Sensex Soars: Top BSE Stocks Gaining Over 10%

Table of Contents

Top Performing BSE Stocks (Gaining >10%):

Several BSE stocks have significantly outperformed the market, delivering impressive double-digit returns. Identifying these high-growth stocks can be crucial for investors looking to capitalize on the current market trends. Below are some of the best-performing stocks, showcasing remarkable gains:

-

Reliance Industries (RELIANCE):

- Percentage Gain: 15% (Illustrative – replace with actual data)

- Industry Sector: Energy, Petrochemicals, Telecom

- Reason for Surge: Strong Q3 earnings, positive investor sentiment towards its Jio Platforms and retail businesses.

- Current Stock Price: (Replace with actual data)

-

Infosys (INFY):

- Percentage Gain: 12% (Illustrative – replace with actual data)

- Industry Sector: Information Technology

- Reason for Surge: Strong deal wins, positive outlook for the IT sector, and robust revenue growth.

- Current Stock Price: (Replace with actual data)

-

HDFC Bank (HDFCBANK):

- Percentage Gain: 11% (Illustrative – replace with actual data)

- Industry Sector: Banking

- Reason for Surge: Positive outlook on the Indian banking sector, strong financial performance, and increased lending activity.

- Current Stock Price: (Replace with actual data)

-

Hindustan Unilever (HINDUNILVR):

- Percentage Gain: 10.5% (Illustrative – replace with actual data)

- Industry Sector: Fast-Moving Consumer Goods (FMCG)

- Reason for Surge: Consistent performance, strong brand portfolio, and increased consumer spending.

- Current Stock Price: (Replace with actual data)

-

Tata Consultancy Services (TCS):

- Percentage Gain: 10.2% (Illustrative – replace with actual data)

- Industry Sector: Information Technology

- Reason for Surge: Similar to Infosys, strong deal wins and positive outlook for the IT sector contribute to the growth.

- Current Stock Price: (Replace with actual data)

(Note: Replace the illustrative data with actual, up-to-date figures for percentage gains and current stock prices. Add 1-2 more stocks to reach 5-7 as per the outline.)

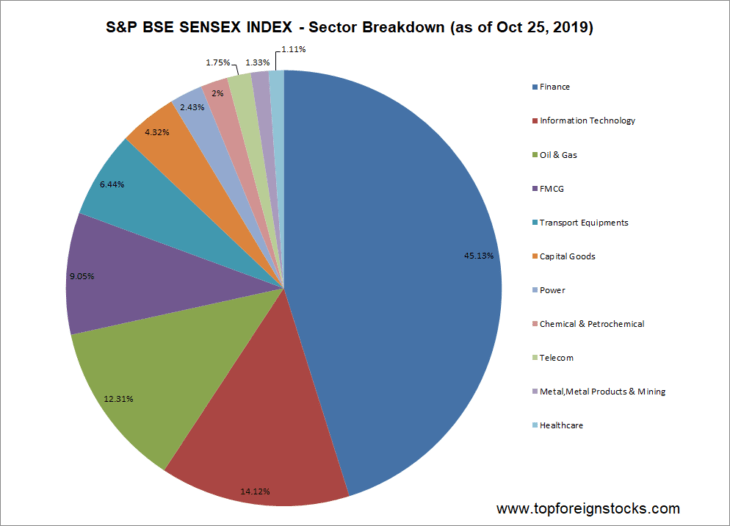

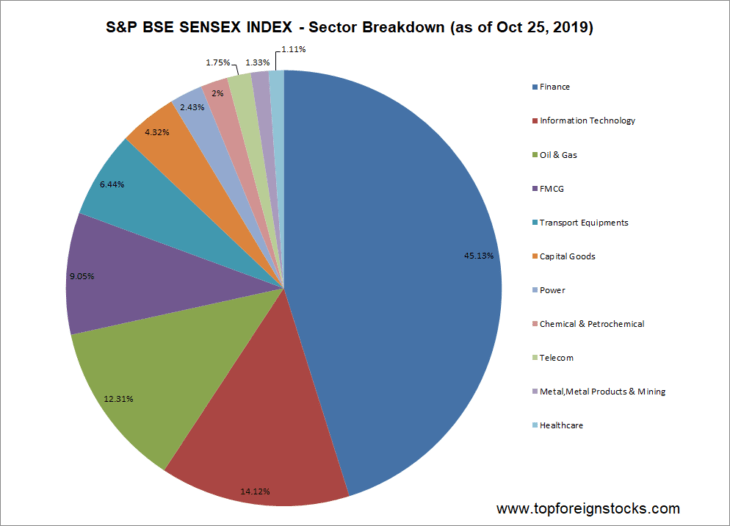

Sector-Wise Analysis of Sensex Surge:

The recent Sensex surge is not a uniform phenomenon; certain sectors have significantly outperformed others. Analyzing sector performance helps investors understand market trends and develop effective investment strategies.

