Understanding Greg Abel: The Canadian Leading Berkshire Hathaway

Table of Contents

Greg Abel's Rise Through Berkshire Hathaway

Understanding Greg Abel requires understanding his journey within Berkshire Hathaway. His career progression is a testament to his dedication, expertise, and strong leadership skills. He didn't simply inherit the top position; he earned it through years of dedicated service and demonstrable success in various key roles. Abel's journey reflects Berkshire Hathaway's commitment to promoting talent from within and fostering a culture of operational excellence.

-

Early Career and Education: While specific details of his early career are less publicized than his later accomplishments, Abel's academic background and early professional experiences undoubtedly laid the foundation for his future success. His career trajectory showcases a pattern of consistent upward mobility and increasing responsibility.

-

Key Roles Before Becoming CEO: Before his appointment as CEO, Abel served as Vice Chairman, overseeing a significant portion of Berkshire Hathaway's diverse operations. This extensive experience provided him with invaluable insights into the company's various subsidiaries and their respective challenges and opportunities. He played a crucial role in streamlining operations, improving efficiency, and driving growth in key sectors.

-

Significant Accomplishments in Previous Positions: His contributions to Berkshire Hathaway Energy, a significant subsidiary, are particularly noteworthy. His strategic vision and management expertise helped position this energy sector giant for continued success and expansion. This achievement highlighted his aptitude for leading complex and multifaceted businesses.

-

Demonstrated Expertise: Abel's deep expertise in energy and insurance – two key sectors within the Berkshire Hathaway portfolio – makes him uniquely qualified to lead the company into the future. This expertise showcases a significant understanding of risk management and long-term value creation within complex industries.

Abel's Leadership Style and Management Approach

Greg Abel's leadership style is often described as pragmatic and results-oriented, a blend of strategic vision and operational focus. While comparisons with Warren Buffett's more outwardly charismatic approach are inevitable, Abel's leadership is characterized by a deep understanding of Berkshire Hathaway's operational nuances and a commitment to long-term value creation.

-

Focus on Operational Efficiency: Abel's management philosophy emphasizes operational efficiency and cost-effectiveness, crucial aspects for maintaining Berkshire Hathaway's competitive edge in a constantly evolving marketplace. He is known for his data-driven approach and his focus on maximizing returns across the company's diverse portfolio.

-

Emphasis on Long-Term Value Creation: Like his predecessor, Abel prioritizes long-term value creation over short-term gains. This unwavering commitment to long-term strategic goals provides stability and resilience in the face of market volatility.

-

Approach to Risk Management: Abel's experience in managing high-risk sectors, such as energy, demonstrates his sophisticated understanding of risk management. This is crucial for overseeing a conglomerate as diverse as Berkshire Hathaway.

-

Communication Style: While less publicly visible than Warren Buffett, Abel is known for his clear and concise communication, fostering a collaborative and efficient work environment. This clear communication style is essential for maintaining consistent direction and alignment across Berkshire Hathaway's numerous subsidiaries.

The Implications of Abel's Leadership for Berkshire Hathaway's Future

Greg Abel's leadership has significant implications for Berkshire Hathaway's future trajectory. His background, experience, and management style will undoubtedly influence the company's strategic direction, investment choices, and overall growth.

-

Potential Changes in Investment Strategies: While it is likely that Abel will continue to uphold many of Warren Buffett's investment principles, his expertise in specific sectors might lead to adjustments in the company's investment portfolio. This could involve a strategic shift towards sectors he's deeply familiar with, or perhaps a more active approach to acquisitions and divestments.

-

Future Acquisitions and Divestments: Abel's tenure may see a shift in the types of acquisitions Berkshire Hathaway pursues. His focus on operational excellence might lead to a greater emphasis on integrating acquired companies efficiently and maximizing synergies within the existing portfolio.

