Unclaimed HMRC Refunds: Millions May Be Eligible

Table of Contents

Common Reasons for Unclaimed HMRC Refunds

Many people are unaware they're owed money by HMRC. Several factors can lead to unclaimed HMRC refunds. Let's explore some of the most common:

Overpaid Income Tax

Overpaying income tax is surprisingly frequent. This often happens due to changes in circumstances during the tax year that aren't immediately reflected in your tax code. For example:

- Changes in employment: Starting a new job, leaving a job, or a significant change in your salary can affect your tax code.

- Self-assessment errors: Mistakes on your self-assessment tax return can lead to overpayment. Incorrectly claiming expenses or forgetting deductions are common errors.

- Marriage allowance: If you're eligible for the marriage allowance but haven't claimed it, you might be owed an HMRC tax refund.

An HMRC tax refund can be significant, so it's crucial to review your tax affairs regularly.

Unclaimed Tax Credits

Tax credits, such as Child Tax Credit and Working Tax Credit, can significantly reduce your tax bill. However, many eligible individuals don't claim them, leading to unclaimed HMRC tax credits refunds.

- Eligibility criteria: Understanding the specific eligibility requirements for each tax credit is vital. These criteria can change, so staying informed is crucial.

- Missing deadlines: Failing to submit your claim by the deadline means you miss out.

- Changes in circumstances: Not notifying HMRC of changes in your circumstances (e.g., changes to income or family size) can affect your entitlement.

An HMRC tax credits refund can provide substantial financial relief, making it worth checking your eligibility.

Pension Contributions

Contributions to pension schemes can reduce your taxable income, potentially leading to an HMRC pension refund. However, if you haven't correctly declared your contributions, you might be missing out on a refund.

- Different types of pensions: Understanding the tax implications of different pension schemes (e.g., workplace pensions, personal pensions, SIPPs) is important for accurate tax calculations.

- Incorrect reporting: Inaccuracies in reporting pension contributions to HMRC can lead to under-reclaimed tax relief.

- Relief at source: If your pension contributions are subject to relief at source, you may still be entitled to additional relief depending on your circumstances.

How to Check if You're Eligible for an Unclaimed HMRC Refund

Checking your eligibility for an unclaimed HMRC refund is relatively straightforward. Here are several ways to do it:

Using the HMRC Online Service

The easiest way to check is through the HMRC online service.

- Access your HMRC online account: Log in to your personal tax account through the HMRC portal.

- Navigate to your tax summaries: Check your Self Assessment tax returns, PAYE summaries and tax credit details.

- Review your tax calculations: Carefully review the details to identify potential overpayments. The HMRC online account provides clear summaries of your tax affairs.

Contacting HMRC Directly

If you have difficulty accessing your HMRC online account or need clarification, you can contact HMRC directly:

- Phone: Call the HMRC helpline (numbers are readily available on their website). Be prepared to provide personal details for verification.

- Mail: Write to HMRC using their postal address (find the correct address on their website, depending on your specific query).

Using a Tax Advisor

For complex tax situations, consider seeking professional help from a tax advisor.

- Expertise: Tax advisors possess in-depth knowledge of tax laws and regulations.

- Time savings: They can handle the complexities of your HMRC tax claim, saving you time and effort.

- Maximizing your refund: They can help ensure you claim everything you’re entitled to.

Time Limits for Claiming HMRC Refunds

Understanding the HMRC refund claim deadline is crucial to avoid missing out on your money.

Understanding Deadlines

Time limits for claiming refunds vary depending on the type of refund:

- Income tax: Generally, you have four years to claim a refund for overpaid income tax.

- Tax credits: The time limit for claiming back tax credits can vary depending on the circumstances.

- Other refunds: Specific deadlines apply to other types of HMRC refunds. Check the relevant HMRC guidelines.

It's essential to act promptly, as missing the HMRC refund claim deadline can mean losing your entitlement.

Avoiding Late Penalties

Missing the deadline for claiming a refund could result in:

- Reduced refund amount: You might receive a smaller refund than you're entitled to.

- Interest charges: HMRC might charge interest on the unpaid tax.

- Further penalties: Depending on the circumstances, you might face other penalties.

Conclusion

Many people are unknowingly entitled to unclaimed HMRC refunds due to overpaid income tax, unclaimed tax credits, or misreported pension contributions. Checking your eligibility is straightforward through the HMRC online service, contacting HMRC directly, or seeking assistance from a tax advisor. Remember, there are time limits for claiming these refunds, so don't delay. Don't let your money go unclaimed! Check your eligibility for an Unclaimed HMRC Refund today. Visit the HMRC website or contact a tax advisor to start your claim and ensure you receive every penny you're owed.

