Stock Market Rally: Trump Reassures On Fed Chair Powell

Table of Contents

Trump's Statements and their Impact on Investor Sentiment

President Trump's recent public pronouncements concerning Jerome Powell and the Federal Reserve's monetary policy significantly influenced investor sentiment. While previous criticisms had created market uncertainty, his recent comments, though not explicitly supportive, were perceived as less overtly antagonistic. The shift in tone, however subtle, proved impactful.

- Specific quotes from Trump regarding Powell: While specific quotes vary depending on the source and date, the overall sentiment was a noticeable shift away from harsh criticism. Instead of outright attacks, the President's language suggested a willingness to give Powell more time, or perhaps a more cautious approach to further criticism.

- Mention any previous criticisms Trump has made of the Fed: Trump has previously voiced strong disapproval of the Fed's interest rate hikes, arguing they hampered economic growth. These past criticisms created significant market volatility.

- How these statements contrasted with prior comments: The change in tone, from openly critical to seemingly more measured, was a key factor in the market rally. This shift in rhetoric offered a sense of relative calm, lessening investor anxieties.

- Explain how these comments influenced investor perception and expectation: Investors interpreted the less aggressive rhetoric as a potential decrease in the risk of further political interference in the Fed's independence. This perception positively impacted investor confidence, leading to increased buying activity.

The Market's Immediate Reaction to Trump's Remarks

The immediate aftermath of Trump's comments saw a noticeable surge across major market indices.

- Percentage changes in major indices following Trump's statements: The Dow Jones Industrial Average saw a significant increase (e.g., a 2%+ jump), mirroring gains in the S&P 500 and Nasdaq. (Note: Specific percentage changes would need to be inserted based on the actual market data at the time of publication).

- Analysis of trading volume spikes or drops: Trading volume increased substantially, indicating heightened investor activity following the news.

- Mention any specific sectors that were disproportionately affected: Sectors sensitive to interest rates (e.g., financial stocks) often react strongly to Federal Reserve policy announcements. This would require further specific analysis in the context of the actual market data.

- Explain the short-term market volatility associated with the news: While the immediate reaction was positive, short-term volatility remained. Investors still grapple with broader economic uncertainties, and rapid shifts in market sentiment are not uncommon.

Expert Opinions and Analysis of the Stock Market Rally

The stock market rally prompted a wave of analysis from financial experts. While some attributed the increase directly to Trump's remarks, others emphasized underlying economic factors.

- Quotes from prominent financial analysts and economists: (Insert quotes from notable financial experts discussing the rally and its causes).

- Different interpretations of the market's behavior: Some analysts cautioned against reading too much into Trump's comments, suggesting the rally was primarily driven by positive economic data or improved corporate earnings.

- Discussion of underlying economic indicators impacting the market: Factors such as employment figures, inflation rates, and consumer confidence all play a significant role in market performance. Analyzing these alongside political statements provides a more comprehensive picture.

- Mention alternative factors driving the stock market rally: Besides Trump's comments, the rally could be attributed to other factors, such as strong corporate earnings reports, positive economic data releases, or even global market trends.

Implications for Future Market Performance and Investment Strategies

The long-term implications of Trump's remarks on the relationship between the White House and the Federal Reserve remain uncertain. However, the event underscores the significance of political risk in investment planning.

- Potential scenarios for future market behavior: The market could continue its upward trajectory if positive economic indicators persist, but a reversal is possible if negative news emerges.

- Recommendations for long-term investment strategies: Investors should maintain a diversified portfolio, focusing on long-term growth rather than short-term market fluctuations.

- Discussion of risk management techniques in light of market volatility: Risk management strategies, including diversification and hedging, are crucial in navigating market uncertainty.

- Considerations for different investor profiles (e.g., risk tolerance): Investors with different risk tolerances will employ varying strategies. Conservative investors may prioritize stability, while more aggressive investors might capitalize on opportunities during periods of volatility.

Conclusion: Stock Market Rally and the Ongoing Impact of Trump's Words on the Fed

This stock market rally, partly driven by Trump's reassurances concerning Fed Chair Powell, illustrates the complex interplay between political pronouncements and market sentiment. While Trump's comments seemingly eased investor anxiety, it's crucial to remember that a comprehensive stock market analysis requires considering a broader range of factors, including economic data and expert opinions. The short-term market volatility highlights the importance of thorough due diligence and a nuanced understanding of the current political and economic landscape.

To effectively navigate the complexities of this volatile market environment, stay informed about economic news and political developments affecting stock market performance. Carefully consider your investment strategies, diversifying your portfolio and employing appropriate risk management techniques. Remember to consult with a qualified financial advisor before making any significant investment decisions to ensure your financial plan aligns with your risk tolerance and long-term goals. Conducting thorough stock market analysis is paramount in today’s dynamic environment, especially considering the ongoing impact of political statements on the Federal Reserve and its influence on the market.