-

Impact on Berkshire Hathaway's Diverse Portfolio: Given his experience, Abel's leadership might result in increased focus on streamlining operations and improving efficiency across Berkshire Hathaway's diverse portfolio of companies. This could involve identifying areas for improvement, implementing cost-saving measures, or optimizing inter-company collaboration.

-

Long-Term Vision: Under Abel’s leadership, we can expect Berkshire Hathaway to maintain its focus on long-term value creation. However, his unique perspective and management style may influence the company's long-term vision, potentially leading to new strategies and innovations to ensure continued growth and sustainability.

Comparing Greg Abel's approach with Warren Buffett's legacy

Comparing Greg Abel's approach to Warren Buffett's legacy is essential for understanding the transition at Berkshire Hathaway. While both share a commitment to long-term value creation, their styles differ in subtle but significant ways.

-

Similarities: Both share a deep understanding of value investing and a commitment to long-term growth. Both prioritize operational efficiency and prudent risk management.

-

Differences: Buffett's public persona and emphasis on individual stock selection are largely different from Abel's more operational, behind-the-scenes style. Buffett's investment decisions are often made public; Abel's may be less so, reflecting a difference in communication preferences.

-

Honoring Buffett's Legacy: Abel's challenge lies in balancing honoring Buffett's successful legacy with adapting to the evolving needs of the company in a new era. His ability to maintain Berkshire Hathaway's core values while embracing innovation and adaptability will be a key determinant of his success.

Conclusion

Greg Abel's ascension to the CEO role at Berkshire Hathaway marks a significant turning point for the company. His leadership style, deep operational expertise, and clear vision will shape the future trajectory of this investment giant. Understanding his background and approach is crucial for anyone seeking to grasp the future of one of the world's most influential companies. His Canadian perspective and his extensive experience within the company provide a unique foundation for his leadership.

Call to Action: Learn more about the dynamic leadership of Greg Abel and the exciting future of Berkshire Hathaway. Stay informed about the latest developments in this influential company and its Canadian CEO. Continue researching Greg Abel to fully understand his impact on Berkshire Hathaway and the future of this powerful investment conglomerate.

