XRP's Road To Recovery: Overcoming The Derivatives Market Hurdle

Table of Contents

The SEC Lawsuit and its Impact on XRP Derivatives Trading

The SEC's lawsuit alleging that Ripple's XRP sales constituted unregistered securities offerings significantly impacted the XRP derivatives market. This legal uncertainty created a ripple effect (pun intended!), leading to reduced liquidity and widespread caution among market participants.

- Reduced liquidity in XRP futures and options markets: Many exchanges significantly reduced or completely halted XRP derivatives trading, fearing potential legal repercussions. This lack of liquidity made it difficult for traders to enter or exit positions efficiently, impacting price discovery.

- Uncertainty among exchanges regarding listing XRP derivatives: The regulatory ambiguity surrounding XRP forced many exchanges to adopt a wait-and-see approach, delaying or preventing the listing of new XRP derivatives products. This limited the availability of trading opportunities for investors.

- Impact on institutional investor participation: Institutional investors, often risk-averse, largely withdrew from XRP derivatives trading due to the regulatory uncertainty. This significantly reduced trading volume and market depth.

- Specific examples: Several prominent cryptocurrency exchanges, including BitMEX and others, either delisted XRP derivatives entirely or significantly restricted trading in them following the SEC lawsuit. This created a fragmented and less efficient market.

Regulatory Uncertainty and its Effects on Market Sentiment

The ongoing regulatory uncertainty surrounding XRP remains a significant obstacle to its recovery in the derivatives market. Investor confidence is directly tied to clarity on the regulatory landscape.

- The need for clearer regulatory frameworks for cryptocurrencies: A lack of consistent and globally harmonized regulations for cryptocurrencies, including XRP, creates confusion and discourages mainstream adoption. This uncertainty makes it challenging for institutional investors to participate comfortably.

- The role of self-regulatory organizations (SROs): The involvement of SROs in establishing industry best practices and providing guidance could help to improve transparency and trust in the XRP derivatives market.

- The impact of differing regulatory approaches across jurisdictions: The varied regulatory stances on cryptocurrencies across different countries add to the complexity. A lack of consistent global standards makes it difficult for XRP derivatives to function effectively in a truly global market.

- How regulatory clarity can boost investor confidence: Clearer regulatory frameworks would reassure investors, boosting confidence and leading to increased participation and trading volume in XRP derivatives.

Innovation in XRP Derivatives Markets: New Approaches and Solutions

Overcoming the hurdles in the XRP derivatives market requires innovative solutions that address the concerns of both regulators and investors.

- Development of regulated XRP derivative exchanges: The creation of exchanges specifically designed to comply with existing and evolving regulations is crucial for attracting institutional investors and increasing trading volume. This requires cooperation between exchanges and regulatory bodies.

- Creation of innovative products tailored to address regulatory concerns: New derivative products could be designed to incorporate features that mitigate regulatory risks, such as structured products with built-in compliance mechanisms.

- The role of blockchain technology in enhancing transparency and security: Blockchain's inherent transparency and security features can be leveraged to create more trustworthy and auditable XRP derivatives markets. Smart contracts could automate processes and enhance compliance.

- Exploring decentralized finance (DeFi) options for XRP derivatives: Decentralized exchanges (DEXs) could offer alternative trading venues for XRP derivatives, bypassing some of the challenges associated with centralized exchanges and traditional regulatory frameworks, while still acknowledging the need for responsible development.

The Potential for Growth in XRP Derivatives Trading

If regulatory hurdles are overcome, the potential for growth in XRP derivatives trading is significant.

- Increased institutional investment driven by hedging and speculation: Regulatory clarity could attract institutional investors seeking to hedge against price volatility or speculate on XRP's future price movements.

- Growth in retail investor participation: Increased transparency and improved regulatory oversight would make XRP derivatives more accessible to retail investors.

- Potential for the development of sophisticated trading strategies: As the market matures, more sophisticated trading strategies, such as arbitrage and options trading, will emerge, leading to increased liquidity and price efficiency.