Featured Posts

-

Security Risks And The Philippine Deployment Of The Typhon Missile System

May 20, 2025

Security Risks And The Philippine Deployment Of The Typhon Missile System

May 20, 2025 -

Burnham And Highbridge Historical Photo Archive Unveiled Tomorrow

May 20, 2025

Burnham And Highbridge Historical Photo Archive Unveiled Tomorrow

May 20, 2025 -

Amorims Impact Analyzing Man Utds Latest Forward Acquisition

May 20, 2025

Amorims Impact Analyzing Man Utds Latest Forward Acquisition

May 20, 2025 -

30 Year Treasury Yield Hits 5 Implications For The Sell America Narrative

May 20, 2025

30 Year Treasury Yield Hits 5 Implications For The Sell America Narrative

May 20, 2025 -

Cote D Ivoire Bruno Kone Et Le Developpement Urbain Nouveaux Plans D Urbanisme Lances

May 20, 2025

Cote D Ivoire Bruno Kone Et Le Developpement Urbain Nouveaux Plans D Urbanisme Lances

May 20, 2025

Latest Posts

-

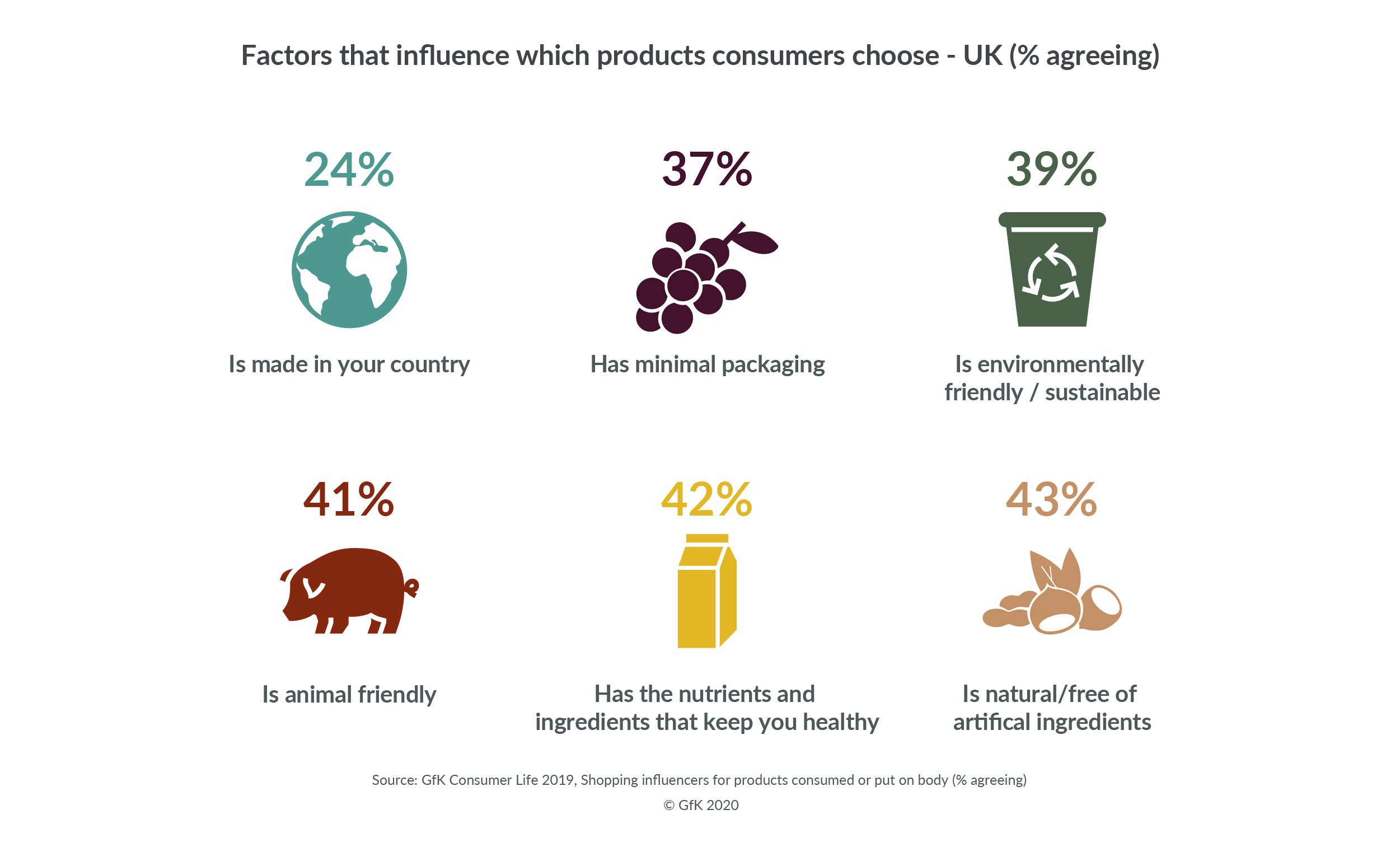

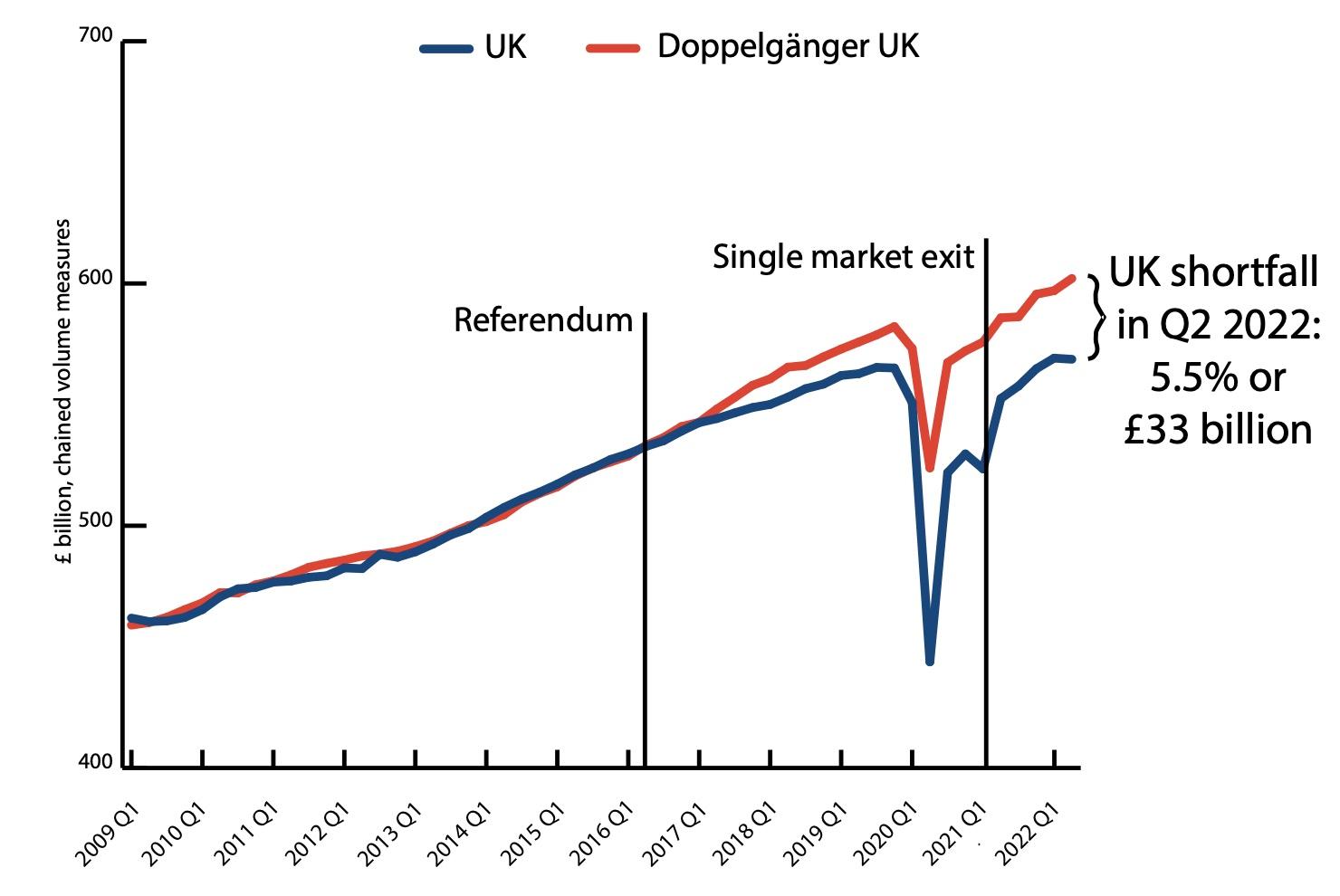

Brexit Hinders Uk Luxury Goods Eu Market Access

May 20, 2025

Brexit Hinders Uk Luxury Goods Eu Market Access

May 20, 2025 -

Uk Luxury Sector Brexits Toll On Eu Trade

May 20, 2025

Uk Luxury Sector Brexits Toll On Eu Trade

May 20, 2025 -