Featured Posts

-

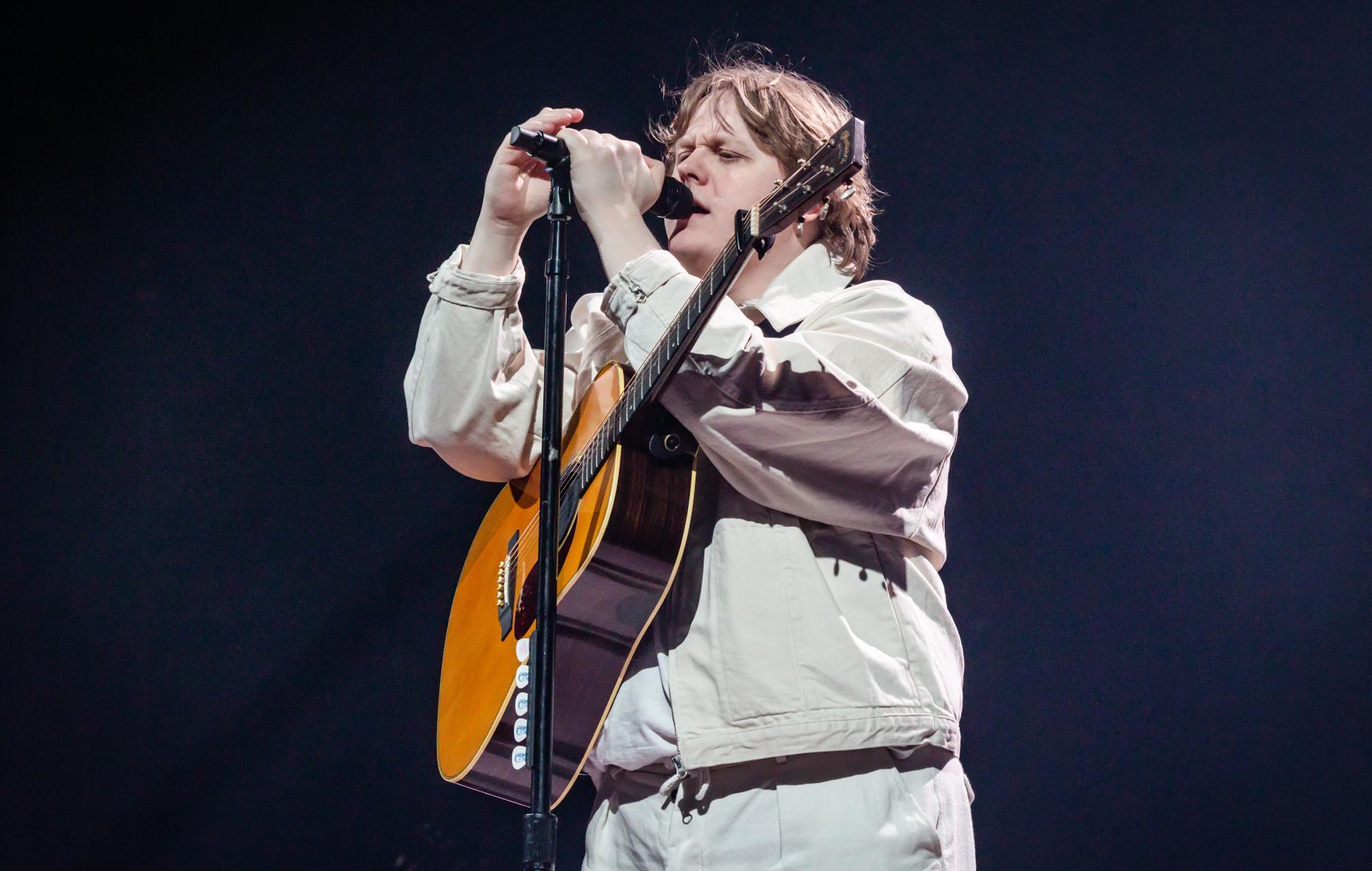

Lewis Capaldis Return A Friend Reveals New Music In The Works

May 07, 2025

Lewis Capaldis Return A Friend Reveals New Music In The Works

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special Behind The Scenes Of The Famous Game Show

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special Behind The Scenes Of The Famous Game Show

