share buyback can reassure investors, potentially boosting the company's stock price and attracting new investment.

-

Strategic Timing: The timing of the announcement, coinciding with the acknowledgment of tariff war risks, suggests a deliberate attempt to mitigate negative market reactions and maintain investor confidence. It shows a proactive approach to addressing challenges.

Impact on the Broader Airline Industry

Ryanair's concerns are not isolated. Its statement highlights a broader trend impacting the entire airline industry:

-

Increased Competition: The pressure on profitability is forcing airlines to become more innovative and efficient. This could lead to further consolidation within the industry as smaller airlines struggle to compete.

-

Industry-Wide Adaptation: Other low-cost carriers will likely face similar challenges and need to adapt their strategies. This could involve exploring new revenue streams, optimizing operations, or potentially merging to achieve economies of scale.

-

Fluctuating Fuel Prices: The persistent volatility in fuel prices remains a major concern for the entire industry. Airlines will continue to look for ways to hedge against these fluctuations and minimize their impact.

-

Geopolitical Factors: Global events and geopolitical instability can significantly affect the airline industry, adding another layer of complexity to the challenges airlines face.

Conclusion: Ryanair's Growth Strategy Navigating Tariff Wars

Ryanair's recent announcements highlight a pivotal moment for the airline and the broader industry. The company clearly identifies tariff wars as a primary growth risk, but the concurrent share buyback program signals confidence in its long-term strategy and financial strength. The strategic implications of both the risk assessment and the share buyback are significant, indicating a proactive approach to navigating a challenging market. To stay updated on Ryanair's fight against tariff wars and their impact on future growth, follow Ryanair's official channels and stay informed through reputable financial news sources. Learn more about how Ryanair is managing tariff war risks and its share buyback initiatives to understand the evolving dynamics of the low-cost carrier sector.