- Expansion of XRP derivatives markets globally: A well-regulated XRP derivatives market could expand globally, providing opportunities for traders and investors worldwide.

Conclusion

XRP's journey to full recovery faces significant challenges in the derivatives market, primarily stemming from the SEC lawsuit and lingering regulatory uncertainty. However, innovative solutions are emerging, and the potential for growth remains substantial. Continued innovation, regulatory clarity, and a proactive approach from both developers and regulatory bodies will be crucial for unlocking the vast potential of XRP derivatives and securing its place in the future of finance. Stay informed about the latest developments in XRP's road to recovery and explore the opportunities in this evolving landscape.

Featured Posts

-

Royal Air Maroc Flight Cancellations Brussels Strikes Impact

May 07, 2025

Royal Air Maroc Flight Cancellations Brussels Strikes Impact

May 07, 2025 -

Stoerre Nhl Turnering Konflikt Och Nya Planer

May 07, 2025

Stoerre Nhl Turnering Konflikt Och Nya Planer

May 07, 2025 -

Is John Wick 5 Actually Happening A Look At The Latest News

May 07, 2025

Is John Wick 5 Actually Happening A Look At The Latest News

May 07, 2025 -

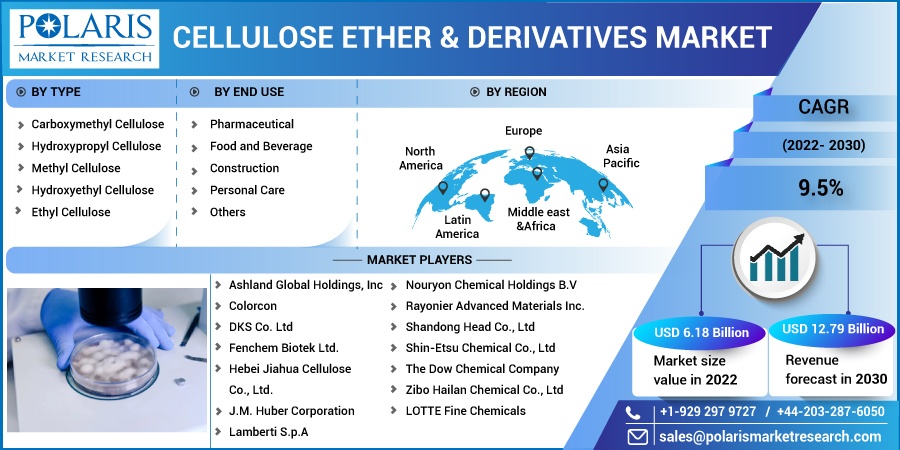

Ldc Graduation Strategy Governments Commitment To Success

May 07, 2025

Ldc Graduation Strategy Governments Commitment To Success

May 07, 2025 -

Steelers Star Wide Receiver Future Uncertain After Team Decision

May 07, 2025

Steelers Star Wide Receiver Future Uncertain After Team Decision

May 07, 2025

Latest Posts

-

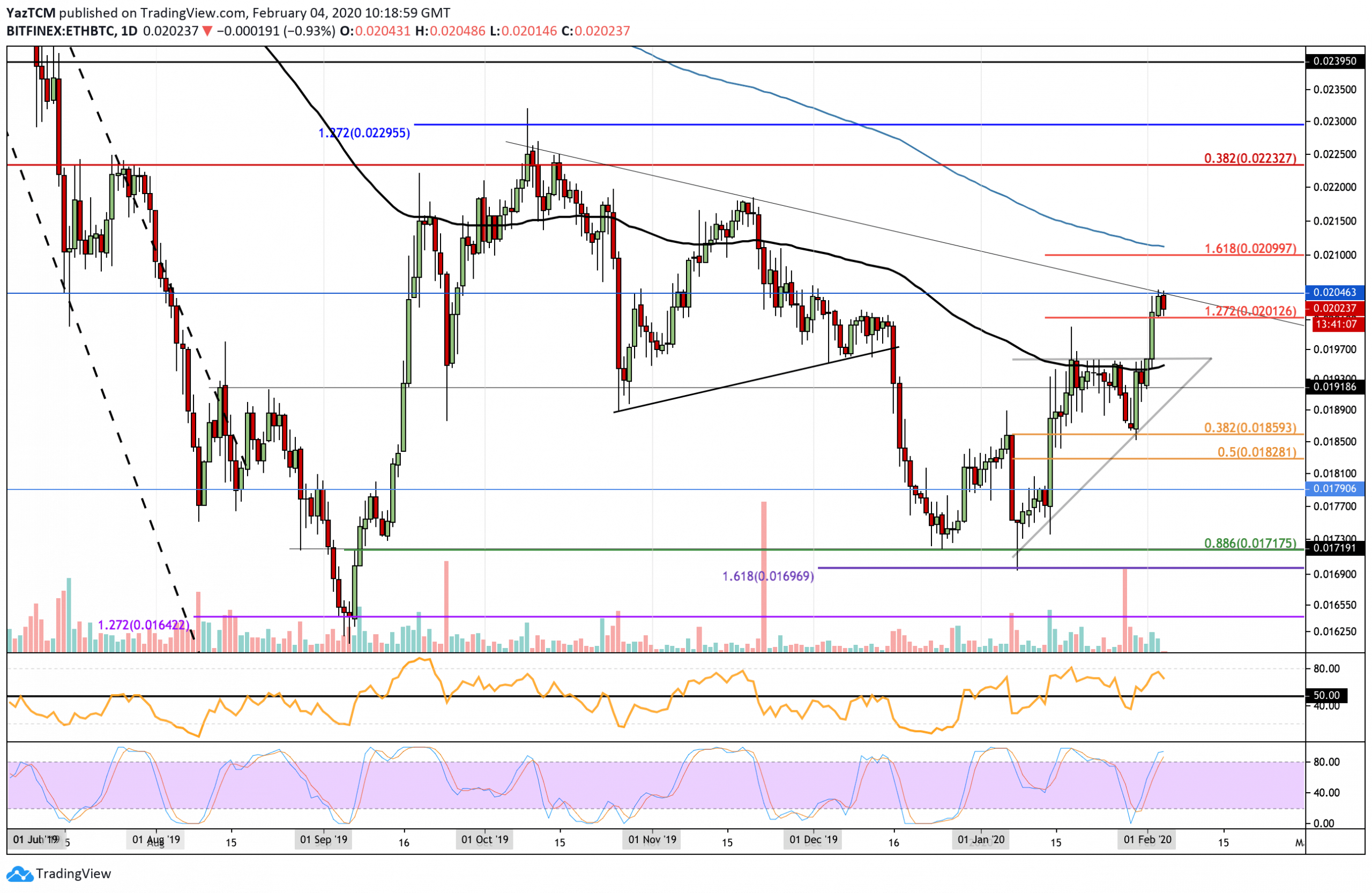

Ethereum Price Analysis Resistance Broken 2 000 In Sight

May 08, 2025

Ethereum Price Analysis Resistance Broken 2 000 In Sight

May 08, 2025 -

Ethereums Price Action Conquering Resistance Aiming For 2 000

May 08, 2025

Ethereums Price Action Conquering Resistance Aiming For 2 000

May 08, 2025 -

Analyzing The Ethereum Weekly Chart A Buy Signal Emerges

May 08, 2025

Analyzing The Ethereum Weekly Chart A Buy Signal Emerges

May 08, 2025 -

Ethereum Price Analysis Support Holds But Is A Fall To 1500 Likely

May 08, 2025

Ethereum Price Analysis Support Holds But Is A Fall To 1500 Likely

May 08, 2025 -

Ethereum Price Rebound Weekly Chart Indicator Suggests Buy

May 08, 2025

Ethereum Price Rebound Weekly Chart Indicator Suggests Buy

May 08, 2025