May 07, 2025 -

Svitskiy Vikhid Rianni Shiroki Dzhinsi Ta Bliskuchi Prikrasi

May 07, 2025

Svitskiy Vikhid Rianni Shiroki Dzhinsi Ta Bliskuchi Prikrasi

May 07, 2025 -

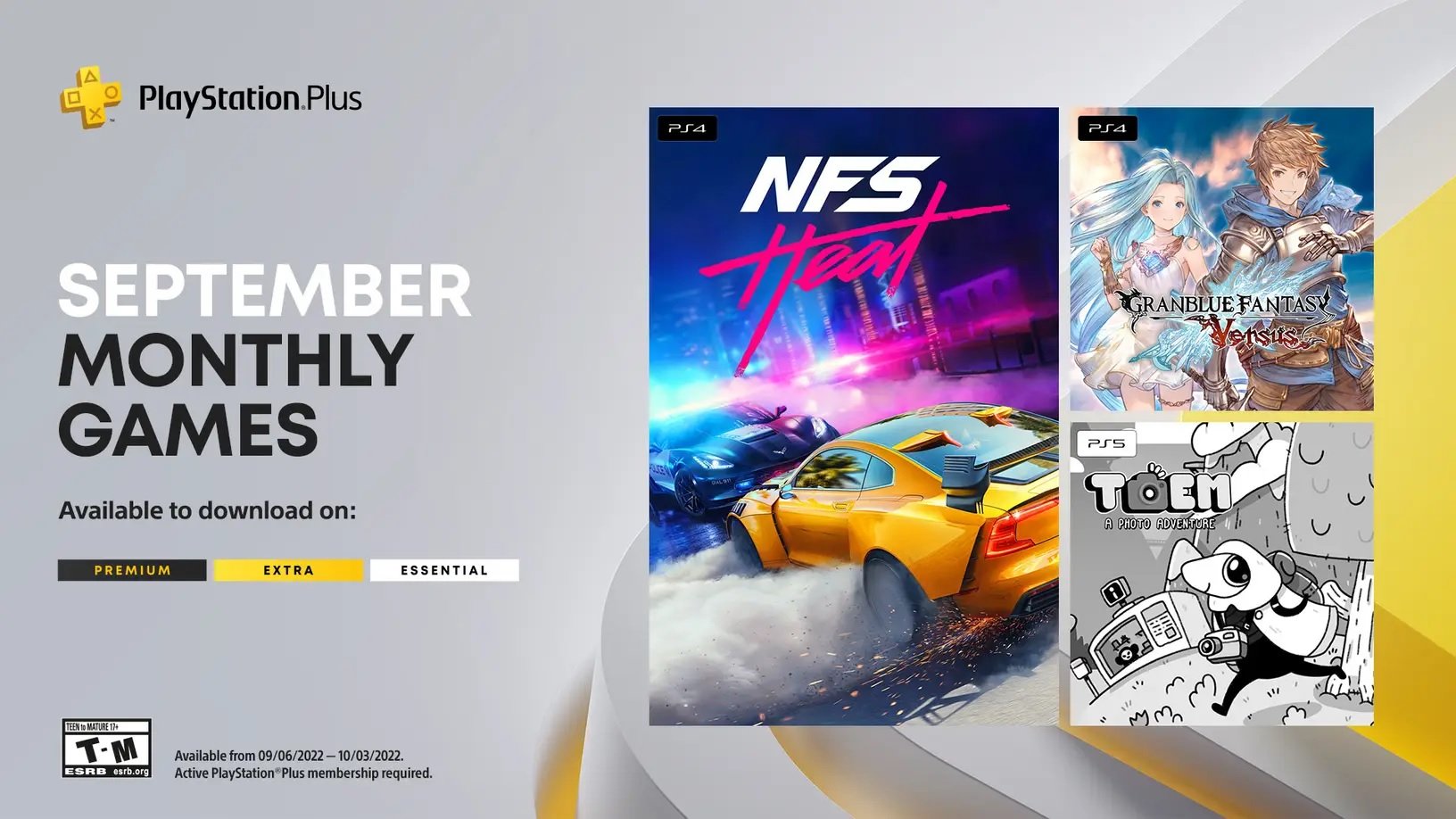

Play Station Plus March 2024 Premium And Extra Game Lineup

May 07, 2025

Play Station Plus March 2024 Premium And Extra Game Lineup

May 07, 2025 -

Where To Buy A Ps 5 Before A Potential Price Increase

May 07, 2025

Where To Buy A Ps 5 Before A Potential Price Increase

May 07, 2025

Latest Posts

-

Ethereums Price Action Conquering Resistance Aiming For 2 000

May 08, 2025

Ethereums Price Action Conquering Resistance Aiming For 2 000

May 08, 2025 -

Analyzing The Ethereum Weekly Chart A Buy Signal Emerges

May 08, 2025

Analyzing The Ethereum Weekly Chart A Buy Signal Emerges

May 08, 2025 -

Ethereum Price Analysis Support Holds But Is A Fall To 1500 Likely

May 08, 2025

Ethereum Price Analysis Support Holds But Is A Fall To 1500 Likely

May 08, 2025 -

Ethereum Price Rebound Weekly Chart Indicator Suggests Buy

May 08, 2025

Ethereum Price Rebound Weekly Chart Indicator Suggests Buy

May 08, 2025 -

Ethereums Future Analyzing The Current Support Level And Potential Price Drop To 1500

May 08, 2025

Ethereums Future Analyzing The Current Support Level And Potential Price Drop To 1500

May 08, 2025