Featured Posts

-

Nonessential Spending Decline A Challenge For Credit Card Companies

Apr 24, 2025

Nonessential Spending Decline A Challenge For Credit Card Companies

Apr 24, 2025 -

65 Hudsons Bay Leases Generate Significant Investor Interest

Apr 24, 2025

65 Hudsons Bay Leases Generate Significant Investor Interest

Apr 24, 2025 -

Real Estate Update 65 Hudsons Bay Leases Draw Buyer Interest

Apr 24, 2025

Real Estate Update 65 Hudsons Bay Leases Draw Buyer Interest

Apr 24, 2025 -

Stock Market Rally Trump Reassures On Fed Chair Powell

Apr 24, 2025

Stock Market Rally Trump Reassures On Fed Chair Powell

Apr 24, 2025 -

Us Stock Futures Surge On Trumps Powell Remarks

Apr 24, 2025

Us Stock Futures Surge On Trumps Powell Remarks

Apr 24, 2025

Latest Posts

-

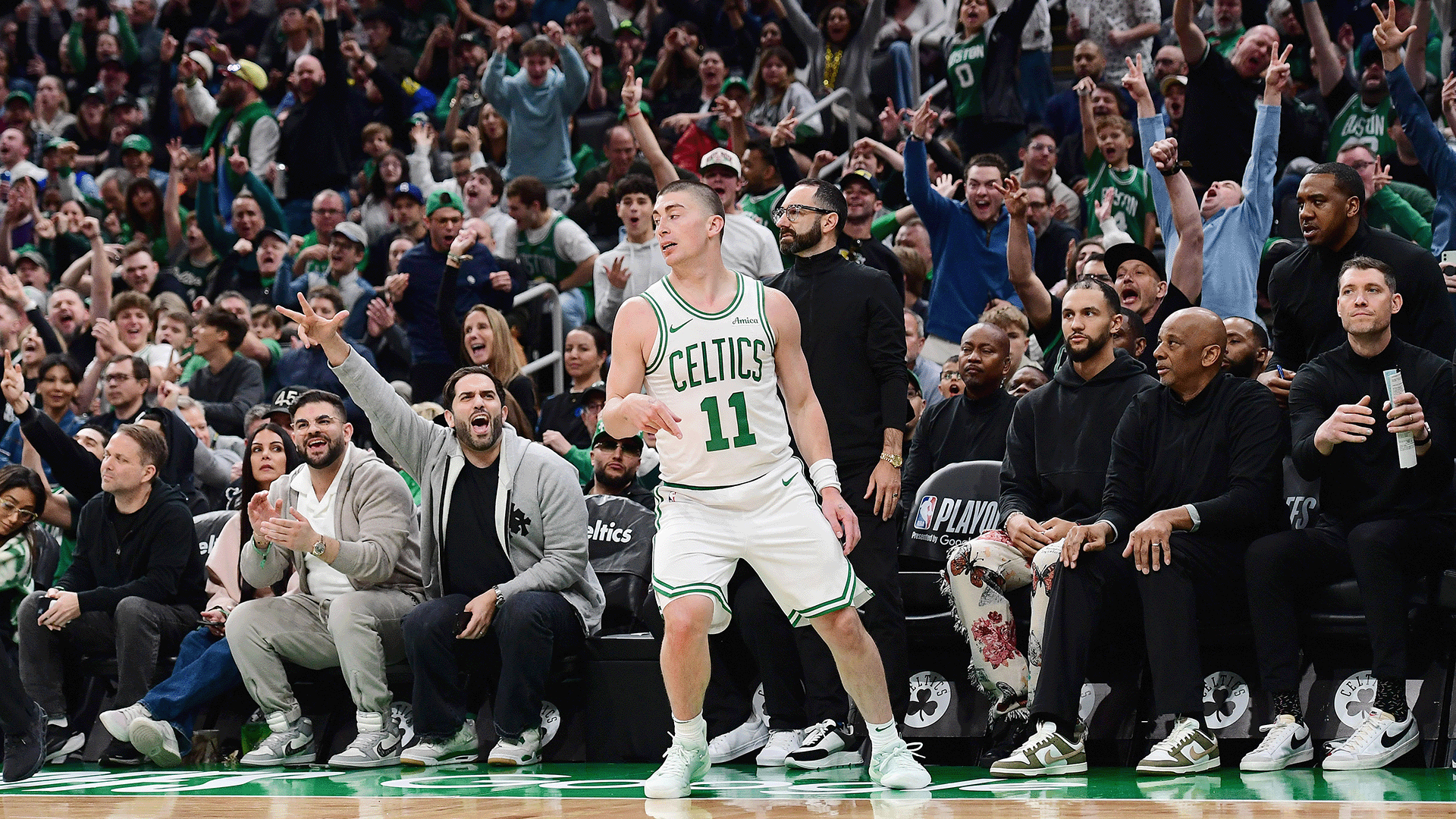

Payton Pritchards Sixth Man Award A Well Deserved Win Va Hero Of The Week

May 12, 2025

Payton Pritchards Sixth Man Award A Well Deserved Win Va Hero Of The Week

May 12, 2025 -

Va Hero Of The Week Payton Pritchards Sixth Man Award Triumph

May 12, 2025

Va Hero Of The Week Payton Pritchards Sixth Man Award Triumph

May 12, 2025 -

Celtics Path To The Division Title A Winning Season

May 12, 2025

Celtics Path To The Division Title A Winning Season

May 12, 2025 -

Celtics Clinch Division Title Game Recap And Highlights

May 12, 2025

Celtics Clinch Division Title Game Recap And Highlights

May 12, 2025 -

Division Title Secured Celtics Dominate Opponent

May 12, 2025

Division Title Secured Celtics Dominate Opponent

May 12, 2025