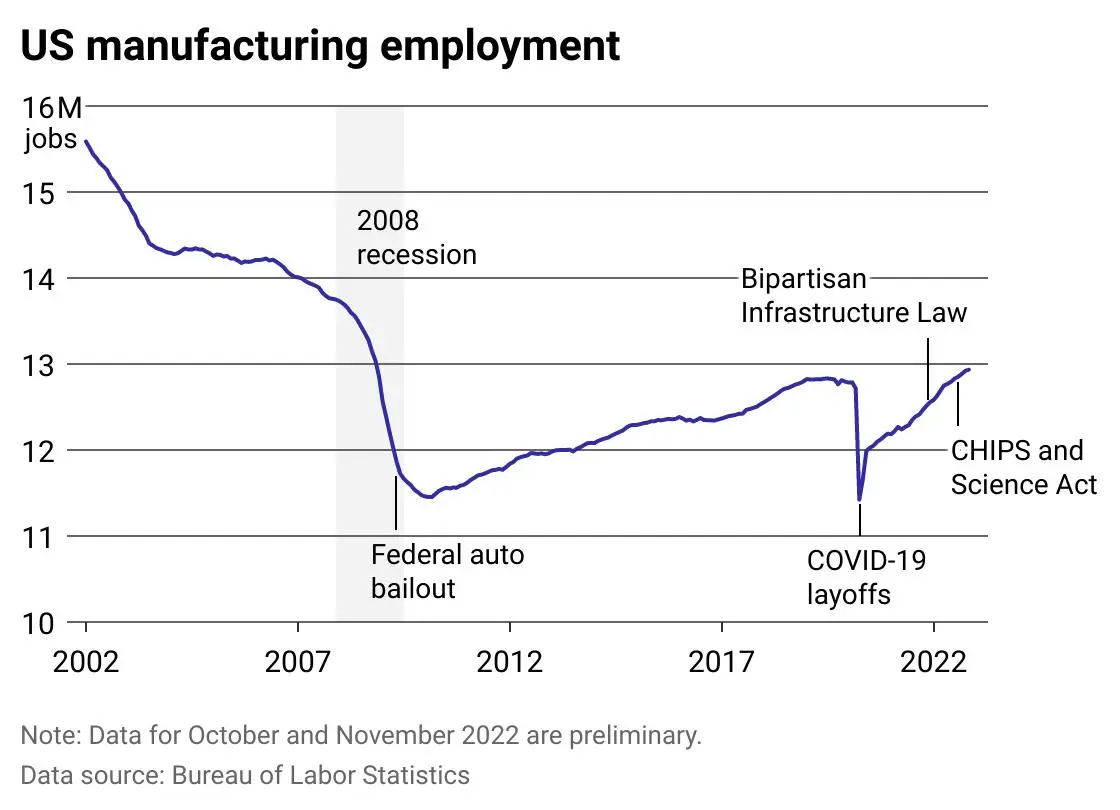

The Future Of American Manufacturing Will Factory Jobs Return Under Trumps Policies

May 20, 2025

The Future Of American Manufacturing Will Factory Jobs Return Under Trumps Policies

May 20, 2025 -

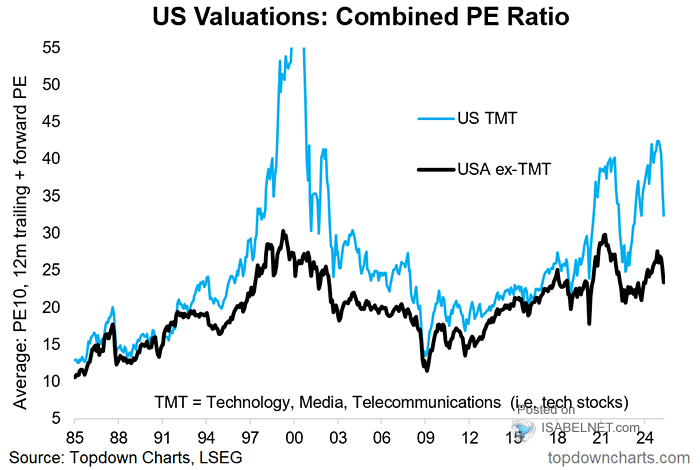

Understanding Elevated Stock Market Valuations Insights From Bof A

May 20, 2025

Understanding Elevated Stock Market Valuations Insights From Bof A

May 20, 2025 -

Invest In The Future Mapping The Countrys Promising Business Locations

May 20, 2025

Invest In The Future Mapping The Countrys Promising Business Locations

May 20, 2025