Featured Posts

-

Unveiling The Meaning Peppa Pig Welcomes A New Baby Sister

May 21, 2025

Unveiling The Meaning Peppa Pig Welcomes A New Baby Sister

May 21, 2025 -

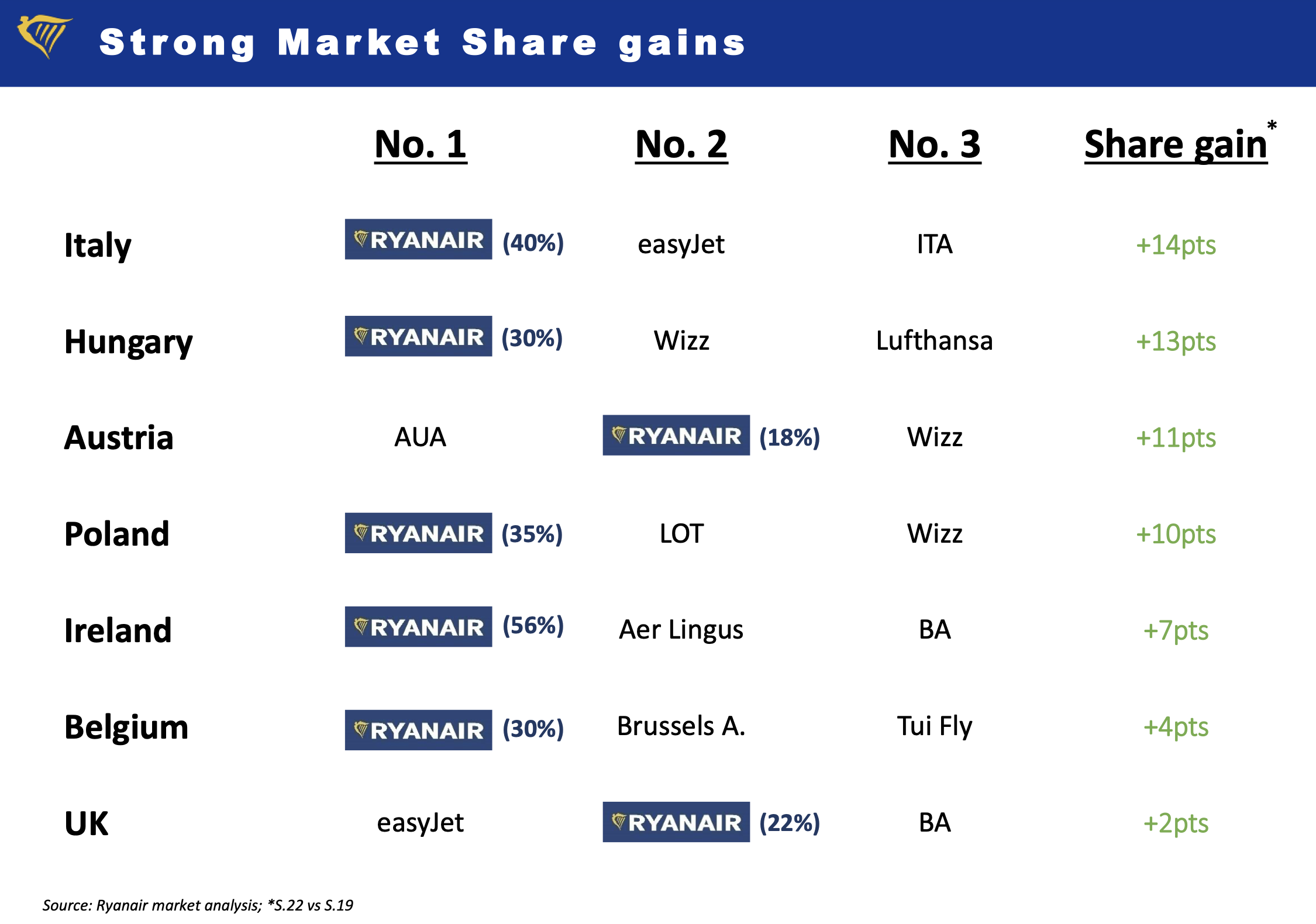

D Wave Quantum Qbts Stock Market Performance A Deep Dive Into Recent Gains

May 21, 2025

D Wave Quantum Qbts Stock Market Performance A Deep Dive Into Recent Gains

May 21, 2025 -

Accelerating Drug Discovery The Impact Of D Waves Qbts Quantum Computing On Ai

May 21, 2025

Accelerating Drug Discovery The Impact Of D Waves Qbts Quantum Computing On Ai

May 21, 2025 -

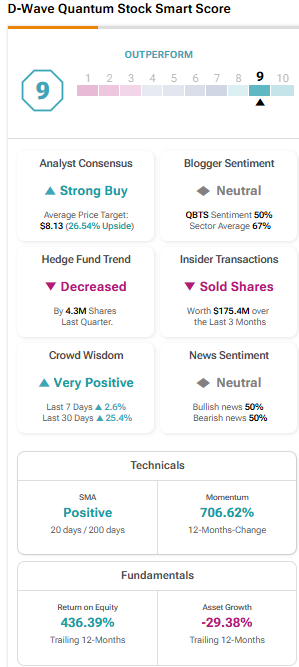

Abn Amro Us Import Tariffs Slash Dutch Food Exports

May 21, 2025

Abn Amro Us Import Tariffs Slash Dutch Food Exports

May 21, 2025 -

Fastest Australian Crossing Man Completes Epic Foot Race

May 21, 2025

Fastest Australian Crossing Man Completes Epic Foot Race

May 21, 2025

Latest Posts

-

The 2025 Decline Of Big Bear Ai Bbai Causes And Implications

May 21, 2025

The 2025 Decline Of Big Bear Ai Bbai Causes And Implications

May 21, 2025 -

D Wave Quantum Qbts Stock Investigating Thursdays Price Decrease

May 21, 2025

D Wave Quantum Qbts Stock Investigating Thursdays Price Decrease

May 21, 2025 -

Bbai Stock Assessing The Impact Of The Recent Analyst Downgrade

May 21, 2025

Bbai Stock Assessing The Impact Of The Recent Analyst Downgrade

May 21, 2025 -

Analyzing The 2025 Drop In Big Bear Ai Bbai Stock Key Insights

May 21, 2025

Analyzing The 2025 Drop In Big Bear Ai Bbai Stock Key Insights

May 21, 2025 -

Big Bear Ai Bbai Stock Analyst Downgrade Sparks Investor Uncertainty

May 21, 2025

Big Bear Ai Bbai Stock Analyst Downgrade Sparks Investor Uncertainty

May 21, 2025