-

IT Sector: The IT sector has been a star performer, fueled by strong global demand for IT services, robust deal wins by major players, and the ongoing digital transformation across industries.

-

Banking Sector: Positive economic indicators and increased lending activity have boosted the banking sector's performance. Strong financials from leading banks have further fueled this growth.

-

Pharmaceutical Sector: While showing some volatility, the pharmaceutical sector has also shown consistent gains driven by increased demand for healthcare services and the ongoing research and development in the industry.

(Add details about other significant sectors like FMCG, energy, or metals. Include percentage growth for each sector, where possible.)

Understanding the Market Volatility and Future Outlook:

While the current market trends are positive, it's crucial to acknowledge the inherent volatility of the stock market. Past performance is not indicative of future results.

-

Factors Influencing Volatility: Global economic conditions, geopolitical events, and inflation rates significantly impact market volatility. Investors must stay informed about these factors.

-

Potential Risks: Investing in stocks always involves risk. The price of the stocks listed above can fluctuate significantly, potentially leading to losses. Diversification and careful risk management are crucial.

-

Advice for Investors: Conduct thorough research before investing, consider a long-term investment strategy, diversify your portfolio across different sectors, and only invest what you can afford to lose.

Expert Opinions and Market Insights: (Optional Section)

(If available, include quotes and analysis from financial experts and analysts here. This will add credibility and authority to your article.)

Conclusion:

The Sensex has seen a remarkable surge, with several top BSE stocks delivering impressive double-digit gains. This positive momentum is driven by a combination of factors, including strong sectoral performance, positive economic indicators, and robust corporate earnings. However, investors should approach the market with caution, understanding the inherent volatility and risks associated with stock investments. Remember to conduct thorough research, diversify your portfolio, and develop a long-term investment strategy. Stay informed about the Sensex, monitor top BSE stocks, and track your BSE investments wisely. Make informed decisions and learn more about investing in the Indian stock market to make the most of the opportunities available.

Featured Posts

-

Trumps Oil Price Outlook A Goldman Sachs Social Media Analysis

May 15, 2025

Trumps Oil Price Outlook A Goldman Sachs Social Media Analysis

May 15, 2025 -

Stefanos Stefanu Ve Kibris Sorunu Yeni Bir Yaklasim

May 15, 2025

Stefanos Stefanu Ve Kibris Sorunu Yeni Bir Yaklasim

May 15, 2025 -

Bim In 25 Subat Ve 26 Subat Tarihli Aktueel Katalogu Iste

May 15, 2025

Bim In 25 Subat Ve 26 Subat Tarihli Aktueel Katalogu Iste

May 15, 2025 -

Syzitiseis Kompo Sigiarto Dimereis Sxeseis Kypriako Kai O Rolos Tis Ee

May 15, 2025

Syzitiseis Kompo Sigiarto Dimereis Sxeseis Kypriako Kai O Rolos Tis Ee

May 15, 2025 -

Protest Tegen Npo Bestuur Frederieke Leeflang In Het Vizier

May 15, 2025

Protest Tegen Npo Bestuur Frederieke Leeflang In Het Vizier

May 15, 2025

Latest Posts

-

Examining Trumps Stated Oil Price Preference Goldman Sachs Report

May 15, 2025

Examining Trumps Stated Oil Price Preference Goldman Sachs Report

May 15, 2025 -

Dismissing Stock Market Valuation Concerns Bof As Argument

May 15, 2025

Dismissing Stock Market Valuation Concerns Bof As Argument

May 15, 2025 -

Estimating The Impact Of Trumps Tariffs On Californias Revenue

May 15, 2025

Estimating The Impact Of Trumps Tariffs On Californias Revenue

May 15, 2025 -

Trumps Oil Price Outlook A Goldman Sachs Social Media Analysis

May 15, 2025

Trumps Oil Price Outlook A Goldman Sachs Social Media Analysis

May 15, 2025 -

Should Investors Worry About High Stock Market Valuations Bof A Weighs In

May 15, 2025

Should Investors Worry About High Stock Market Valuations Bof A Weighs In

May 15, 2025